+91-22-48913909

+91-22-48913909

Table of Contents

- ലാർജ് ക്യാപ് ഫണ്ടുകൾ എങ്ങനെ തിരഞ്ഞെടുക്കാം?

- മികച്ച 11 മികച്ച പ്രകടനം നടത്തുന്ന ലാർജ് ക്യാപ് മ്യൂച്വൽ ഫണ്ടുകൾ FY 22 - 23

- എന്തുകൊണ്ട് മികച്ച ലാർജ് ക്യാപ് മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കണം

- മികച്ച ലാർജ് ക്യാപ് ഫണ്ടുകളിൽ ഓൺലൈനിൽ എങ്ങനെ നിക്ഷേപിക്കാം?

- ഉപസംഹാരം

Top 11 Equity - Large Cap Funds

- IDBI India Top 100 Equity Fund

- Nippon India Large Cap Fund

- DSP BlackRock TOP 100 Equity

- ICICI Prudential Bluechip Fund

- HDFC Top 100 Fund

- BNP Paribas Large Cap Fund

- L&T India Large Cap Fund

- Invesco India Largecap Fund

- Edelweiss Large Cap Fund

- Canara Robeco Bluechip Equity Fund

- Aditya Birla Sun Life Frontline Equity Fund

11 മികച്ച ലാർജ് ക്യാപ് ഇക്വിറ്റി ഫണ്ടുകൾ 2022

അനുയോജ്യമായി, ആരെങ്കിലും ചിന്തിക്കുമ്പോൾനിക്ഷേപിക്കുന്നു, ഒരാളുടെ മനസ്സിൽ ആദ്യം വരുന്ന ചിന്ത കൂടുതലും ഇക്വിറ്റി ആയിരിക്കും. നിങ്ങൾ കൂടുതൽ പര്യവേക്ഷണം ചെയ്യുമ്പോൾഇക്വിറ്റി ഫണ്ടുകൾ, നിങ്ങൾ വലിയ ക്യാപ് ഫണ്ടുകൾ ചെയ്യും.

വലിയ തൊപ്പിമ്യൂച്വൽ ഫണ്ടുകൾ ഇക്വിറ്റികൾക്ക് നല്ല റിട്ടേൺ ഉള്ളതിനാലും അസ്ഥിരത കുറവായതിനാലും ഇവയിലെ ഏറ്റവും സുരക്ഷിതമായ നിക്ഷേപങ്ങളിലൊന്നായി കണക്കാക്കപ്പെടുന്നു.വിപണി മറ്റ് ഇക്വിറ്റി ഫണ്ടുകളുമായി താരതമ്യപ്പെടുത്തുമ്പോൾ ഏറ്റക്കുറച്ചിലുകൾ അതായത്, ഇടത്തരം &സ്മോൾ ക്യാപ് ഫണ്ടുകൾ. ഈ ഫണ്ടുകൾ വലിയ കമ്പനികളുടെ ഓഹരികളിൽ നിക്ഷേപിക്കുന്നു. ബ്ലൂ ചിപ്പ് കമ്പനികളുടെ ഓഹരി വില ഉയർന്നതാണെങ്കിലും നിക്ഷേപകർ തങ്ങളുടെ പണം വലിയ ക്യാപ്സിൽ നിക്ഷേപിക്കാൻ താൽപ്പര്യപ്പെടുന്നു.

മികച്ച ലാർജ് ക്യാപ് മ്യൂച്വൽ ഫണ്ട് തിരഞ്ഞെടുക്കുന്നത് ഒരു പ്രധാന ജോലിയാണ്, അതിന് അർഹമായ പ്രാധാന്യം നൽകേണ്ടതുണ്ട്. നമുക്ക് താഴെ നോക്കാംനിക്ഷേപത്തിന്റെ നേട്ടങ്ങൾ ലാർജ് ക്യാപ് മ്യൂച്വൽ ഫണ്ടുകളിൽ മികച്ചത് എങ്ങനെ തിരഞ്ഞെടുക്കാംവലിയ ക്യാപ് ഫണ്ടുകൾ അവസാനമായി, 2022-ൽ നിക്ഷേപിക്കാൻ ഏറ്റവും മികച്ച 10 വലിയ ക്യാപ് ഫണ്ടുകളുടെ ഒരു ലിസ്റ്റ്.

