Table of Contents

- What is GSTR-6?

- Who are Input Service Distributors?

- Who Should File GSTR-6 Form?

- What is GSTR-6A?

- Due Dates for Ffiling GSTR-6 Form

- Details of GSTR-6

- 1.GSTIN

- 2. Name of the Taxpayer

- 3. Input Tax Credit received for Distribution

- 4. Total ITC/Eligible ITC/Ineligible ITC to be distributed for the Tax period

- 5. Distribution of input tax credit reported in Table 4

- 6. Amendments in the information furnished in earlier returns in Table No.3

- 7. Input tax credit mismatches and reclaims to be distributed in the tax period

- 8. Distribution of input tax credit reported in Table 6 and 7 (plus/minus)

- 9. Redistribution of ITC distributed to a wrong recipient (plus/minus)

- 10. Late fee

- 11. Refund claimed from electronic cash ledger

- Penalty for Late Filing

- Conclusion

GSTR-6: Return for Input Service Distributors

GSTR-6 is an important return that Input Service Distributors are required to file under the GST regime. It’s a mandatory monthly return for Input Service Distributors.

What is GSTR-6?

The GSTR-6 form is a monthly return that Input Service Distributors are required to file. This contains the details about the Input Tax Credit (ITC) received by the Input Service Distributors. It also contains all the documents issued for the distribution of Input Tax Credit along with how it was distributed against relevant tax invoices. Input Service Distributors are to file this return even if they have NIL returns.

One of the things to remember is that GSTR-6 can’t be revised. Any changes to be made can only be done in the following month’s return.

Who are Input Service Distributors?

Input Service Distributors are businesses who get invoices for services used by their branches. They act as an intermediary between Manufacturing businesses and producers of final products.

Who Should File GSTR-6 Form?

Input Service Distributors who have to file GSTR-6 include:

- Composition Dealers

- Suppliers of Online Information and Database Access or Retrieval (OIDAR)

- compounding Taxable person

- Taxpayers liable to collect TCS

- Taxpayers liable to deduct TDS

- Non-resident Taxable Person

What is GSTR-6A?

GSTR-6A is a document that is generated automatically based on the details entered by the Input Service distributor in GSTR-1. It is a read-only Form and if changes are to be made, it should be made while filing the GSTR-6 form.

GSTR-6A is not to be filed. It's automatically generated.

Due Dates for Ffiling GSTR-6 Form

GSTR-6 is a mandatory monthly return. It is to be filed on the 13th of every month.

The due dates for 2020 are mentioned below:

| Period (Monthly) | Due Date |

|---|---|

| February Return | March 13th 2020 |

| March Return | April 13th 2020 |

| April Return | May 13th 2020 |

| May Return | June 13th 2020 |

| June Return | July 13th 2020 |

| July Return | August 13th 2020 |

| August Return | September 13th 2020 |

| September Return | October 13th 2020 |

| October Return | November 13th 2020 |

| November Return | December 13th 2020 |

| December Return | January 13th 2021 |

Talk to our investment specialist

Details of GSTR-6

The government has specified 11 heading under GSTR-6 form.

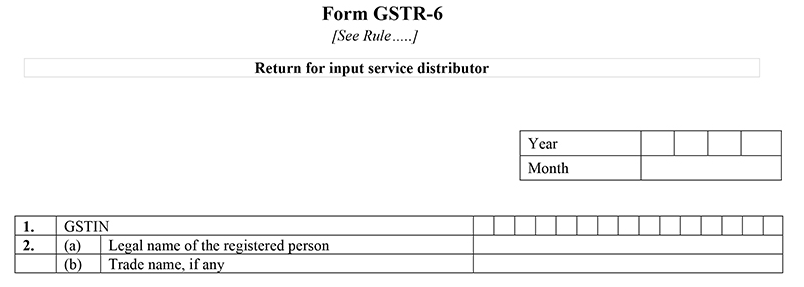

1.GSTIN

It’s a unique 15-digit number that every registered dealer has. It is auto-populated.

2. Name of the Taxpayer

Enter the name and business name.

Month, Year: Enter the relevant month and year of filing.

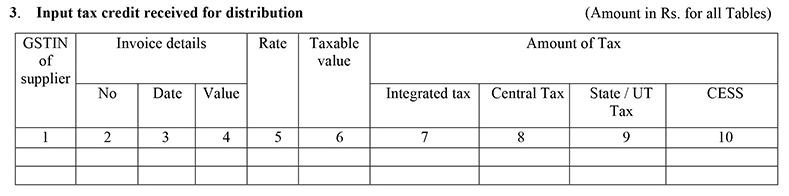

3. Input Tax Credit received for Distribution

Input Service Distributor enters the details of purchases from a registered supplier. Inward supply details are auto-populated from the GSTR-1 and GSTR-5 of the counterparty. All credit covered under SGST/IGST/CGST has to be mentioned.

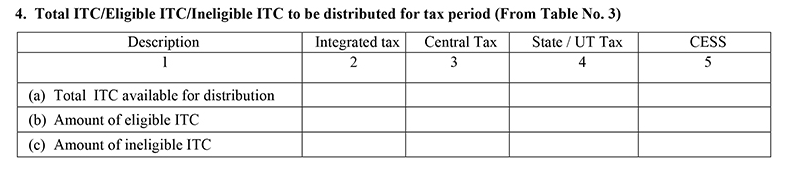

4. Total ITC/Eligible ITC/Ineligible ITC to be distributed for the Tax period

All entries will be auto-populated from Table 3. It will contain details about the total ITC of the Input Service Distributor divided into eligible ITC and ineligible ITC.

