Fincash » Investment Plan » Investing Rules from Steven Cohen

Table of Contents

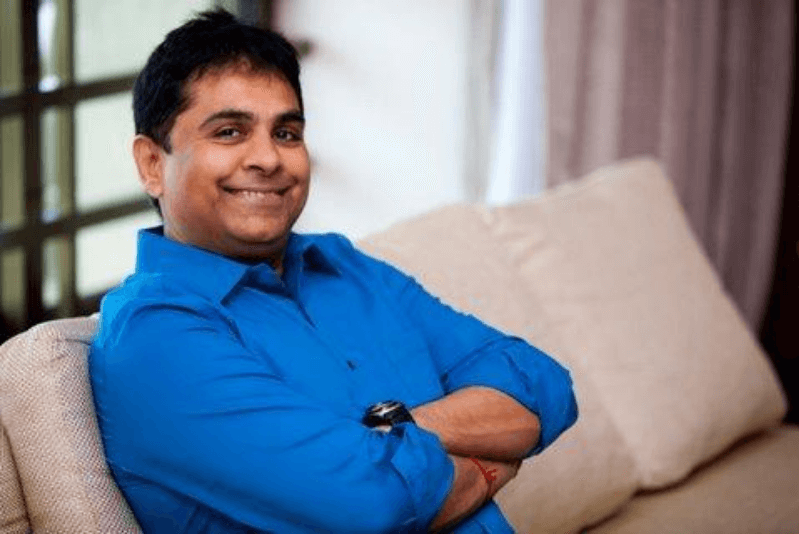

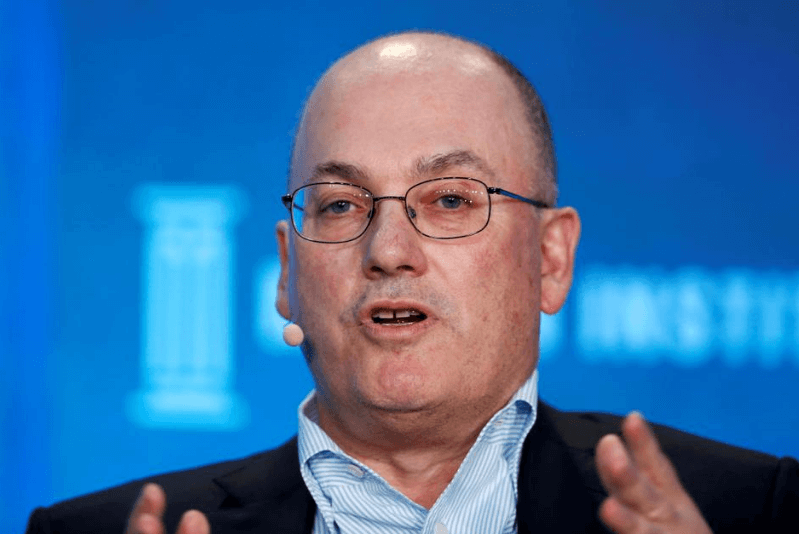

Top Investing Rules from Billionaire Steven Cohen

Steven A. Cohen is an American hedge fund manager. He is a billionaire and the founder of hedge fund Point 72 Asset Management. He is also the founder of S.A.C Capital Advisors. Time Magazine listed him as one of the most influential people in the world in 2007.

He has one of the most expensive private art collections in the world. The total price of the collection is worth more than $1 billion. According to Forbes, Cohen’s Net worth as of July 2020 is $14.6 billion.

| Details | Description |

|---|---|

| Name | Steven A. Cohen |

| Birth Date | June 11, 1956 |

| Age | 64 Years |

| Birth Place | Great Neck, New York, U.S. |

| Nationality | American |

| Alma mater | The Wharton School of the University of Pennsylvania |

| Occupation | Hedge fund manager |

| Known for | Founding and leading: S.A.C. Capital Advisors & Point72 Asset Management |

| Net worth | US$14.6 billion (July 2020) |

About Steven Cohen

Cohen graduated from Wharton in 1978 with a degree in Economics. He got a job at Wall Street as a junior trader in the options arbitrage department at Gruntal & Co. Within the first day of his job there, he made an $8000 profit. Soon enough he started making around $100,000 profit for the company. Eventually, he managed to have a $75 million Portfolio with 6 traders working under him. He started running his own trading group at Gruntal & Co in 1984. This continued till he could form his own company S.A.C.

He started S.A.C. Capital Advisors in 1992 with $10 million from his own pocket. He also called for working capital of $10 million from outside. In 2003, the New York Times wrote that S.A.C is one of the biggest hedge funds and is known for frequent and rapid trading. As of 2009, his firm managed $14 billion in equity.

Talk to our investment specialist

Investing Strategies from Steven Cohen

1. Have Passion for Investing

Steven Cohen once said that he had a passion for stocks since childhood. He didn’t invest in stocks just for the money, but also because he loved what he did. He says it is important to keep oneself excited about trading in the stock Market and Investing in funds.

Passion can help one make decisions well when it comes to success in the stock market.

2. Be Calm

Steven Cohen believes psychology plays a big role when it comes to investing. He had even hired a psychiatrist to help him get through panic regarding trading risks. The market is always changing because of the investors and their emotions regarding circumstances. It is hard to keep calm during such tiring times.

With panic all around, anyone can slip into making the wrong decision and face huge financial loss. He once said that one cannot control what the stock market does but one can control reaction to the market. It is important to keep your attitude and reaction in check and maintain calm before taking major investing decisions.

3. Keep Focus

One of the biggest mistakes to commit when investing in stocks and funds is to lose focus. Losing focus can lead to losses that can wreck your entire investment career. Steven Cohen once said that instead of knowing little about everything, know everything about something. If you are planning to invest, don’t go around digging at everything you find. Do your research and find one stock and know all about it. Decide whether this is what you would like to be the centre of your focus.

You should put your entire focus to investing if you want success in that area. It is important to be convinced of your ideas regarding your choice of investments. Therefore, keep the focus on research and understanding the investment and the market.

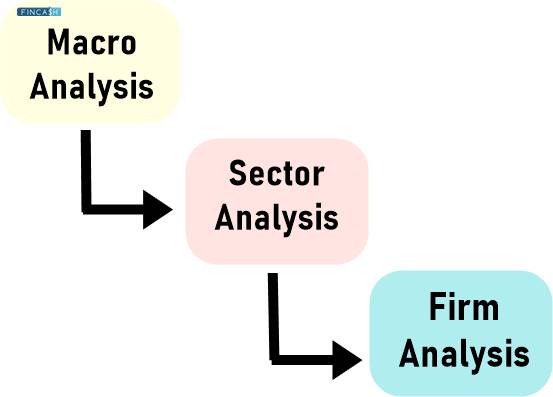

4. Develop Knack for Research and Thinking

Steven Cohen encourages investors to make informed decisions with investments. It is important to not follow other trading styles. Everyone should do their own research and come up with their own way of trading.

He says his firm encourages clients to identify their strengths and weaknesses. They are encouraged to identify what they like investing in. Look at market bets that get your blood pumping because you know about it too well. It is important to learn from mistakes and make well-judged decisions.

Conclusion

Steven Cohen has been one of the pioneers when it comes to investing and earning profits. One thing to take back from his style of investing would be to develop a passion for investments. Maintain calm and invest with an open mind. Do your research well before investing and learn from any mistake made. Maintain focus without wavering and don’t let market panic get to you. Making hasty and uninformed decisions can ruin your investments.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.