ലാർജ് ക്യാപ് ഫണ്ടുകൾ എങ്ങനെ തിരഞ്ഞെടുക്കാം?

ശരിയായ വലിയ ക്യാപ് മ്യൂച്വൽ ഫണ്ട് തിരഞ്ഞെടുക്കുന്നത് ഒരിക്കലും എളുപ്പമല്ല. ചില ഫണ്ടുകൾ മികച്ച പ്രകടനം കാഴ്ചവയ്ക്കുന്നു, മറ്റ് ഫണ്ടുകൾ ക്ഷയിക്കുന്നു. എന്നാൽ, ശരിയായ ഫണ്ട് തിരഞ്ഞെടുക്കുമ്പോൾ നിക്ഷേപകർ ശ്രദ്ധിക്കേണ്ട ചില പാരാമീറ്ററുകളുണ്ട്. ഒരു ഫണ്ട് തീരുമാനിക്കുന്നതിന് മുമ്പ് ഒരാൾ നിരവധി അളവിലും ഗുണപരമായ ഘടകങ്ങളും നോക്കേണ്ടതുണ്ട്.

ക്വാണ്ടിറ്റേറ്റീവ് ഘടകങ്ങൾ

പരസ്പരമുള്ളത്ഫണ്ട് റേറ്റിംഗ് ഒരു നല്ല ആരംഭ പോയിന്റായിരിക്കാം. ഫണ്ടിന്റെ പ്രായം, മാനേജ്മെന്റിന് കീഴിലുള്ള ആസ്തികൾ (AUM), മുൻകാല റിട്ടേണുകൾ, ചെലവ് അനുപാതം മുതലായവ പോലുള്ള മറ്റ് ഡാറ്റയ്ക്കൊപ്പം ഇത് അനുബന്ധമായി നൽകേണ്ടതുണ്ട്. കൂടാതെ, ഒരു ഫണ്ടിന്റെ കഴിഞ്ഞ മൂന്ന് വർഷത്തെ പ്രകടനം പരിശോധിക്കാൻ നിക്ഷേപകരോട് നിർദ്ദേശിക്കുന്നു. ഒരു ഫണ്ടിന് 1000 കോടി രൂപയിലധികം അറ്റ ആസ്തി ഉണ്ടായിരിക്കണം കൂടാതെ കഴിഞ്ഞ ഒരു വർഷമായി വലിയ ക്യാപ് സ്റ്റോക്കുകൾക്കുള്ള ഏറ്റവും കുറഞ്ഞ ശരാശരി വിഹിതം 65 ശതമാനവും ഉണ്ടായിരിക്കണം.

