Table of Contents

Best Critical Illness Policy India 2025

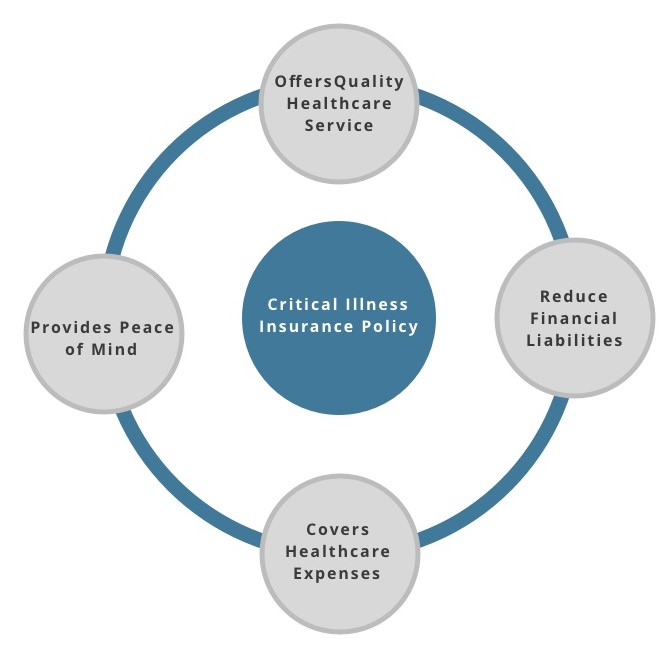

Best critical illness policy? How to buy a Critical illness insurance? Where to buy it? These are the common questions that come across the mind of people new to insurance. Critical Illness health insurance is a health insurance plan specially formulated to provide safety against critical illnesses that are very costly to treat and generally take a longer time for recovery. Thinking do you actually need it? According to a study, one out of every four Indians is at a risk of suffering from critical illnesses before the age of 70. This is why getting a critical insurance plan is important. However, it is suggested to look for the best critical illness policy with an appropriate critical illness cover among various policies offered by both general insurance (including health insurance) and life Insurance companies in India.

Checkpoints for Buying a Critical Illness Insurance

Before you select the best critical illness policy, make sure you know all your requirements well. Sometimes, with so many available options, it gets difficult for people to decide the best critical illness policy that would best suit their needs. For your convenience, we have listed a few things to look for when choosing the best critical illness policy.

Period of Survival of Critical Illness Policy

Usually, the critical illness policies have a survival period of 30 days. This means that the insured has to survive for 30 continuous days after the detection of a critical illness in order to make a claim. However, some health insurance companies may increase the survival period beyond 30 days as well. So, it is important to go through this clause before you buy.

Total Illnesses Covered under a Critical Illness Plan

This is the most important Factor to look for when buying a critical illness insurance. The diseases covered under a policy are different from one another. Some of the policies may provide a critical illness cover for 8 ailments while some other may provide a coverage for as many as 20 severe ailments. Choose a plan that covers a broad category of ailments so that if the cost of treatment is high you are saved from a financial drain.

Built-in Coverage of a Critical Illness Plan

Although the critical illness plans in India provide a health cover against critical illnesses, some of the general insurance companies offer a built-in coverage as well. This includes a personal accident insurance cover, hospital cash, child education benefit, complementary health checkup etc. Look for these benefits before making a final decision.

Talk to our investment specialist

Best Critical Illness Policy 2025

Now that you know how to choose a Critical Illness Insurance, here's a few list of the top critical illness plans enabling you to choose the best critical illness policy for yourself.

1. ICICI Lombard Critical Care

Critical Care by ICICI Lombard is an insurance cover that empowers you to be prepared for the unexpected events in life. The policy provides lump sum benefit on diagnosis of any of nine critical illnesses, accidental death and Permanent Total Disablement (PTD). The insured can be either you or your spouse, aged between 20-45 years.

9 Critical Illness Cover

The following are the major medical illnesses and procedures covered in the plan. On diagnosis of any of the below illnesses, the insured is entitled to the lump sum benefit of the entire Sum Insured opted for.

