Table of Contents

Return On Net Assets - RONA

What is Return On Net Assets?

Return on Net Assets (RONA) can be used to assess how well a company is performing compared to others in its Industry. RONA is a measure of Financial Performance calculated as net Income divided by the sum of fixed assets and net working Capital.It reveals if a company and its management are deploying assets in economically valuable ways or if the company is performing poorly versus its peers.

The return on net assets (RONA) is a comparison of net income with the net assets. This is a metric of financial performance of a company that takes into account Earnings of a company with regard to fixed assets and net working capital. The ratio shows how effectively and efficiently the company is using its assets to generate earnings.

It is an especially important metric for capital intensive companies which have fixed assets as their major components.

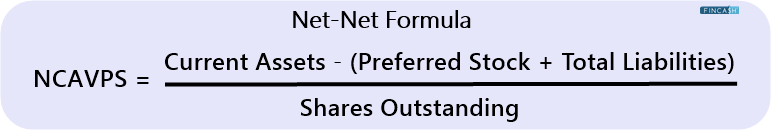

RONA Formula

RONA can be calculated as:

Return on Net Assets = Net Income / (Fixed Assets + Net Working Capital)

Talk to our investment specialist

The RONA calculation is similar to that of the Return on Assets (ROA) metric. Unlike ROA, RONA takes a company’s associated liabilities into account.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.