Talk to our investment specialist

ഗുണപരമായ ഘടകങ്ങൾ

ഫണ്ട് ഹൗസ് പ്രശസ്തി, ഫണ്ട് മാനേജർ ട്രാക്ക് റെക്കോർഡ്, നിക്ഷേപ പ്രക്രിയ തുടങ്ങിയ ഗുണപരമായ ഘടകങ്ങൾ ഉപയോഗിച്ച് ഇത് കൂടുതൽ ഫിൽട്ടർ ചെയ്യേണ്ടതുണ്ട്. നിങ്ങളുടെ പണം നിക്ഷേപിക്കുന്നതിന് നിങ്ങൾക്ക് വിശ്വാസമുള്ള ഫണ്ട് ഹൗസ് തിരഞ്ഞെടുക്കണം. വിപണിയിൽ ശക്തമായ സാന്നിധ്യമുള്ള ഫണ്ട് ഹൗസുകളെ തിരിച്ചറിയുകയും ദീർഘവും സ്ഥിരവുമായ ട്രാക്ക് റെക്കോർഡുള്ള വിവിധ ഫണ്ടുകൾ നൽകുകയും ചെയ്യുന്നു. എത്ര ഫണ്ടുകൾ മികച്ച പ്രകടനം കാഴ്ചവയ്ക്കുന്നുവെന്നും ഒന്ന് കാണണം. നല്ല ട്രാക്ക് റെക്കോർഡുള്ള ഒരു ഫണ്ട് മാനേജർ നിർബന്ധമാണ്. എഅസറ്റ് മാനേജ്മെന്റ് കമ്പനി ഒരു ഫണ്ട് മാനേജർ (വ്യക്തി - അതിനാൽ കീമാൻ അപകടസാധ്യത) എന്നതിലുപരി പണം സമ്പാദിക്കാൻ നിങ്ങളെ സഹായിക്കുന്ന ഒരു പ്രക്രിയയാണ് ഇത് എന്ന് ഉറപ്പുനൽകുന്നതിനാൽ സ്ഥാപനവൽക്കരിച്ച നിക്ഷേപ പ്രക്രിയയും പ്രധാനമാണ്. മുകളിൽ പറഞ്ഞ കാര്യങ്ങൾ ചെയ്യുന്നതിലൂടെ, ഒരാൾക്ക് ഏറ്റവും മികച്ച ലാർജ് ക്യാപ് ഫണ്ട് തിരഞ്ഞെടുക്കാൻ ശ്രമിക്കാം അല്ലെങ്കിൽ തിരഞ്ഞെടുക്കാൻ ഏറ്റവും മികച്ച 10 വലിയ ക്യാപ് ഫണ്ടുകളുടെ ഒരു ലിസ്റ്റ് ഉണ്ടാക്കാം.

മികച്ച 11 മികച്ച പ്രകടനം നടത്തുന്ന ലാർജ് ക്യാപ് മ്യൂച്വൽ ഫണ്ടുകൾ FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 9.2 12.5 15.4 21.9 12.6 Nippon India Large Cap Fund Growth ₹82.9473

↑ 2.02 ₹34,212 -0.9 -7.7 5.5 17.4 26.6 18.2 DSP BlackRock TOP 100 Equity Growth ₹448

↑ 9.49 ₹4,519 2 -4.8 13.5 16.8 22.5 20.5 ICICI Prudential Bluechip Fund Growth ₹102.47

↑ 2.38 ₹60,177 1.3 -6.4 7.3 15.8 25.1 16.9 HDFC Top 100 Fund Growth ₹1,071.23

↑ 24.05 ₹33,913 0.3 -8.2 4.1 14.9 24.4 11.6 BNP Paribas Large Cap Fund Growth ₹204.872

↑ 4.18 ₹2,263 -2.5 -11 3.5 13.8 21.3 20.1 L&T India Large Cap Fund Growth ₹42.242

↑ 0.02 ₹758 4.4 16.7 2.9 13.6 10.5 Invesco India Largecap Fund Growth ₹63.27

↑ 1.70 ₹1,229 -2.4 -10.3 6.4 13.2 22.4 20 Edelweiss Large Cap Fund Growth ₹78.34

↑ 1.69 ₹1,059 -0.5 -9 4.7 13.1 21.8 14.6 Canara Robeco Bluechip Equity Fund Growth ₹58.82

↑ 1.31 ₹13,848 0.5 -6.6 8.8 13 21.2 17.8 Aditya Birla Sun Life Frontline Equity Fund Growth ₹488.22

↑ 9.85 ₹26,286 0.2 -8.3 7.8 12.9 22.8 15.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23

*എയുഎം/നെറ്റ് അസറ്റുകൾ ഉള്ള 11 മികച്ച ലാർജ് ക്യാപ് മ്യൂച്വൽ ഫണ്ടുകളുടെ ലിസ്റ്റ് >500 കോടി. ഉള്ളത്ഫണ്ട് പ്രായം >=3 ക്രമീകരിച്ചു3 വർഷംസിഎജിആർ മടങ്ങുന്നു.

