Table of Contents

What is KYC & How to Check Your KYC Status

Know Your Customer, commonly known as KYC, enables a Bank or a financial institution in authenticating the identity of its customers. This helps in prohibiting money-laundering activities and further ensures that the deposits/investments are made in the name of a real person and not fictitious one. KYC is a government-required compliance that all mutual fund investors have to adhere to.

1. Know Your Customer or KYC

Money laundering is one of the major menaces of any country’s Economy. Financial institutions and the government are constantly on the watch for such illegal activities. Mandating KYC or know your customer formalities for banking or investment transactions is an effective way to prevent this.

The primary objective is to ensure that the deposits/investments are made in the name of a real person and not fictitious one. It also helps to curb Black Money. Hence, Know Your Customer procedure is something that all mutual fund investors have to adhere to via a KYC Registration Agency (KRA). A SEBI-registered entity, KRA holds investors’ info in a single database that all fund houses and intermediaries can access. CAMS, NSE, and KDMS are few agencies many investors are familiar with.

Why is KYC Required to Invest in Mutual Funds?

An individual who wants to invest in Mutual Funds must submit KYC documents to be able to invest. However, such documents need to be submitted only once (in the initial stage) to the intermediaries such as fund companies, brokerages or mutual fund distributors. As per KYC norms for Mutual Funds introduced in 2012, the customers who comply with KYC norms don’t have to separately submit their PAN Card. Before the implementation of these norms, customers had to deposit a copy of their PAN card for the investments which amounted to be ₹50,000 or more in one financial year.

SEBI later announced a common KYC process in order to add uniformity and consistency across SEBI-registered intermediaries including Portfolio Managers, Mutual Fund Companies, Venture Capital Funds, Stock Brokers and many others. This implementation brings duplication of KYC documents to zero and makes it easier for investors to invest in mutual funds without any inconvenience.

Do you have to get KYC done every time you wish to invest?

Investors need to present KYC documents just once before making investments. The KYC Registration Agencies (KRAs) registered under SEBI have accurate records of all KYC documents. After going through the process in the securities Market, KRAs are responsible for sharing the details with other intermediaries whom you consider for future investments.

How to check if you are already KYC-compliant?

The mutual fund, if invested well, is one way to build your wealth faster. As a diligently monitored investment scheme, Know Your Customer is the first step to mutual fund investment. You may be already KYC-compliant though. It is now very easy to check KYC your status online for free by clicking here.

2. What is the Process to get KYC done?

CDSL Ventures Limited, nominated by the mutual fund Industry, has the authority to conduct the procedure to be compliant with KYC. The process of KYC can be successfully completed either offline or online. Here is a glimpse of both the processes.

Offline

Download the KYC application form from the CDSL Ventures website and fill in the required details

Sign and submit a physical copy of the form to the specified authorities or intermediaries through whom you wish to invest in mutual funds

Attach the photocopies of ID proof, residence proof and a passport size photo along with the form

Check Your KYC STATUS

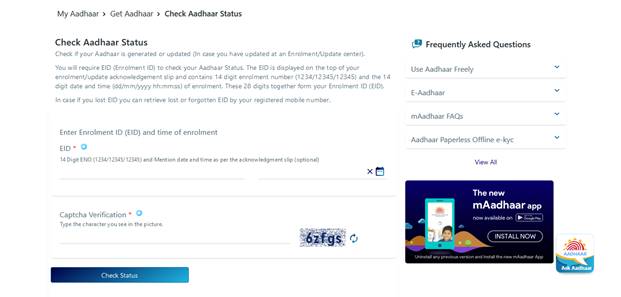

Online (Aadhaar KYC)

Create an account on the KRA’s official website and fill in your personal details Provide your registered mobile number along with their aadhaar card number. You will receive an OTP to verify your phone number Upload a self-attested copy of E-aadhaar and accept the consent declaration terms Check Your KYC STATUS

Aadhaar Based Biometric

If you have the Aadhaar Card, you can opt for Aadhaar-based KYC. You may request an official from the fund house or agency to visit you at home or office to collect the details. Submit a copy of your Aadhaar to the fund house or broker or distributor, and they will map your fingerprints on their scanner and link it to the Aadhaar database. By matching the fingerprint to that in the database, your details there will pop up. This means that they have validated your KYC before proceeding with your mutual fund investment. Check Your KYC STATUS

