6 Best Liquid Mutual Funds 2025

In common terms, Best Liquid Funds are Debt Mutual Funds or rather money market Mutual Funds with the only difference being in the investment duration. Liquid Funds invest in very short money Market instruments like the Certificate of Deposit, treasury bills, commercial papers etc.

The investment duration of these funds is very short, generally ranging from a couple of days to a few weeks (it can even be one day!). The average residual maturity of liquid funds is less than 91 days as they invest in securities which individually have a maturity upto 91 days. Being a short-term Debt fund, these funds are highly suitable for investors looking for low-risk investments for short duration.

The low maturity period of best liquid funds helps fund managers to fulfil the Redemption demand of investors easily. In the market, there are various liquid fund investments available.

Why Invest in Liquid Funds?

- Liquid funds have no lock-in or very low lock-in period.

- The interest rate of liquid mutual funds is the lowest among all short-term investments due to low maturity period.

- No entry and exit loads are applicable.

- Liquid funds are a perfect solution for investors who wish to park their idle cash for a short duration without the risk of Capital Loss.

Liquid Funds better than Saving Bank Account?

Investing in liquid funds are any day a better option on investment as compared to putting money in popular saving Bank account schemes.

Owing to its familiarity and institutionalized nature of saving bank accounts, an average Indian taxpayer has more trust in them. However, it seems they are not the most popular short-term investment anymore. This is due to the rising acceptance of mutual funds by investors with different investment goals. Your hard earned money that lies in a savings bank account fetches you only 3.5% interest per annum. However, the best liquid funds have returned as high as 6.5-7.5% on an average in the past 1 year period, on an annualized Basis.

So, on returns alone, liquid funds score over a savings bank account. If you have a raise or a bonus coming your way, invest in liquid funds and party later.

Talk to our investment specialist

6 Best Liquid Funds India FY 25 - 26

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹2,989.48

↑ 0.41 ₹37,358 0.5 1.5 2.9 6.6 7.4 5.98% 1M 9D 1M 12D LIC MF Liquid Fund Growth ₹4,851.5

↑ 0.66 ₹11,543 0.5 1.4 2.8 6.5 7.4 5.93% 1M 15D 1M 15D DSP Liquidity Fund Growth ₹3,832.77

↑ 0.46 ₹21,344 0.5 1.4 2.9 6.5 7.4 5.98% 1M 2D 1M 6D Invesco India Liquid Fund Growth ₹3,690.01

↑ 0.55 ₹15,709 0.5 1.5 2.9 6.5 7.4 5.94% 1M 10D 1M 10D ICICI Prudential Liquid Fund Growth ₹397.358

↑ 0.05 ₹49,334 0.5 1.4 2.9 6.5 7.4 5.97% 1M 10D 1M 13D Aditya Birla Sun Life Liquid Fund Growth ₹432.569

↑ 0.06 ₹53,926 0.5 1.4 2.9 6.5 7.3 6.06% 1M 6D 1M 6D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Dec 25 Research Highlights & Commentary of 6 Funds showcased

Commentary Axis Liquid Fund LIC MF Liquid Fund DSP Liquidity Fund Invesco India Liquid Fund ICICI Prudential Liquid Fund Aditya Birla Sun Life Liquid Fund Point 1 Upper mid AUM (₹37,358 Cr). Bottom quartile AUM (₹11,543 Cr). Lower mid AUM (₹21,344 Cr). Bottom quartile AUM (₹15,709 Cr). Upper mid AUM (₹49,334 Cr). Highest AUM (₹53,926 Cr). Point 2 Established history (16+ yrs). Oldest track record among peers (23 yrs). Established history (20+ yrs). Established history (19+ yrs). Established history (20+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Rating: 4★ (upper mid). Rating: 4★ (upper mid). Rating: 4★ (lower mid). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.59% (top quartile). 1Y return: 6.45% (bottom quartile). 1Y return: 6.54% (upper mid). 1Y return: 6.55% (upper mid). 1Y return: 6.51% (bottom quartile). 1Y return: 6.54% (lower mid). Point 6 1M return: 0.46% (upper mid). 1M return: 0.45% (bottom quartile). 1M return: 0.46% (upper mid). 1M return: 0.46% (top quartile). 1M return: 0.46% (lower mid). 1M return: 0.46% (bottom quartile). Point 7 Sharpe: 3.40 (top quartile). Sharpe: 2.66 (bottom quartile). Sharpe: 3.34 (upper mid). Sharpe: 3.20 (upper mid). Sharpe: 2.87 (bottom quartile). Sharpe: 3.07 (lower mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.32 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 5.98% (upper mid). Yield to maturity (debt): 5.93% (bottom quartile). Yield to maturity (debt): 5.98% (upper mid). Yield to maturity (debt): 5.94% (bottom quartile). Yield to maturity (debt): 5.97% (lower mid). Yield to maturity (debt): 6.06% (top quartile). Point 10 Modified duration: 0.11 yrs (upper mid). Modified duration: 0.13 yrs (bottom quartile). Modified duration: 0.09 yrs (top quartile). Modified duration: 0.11 yrs (bottom quartile). Modified duration: 0.11 yrs (lower mid). Modified duration: 0.10 yrs (upper mid). Axis Liquid Fund