The Investment objective of the Scheme is to provide investors with the opportunities for long-term capital appreciation by investing predominantly in Equity and Equity related Instruments of Large Cap companies. However

there can be no assurance that the investment objective under the Scheme will be realized. IDBI India Top 100 Equity Fund is a Equity - Large Cap fund was launched on 15 May 12. It is a fund with Moderately High risk and has given a Below is the key information for IDBI India Top 100 Equity Fund Returns up to 1 year are on (Erstwhile Reliance Top 200 Fund) The primary investment objective of the scheme is to seek to generate long term capital appreciation by investing in equity and equity related instruments of companies whose market capitalization is within the range of highest & lowest market capitalization of S&P BSE 200 Index. The secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Large Cap Fund is a Equity - Large Cap fund was launched on 8 Aug 07. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Large Cap Fund Returns up to 1 year are on The Fund is seeking to generate capital appreciation, from a portfolio that is substantially constituted of equity and equity related securities of the 100 largest corporates, by market capitalisation, listed in India. DSP BlackRock TOP 100 Equity is a Equity - Large Cap fund was launched on 10 Mar 03. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock TOP 100 Equity Returns up to 1 year are on (Erstwhile ICICI Prudential Focused Bluechip Equity Fund) To generate long-term capital appreciation and income distribution to unit holders from a portfolio that is invested in equity and equity related securities of about 20 companies belonging to the large cap domain and the balance in debt securities and money market instruments. The Fund Manager will always select stocks for investment from among Top 200 stocks in terms of market capitalization on the National Stock Exchange of India Ltd. If the total assets under management under this scheme goes above Rs. 1,000 crores the Fund

Manager reserves the right to increase the number of companies to more than 20. ICICI Prudential Bluechip Fund is a Equity - Large Cap fund was launched on 23 May 08. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Bluechip Fund Returns up to 1 year are on (Erstwhile HDFC Top 200) To generate long term capital appreciation from a portfolio of equity and equity linked instruments. The investment portfolio for equity and equity linked instruments will be primarily drawn from the companies in the BSE 200 Index.

Further, the Scheme may also invest in listed companies that would qualify to be in the top 200 by market capitalisation on the BSE even though they may not be listed on the BSE. This includes participation in large Ipos where in the market

capitalisation of the company based on issue price would make the company a part of the top 200 companies listed on the BSE based on market capitalisation. HDFC Top 100 Fund is a Equity - Large Cap fund was launched on 11 Oct 96. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Top 100 Fund Returns up to 1 year are on (Erstwhile BNP Paribas Equity Fund) The investment objective of the Scheme is to generate long-term capital growth from a diversifi ed and actively managed portfolio of equity and equity related securities. The Scheme will invest in a range of companies, with a bias towards large & medium market capitalisation companies. However, there can be no

assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. BNP Paribas Large Cap Fund is a Equity - Large Cap fund was launched on 23 Sep 04. It is a fund with Moderately High risk and has given a Below is the key information for BNP Paribas Large Cap Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets. The Scheme will predominantly invest in large cap stocks. The Scheme could also additionally invest in Foreign Securities. L&T India Large Cap Fund is a Equity - Large Cap fund was launched on 23 Oct 07. It is a fund with Moderately High risk and has given a Below is the key information for L&T India Large Cap Fund Returns up to 1 year are on (Erstwhile Invesco India Business Leaders Fund) To generate long term capital appreciation by investing in equity and equity related instruments including equity derivatives of companies which in our opinion are leaders in their respective industry or industry segment. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Invesco India Largecap Fund is a Equity - Large Cap fund was launched on 21 Aug 09. It is a fund with Moderately High risk and has given a Below is the key information for Invesco India Largecap Fund Returns up to 1 year are on (Erstwhile Edelweiss Large Cap Advantage Fund) The investment objective is to seek to generate long-term capital appreciation from a portfolio predominantly consisting equity and equity-related securities of the 100 largest corporate by market capitalisation listed in India.

