Table of Contents

- What is GSTR-5?

- Who is a Non-resident Taxable Person?

- Due Dates for Filing GSTR 5 Form

- Details of Filing GSTR-5

- 1. GSTIN

- 2. Name of the Taxpayer

- 3. Inputs/Capital goods received from Overseas (Import of goods)

- 4. Amendment in the details furnished in any earlier return

- 5. Taxable outward supplies made to registered persons (including UIN Holders)

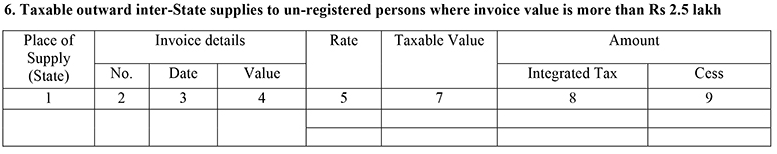

- 6. Taxable outward inter-state supplies to unregistered persons where invoice value is more than Rs. 2.5 lakh

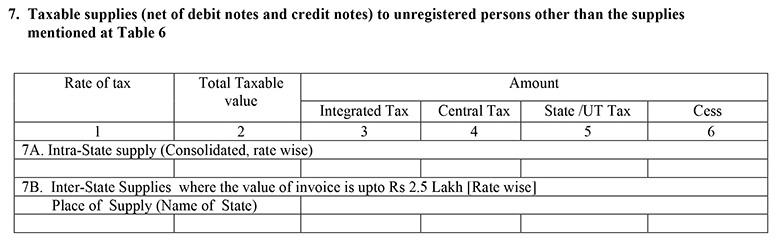

- 7. Taxable supplies (net debit and credit notes) to unregistered persons other than the supplies mentioned in Table 6

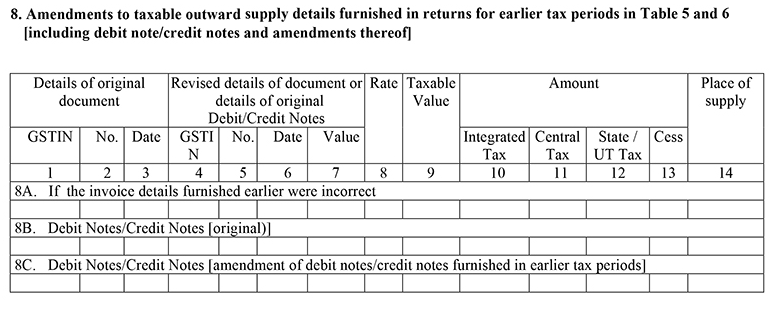

- 8. Amendments to taxable outward supply details furnished in returns for earlier tax periods in Table 5 and 6 (including debit notes/credit notes and amendments thereof)

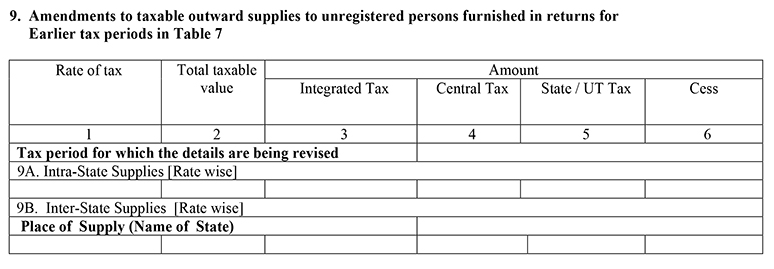

- 9. Amendments to taxable outward supplies to unregistered persons furnished in returns for earlier tax periods in Table 7