LIC MF Liquid Fund

DSP Liquidity Fund

Invesco India Liquid Fund

ICICI Prudential Liquid Fund

Aditya Birla Sun Life Liquid Fund

Liquid funds having AUM/Net Assets above 10,000 Crore and managing funds for 5 or more years. Sorted on Last 1 Calendar Year Return.

To provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However there can be no assurance that the investment objective of the scheme will be achieved. Research Highlights for Axis Liquid Fund Below is the key information for Axis Liquid Fund Returns up to 1 year are on An open ended scheme which seeks to generate reasonable returns with low risk and high liquidity through a judicious mix of investment in money market

instruments and quality debt instruments. However, there is no assurance that the investment objective of the Scheme will be realised. Research Highlights for LIC MF Liquid Fund Below is the key information for LIC MF Liquid Fund Returns up to 1 year are on The Scheme seeks to generate reasonable returns commensurate with low risk from a portfolio constituted of money market and high quality debts Research Highlights for DSP Liquidity Fund Below is the key information for DSP Liquidity Fund Returns up to 1 year are on To provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through a portfolio of money market and debt securities. Research Highlights for Invesco India Liquid Fund Below is the key information for Invesco India Liquid Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Liquid Plan) To provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through investments made primarily in money market and debt securities. Research Highlights for ICICI Prudential Liquid Fund Below is the key information for ICICI Prudential Liquid Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life Cash Plus Fund) An Open-ended liquid scheme with the objective to provide reasonable returns at a high level of safety and liquidity through judicious investments in high quality debt and money market instruments. Research Highlights for Aditya Birla Sun Life Liquid Fund Below is the key information for Aditya Birla Sun Life Liquid Fund Returns up to 1 year are on 1. Axis Liquid Fund

Axis Liquid Fund

Growth Launch Date 9 Oct 09 NAV (26 Dec 25) ₹2,989.48 ↑ 0.41 (0.01 %) Net Assets (Cr) ₹37,358 on 30 Nov 25 Category Debt - Liquid Fund AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.4 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 5.98% Effective Maturity 1 Month 12 Days Modified Duration 1 Month 9 Days Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹10,323 30 Nov 22 ₹10,797 30 Nov 23 ₹11,553 30 Nov 24 ₹12,409 30 Nov 25 ₹13,234 Returns for Axis Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Dec 25 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 2.9% 1 Year 6.6% 3 Year 7% 5 Year 5.8% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.1% 2022 4.9% 2021 3.3% 2020 4.3% 2019 6.6% 2018 7.5% 2017 6.7% 2016 7.6% 2015 8.4% Fund Manager information for Axis Liquid Fund

Name Since Tenure Devang Shah 5 Nov 12 13.08 Yr. Aditya Pagaria 13 Aug 16 9.31 Yr. Sachin Jain 3 Jul 23 2.42 Yr. Data below for Axis Liquid Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 99.75% Debt 0% Other 0.25% Debt Sector Allocation

Sector Value Cash Equivalent 74.66% Corporate 18.54% Government 6.55% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -4% ₹1,651 Cr T-Bill