However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. Edelweiss Large Cap Fund is a Equity - Large Cap fund was launched on 20 May 09. It is a fund with Moderately High risk and has given a Below is the key information for Edelweiss Large Cap Fund Returns up to 1 year are on (Erstwhile Canara Robeco Large Cap+ Fund) The Investment Objective of the fund is to provide capital appreciation by predominantly investing in companies having a large market capitalization. However, there can be no assurance that the investment objective of the scheme will be realized. Canara Robeco Bluechip Equity Fund is a Equity - Large Cap fund was launched on 20 Aug 10. It is a fund with Moderately High risk and has given a Below is the key information for Canara Robeco Bluechip Equity Fund Returns up to 1 year are on An Open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 100% equity by aiming at being as diversified across various industries and or sectors as its chosen benchmark index, S&P BSE 200. Aditya Birla Sun Life Frontline Equity Fund is a Equity - Large Cap fund was launched on 30 Aug 02. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Frontline Equity Fund Returns up to 1 year are on 1. IDBI India Top 100 Equity Fund

CAGR/Annualized return of 14.2% since its launch. Ranked 45 in Large Cap category. . IDBI India Top 100 Equity Fund

Growth Launch Date 15 May 12 NAV (28 Jul 23) ₹44.16 ↑ 0.05 (0.11 %) Net Assets (Cr) ₹655 on 30 Jun 23 Category Equity - Large Cap AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.47 Sharpe Ratio 1.09 Information Ratio 0.14 Alpha Ratio 2.11 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,198 31 Mar 22 ₹20,056 31 Mar 23 ₹19,852 Returns for IDBI India Top 100 Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3% 3 Month 9.2% 6 Month 12.5% 1 Year 15.4% 3 Year 21.9% 5 Year 12.6% 10 Year 15 Year Since launch 14.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI India Top 100 Equity Fund

Name Since Tenure Data below for IDBI India Top 100 Equity Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. Nippon India Large Cap Fund

CAGR/Annualized return of 12.7% since its launch. Ranked 20 in Large Cap category. Return for 2024 was 18.2% , 2023 was 32.1% and 2022 was 11.3% . Nippon India Large Cap Fund

Growth Launch Date 8 Aug 07 NAV (15 Apr 25) ₹82.9473 ↑ 2.02 (2.50 %) Net Assets (Cr) ₹34,212 on 28 Feb 25 Category Equity - Large Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.7 Sharpe Ratio -0.27 Information Ratio 1.96 Alpha Ratio 0.51 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,768 31 Mar 22 ₹20,972 31 Mar 23 ₹22,342 31 Mar 24 ₹32,354 31 Mar 25 ₹34,538 Returns for Nippon India Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.8% 3 Month -0.9% 6 Month -7.7% 1 Year 5.5% 3 Year 17.4% 5 Year 26.6% 10 Year 15 Year Since launch 12.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 18.2% 2022 32.1% 2021 11.3% 2020 32.4% 2019 4.9% 2018 7.3% 2017 -0.2% 2016 38.4% 2015 2.2% 2014 1.1% Fund Manager information for Nippon India Large Cap Fund

Name Since Tenure Sailesh Raj Bhan 8 Aug 07 17.58 Yr. Kinjal Desai 25 May 18 6.77 Yr. Bhavik Dave 19 Aug 24 0.53 Yr. Data below for Nippon India Large Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 36.44% Consumer Cyclical 14.09% Industrials 9.78% Technology 8.82% Energy 7.59% Consumer Defensive 6.4% Basic Materials 5.89% Utility 5.5% Health Care 3.75% Communication Services 0.25% Asset Allocation

