Table of Contents

- What is GSTR-8?

- Who Should File GSTR-8?

- Who are E-commerce Operators?

- Due Dates for Filing GSTR-8 Form

- Details of GSTR-8 Form

- 1. GSTIN

- 2. Name of the Taxpayer and Trade name

- 3. Details of supplies made through e-commerce operator

- 4. Amendments to details of supplies in respect of any earlier statement

- 5. Details of Interest

- 6. Tax Payable and paid

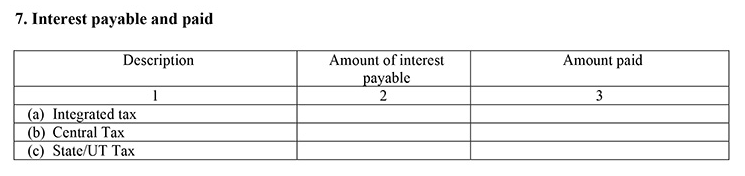

- 7. Interest payable and paid

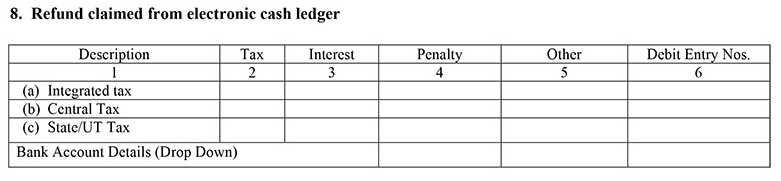

- 8. Refund claimed from the electronic cash ledger

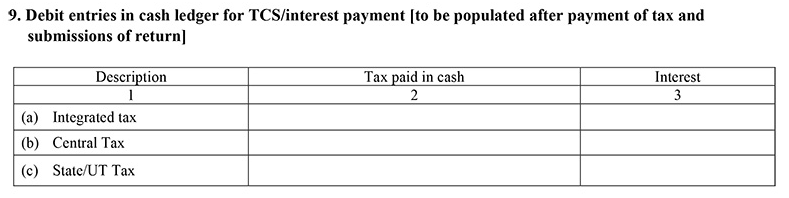

- 9. Debit entries in cash ledger for TCS/interest payment [to be populated after payment of tax and submissions of return

- Penalty on Late Filing of GSTR 8

- Conclusion

GSTR-8: Return For E-Commerce Operators

GSTR-8 is a monthly return that registered taxpayers have to file under the GST regime. However, GSTR-8 is not to be filed by the masses, but by a specific category of people. The returns have to be filed by the E-commerce operators every month.

What is GSTR-8?

GSTR-8 is a return that is to be filed by e-commerce operators on a monthly Basis. These e-commerce operators are those who are required to deduct TCS (Tax Collected at Source) under the GST. GSTR-8 Form contains all the details of sales done over the e-commerce platform and also the amount/revenue collected via those sales.

Any mistakes made in GSTR-8 can’t be revised after submission. It can only be changed during the filing in the following month. For eg. If you have submitted the GSTR-8 return for the month of February and want to revise it, you can do so only during the filing in March.

Who Should File GSTR-8?

GSTR-8 is to be filed exclusively by e-commerce operators. They are required to be registered under the GST regime and TCS.

Who are E-commerce Operators?

The GST Act has defined an E-commerce operator as any individual who owns or manages a digital platform for the purpose of commerce. Amazon and Flipkart are two of the many examples of E-commerce Facility. They provide a platform for businesses and consumers to meet for commercial purposes. The process of buying and selling makes it fall under the GST business.

Due Dates for Filing GSTR-8 Form

GSTR-8 is a monthly return and has to be filed on the 10th of every month.

Following are the due dates for filing GSTR-8 in 2020.

| Period (Monthly) | Due Date |

|---|---|

| February Return | March 10th 2020 |

| March Return | April 10th 2020 |

| April Return | May 10th 2020 |

| May Return | June 10th 2020 |

| June Return | July 10th 2020 |

| July Return | August 10th 2020 |

| August Return | September 10th 2020 |

| September Return | October 10th 2020 |

| October Return | November 10th 2020 |

| November Return | December 10th 2020 |

| December Return | January 10th 2020 |

Talk to our investment specialist

Details of GSTR-8 Form

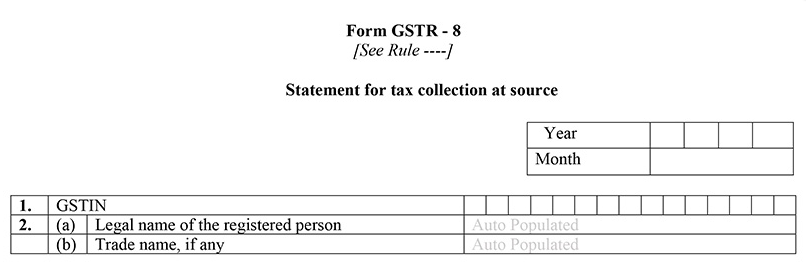

The government has specified nine headings for the GSTR-8 Form.