Sovereign Bonds | -3% ₹1,293 Cr 130,807,200

↑ 130,807,200 Titan Company Limited

Commercial Paper | -3% ₹1,273 Cr 25,500 Bank Of Baroda (18/12/2025) **

Net Current Assets | -3% ₹997 Cr 20,000 Punjab National Bank (18/12/2025) **

Net Current Assets | -3% ₹997 Cr 20,000 Small Industries Development Bk Of India

Commercial Paper | -3% ₹988 Cr 20,000

↑ 20,000 Export Import Bank Of India

Commercial Paper | -3% ₹988 Cr 20,000

↑ 20,000 Small Industries Development Bank Of India

Commercial Paper | -3% ₹986 Cr 20,000

↑ 20,000 Indian Bank (25/02/2026) **

Net Current Assets | -3% ₹986 Cr 20,000

↑ 20,000 India (Republic of)

- | -3% ₹942 Cr 95,000,000

↑ 95,000,000 2. LIC MF Liquid Fund

LIC MF Liquid Fund

Growth Launch Date 11 Mar 02 NAV (26 Dec 25) ₹4,851.5 ↑ 0.66 (0.01 %) Net Assets (Cr) ₹11,543 on 30 Nov 25 Category Debt - Liquid Fund AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating ☆☆☆ Risk Low Expense Ratio 0.22 Sharpe Ratio 2.66 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 5.93% Effective Maturity 1 Month 15 Days Modified Duration 1 Month 15 Days Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹10,321 30 Nov 22 ₹10,780 30 Nov 23 ₹11,524 30 Nov 24 ₹12,379 30 Nov 25 ₹13,184 Returns for LIC MF Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Dec 25 Duration Returns 1 Month 0.5% 3 Month 1.4% 6 Month 2.8% 1 Year 6.5% 3 Year 6.9% 5 Year 5.7% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.7% 2021 3.3% 2020 4.3% 2019 6.5% 2018 7.3% 2017 6.6% 2016 7.6% 2015 8.4% Fund Manager information for LIC MF Liquid Fund

Name Since Tenure Rahul Singh 5 Oct 15 10.16 Yr. Aakash Dhulia 1 Sep 25 0.25 Yr. Data below for LIC MF Liquid Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 99.74% Other 0.26% Debt Sector Allocation

Sector Value Cash Equivalent 62.12% Corporate 18.87% Government 18.76% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Treps

CBLO/Reverse Repo | -5% ₹615 Cr Net Receivables / (Payables)

CBLO | -5% -₹522 Cr India (Republic of)

- | -3% ₹400 Cr 40,000,000 Motilal Oswal Financial Services Limited

Commercial Paper | -3% ₹399 Cr 8,000 India (Republic of)

- | -3% ₹396 Cr 40,000,000

↑ 40,000,000 Indusind Bank Limited

Certificate of Deposit | -3% ₹347 Cr 7,000 Kotak Mahindra Bank Limited

Certificate of Deposit | -3% ₹323 Cr 6,500 182 Days Tbill Red 11/12/2026

Sovereign Bonds | -3% ₹300 Cr 30,000,000 Small Industries Development Bank Of India

Certificate of Deposit | -3% ₹297 Cr 6,000 91 Days Tbill Red 26-02-2026

Sovereign Bonds | -3% ₹296 Cr 30,000,000

↑ 30,000,000 3. DSP Liquidity Fund

DSP Liquidity Fund

Growth Launch Date 23 Nov 05 NAV (26 Dec 25) ₹3,832.77 ↑ 0.46 (0.01 %) Net Assets (Cr) ₹21,344 on 30 Nov 25 Category Debt - Liquid Fund AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Low Expense Ratio 0.21 Sharpe Ratio 3.34 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 5.98% Effective Maturity 1 Month 6 Days Modified Duration 1 Month 2 Days Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹10,320 30 Nov 22 ₹10,791 30 Nov 23 ₹11,537 30 Nov 24 ₹12,390 30 Nov 25 ₹13,208 Returns for DSP Liquidity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Dec 25 Duration Returns 1 Month 0.5% 3 Month 1.4% 6 Month 2.9% 1 Year 6.5% 3 Year 7% 5 Year 5.8% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.8% 2021 3.3% 2020 4.2% 2019 6.5% 2018 7.4% 2017 6.6% 2016 7.6% 2015 8.3% Fund Manager information for DSP Liquidity Fund

Name Since Tenure Karan Mundhra 31 May 21 4.51 Yr. Shalini Vasanta 1 Aug 24 1.33 Yr. Data below for DSP Liquidity Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 99.77% Other 0.23% Debt Sector Allocation