Asset Class Value Cash 1.51% Equity 98.49% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK10% ₹3,281 Cr 18,940,367 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 19 | RELIANCE6% ₹2,165 Cr 18,036,077 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹2,047 Cr 17,000,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | 5322155% ₹1,675 Cr 16,489,098

↑ 2,224,076 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Dec 21 | 5000344% ₹1,451 Cr 1,700,882

↓ -126,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 07 | LT4% ₹1,329 Cr 4,200,529

↑ 600,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 07 | INFY4% ₹1,235 Cr 7,318,494

↓ -1,181,590 State Bank of India (Financial Services)

Equity, Since 31 Oct 10 | SBIN4% ₹1,219 Cr 17,700,644 NTPC Ltd (Utilities)

Equity, Since 30 Apr 20 | 5325553% ₹892 Cr 28,639,816

↑ 1,500,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Jun 24 | TCS3% ₹871 Cr 2,500,000 3. DSP BlackRock TOP 100 Equity

CAGR/Annualized return of 18.8% since its launch. Ranked 60 in Large Cap category. Return for 2024 was 20.5% , 2023 was 26.6% and 2022 was 1.4% . DSP BlackRock TOP 100 Equity

Growth Launch Date 10 Mar 03 NAV (15 Apr 25) ₹448 ↑ 9.49 (2.16 %) Net Assets (Cr) ₹4,519 on 28 Feb 25 Category Equity - Large Cap AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 2.08 Sharpe Ratio 0.23 Information Ratio 0.97 Alpha Ratio 6.95 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,370 31 Mar 22 ₹18,059 31 Mar 23 ₹18,472 31 Mar 24 ₹25,242 31 Mar 25 ₹28,966 Returns for DSP BlackRock TOP 100 Equity

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 5% 3 Month 2% 6 Month -4.8% 1 Year 13.5% 3 Year 16.8% 5 Year 22.5% 10 Year 15 Year Since launch 18.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 20.5% 2022 26.6% 2021 1.4% 2020 19.5% 2019 7.5% 2018 14.8% 2017 -2.7% 2016 26.5% 2015 4.9% 2014 -2.3% Fund Manager information for DSP BlackRock TOP 100 Equity

Name Since Tenure Abhishek Singh 1 Jun 22 2.75 Yr. Data below for DSP BlackRock TOP 100 Equity as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 44.95% Consumer Cyclical 12.7% Health Care 8.03% Utility 6.01% Consumer Defensive 5.47% Technology 4.82% Energy 3.37% Basic Materials 2.06% Industrials 1.94% Communication Services 1.67% Asset Allocation

Asset Class Value Cash 9% Equity 91% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 14 | HDFCBANK10% ₹436 Cr 2,515,326

↑ 68,972 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 16 | ICICIBANK9% ₹412 Cr 3,420,782

↑ 95,172 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 21 | ITC5% ₹247 Cr 6,252,928

↑ 562,934 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Jun 22 | 5000345% ₹234 Cr 274,515

↓ -21,546 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | 5322155% ₹229 Cr 2,257,989

↑ 114,626 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 22 | M&M5% ₹223 Cr 863,416 Cipla Ltd (Healthcare)

Equity, Since 30 Jun 20 | 5000875% ₹205 Cr 1,455,004 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 17 | SBILIFE4% ₹185 Cr 1,290,469

↑ 65,890 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 May 24 | KOTAKBANK4% ₹182 Cr 953,830 NTPC Ltd (Utilities)

Equity, Since 30 Nov 23 | 5325554% ₹172 Cr 5,537,480

↑ 734,109 4. ICICI Prudential Bluechip Fund

CAGR/Annualized return of 14.8% since its launch. Ranked 21 in Large Cap category. Return for 2024 was 16.9% , 2023 was 27.4% and 2022 was 6.9% . ICICI Prudential Bluechip Fund