1. GSTIN

It is a 15-digit identification number provided to every registered taxpayer in the country. It is auto-populated.

2. Name of the Taxpayer and Trade name

The taxpayer has to mention both the name and the name of the business involved in.

Month, Year: Enter relevant month and year.

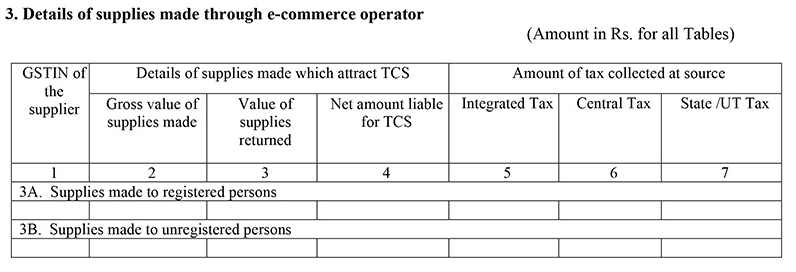

3. Details of supplies made through e-commerce operator

This section contains the details of B2B supplies made through the digital platform.

Supplies made to registered persons: The taxpayer will file the details of the registered supplier who delivers goods and services to consumers. This includes the GSTIN of the supplier, the total gross value of the supplies made, the value of supplies returned and net tax amount.

Supplies made to unregistered persons: The taxpayer will file to details of the registered supplier who delivers goods and services to unregistered persons. It involves the GSTIN of the supplier, the gross value of the supplies made, the value of supplies returned and other Taxes.

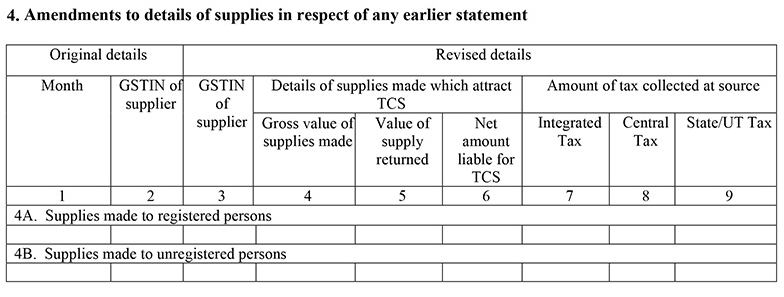

4. Amendments to details of supplies in respect of any earlier statement

Any correction in the data that the taxpayer has submitted in the previous return can be made here.

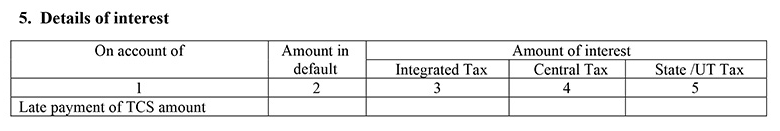

5. Details of Interest

E-commerce operators are liable to attract interest if they don’t pay the TCS amount on time.

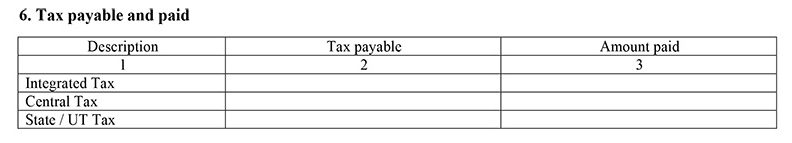

6. Tax Payable and paid

This section includes details of the tax that is to be paid under the CGST, IGST and SGST category. It also includes details about the amount of tax that has been paid.

7. Interest payable and paid

A taxpayer will attract an 18% interest rate on late payment of GST. This interest will be calculated on the outstanding amount of tax.

8. Refund claimed from the electronic cash ledger

This can be claimed only after all the liability over TCS for that period has been discharged.

9. Debit entries in cash ledger for TCS/interest payment [to be populated after payment of tax and submissions of return

TCS amount will be shown in ‘Part C’ of GSTR-2A of the taxpayer after filing of GSTR-8.

Penalty on Late Filing of GSTR 8

Both interest and a Late Fee will be applied to late filing of GSTR-8.

Interest

The taxpayer will have to pay 18% per annum. This has to be calculated by the taxpayer on the tax to be paid. The interest will be levied from the next day of the due date to the date of actual payment.

Late Fees

A penalty of Rs. 100 under CGST and Rs.100 under SGST will be levied on the taxpayer. The taxpayer will be charged a total of Rs. 200 per day. The maximum amount that can be charged is Rs. 5000.

Conclusion

GSTR-8 is exclusively for e-commerce operators. Punctual monthly filing with payment of taxes can help them gain and maintain goodwill in the Market. It will also help you make great profits in the business.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.