Sector Value Cash Equivalent 72.99% Corporate 22.26% Government 4.52% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.59% Govt Stock 2026

Sovereign Bonds | -11% ₹2,203 Cr 213,000,000

↑ 60,000,000 Treps / Reverse Repo Investments / Corporate Debt Repo

CBLO/Reverse Repo | -5% -₹1,000 Cr 00 Treps / Reverse Repo Investments / Corporate Debt Repo

CBLO/Reverse Repo | -4% -₹782 Cr 81,527,785

↑ 81,527,785 Small Industries Development Bk Of India

Commercial Paper | -3% ₹569 Cr 11,500 HDFC Bank Limited

Certificate of Deposit | -3% ₹544 Cr 11,000 Small Industries Development Bank of India

Commercial Paper | -2% ₹493 Cr 10,000

↑ 10,000 HDFC Bank Ltd.

Debentures | -2% ₹475 Cr 9,500

↑ 9,500 Union Bank Of India

Certificate of Deposit | -2% ₹469 Cr 9,500

↑ 9,500 Bank Of Baroda

Certificate of Deposit | -2% ₹444 Cr 9,000

↑ 9,000 Bank Of Baroda

Certificate of Deposit | -2% ₹444 Cr 9,000

↑ 9,000 4. Invesco India Liquid Fund

Invesco India Liquid Fund

Growth Launch Date 17 Nov 06 NAV (26 Dec 25) ₹3,690.01 ↑ 0.55 (0.02 %) Net Assets (Cr) ₹15,709 on 15 Dec 25 Category Debt - Liquid Fund AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.22 Sharpe Ratio 3.2 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 5.94% Effective Maturity 1 Month 10 Days Modified Duration 1 Month 10 Days Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹10,321 30 Nov 22 ₹10,790 30 Nov 23 ₹11,538 30 Nov 24 ₹12,391 30 Nov 25 ₹13,210 Returns for Invesco India Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Dec 25 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 2.9% 1 Year 6.5% 3 Year 7% 5 Year 5.8% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.8% 2021 3.3% 2020 4.1% 2019 6.5% 2018 7.4% 2017 6.7% 2016 7.6% 2015 8.4% Fund Manager information for Invesco India Liquid Fund

Name Since Tenure Krishna Cheemalapati 25 Apr 11 14.61 Yr. Data below for Invesco India Liquid Fund as on 15 Dec 25

Asset Allocation

Asset Class Value Cash 99.78% Other 0.22% Debt Sector Allocation

Sector Value Cash Equivalent 64.72% Corporate 21.95% Government 13.12% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Receivables / (Payables)

Net Current Assets | -6% -₹973 Cr India (Republic of)

- | -3% ₹494 Cr 50,000,000

↑ 50,000,000 India (Republic of)

- | -3% ₹447 Cr 45,000,000 Treasury Bills

Sovereign Bonds | -3% ₹398 Cr 40,000,000 Punjab National Bank

Certificate of Deposit | -3% ₹395 Cr 40,000,000

↑ 40,000,000 T-Bill

Sovereign Bonds | -2% ₹372 Cr 37,500,000 India (Republic of)

- | -2% ₹348 Cr 35,000,000 364 DTB 12022026

Sovereign Bonds | -2% ₹347 Cr 35,000,000

↑ 35,000,000 India (Republic of)

- | -2% ₹325 Cr 32,500,000 Small Industries Dev Bank Of India 2026 **

Net Current Assets | -2% ₹296 Cr 30,000,000

↑ 30,000,000 5. ICICI Prudential Liquid Fund

ICICI Prudential Liquid Fund

Growth Launch Date 17 Nov 05 NAV (26 Dec 25) ₹397.358 ↑ 0.05 (0.01 %) Net Assets (Cr) ₹49,334 on 30 Nov 25 Category Debt - Liquid Fund AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.29 Sharpe Ratio 2.87 Information Ratio -0.32 Alpha Ratio -0.04 Min Investment 500 Min SIP Investment 99 Exit Load NIL Yield to Maturity 5.97% Effective Maturity 1 Month 13 Days Modified Duration 1 Month 10 Days Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹10,317 30 Nov 22 ₹10,779 30 Nov 23 ₹11,526 30 Nov 24 ₹12,378 30 Nov 25 ₹13,191 Returns for ICICI Prudential Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Dec 25 Duration Returns 1 Month 0.5% 3 Month 1.4% 6 Month 2.9% 1 Year 6.5% 3 Year 6.9% 5 Year 5.7% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.8% 2021 3.2% 2020 4.3% 2019 6.6% 2018 7.4% 2017 6.6% 2016 7.7% 2015 8.3% Fund Manager information for ICICI Prudential Liquid Fund