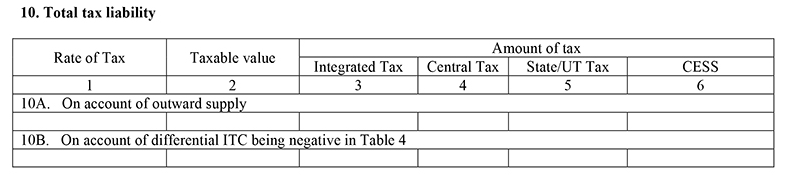

- 10. Total Tax Liability

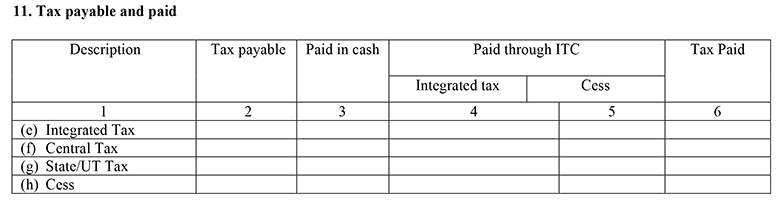

- 11. Tax Payable and Paid

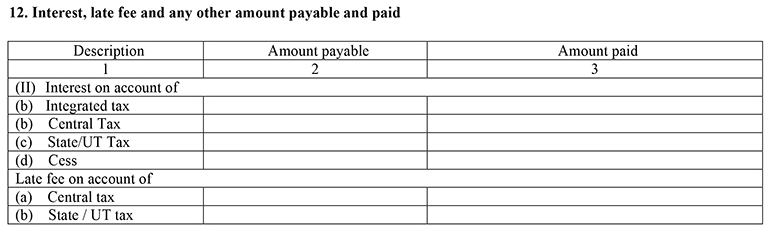

- 12. Interest, late fee and any other amount payable and paid

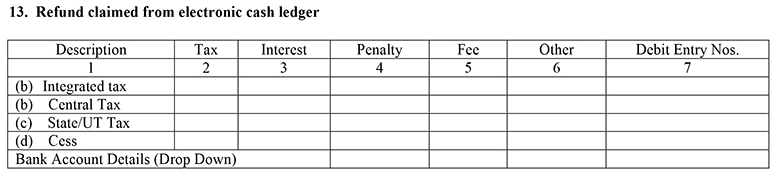

- 13. Refund claimed from Electronic Cash Ledger

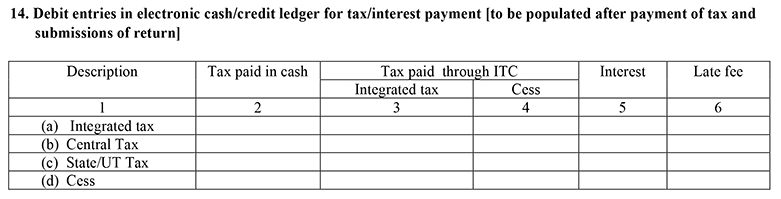

- 14. Debit entries in electronic cash/credit ledger for tax/interest payment (to be populated after payment of tax and submissions of return)

- Penalty for Late Filing of GSTR 5

- Conclusion

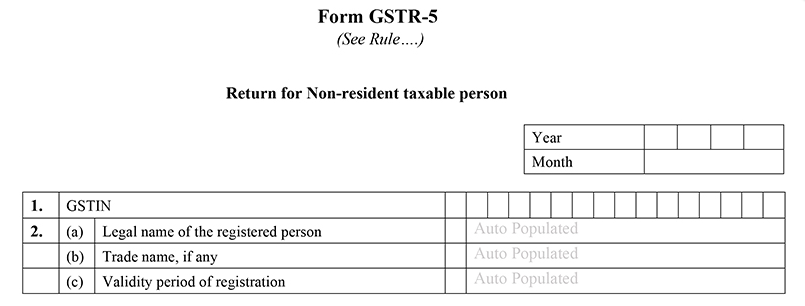

GSTR-5 Form: Return for Non-Resident Taxable Person

GSTR-5 is a special return that has to be filed under the GST regime. What makes this particular return special is the fact that it has to be filed by registered ‘non-resident’ taxable persons. It is a mandatory monthly return.

What is GSTR-5?

GSTR-5 is a monthly return that every registered ‘non-resident’ taxpayer has to file under the GST regime of India. This particular return will contain all the details of sales and purchases carried out of ‘non-resident’ foreign taxpayers. They are to provide all the details in this form.

Who is a Non-resident Taxable Person?

A non-resident taxable person is anyone who doesn’t have a business establishment in India but has come here for a short period of time to make supplies or purchases or both.

Section 24 of the GST law says that the registration of a ‘non-resident’ taxable person is mandatory. Even if the business transactions in India are not very frequent, every non-resident individual or company has to register under the GST regime.

The information from the seller’s GSTR-5 will be reflected in the relevant sections of the buyer’s GSTR-2.

Due Dates for Filing GSTR 5 Form

GSTR-5 is to be filed by the 20th of every month by the non-resident taxable person.

Here are the upcoming due dates:

| Period (Monthly) | Due date |

|---|---|

| January 2020 Return | 20th February 2020 |

| February 2020 Return | 20th March 2020 |

| March 2020 Return | 20th April 2020 |

| April 2020 Return | 20th May 2020 |

| May 2020 Return | 20th June 2020 |

| June 2020 Return | 20th July 2020 |

| July 2020 Return | 20th August 2020 |

| August 2020 Return | 20th September 2020 |

| September 2020 Return | 20th October 2020 |

| October 2020 Return | 20th November 2020 |

| November 2020 Return | 20th December 2020 |

| December 2020 Return | 20th January 2021 |

Talk to our investment specialist

Details of Filing GSTR-5

1. GSTIN

Each registered taxpayer is allotted a 15-digit GST identification number. This is auto-populated.