Growth Launch Date 23 May 08 NAV (15 Apr 25) ₹102.47 ↑ 2.38 (2.38 %) Net Assets (Cr) ₹60,177 on 28 Feb 25 Category Equity - Large Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.69 Sharpe Ratio -0.28 Information Ratio 1.15 Alpha Ratio 1.11 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,870 31 Mar 22 ₹20,629 31 Mar 23 ₹21,243 31 Mar 24 ₹30,242 31 Mar 25 ₹32,375 Returns for ICICI Prudential Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 5% 3 Month 1.3% 6 Month -6.4% 1 Year 7.3% 3 Year 15.8% 5 Year 25.1% 10 Year 15 Year Since launch 14.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 16.9% 2022 27.4% 2021 6.9% 2020 29.2% 2019 13.5% 2018 9.8% 2017 -0.8% 2016 32.7% 2015 7.7% 2014 -0.2% Fund Manager information for ICICI Prudential Bluechip Fund

Name Since Tenure Anish Tawakley 5 Sep 18 6.49 Yr. Vaibhav Dusad 18 Jan 21 4.12 Yr. Sharmila D’mello 31 Jul 22 2.59 Yr. Data below for ICICI Prudential Bluechip Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 28.99% Industrials 10.23% Consumer Cyclical 9.81% Energy 8.47% Technology 7.79% Basic Materials 7.38% Consumer Defensive 4.97% Health Care 4.92% Communication Services 4.75% Utility 3.5% Real Estate 1.1% Asset Allocation

Asset Class Value Cash 8.09% Equity 91.91% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 10 | HDFCBANK10% ₹6,005 Cr 34,665,562

↑ 371,549 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 08 | ICICIBANK8% ₹4,879 Cr 40,518,440 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 12 | LT6% ₹3,717 Cr 11,749,504

↑ 256,582 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 08 | RELIANCE5% ₹2,811 Cr 23,426,200

↑ 571,641 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 09 | BHARTIARTL5% ₹2,811 Cr 17,902,581

↑ 380,300 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY5% ₹2,797 Cr 16,573,722 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Apr 16 | MARUTI5% ₹2,772 Cr 2,320,691

↓ -49,518 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 14 | 5322154% ₹2,468 Cr 24,304,208

↑ 497,149 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 17 | 5325384% ₹2,455 Cr 2,423,893

↑ 46,165 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Jul 15 | SUNPHARMA3% ₹1,631 Cr 10,239,095 5. HDFC Top 100 Fund

CAGR/Annualized return of 18.7% since its launch. Ranked 43 in Large Cap category. Return for 2024 was 11.6% , 2023 was 30% and 2022 was 10.6% . HDFC Top 100 Fund

Growth Launch Date 11 Oct 96 NAV (15 Apr 25) ₹1,071.23 ↑ 24.05 (2.30 %) Net Assets (Cr) ₹33,913 on 28 Feb 25 Category Equity - Large Cap AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.67 Sharpe Ratio -0.43 Information Ratio 1.5 Alpha Ratio -0.81 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,656 31 Mar 22 ₹20,128 31 Mar 23 ₹21,373 31 Mar 24 ₹29,782 31 Mar 25 ₹31,265 Returns for HDFC Top 100 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.6% 3 Month 0.3% 6 Month -8.2% 1 Year 4.1% 3 Year 14.9% 5 Year 24.4% 10 Year 15 Year Since launch 18.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 11.6% 2022 30% 2021 10.6% 2020 28.5% 2019 5.9% 2018 7.7% 2017 0.1% 2016 32% 2015 8.5% 2014 -6.1% Fund Manager information for HDFC Top 100 Fund

Name Since Tenure Rahul Baijal 29 Jul 22 2.59 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Top 100 Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 34.2% Consumer Cyclical 12.21% Technology 9.76% Industrials 8.28% Energy 7.75% Consumer Defensive 7.62% Health Care 5.98% Communication Services 5.52% Utility 5.02% Basic Materials 2.67% Real Estate 0.56% Asset Allocation