Name Since Tenure Nikhil Kabra 1 Dec 23 2 Yr. Darshil Dedhia 12 Jun 23 2.47 Yr. Data below for ICICI Prudential Liquid Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 99.72% Other 0.28% Debt Sector Allocation

Sector Value Cash Equivalent 74.39% Corporate 18.38% Government 6.95% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Treasury Bill

Sovereign Bonds | -7% ₹3,273 Cr 330,000,000

↑ 30,000,000 HDFC Bank Limited

Certificate of Deposit | -5% ₹2,473 Cr 50,000 India (Republic of)

- | -3% ₹1,700 Cr 170,000,000

↓ -25,000,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹1,188 Cr 24,000 Reverse Repo (12/16/2025)

CBLO/Reverse Repo | -2% ₹1,000 Cr Bank Of India

Certificate of Deposit | -2% ₹990 Cr 20,000 Indian Oil Corporation Limited

Commercial Paper | -2% ₹875 Cr 17,500

↓ -3,500 364 DTB 12022026

Sovereign Bonds | -2% ₹843 Cr 85,000,000

↑ 85,000,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹791 Cr 16,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹785 Cr 7,850 6. Aditya Birla Sun Life Liquid Fund

Aditya Birla Sun Life Liquid Fund

Growth Launch Date 30 Mar 04 NAV (26 Dec 25) ₹432.569 ↑ 0.06 (0.01 %) Net Assets (Cr) ₹53,926 on 15 Dec 25 Category Debt - Liquid Fund AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.34 Sharpe Ratio 3.07 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.06% Effective Maturity 1 Month 6 Days Modified Duration 1 Month 6 Days Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹10,320 30 Nov 22 ₹10,789 30 Nov 23 ₹11,545 30 Nov 24 ₹12,397 30 Nov 25 ₹13,215 Returns for Aditya Birla Sun Life Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Dec 25 Duration Returns 1 Month 0.5% 3 Month 1.4% 6 Month 2.9% 1 Year 6.5% 3 Year 7% 5 Year 5.8% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.3% 2023 7.1% 2022 4.8% 2021 3.3% 2020 4.3% 2019 6.7% 2018 7.4% 2017 6.7% 2016 7.7% 2015 8.4% Fund Manager information for Aditya Birla Sun Life Liquid Fund

Name Since Tenure Sunaina Cunha 15 Jul 11 14.39 Yr. Kaustubh Gupta 15 Jul 11 14.39 Yr. Sanjay Pawar 1 Jul 22 3.42 Yr. Data below for Aditya Birla Sun Life Liquid Fund as on 15 Dec 25

Asset Allocation

Asset Class Value Cash 99.42% Debt 0.32% Other 0.26% Debt Sector Allocation

Sector Value Cash Equivalent 65.96% Corporate 25.29% Government 8.5% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Receivables / (Payables)

Net Current Assets | -9% -₹4,770 Cr Rbl Bank Limited

Certificate of Deposit | -4% ₹2,400 Cr 48,000 364 DTB 27022026

Sovereign Bonds | -3% ₹1,583 Cr 160,000,000

↑ 160,000,000 182 Days Tbill Red 28-05-2026

Sovereign Bonds | -2% ₹1,024 Cr 102,500,000

↑ 52,500,000 Yes Bank Limited

Certificate of Deposit | -2% ₹1,000 Cr 20,000 Treasury Bill

Sovereign Bonds | -2% ₹999 Cr 100,000,000

↑ 100,000,000 364 DTB 12022026

Sovereign Bonds | -2% ₹992 Cr 100,000,000

↑ 100,000,000 T-Bill

Sovereign Bonds | -2% ₹991 Cr 100,000,000 Yes Bank Limited (05/03/2026) ** #

Net Current Assets | -2% ₹987 Cr 20,000

↑ 20,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹940 Cr 19,000

How to evaluate Liquid Mutual Funds?

