Table of Contents

- What is GSTR 7?

- Who Should File GSTR-7?

- Due Dates for filing GSTR-7

- Details for Filing GSTR-7

- 1. GSTIN

- 2. Legal Name of the Deductor

- 3. Details of Tax deducted at Source

- 4. Amendments to details of tax deducted at source in respect to any earlier tax period

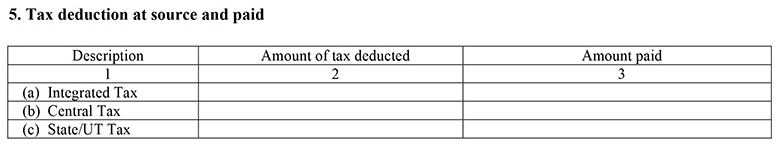

- 5. Tax deduction at Source and paid

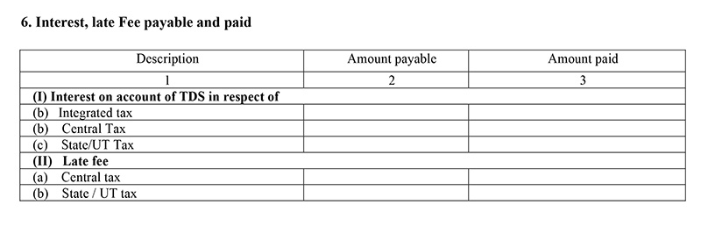

- 6. Interest, late fee payable and paid

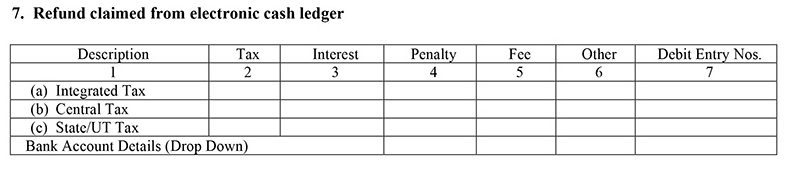

- 7. Refund claimed from electronic cash ledger

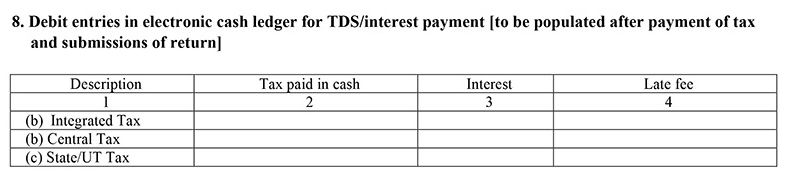

- 8. Debit entries in electronic cash ledger for TDS/interest payment [to be populated after payment of tax and submissions of return]

- Penalty for Late Filing

- Conclusion

All About GSTR-7 Form

GSTR-7 is an important monthly return to be filed under the GST regime. However, not all taxpayers are supposed to file this return. It is limited to those who have to deduct TDS (Tax Deducted at Source) under the GST regime.

What is GSTR 7?

GSTR-7 is a mandatory monthly return to be filed by deductors of TDS. It contains details of TDS deducted, TDS Refund claim, TDS liability payable or paid, etc.

