Fincash » Investment Plan » Investing Strategies from Chris Sacca

Table of Contents

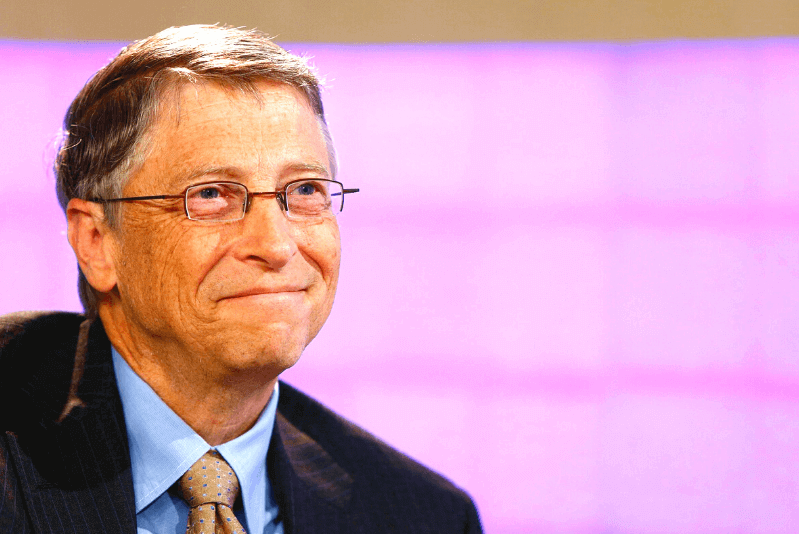

Top Investment Strategies from Venture Capital Investor Chris Sacca

Christopher Sacca, most commonly known as Chris Sacca is an American self-made venture Capital investor. He is also a company advisor, lawyer and entrepreneur. He is the head of Lowercase Capital, a venture capital fund that has invested in Twitter, Uber, Instagram, Twilio and Kickstarter in its early stages.

His knack with investments bagged him the #2 position on Forbes Midas List: Top Tech Investors for 2017. Before starting Lowercase Capital, Chris has worked with Google. In 2017, he announced that he would be retiring from venture capital Investing.

| Details | Description |

|---|---|

| Name | Christopher Sacca |

| Birthdate | May 12, 1975 |

| Age | 45 |

| Birthplace | Lockport, New York, U.S. |

| Education | Georgetown University (BS, JD) |

| Occupation | Angel investor, founder of Lowercase Capital |

| Net worth | US$1 billion (July 15, 2020) |

Chris Sacca Net Worth

According to Forbes, as of 15th July 2020, Chris Sacca’s net worth stands at $1 billion.

Well, Chris is a self-made billionaire and has a great eye when it comes to recognising the potential in startups. With over 20 years of experience in the investing sector, Chris Sacca has an eye for detail and successful investment. In his younger days, he had planned to retire when he turned 40. However, he retired at 42. According to a report, Chris said that while being invested in venture capital, he had time to pursue nothing else.

While working with Google, Chris led some pretty huge initiatives. He was the head of special initiatives at Google and founded the 700MHz and TV white spaces spectrum initiative. He was also awarded Google’s prestigious Founder’s Award.

Earlier in his career, Chris was also an attorney at the Silicon Valley firm of Fenwick & West. He worked on venture capital, mergers and acquisitions and licensing transactions for the big names in technology.

Talk to our investment specialist

Chris Sacca’s Top Investment Strategies

1. Learn to say No

Chris Sacca once said that when it comes to investing in companies, one’s Default response should be no. He believes that many make a mistake of jumping at opportunities that later turn out to be fatal. After his experience of investing in startups and companies, he encourages investors to do their homework before investing.

Look at the Market and give yourself some time to go over all the necessary details. Don’t say yes to every opportunity or you will lose your path. Do your research, look for the extra-ordinary, and then invest.

2. Have a Personal Touch

Chris believes that it is important to evaluate whether the company you are investing in could be impacted by your investment. Can you play a role in its success? It is important to understand your investments so well that you know you could make a difference with every penny you are putting in.

Having a personal touch with investments is essential if you are looking for success in investments.

3. Invest in Great Companies

Chris advocates that it is important to invest in companies that are doing great. Many-a-times, investors invest in companies that are doing well at present, but Fail to deliver growth in the long-term. He believes that investing in businesses that not only promise innovation, but have a strong long-term vision - will help investors go the long way.

So look for companies that are in strong industries with promising products & services. Study the fundamentals of the company and invest wisely. With your investments, you should be able to push the company from greatness to excellence.

4. Be Proud of Your Deals

Chris Sacca believes that one should be proud of every investment they make. Be straight forward and celebrate your deals and success. Your investments should be a product of careful planning and research. Once that is done don’t doubt your investments. Don’t be afraid to say no to anything you are convinced won’t work.

He encourages people to invest in their own business and empower other businesses.

Conclusion

Chris Sacca’s greatest advice to investors would be to always follow your dream and do what makes you happy. Be proud of everything you do and never give up on getting what you want. It is important to succeed as an individual and learn to say no to things that are unnecessary.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.