When looking for a liquid mutual fund, the past return should not be the only Factor for consideration. Other factors like fund size, track record, credit quality of Underlying securities should also be kept in mind.

1. Investment Plans

Liquid funds come with different plans like a daily dividend plan, weekly dividend plan, monthly dividend plan and growth plans. In the growth option, profits made by the scheme are invested back into it. This results in the NAV (Net Asset Value) of the scheme rising over time. In the dividend option, the profits made by the fund are not re-invested. Dividends are distributed to the investor from time to time. Investors can choose their plan as per their convenience and liquidity needs.

2. Expense Ratio

Mutual funds charge a fee to manage your funds called an expense ratio. As per SEBI norms, the upper limit of expense ratio is 2.25%. In case of liquid funds, they maintain a lower expense ratio to provide relatively higher returns over a short period of time.

3. Investment Horizon

Plan your investment horizon. Liquid funds are exclusively meant to invest surplus cash over a very short period of time that is for 91 days. So, if you have an idle cash, you can invest here for a short period and earn better returns than bank Savings Account. In case you have a longer investment horizon of up to 1 year, then you may consider investing in short duration funds to get relatively higher returns.

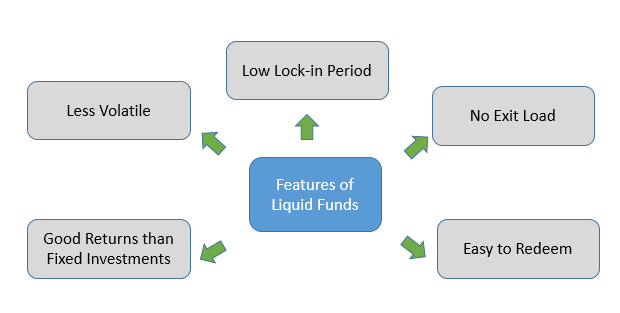

Features of Liquid Mutual Funds

1. Exit Load Of Liquid Mutual Funds

Considering the fact that liquid mutual funds are short-term investments with a low maturity period, the majority of the funds under this category do not levy any exit load on redemption. Also, if there exists any exit load, it is very nominal and usually not more than a week. Liquid funds generally do not have an exit load given they are very short investment products.

2. Volatility Of Liquid Fund Investment

Generally, the Volatility of liquid funds is low as the investment lasts for a few days to weeks. So, the risk of loss in investment is quite less. However, it is suggested to make a liquid fund investment considering the market condition to avoid the opportunity of loss.

3. Lock-in Period Of Best Liquid Funds

Given that liquid mutual funds are very short-term investment options, liquid funds do not have any lock-in period. Liquid Funds can be invested for a time period as short as one day going upto a couple of weeks.

4. Liquid Fund Returns

Liquid funds are one of the best short-term investments during a high Inflation period. In the high inflation period, the interest rate on the liquid fund is high. Thus, helping liquid mutual funds to earn good returns. The liquid fund returns are usually higher than that of other traditional investments like bank fixed deposits or savings accounts. However, it is suggested to invest in best liquid funds choosing a right option (growth, dividend payout, dividend re-investment) suiting your needs.

5. Liquid Funds Taxation

Generally, liquid fund returns receive in the form of dividends are not taxed in the hands of investors. However, a Dividend Distribution Tax (DDT) of approximately 28% is deducted by the mutual fund company from the dividends. Moreover, for the investors who have opted for growth option, a short-term Capital Gain tax is deducted as per the individual’s tax slab. This tax Deduction is same as that of a savings account.

How to Invest in Liquid Funds Online?

Open Free Investment Account for Lifetime at Fincash.com

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Due to the lack of awareness about liquid funds, people don’t invest in them and instead keep huge sums in a savings account. But, it’s never too late to begin something good. So, invest in best liquid funds today!

By Rohini Hiremath

By Rohini Hiremath

Rohini Hiremath works as a Content Head at Fincash.com. Her passion is to deliver financial knowledge to the masses in simple language. She has a strong background in start-ups and diverse content. Rohini is also an SEO expert, coach and motivating team head!

You can connect with her at rohini.hiremath@fincash.com

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good knowledgeable information, you should have to give an example