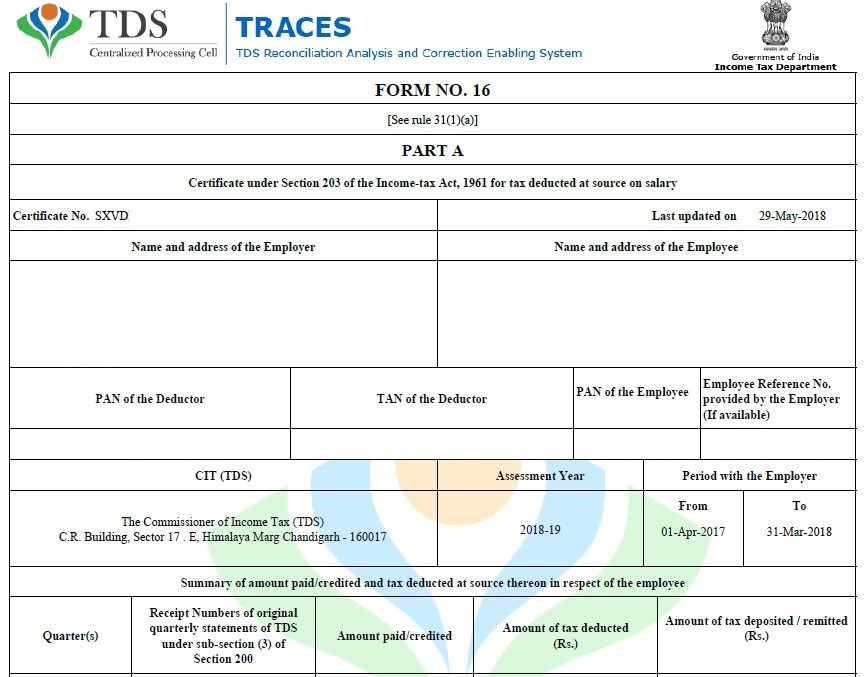

This is an important return as the person whose TDS has been deducted can claim input credit. The individual can then use it for the payment of output Tax Liability. These details are made available to the deductee (whose TDS has been deducted) in the ‘Part C’ of GSTR-2A after the due date of filing GSTR-7. Moreover, the deductee will also be able to access a certificate for such TDS in GSTR-7A form based on GSTR-7.

Remember that once the form is submitted any mistake can’t be revised. Any changes required can only be made in the next filing.

Who Should File GSTR-7?

Here’s a list of those who deduct TDS:

- Department/establishment of Central or State government

- Local Authority

- Government Agencies

- Persons or category of persons who are notified by the Central/State government on the Council’s recommendations

According to Notification No. 33/2017- Central Tax, 15th September 2017

The following mentioned entities are required to deduct TDS:

- Any authority or a board or any other body that is set up the Parliament or State legislature or by the government, where 51% of the equity is owned by the government

- Society established by the Central or the State government or any Local authority and the society is registered under the Societies Registration Act of 1860

- Any Public Sector Undertakings

These persons or entities can deduct TDS when total supply value exceeds Rs. 2.5 lakh. Furthermore, in the case of intra-state supplies, the rate of TDS is 2% i.e. CGST 1% & SGST 1%. In the case of interstate supplies, the rate of TDS is 2% i.e. IGST 2%.

Note: TDS will not be deducted if the location of the supplier and supply place is different from the recipient’s registration place.

Talk to our investment specialist

Due Dates for filing GSTR-7

GSTR-7 is a monthly return and has to be filed by 10th of every month.

Here is a list of due dates for 2020.