- Cancer

- Coronary Artery Bypass Graft Surgery

- Myocardial Infarction (Heart Attack)

- Kidney Failure (End Stage Renal Failure)

- Major Organ Transplant

- Stroke

- Paralysis

- Heart Valve Replacement Surgery

- Multiple Sclerosis

Sum Assured

| Covers | Sum Insured Options |

|---|---|

| Critical Illness/Major Medical Illness Diagnosis | Rs. 3, 6 or Rs. 12 Lakh |

| Accidental Death | Rs. 3, 6 or Rs. 12 Lakh |

| Permanent Total Disability (PTD) | Rs. 3, 6 or Rs. 12 Lakh |

2. HDFC ERGO Critical Illness Insurance

Critical Illness Insurance by HDFC ERGO is a smart move made well in advance to have better financial planning so that you can tackle life threatening diseases such as cancer, stroke, etc., from draining your savings. This plan comes with lower premiums and bigger coverage to help you focus on your health without any Financial Stress. HDFC ERGO Critical Illness policy covers individuals in the age group of 5 years to 65 years.

HDFC ERGO Critical Illness Insurance - SILVER Plan

- Heart Attack

- Multiple Sclerosis

- Stroke

- Cancer

- Major Organ Transplantation

- Coronary Artery Bypass Surgery

- Paralysis

- Kidney failure

HDFC ERGO Critical Illness Insurance - PLATINUM Plan

- Heart Attack

- Multiple Sclerosis

- Stroke

- Cancer

- Major Organ Transplantation

- Coronary Artery Bypass Surgery

- Paralysis

- Kidney failure

- Aorta Graft Surgery

- Primary Pulmonary Arterial Hypertension

- Heart Valve Replacement

- Parkinson's Disease

- Alzheimer's Disease

- End Stage Liver Disease

- Benign Brain Tumour

3. New India Asha Kiran Policy

New India Asha Kiran Policy is designed to the parents with only girl child. The maximum of two dependent daughters can be covered under this plan. If a boy child is born or daughter/s become independent after taking the policy, then the company shall offer an option to migrate to suitable health insurance policy.

Highlights of the Policy

- 50% discount on the premium for girl children

- Critical care benefit - 10% of the Sum Insured

- Personal accident cover up to 100% of Sum Insured

- Room rent and ICU charges at 1% and 2% of Sum Insured per day respectively

- Hospital cash up to 1% of Sum Insured

- Ambulance charges up to 1% of Sum Insured

- Cataract claims, up to 10% of Sum Insured or Rs. 50,000 whichever less, for each eye

- Ayurvedic/ Homeopathic/ Unani treatments are covered, up to 25% of the Sum Insured

- Pre-existing diseases has a waiting period of 48 months

- Specified diseases has a waiting period of 24 months

- Accidental death

- Permanent Total Disablement

- Loss of one limb and one eye or loss of both eyes and/or loss of both limbs of

- Loss of one limb/ sight in one eye of

4. Star CriticCare Insurance

The critical plan by Star Insurance covers critical benefits with special advantages such as reimbursement for hospitalisation expenses arising of sickness/illness/disease and/or accidental injuries. The plan provides lump sum payment on diagnosis of critical illness. Anyone who is living in India and is aged between 18 years-65 years can opt for Star CriticCare Insurance plan.

Benefits

- Cover for 9 specified critical illness

- Lump sum payment on diagnosis of critical illness

- Also covers regular hospitalization

- Cover for non-allopathic treatment up to specified limit

- On payment of lumpsum, the cover will continue until expiry of the policy for regular hospitalization

- Lifelong renewals guaranteed

Inclusions

- Major organ transplant

- First time diagnosis of brain tumor, kidney disease, cancer and other major illness

- Coma

- Paraplegia

- Quadriplegia

5. Bajaj Allianz Critical Illness Plan

Major or critical health issues can be unpredictable. Therefore, it is imperative for every individual to equip themselves with a health insurance policy that covers critical illnesses, as these illnesses may lead to the unemployment of a family’s sole earning member. Bajaj Allianz Critical Illness Plan is designed to protect you and your family against the financial burden during such life-threatening illnesses.

10 Major Medical Inclusions

- Aorta graft surgery

- Cancer

- Coronary artery bypass surgery

- First heart attack (myocardial infarction)

- Kidney failure

- Major organ transplant

- Multiple sclerosis with persisting symptoms

- Permanent paralysis of limbs

- Primary pulmonary arterial hypertension

- Stroke

Conclusion

The life of people is changing drastically and so is the need for a critical illness insurance. In today's times, most people have a low indulgence in physical activity and follow an unhealthy diet full of processed or junk food. Moreover, they are so busy that they cannot take care of their health. As a result, the chances of getting a critical illness has increased. So, in order to protect your family from the financial drain caused due to severe ailments, buy the best critical illness policy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.