GSTR-9C- How to File GSTR-9C?

GSTR-9C is another important form to be filed under the GST regime. It is a Reconciliation statement between GSTR-9 for an audited financial statement of any taxpayer with a turnover of above 2 crores.

What is GSTR-9C?

GSTR-9C was introduced in September 13,2018. It’s an audit form that has to be filed annually by taxpayers with a turnover of above 2 crores. This has to be certified by a Chartered Accountant (CA). GSTR 9C form contains the taxpayer’s annual audited gross and taxable turnover as recorded in the Accounting books, which is reconciled with the corresponding figures after the consolidation of all GST Returns for the financial year.

If there’s any difference shown in the reconciliation statement, it should be mentioned. GSTR-9C should be issued for every GSTIN.

Who Should File GSTR-9C?

Taxpayers with an annual turnover of more than Rs. 2 crores should file GSTR-9C. The taxpayer must contact a chartered accountant or cost accountant to certify their form. The taxpayer can then file this on the GST portal or through a felicitation centre. The taxpayer may be required to file a copy of their audited accounts and their annual returns in a GSTR-9 form.

Due Dates for Filing GSTR-9C

The GSTR-9C is to be filed on or before 31st December following the financial year that is under audit. For eg. The GSTR-9C for financial year 2019-2020 must be filed on 31st December 2021.

How to File GSTR-9C?

GSTR-9C is divided into two sections namely Part A and Part B. Part A is all about tax information and Part B is certification that is to be completed by a CA.

Talk to our investment specialist

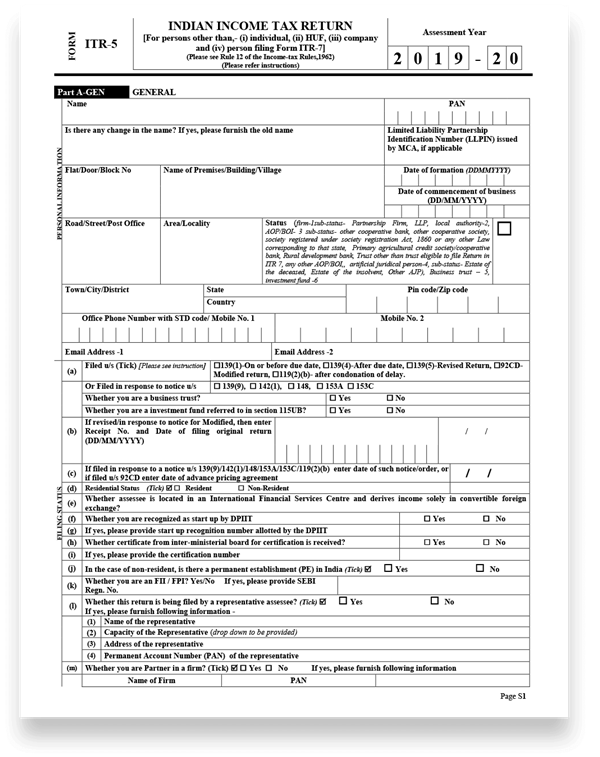

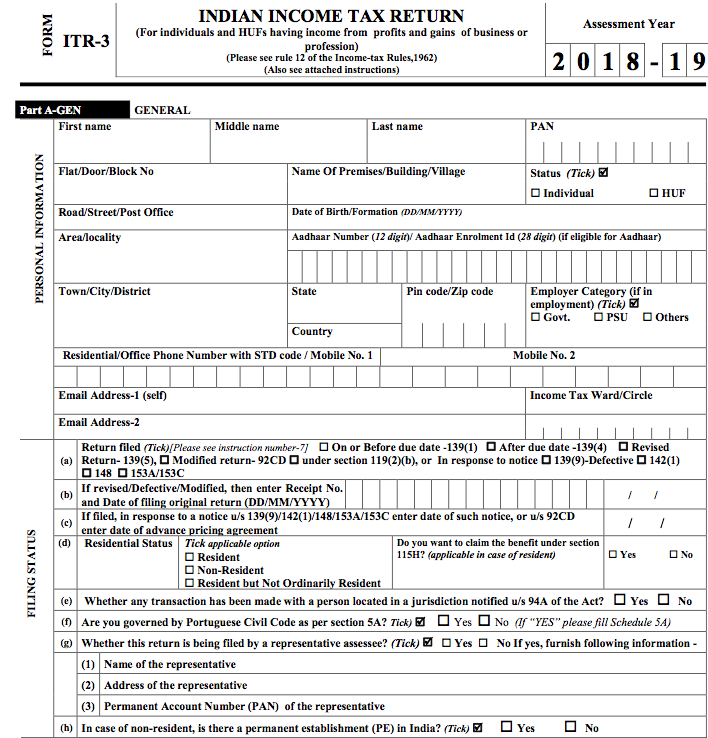

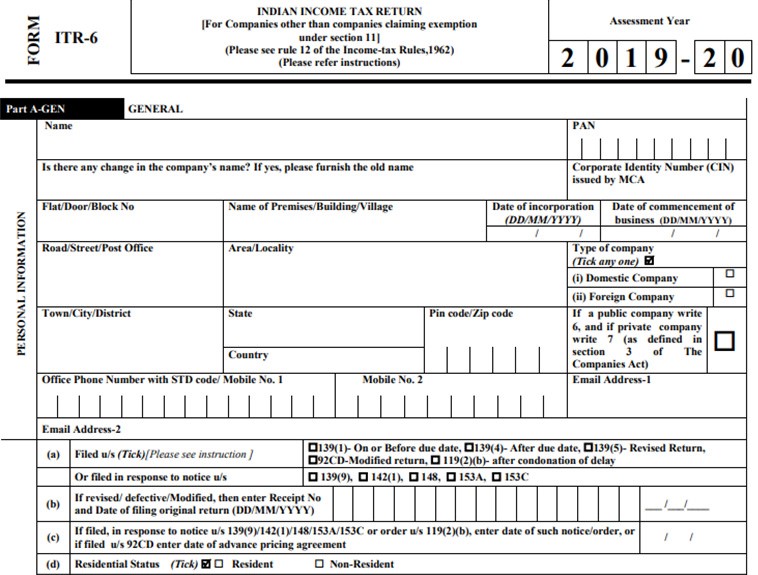

PART 1: Basic Details

This is the first part in the GSTR-9C form where you can enter the financial year, GSTIN, legal name, trade name and whether or not you are liable to audit under any act.