| Period (Monthly) | Due Date |

|---|---|

| February Return | March 10th 2020 |

| March Return | April 10th 2020 |

| April Return | May 10th 2020 |

| May Return | June 10th 2020 |

| June Return | July 10th 2020 |

| July Return | August 10th 2020 |

| August Return | September 10th 2020 |

| September Return | October 10th 2020 |

| October Return | November 10th 2020 |

| November Return | December 10th 2020 |

| December Return | January 10th 2021 |

Details for Filing GSTR-7

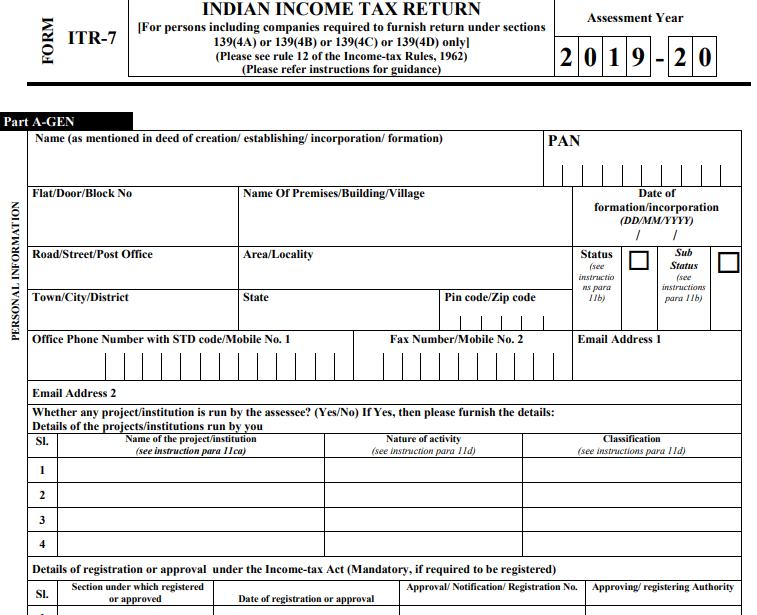

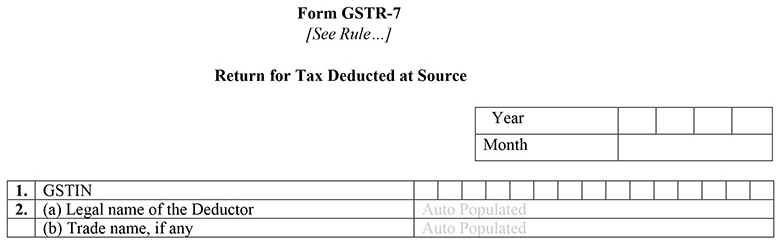

The government has specified a total of 8 heading in the GSTR-7 form.

1. GSTIN

It’s a 15-digit identification number given to every registered taxpayer under the GST regime. It is auto-populated.

2. Legal Name of the Deductor

The deductor is to enter their name.

Month, Year: Enter the relevant month and year

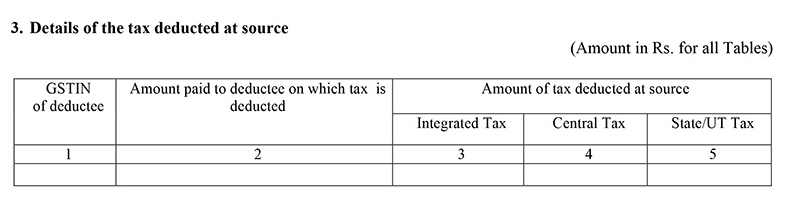

3. Details of Tax deducted at Source

This section will contain the details of the deductee, total TDS amount (Central/State/Integrated).

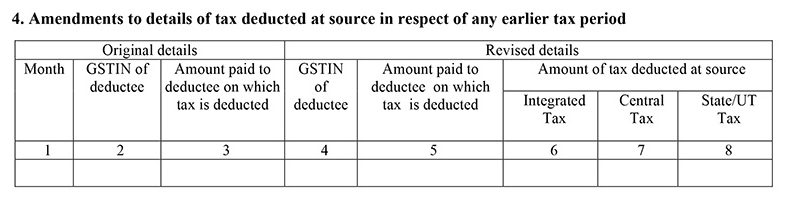

4. Amendments to details of tax deducted at source in respect to any earlier tax period

If you need to make any corrections with regards to data entered in previous filings, you can make the changes in this section. This amendment will revise the TDS certificate GSTR-7A.

5. Tax deduction at Source and paid

This section will contain the details of the amount of tax deducted from the deductee (Central/State/Integrated) and the tax paid to the government (Central/State/Integrated).

6. Interest, late fee payable and paid

This section contains details of the interest or late fees applicable on TDS amount and the balance of how much has been paid till date.

7. Refund claimed from electronic cash ledger

TDS refund can be claimed from electronic cash ledger in this section. Mention the details for the same and also provide Bank details for the transfer of the refund.

8. Debit entries in electronic cash ledger for TDS/interest payment [to be populated after payment of tax and submissions of return]

Entries here are auto-populated after you have finished filing under other sections.

Penalty for Late Filing

Late filing will attract both Interest and late fees.

Interest

Every late filing will attract an interest of 18% per annum on the tax to be paid. This will be calculated from the due date to the date of actual payment.

Late Fee

The taxpayer will be required to pay Rs. 25 CGST and Rs. 25 SGST per day till the date of filing returns. A maximum of Rs. 5000 will be charged.

Conclusion

Filing of GSTR-7 is equally important as any other return filing. Accumulating interest and late fees on the return can affect the standing of the taxpayer while also causing unnecessary financial loss.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like