Table of Contents

Gold Loans in India - Everything You Should Know!

Since the beginning, Indians have a strong affinity towards gold. Also, as per historical data, gold has proved to be the best hedge against Inflation. India imports 25%-30% of gold production. Many banks and institutions offer gold loans with effective interest rates. In this article, you'll understand the important aspects of gold loan, top banks Offering gold loans, gold loan interest rates, eligibility and procedure to apply for gold loan, etc.

What is a Gold Loan?

A gold loan is a secured loan in which an individual pledges their gold ornaments or coins to a lender in exchange for funds. The loan amount is usually a percentage of the gold's value, and the borrower has to pay interest on the loan amount. The loan tenure typically ranges from a few months to a few years, and the borrower has to repay the loan amount along with interest within the stipulated time. Gold loans are popular in India as they provide quick and hassle-free access to funds, especially for those who may not have a good Credit Score or other assets to pledge as Collateral.

The gold loan Industry in India continues to flourish, driven by rising gold prices and increasing demand for quick and hassle-free access to funds. With the Reserve Bank of India (RBI) easing the loan-to-value ratio for gold loans, more lenders have entered the Market, increasing competition and attractive interest rates for borrowers. Moreover, the digitalisation of the gold loan process has made it easier for individuals to avail of gold loans from the comfort of their homes. The industry is expected to continue its growth trajectory, aided by the increasing financial awareness and need for emergency funds.

Top Banks for Gold Loan in India 2025

Here is the list of top banks and financial institutions offering gold loans in India -

| Name of the Bank | Interest Rate | Loan Amount |

|---|---|---|

| Axis Bank Gold Loan | 13.50% p.a.to 16.95% p.a | Rs.25,001 to Rs.25 lakhs |

| Bank of Baroda Gold Loan | 8.85% p.a. onwards | Up to Rs.50 lakhs |

| Bank of India Gold Loan | 7.80% to 8.95% per annum | Up to Rs.50 lakhs |

| Bank of Maharashtra Gold Loan | 7.10% p.a. | Up to Rs.20 lakhs |

| Canara Bank Gold Loan | 7.35% p.a. | Rs.5,000 to Rs.35 lakhs |

| Federal Bank Gold Loan | 8.89% p.a. onwards | Up to Rs.10 lakhs |

| HDFC Bank Gold Loan | 11% p.a. to 16% p.a. | Rs.10,000 onwards |

| IDBI Bank Gold Loan | 5.88% per annum | Up to Rs. 1 crore |

| IIFL Bank Gold Loan | 6.48% p.a. - 27% p.a. | Rs.3,000 onwards |

| IOB Gold Loan | 5.88% per annum | Up to Rs. 1 Crore |

| Indian Bank Gold Loan | 8.95% - 9.75% | Up to Rs. 1 Crore |

| Indulsnd Bank Gold Loan | 11.50% p.a. - 16.00% p.a. | Up to Rs.10 lakhs |

| Karnataka Bank Gold Loan | 11.00%p.a. | Up to Rs. 50 lakhs |

| Kotak Mahindra Gold Loan | 10.00% p.a. - 17.00% p.a. | Rs.20,000 to Rs.1.5 crore |

| KVB Gold Loan | 8.05% - 8.15% | Up to Rs. 25 lakhs |

| Manappuram Gold Loan | 9.90% p.a. to 24.00% p.a. | As per the requirement of the scheme |

| Muthoot Gold Loan | 12% p.a. to 26% p.a. | Rs.1,500 onwards |

| PNB Gold Loan | 7.70% p.a. to 8.75% p.a. | Rs.25,000 to Rs.10 lakhs |

| SBI Gold Loan | 7.00% p.a. onwards | Rs.20,000 to Rs.50 lakhs |

| Union Bank Gold Loan | 8.65% p.a. to 10.40% p.a. | As per the requirement of the scheme |

Talk to our investment specialist

Features of Gold Loan

An individual can avail a gold loan for various needs such as educational purpose, vacation, medical emergencies, and so on

Gold itself acts as collateral against the loan

Ideally, the loan tenure falls between 3 months to 3 years. But again, it may vary bank to bank

Processing fees, late payment charges/fine for non-payment of the interest are some of the terms applicable for gold loan. So ensure you know all the terms of the loan before applying

There are mainly three options where the lender can offer the customer for repaying the gold loan. They are-

- Repayment in equated monthly instalments (EMIs)

- Some lenders let the customers pay only the interest amount each month and the principal amount at the end of the loan tenure

- Paying the entire interest on a monthly Basis and then the principal amount at the end of the loan tenure

Sometimes the option of discount is offered by the lenders at the prevailing interest rate on the gold loan. This is if the customer repays the interest on time, then 1% -2% discount might be offered from the original rate of interest.

Why Opt for a Gold Loan?

