Table of Contents

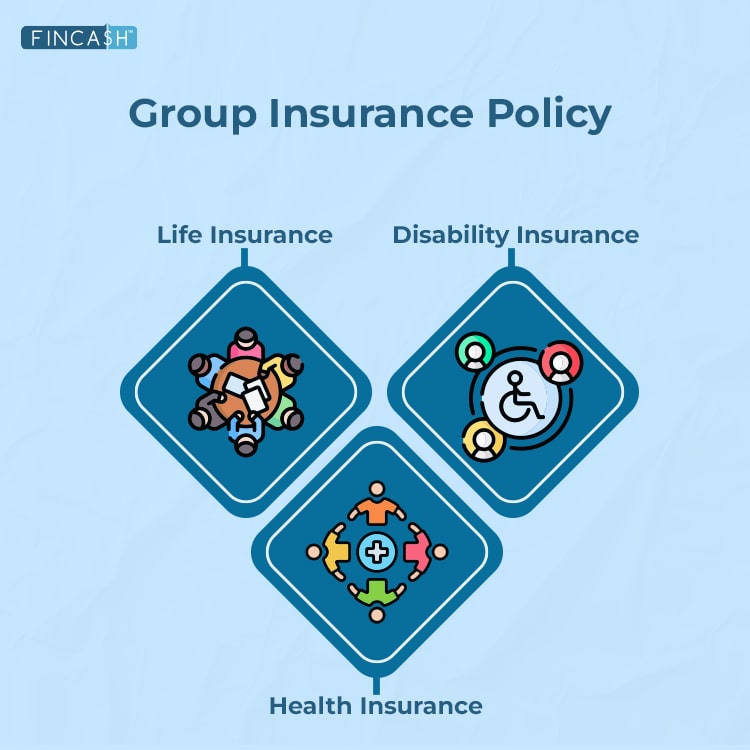

What is Group Insurance Policy?

Group insurance is a single contract (master plan policy) that covers a group of homogenous people. A group may consist of lawyers, doctors, credit societies, members of cooperative banks, etc. Members of group insurance plans are insured in the event when they are diagnosed with a terminal illness or when they suffer from a partial or total disablement from injury or sickness, either permanently or temporarily.

During such events Group Life Insurance, Group health insurance and Group Disability Insurance may help the insured if they are covered for the same. Group Insurance Benefits should be well known to the insured in the plan that they have signed up for. Many Insurance companies offer Group Insurance in India.

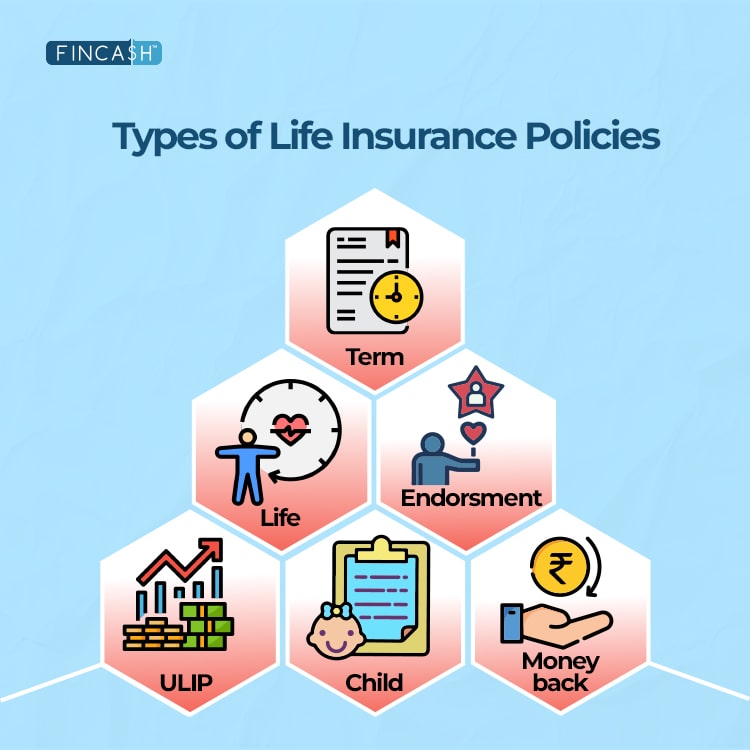

Types of Group Insurance Policies

The types of group insurance policies are as follows-

1. Group Life Insurance

Group Life Insurance Schemes (GLIS) are popular with companies as an incentive for their employees. The group can be any number and must share a commonality, for example- group can be employees of the company, players of a club, member of an association, etc. Most of the group insurance plans that are available in the Market are covered under the Employee Provident Fund Organisation. It makes compulsory for the employer to offer insurance to the employees under the Miscellaneous Provision Act 1952 and the EPF (Employee’s Provident Fund).