Part 2: Reconciliation of turnover declared in audited Annual Financial Statement

Enter the information about your turnover based on your audited Annual Financial Statement.

Section 5 contains details about the reconciliation of your gross turnover. This involves reporting the gross and taxable turnover. They are mentioned below:

A. The turnover, inclusive of exports, as declared in the audited financial reports for the State.

B. The unbilled revenue noted at the beginning of the financial year.

C. Any unadjusted advances at the end of the financial year.

D. The deemed supply as listed under Schedule I.

E. All credit notes that were issued after the end of the financial year but reflected in the annual return.

F. Trade discounts that have been accounted for in the audited annual financial statement, but are not allowed under GST.

G. The turnover for the period between April and June, 2017.

H. The unbilled revenue calculated for the end of the financial year.

I. The unadjusted advances at the beginning of the financial year.

J. Credit notes that have been accounted for in the audited annual financial statements, but are not allowed under GST.

K. Any adjustments on account of supply of goods by SEZ units to DTA units.

L. The turnover for the period under the composition scheme.

M. Any adjustments in turnover under Section 15.

N. Any adjustments in turnover due to foreign exchange fluctuations.

O. Any adjustments in turnover due to reasons that have been not listed above.

P. The annual turnover after all the above adjustments have been made. This field is auto-populated.

Q. The turnover declared in the annual return, GSTR-9.

R. The un-reconciled turnover, which is calculated as the difference between lines P and Q above. (Q - P)

In Section 6, list possible reasons for unreconciled differences in the annual gross turnover occurred.

A. The annual turnover after adjustments. This value is auto-populated.

B. The value of the exempted, nil rated, non-GST supplies, and no-supply turnover.

C. The value of supplies which are zero-rated and for which no tax was paid.

D. Value of supplies for which tax is to be paid by the recipient under reverse charge.

E. The taxable turnover as per the adjustments listed in the above lines. (A - B - C - D)

F. The taxable turnover with regard to the liability listed in the annual return (GSTR-9).

G. Value of the unreconciled taxable turnover. (F - E)

Section 8 is where you can list reasons for the difference between taxable turnover declared in the annual return. Additionally, you can mention the taxable turnover derived from line E of Section 7. It is similar to Section 6.

PART 3: Reconciliation of Tax Paid

In this part enter information about the tax you have paid. In Section 9, fill in the taxable value, central and state tax, integrated tax, and cess value for each Tax Rate: 5%, 12%, 18%, 28%, 3%, 0.25%, and 0.10%. For each rate, tax paid by reverse charge is listed in a separate line.

Under Section 10, enter reasons for the difference between the total amount of tax paid as per the reconciliation statement. Additionally, mention the total amount of tax paid as given in the annual return (GSTR-9).

Enter details of any tax payable but not yet paid because of the reasons specified in Sections 6, 8, and 10 in Section 11.

PART 4

In Section 12, mention the value of the ITC received in the following categories:

A. The ITC availed as per the audited annual financial statement for the state or UT. In the event of multiple GSTINs under the same PAN, this value should be derived from the audited accounts.

B. The ITC that has been mentioned in the accounts for earlier financial years, but availed in the current financial year.

C. The ITC that has been mentioned in the accounts of the current financial year, but kept to be availed in the next financial year.

D. The ITC that has been availed as per the audited financial statements or accounts. This field will be auto-populated.

E. The ITC that has been claimed in your annual return (GSTR-9).

F. The un-reconciled ITC.

In Section 13, list reasons for a difference between the ITC claimed according to the annual return filed (GSTR-9). Also list the reasons for the ITC claimed, as per the audited financial statement.

In Section 14, enter the value, amount of total ITC, and amount of eligible ITC received regarding each expense category.

In Section 15, enter reasons of differences between the amount of ITC received for the different expenses (as said in line R of Section 14) and the received ITC as per the annual return (as said in line S).

In Section 16, enter central and state tax, integrated tax, cess value, interest, and penalty payable regarding the unreconciled differences described in Sections 13 and 15.

PART 5: Auditor’s recommendation on additional liability due to non-reconciliation.

This part has the auditor’s recommendations on additional Tax Liability due to non-reconciliation. Here, the auditor will enter taxable value, central and state tax, integrated tax, and cess value (if applicable) for several categories: the individual tax rates of 5%, 12%, 18%, 28%, 3%, 0.25% and 0.10%; the applicable ITC, interest, late fees, penalties, any other amounts paid but not included in GSTR-9; erroneous refunds to for repayment and outstanding demands still to be settled.

Verification: Sign and authenticate the return either through a digital signature certificate (DSC) or by an Aadhar-based signature verification mechanism before filing GSTR-9C.

Penalty for Late Filing of GSTR-9 Form

Late filing of the form is liable for penalty and the taxpayer will have to cash out Rs. 200 per day, i.e. Rs. 100 under CGST and Rs. 100 under SGST category.

Conclusion

GSTR-9C is a mandatory return that has to be filed with the help of a chartered accountant. Make sure you do not skip this form and be careful while filing the details.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Needfull knowledge