Table of Contents

Steps to Check ITR Status Online

Once you are done with filing your ITR return, most of your stress and tension would be gone. However, this might not be the end of the process as you still need to keep a tab on the status to ensure whether the income tax department has accepted and processed your return. Further, you must keep in mind that refund status will only be visible once you have processed it. Basically, you can check your ITR status online. This simply means figuring out at what stage your return stands. Hence, it is quite essential to follow up on it periodically.

But, how can you check your return status online? This post will help you figure out the procedure seamlessly.

What is Income Tax Refund?

An Income Tax Refund is an amount that you get if you have paid the tax that is higher than the real Tax Liability. The government has eased out the process by allowing people to check the ITR returns status online through the government site.

Keeping an eye on the status from time to time can help you comprehend if things are moving forward for you or not.

How to check ITR Refund Status Online?

Once you have filed your Income Tax Return, keeping a tab on the ITR refund status online would not be a tedious job anymore. Follow the below-mentioned steps, and you will be done before you realize.

Talk to our investment specialist

Checking with ITR Acknowledgement Number

One of the easiest ways of checking the status is by using the ITR acknowledgement number. For this method-

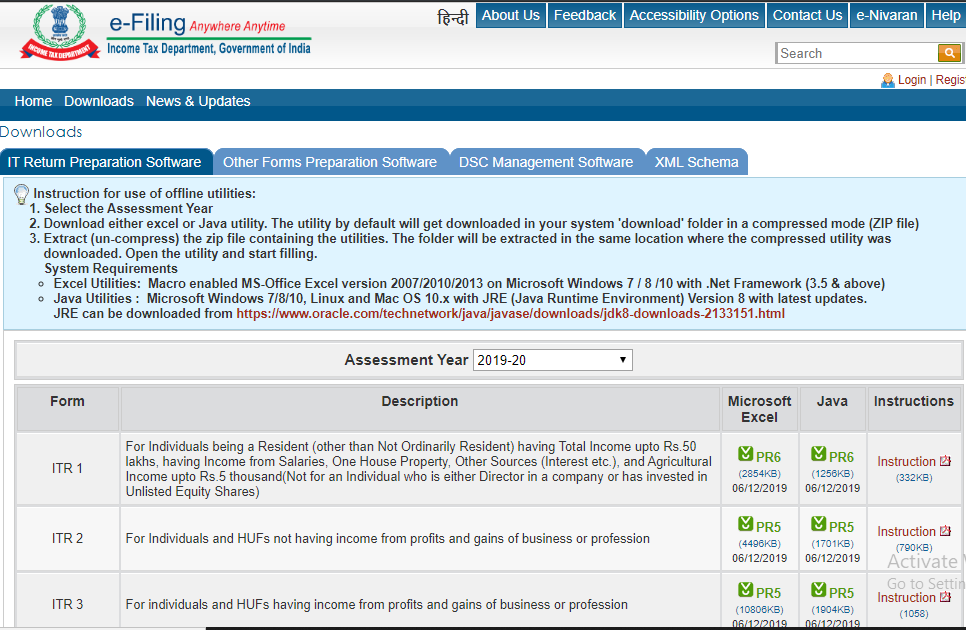

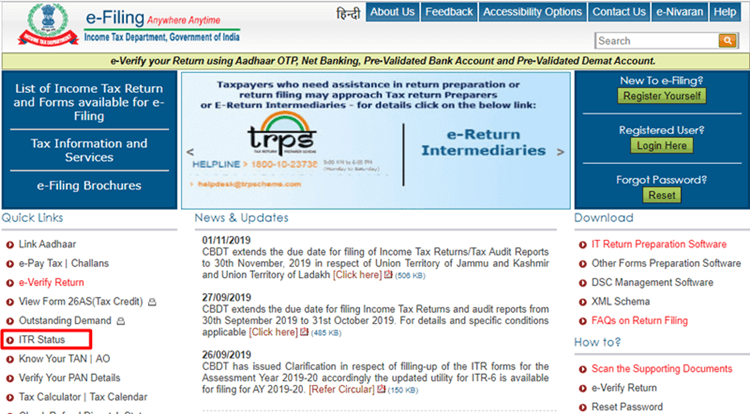

Visit the e-filing website of the government

On the homepage, choose ITR Status option under Quick Links section, available on the left side

Now, you will be redirected to a new page where you would have to enter your details, such as PAN number, acknowledgement number, and captcha code

Once done, click on Submit, and your status will be displayed to you

Since you would have to enter your PAN details as well; thus, the same method can be used for ITR status check by PAN Card number.

ITR Status Check with Login Credentials

If not acknowledgement number, another way to know your ITR status is by using the login credentials. For this method:

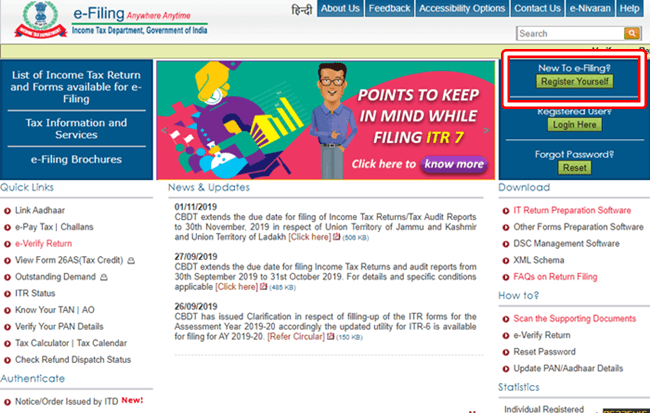

Visit the e-filing website of the government

On the right-hand side, choose Login Here below the Registered User? heading

After that, a new page will open up where you would have to enter your user ID, password, and captcha code

Hit Submit button

Your dashboard will open up where you can see View Returns / Forms option, click on it

From the dropdown menu, choose Income Tax Returns and assessment year and submit

Upon submitting, your status will be shown on the screen

Conclusion

Keep checking your ITR status, it will help you figure out whether your IT return is being processed or not. In case you are on the positive side of the boat, the status will show as Processed.

However, if you don’t see that status even if filing the return on time, you would then have to contact your CA or other professionals who helped you throughout the filing process.

In case, if your return is not processed within a month of filing and you have not got the notice, it would be recommended to get in touch with the Income Tax department. Apart from this consistent ITR status check online, you must also keep a tab on any notice received through email or post.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.