There are two types of group life insurance, one is contributory and other is non-contributory.

In a contributory group life insurance, employees pay some amount of the premium for the policy and the employer pays the balance of the premium. Since both the employee and employer are sharing the cost of the contribution, employees usually tend to get more coverage than an individual insurance policy.

In the non-contributory group life insurance, the employee doesn’t contribute any money, the entire premium is paid by the employer. A non-contributory plan may not have as many covers as in a contributory plan.

Some of the eligible groups of group life insurance are- Professional groups, Employee- Employer groups, Creditor- Debtor groups, etc.

Talk to our investment specialist

2. Group Disability Insurance

Short Term Disability Insurance- This offers Income protection against any short-term injury or sickness. When an employee is unable to work because of a disabling injury or illness, short term disability insurance helps by replacing part of their income. The time of coverage may vary from nine weeks to 52 weeks from date of eligibility.

Long Term Disability Insurance- This policy provides coverage over a longer time period than the short-term disability insurance. Some of the common covers provided by long-term disability insurance are- illness/injury caused due to poisoning, mental disorder, cancer, heart attack, etc.

3. Group Health Insurance

Group health insurance ensures better health benefits for various common groups such as employees, credit card holders of a Bank etc. Group health insurance for employees covers expenses for surgeries, blood transfusion, oxygen tents, X-ray tests, chemotherapy, dialysis, medicines, and many others.

In this policy, there are various options available in the form of covers such as-

- Family Health Coverage

- Individual Health Coverage

- Senior Health Coverage

- Group Health Coverage

As per needs and requirements, individual can buy the relevant plan.

Group Insurance Companies in India

Group Insurance Scheme by Government

The Government or State Governments may also provide Group Insurance Schemes to the employees, at a low cost and with twin benefits of insurance cover to help their families in the event of death in service and a lump sum payment to increase their resource on retirement. This scheme is based on wholly contributory and self-financing.

Group Insurance Benefits

- Group Insurance is usually less expensive than individual coverage.

- This policy offers coverage at a subsidised rate. This is very beneficial to a large segment of people who are unable to afford individual plans.

- Employees can share the cost with the employer.

- Group insurance is one of the best ways to protect employees as it makes the workforce more financially secure.

- An advantage of this policy is that members of this group insurance plan can have peace of mind, even when they are not working.

Eligibility Criteria

Following sections are eligible for Group life insurance policies:

- Employer-employee groups

- Banks

- Non-Banking financial institutions

- Micro finance

Group Insurance Claim Process Documents

During death incident, the organisation needs to be intimated at the earliest. For smooth claim settlement, ensure ensure you submit following documents:

- Identity, address proof of the nominee of the insured

- Duly filled in claim form

- Certificate insurance

- Hospital certificate

- FIR (In case of accident)

- Death certificate

FAQs

1. What are some of the common group insurances available?

A: There are seven main types of group insurance schemes available in India. These are as follows:

- Group term life Cover

- Group Health Insurance

- Group Personal Accident Cover

- Workers Compensation Insurance

- Group Pension/Superannuation Plans

- Public liability insurance

- Group Travel Insurance

2. What is the main benefit of this policy?

A: With a group insurance policy, the premiums payable are significantly reduced, making purchasing insurance affordable. Sometimes even companies make contributions towards group health insurance schemes run by the respective firms. This can prove to be doubly beneficial as such a health insurance scheme allows you to claim tax benefits.

3. Will I get tax benefits if I purchase a group policy?

A: Yes, as a policyholder, you will enjoy tax benefits. However, you have to ensure that the particular type of insurance is eligible for tax deductions. For example, if you purchase a health care policy, you can claim tax benefits under Section 80D. Still, if you purchase a personal accident cover, then you are not eligible for tax benefits.

4. Are there any specific rewards under this?

A: Depending on the type of group insurance scheme you have purchased, the insurance company can reward or loyalty points.

Conclusion

In today’s time, group insurance has become a vital part of Human Resources (HR) management to offer benefits to employees. This plan acts as an important tool to build trust amongst employees and also to give them a sense of security. Apart from this, group insurance is considered to be a beneficial, cost-effective and efficient scheme.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.