2. Name of the Taxpayer

The name of the non-resident taxpayer will be entered here. This is auto-populated.

- Month & Year- The taxpayer chooses the month and year at the time of filing.

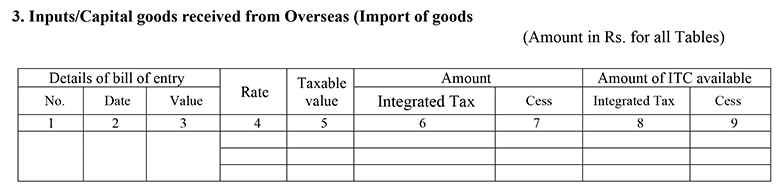

3. Inputs/Capital goods received from Overseas (Import of goods)

The taxpayer has to enter the details of all the goods that are imported into India. The taxpayer has to also fill Harmonised System Nomenclature (HSN) code and other details as and when asked.

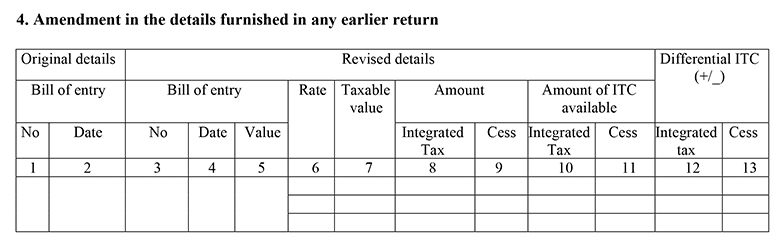

4. Amendment in the details furnished in any earlier return

Any changes regarding imported goods from the previous filing should be updated here.

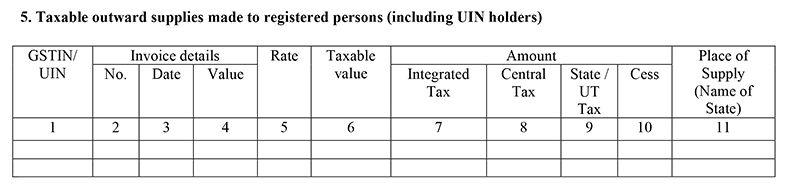

5. Taxable outward supplies made to registered persons (including UIN Holders)

This includes details of the supplies/sales made by non-resident taxpayers outside India.

6. Taxable outward inter-state supplies to unregistered persons where invoice value is more than Rs. 2.5 lakh

This heading covers all the inter-state supplies made to the unregistered person by registered persons.

7. Taxable supplies (net debit and credit notes) to unregistered persons other than the supplies mentioned in Table 6

The supplies from business to the consumer which is above Rs. 2.5 lakh should be reported under this head.

Also supplies lesser than Rs. 2.5 lakh from a registered taxable person to an unregistered should be covered under this head.

8. Amendments to taxable outward supply details furnished in returns for earlier tax periods in Table 5 and 6 (including debit notes/credit notes and amendments thereof)

If there are any changes regarding any filing in Table 5 and 6 from the previous tax periods, the changes are updated here.

9. Amendments to taxable outward supplies to unregistered persons furnished in returns for earlier tax periods in Table 7

Any changes with the entries in Table 7 from the previous tax periods can be updated here.

10. Total Tax Liability

The information here is auto-populated and shows the final GST liability.

11. Tax Payable and Paid

This heading includes the total tax paid under the IGST, CGST and SGST for a tax period.

12. Interest, late fee and any other amount payable and paid

This includes any interest or Late Fee that payable under IGST, CGST and SGST.

13. Refund claimed from Electronic Cash Ledger

This section is auto-populated if any amount is received from electronic cash ledger.

14. Debit entries in electronic cash/credit ledger for tax/interest payment (to be populated after payment of tax and submissions of return)

After the payment of tax and submission of return, the information is auto-populated here.

Penalty for Late Filing of GSTR 5

A late fee and interest are charged for filing the return late.

Interest

An 18% Tax Rate will be charged annually from the due date till the date of actual filing. This will be calculated on the amount of outstanding tax that is yet to be paid. The time period will start from the next day of the due date i.e. 21st of the month till the date of filing.

Late Fee

The taxpayer will be charged Rs.50 per day for late filing. Rs.20 per day will be charged in case of NIL return. The maximum amount for late fees in Rs.5000.

Conclusion

GSTR-5 is an extremely important return for non-resident taxable persons. If you’re one, remember to file your returns monthly and follow the required procedure to file your returns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like