Opting for a gold loan can be beneficial in many ways, including:

- Gold loans are easy to avail of and require minimal documentation. It is a quick, hassle-free process that offers instant cash against gold jewelry or ornaments

- They tend to have lower interest rates than other unsecured loans, as gold ornaments or jewelry are kept as collateral

- Gold loans offer a higher loan amount compared to other secured loans, such as personal loans or home loans, as the value of the gold ornaments or jewelry is taken into account

- You do not require a high credit score for a gold loan, as the loan is secured with collateral. Therefore, even those with a poor credit score can avail of gold loans

- Gold loans offer flexible repayment options, ranging from a few months to a few years, depending on the borrower's convenience

- There are no restrictions on the end-use of the loan amount, which means that the borrower can use the funds for any purpose

Eligibility for Applying a Gold Loan

The eligibility criteria for gold loan differs from bank to bank. The following are some of the general terms of the gold loans-

- Customers applying for the loan should have a minimum age of 18 years

- The loan should be applied by the buyer itself. Meaning, the person should be the owner of the gold

- The gold you are applying for should be a minimum of 18 carats

- The borrower should be financially sound

Documents Required for a Gold Loan

While applying for the loan, you will be given a form which you need to fill with proper details. Following, you need to submit certain documents mentioned below-

- Coloured passport-sized photograph

- Residential proof

- Identity proof

- Form 60 or PAN Card

How to Opt for a Gold Loan in India?

To apply for a gold loan in India, you can follow these steps:

Choose a lender: Choose a lender that suits your requirements. It is important to note that the interest rate, loan amount, and loan tenure may vary from lender to lender. Therefore, do thorough research and compare different lenders before choosing one

Check eligibility criteria: Each lender has different eligibility criteria for gold loans. You can check the lender's website or visit the nearest branch to know the eligibility criteria

Gather required documents: You will need to provide documents such as identity proof, address proof, and proof of ownership of the gold

Visit the lender's branch: Visit the nearest branch of the lender and carry the gold that you want to pledge. The lender will evaluate the gold and determine its value

Fill the application form: Fill the application form provided by the lender with all necessary details such as personal details, loan amount, loan tenure, etc

Submit the documents: Submit the required documents along with the application form

Sign the agreement: After the loan is approved, sign the loan agreement and provide the necessary authorization to the lender

Receive the loan amount: Once the loan agreement is signed, the loan amount will be disbursed to your bank account or provided to you in the form of a cheque.

An Alternative of Gold Loan - Gold Mutual Funds!

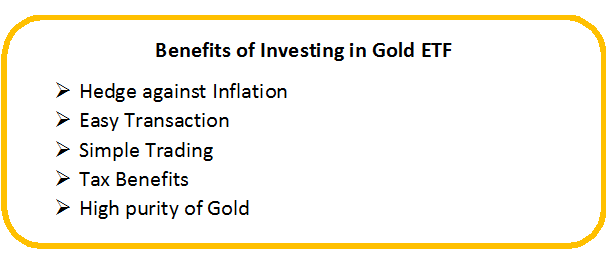

Gold Mutual Funds is a variant of Gold ETFs. A gold ETF (Exchange Traded Fund) is an instrument that is based on gold price or invests in gold bullion. A gold ETF specialises in Investing in a Range of gold securities. Gold Mutual Funds do not directly invest in physical gold but take the same position indirectly by Investing in Gold ETFs. Also, the minimum investment amount one would require to do in Gold Mutual Funds is of INR 1,000 (as monthly SIP). Since this investment is made through a Mutual Fund, investors can opt for systematic investments or withdrawals too. As Gold Mutual Funds units can be bought or sold from the fund house, investors do not face liquidity risks.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) IDBI Gold Fund Growth ₹25.0272

↑ 0.25 ₹93 18.9 23.3 28.2 20.2 13.8 18.7 SBI Gold Fund Growth ₹28.0449

↑ 0.15 ₹3,225 18.6 23.2 28.3 20.2 11.2 19.6 Axis Gold Fund Growth ₹28.0142

↑ 0.08 ₹869 19 23.1 28 20.1 12.7 19.2 ICICI Prudential Regular Gold Savings Fund Growth ₹29.6926

↑ 0.11 ₹1,741 18.9 23.1 28.4 19.9 12.6 19.5 HDFC Gold Fund Growth ₹28.6673

↑ 0.12 ₹3,303 18.9 23.2 28 19.9 13.1 18.9 Nippon India Gold Savings Fund Growth ₹36.7536

↑ 0.14 ₹2,623 19.2 23.2 28 19.8 13 19 Aditya Birla Sun Life Gold Fund Growth ₹28.0046

↑ 0.24 ₹512 19.6 23.6 28.2 19.8 12.8 18.7 Invesco India Gold Fund Growth ₹27.0472

↓ -0.05 ₹127 18.9 22.2 26.2 19.6 13.5 18.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25 Gold Funds having AUM/Net Assets > 25 Crore ordered based on 3 year CAGR returns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.