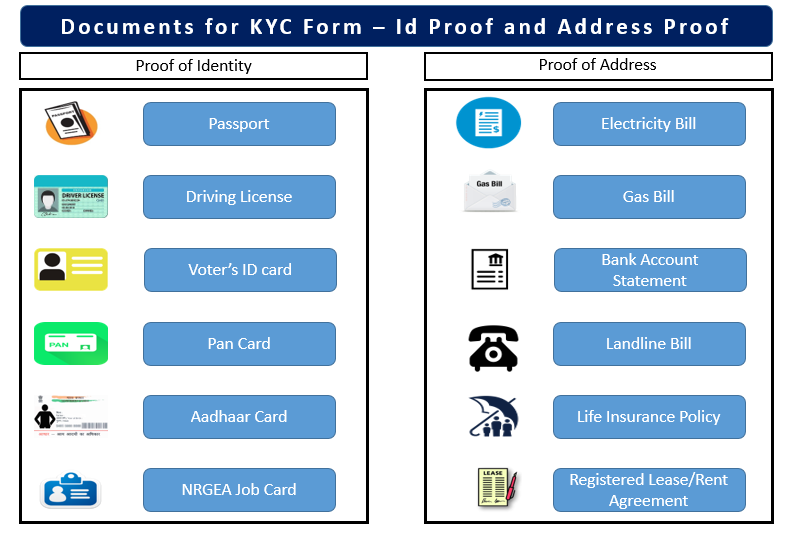

3. What are the documents required for KYC?

Investors need to submit a valid ID proof, a proof of address and a passport sized photograph along with their KYC application form:

ID Proof

- PAN card

- Driving license

- Passport

- Voter ID

- Bank photo passbook

- Aadhaar card

Proof of Address

- Recent landline or mobile bill

- Rlectricity bill

- Passport copy

- Recent Demat account statement

- Latest bank passbook

- Ration card

- Voter ID

- Rent agreement

- Driving license

- Aadhaar card

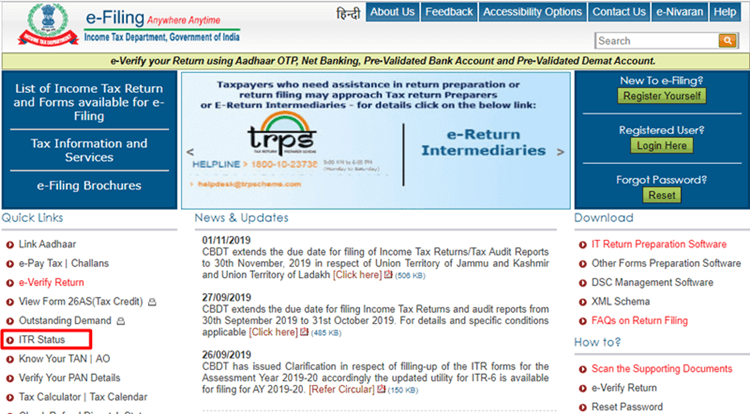

4. Check your KYC Status

One can check KYC Status online for free by clicking here and providing PAN Card & Email id (Where KYC status details will be sent).

FAQs

1. Can I file my KYC online?

A: Yes, you can check online your KYC status. Similarly, you can also file your KYC details online, provided your bank or financial institution has the particular Facility.

2. Is KYC necessary for mutual funds?

A: Yes, KYC is a must! Since the SEBI oversees mutual funds, it is necessary to submit KYC details before Investing in mutual funds.

3. Can I check my KYC status details online?

A: You can log-in to Central Depository Services Limited (website) - provide your PAN details to check your KYC status. If your KYC details are updated, it will show 'verified'; otherwise, the situation will be shown as pending.

4. Can I get the KYC details updated offline?

A: Yes! You can download the form and fill-in the details by hand. You can then submit the signed copy to the necessary subsidiaries.

5. How can I update email ID, mobile number and change in the address in KYC?

A: If your contact details have changed, you will need to update to continue investing in mutual funds. Log in to the website of - Central KYC Registry and download the ‘Change KYC details’ form. Update all the necessary changes that have been made to your contact details, such as your mobile number, address or email ID.

Once you have filled the form, submit it to your intermediary, following which, the KYC details will be updated on the database.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.