Table of Contents

- What is GSTR-10?

- Who Should File GSTR-10?

- Difference Between Annual Return and Final Return

- When to File GSTR-10?

- Details About Filing GSTR-10

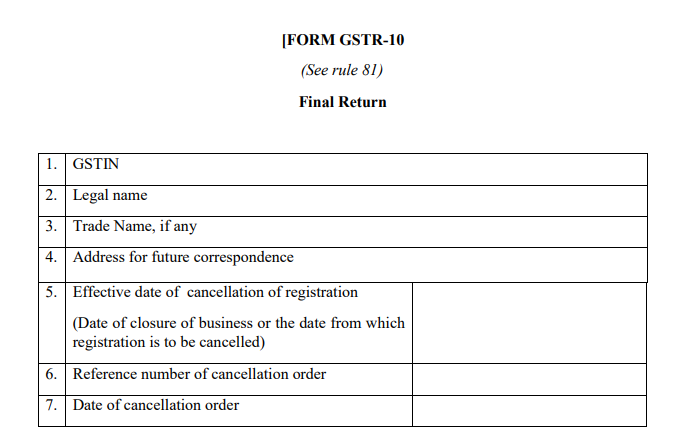

- 1. GSTIN

- 2. Legal Name

- 3. Trade name

- 4. Address

- 5. Application Reference Number

- 6. Effective Date of Surrender/Cancellation

- 7. Whether the cancellation order has been passed

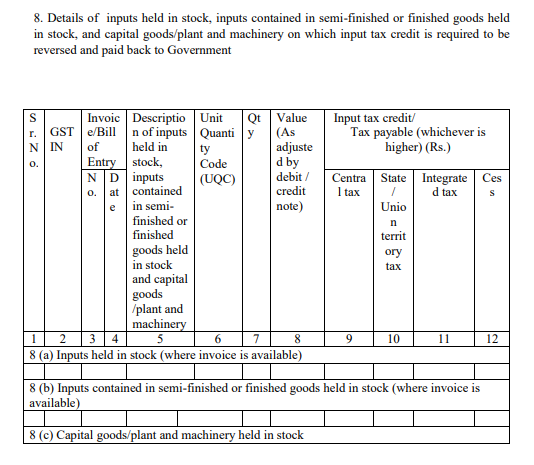

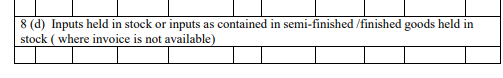

- 8. Details of inputs held in stock, inputs contained in semi-finished or finshed goods held in stock, and capital goods/plant and machinery on which input tax credit is required to be reversed and paid back to Government

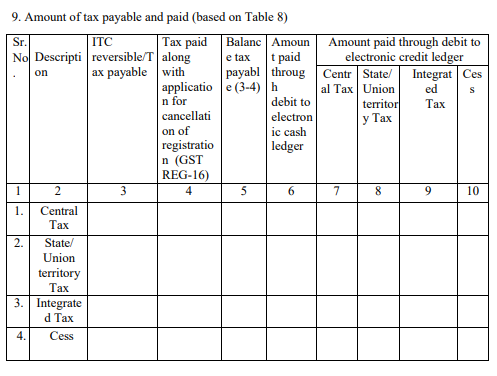

- 9. Amount of tax payable and paid

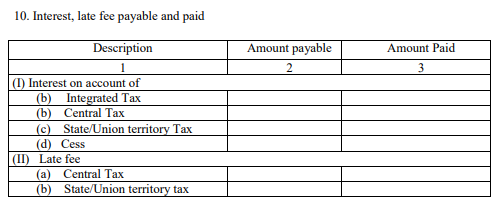

- 10. Interest, late fee payable and paid

- Penalty for Late Filing of GSTR 10

- Conclusion

GSTR 10 Form: Final Return

GSTR-10 is a specific filing that has to be filed by registered taxpayers under the GST regime. But what’s different about this? Well, it has to be filed only by those registered taxpayers whose GST registration is cancelled or surrendered.

What is GSTR-10?