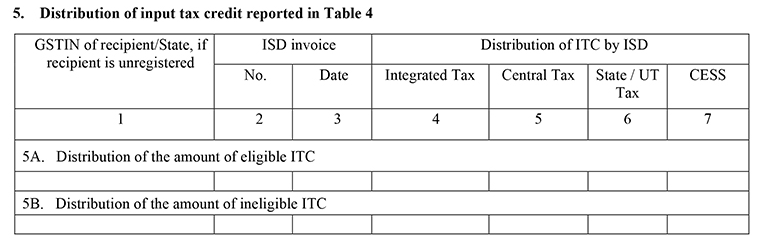

5. Distribution of input tax credit reported in Table 4

This includes information regarding the available credit under CGST, IGST and SGST. Fill in the invoice details in this section.

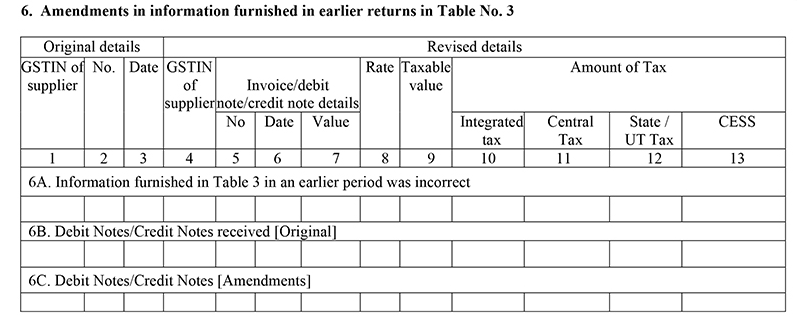

6. Amendments in the information furnished in earlier returns in Table No.3

In this section, the taxpayer is required to provide modified and revised details of invoices with information of CGST, SGST and IGST charged due to any modification or change in the earlier tax period.

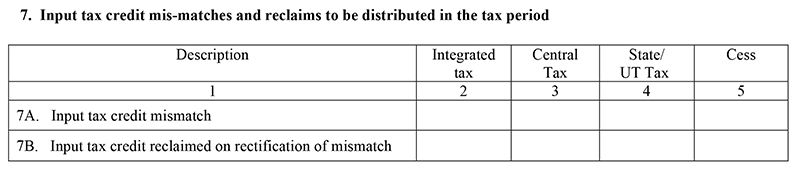

7. Input tax credit mismatches and reclaims to be distributed in the tax period

Any mismatches or reclaims in ITC under IGST/CGST/SGST can be done here.

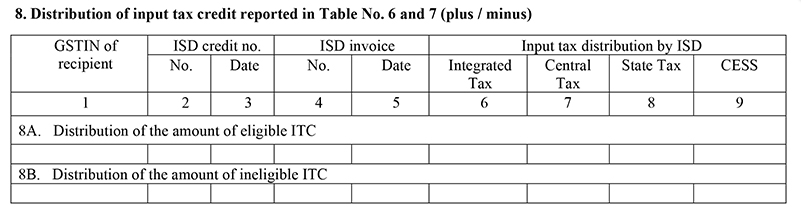

8. Distribution of input tax credit reported in Table 6 and 7 (plus/minus)

ITC amount to be distributed under IGST/CGST/SGST is to be mentioned here.

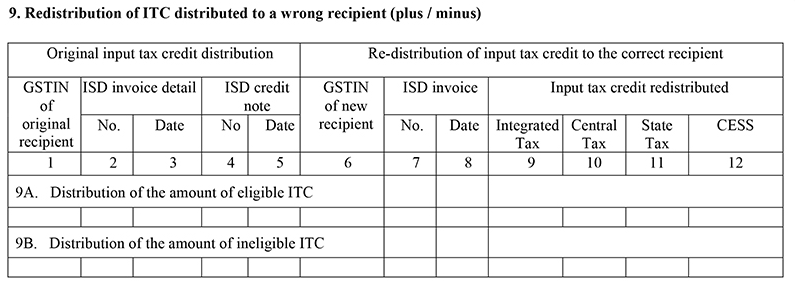

9. Redistribution of ITC distributed to a wrong recipient (plus/minus)

If the amount has been distributed to the wrong person, the changes can be mentioned here.

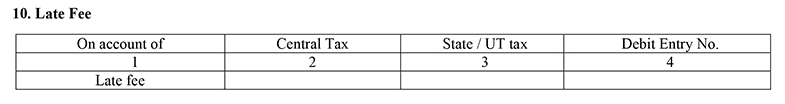

10. Late fee

Late fees payable or paid should be mentioned here.

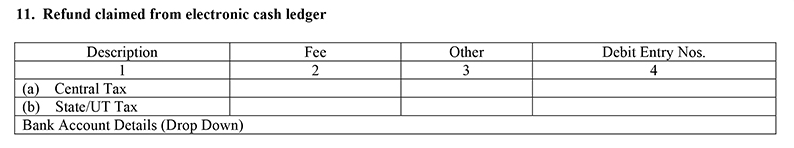

11. Refund claimed from electronic cash ledger

Refund amount and other related information are covered under this heading.

Penalty for Late Filing

Filing GSTR-6 late will attract both interest and late fees as a penalty.

Interest

An interest of 18% will be charged extra while you will also have to pay the total tax amount due for the month. For each delayed day the interest will grow by 4.93%. approximately.

Late Fee

The taxpayer will be liable to pay Rs.50 per day from the due date till the date of actual filing. Rs. 20 per day will be charged in case of late filing of NIL return.

Conclusion

GSTR-6 is an important Tax Return that should be filed by the 13th of every month without Fail. Filing it on time will save both time and money.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

very good