GSTR-10 is a document/statement that has to be filed by a registered taxpayer after the cancellation or surrendering of GST registration. This could be because of the closing down of the business, etc. This could be done by the taxpayer voluntarily or because of a government order. This return is called a ‘Final Return’.

However, in order to file GSTR-10, you have to be a taxpayer with the 15-digit GSTIN number and is now cancelling the registration. Moreover, your business turnover should be over Rs. 20 lakhs per annum.

You can’t revise GSTR-10 form if you’ve made any errors while filing it.

Who Should File GSTR-10?

GSTR-10 is to be filed only by those taxpayers who registration is cancelled.

Regular taxpayers who file Annual Returns are not supposed to file this return. These also include the following:

- Input Service distributor

- Non-resident taxable persons

- Persons who deduct tax at source (TDS)

- Composition Taxpayer

- Persons who collect tax at source (TCS)

Talk to our investment specialist

Difference Between Annual Return and Final Return

There is quite a big difference between Annual Return and Final Return. Annual returns are filed by regular taxpayers, whereas final returns are filed by those taxpayers who are cancelling their GST registration.

The annual return is to be filed once in a year in GSTR-9. The final return is to be filed in GSTR-10.

When to File GSTR-10?

GSTR-10 is to be filed within three months from the date of cancellation of the GST or the date when the cancellation order was issued. For e.g., if the date of cancellation is 1st July 2020, GSTR 10 is to be filed by 30th September 2020.

Details About Filing GSTR-10

The government has specified 10 headings under GSTR-10.

Note- Section 1-4 will auto-populated during the time of the system login.

1. GSTIN

It will be auto-populated.

2. Legal Name

It will be auto-populated.

3. Trade name

It will be auto-populated.

4. Address

Here are the details that need to be entered by the taxpayer

5. Application Reference Number

Application Reference Number (arn) will be given to the taxpayer at the time of passing the cancellation order.

6. Effective Date of Surrender/Cancellation

In this section, mention the date of cancellation of your GST registration as in the order.

7. Whether the cancellation order has been passed

In this section, you have to mention whether your return is being filed on the Basis of cancellation order or voluntarily.

8. Details of inputs held in stock, inputs contained in semi-finished or finshed goods held in stock, and capital goods/plant and machinery on which input tax credit is required to be reversed and paid back to Government

In this section enter the details of all the inputs that are held in stock, semi-finished or finished goods, Capital goods, etc.

9. Amount of tax payable and paid

Enter the details of tax that is paid or yet to be paid under this heading. Segregate them according to CGST, SGST, IGST and Cess.

10. Interest, late fee payable and paid

You have to enter details of your closing stock during the time of the shutting down of your trade. Enter the details of any interest or Late Fee that is to be paid or already paid.

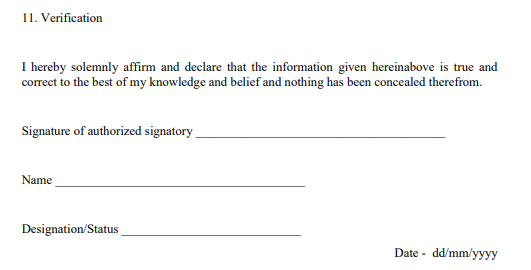

Verification: You are required to sign the document digitally to help the authorities be assured of its correctness. Use Digital Signature Certificate (DSC) or Aadhar based verification to validate GSTR-10.

Penalty for Late Filing of GSTR 10

If you Fail to file the return on the due date, you will receive a notice regarding the same. You will be granted 15 days for filing the returns.

If you fail to file the return despite the notice period, you will be charged with both interest and penalty. Also, there are chances that the tax office will pass the final order for cancellation.

Late Fees

You will be charged Rs. 100 CGST and Rs. 100 SGST per day. That means you have to pay Rs.200 per day until the date of actual payment. There is no maximum limit of the penalty on GSTR-10 filing.

Conclusion

GSTR-10 is an important return, hence it needs to be fully verified before hitting the submit button. Ensure you read every section carefully before filing the return. Also, submit it on time to avoid any further financial losses. This will also help you build goodwill in case you want to set up a new business in the future.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like

Well informed and described in simplified way on topic. Thank you.