Asset Class Value Cash 0.42% Equity 99.58% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 10 | HDFCBANK10% ₹3,487 Cr 20,126,319 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 05 | ICICIBANK10% ₹3,262 Cr 27,090,474

↑ 700,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Aug 06 | LT6% ₹1,920 Cr 6,068,668 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 20 | BHARTIARTL6% ₹1,872 Cr 11,921,785 Infosys Ltd (Technology)

Equity, Since 31 Aug 04 | INFY5% ₹1,833 Cr 10,863,818 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 07 | 5322155% ₹1,733 Cr 17,068,255

↑ 250,000 NTPC Ltd (Utilities)

Equity, Since 30 Jun 15 | 5325555% ₹1,703 Cr 54,669,743 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | KOTAKBANK4% ₹1,397 Cr 7,341,626 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 06 | RELIANCE4% ₹1,374 Cr 11,450,234 ITC Ltd (Consumer Defensive)

Equity, Since 31 Jan 03 | ITC4% ₹1,252 Cr 31,691,145 6. BNP Paribas Large Cap Fund

CAGR/Annualized return of 15.8% since its launch. Ranked 38 in Large Cap category. Return for 2024 was 20.1% , 2023 was 24.8% and 2022 was 4.2% . BNP Paribas Large Cap Fund

Growth Launch Date 23 Sep 04 NAV (15 Apr 25) ₹204.872 ↑ 4.18 (2.08 %) Net Assets (Cr) ₹2,263 on 28 Feb 25 Category Equity - Large Cap AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.11 Sharpe Ratio -0.35 Information Ratio 0.63 Alpha Ratio 0.13 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,543 31 Mar 22 ₹18,283 31 Mar 23 ₹18,589 31 Mar 24 ₹26,040 31 Mar 25 ₹27,311 Returns for BNP Paribas Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3.8% 3 Month -2.5% 6 Month -11% 1 Year 3.5% 3 Year 13.8% 5 Year 21.3% 10 Year 15 Year Since launch 15.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 20.1% 2022 24.8% 2021 4.2% 2020 22.1% 2019 16.8% 2018 17.2% 2017 -4% 2016 37% 2015 -5.5% 2014 5.6% Fund Manager information for BNP Paribas Large Cap Fund

Name Since Tenure Jitendra Sriram 16 Jun 22 2.71 Yr. Kushant Arora 21 Oct 24 0.36 Yr. Data below for BNP Paribas Large Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 26.32% Consumer Cyclical 11.38% Industrials 9.88% Technology 9.71% Consumer Defensive 7.94% Energy 7.53% Health Care 5.58% Basic Materials 4.98% Utility 4.13% Communication Services 3.78% Asset Allocation

Asset Class Value Cash 6.44% Equity 92.45% Debt 1.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK8% ₹192 Cr 1,107,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 12 | ICICIBANK7% ₹163 Cr 1,350,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Sep 17 | RELIANCE6% ₹130 Cr 1,080,000

↑ 45,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Jun 18 | TCS4% ₹89 Cr 254,700

↑ 29,700 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 15 | KOTAKBANK4% ₹87 Cr 459,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT4% ₹85 Cr 270,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 09 | INFY3% ₹77 Cr 456,300

↓ -56,700 Bharti Airtel Ltd (Communication Services)

Equity, Since 29 Feb 08 | BHARTIARTL3% ₹64 Cr 405,000 ITC Ltd (Consumer Defensive)

Equity, Since 28 Feb 18 | ITC3% ₹62 Cr 1,575,000 Hitachi Energy India Ltd Ordinary Shares (Industrials)

Equity, Since 31 Aug 23 | POWERINDIA2% ₹54 Cr 47,700 7. L&T India Large Cap Fund

CAGR/Annualized return of 10% since its launch. Ranked 56 in Large Cap category. . L&T India Large Cap Fund

Growth Launch Date 23 Oct 07 NAV (25 Nov 22) ₹42.242 ↑ 0.02 (0.04 %) Net Assets (Cr) ₹758 on 31 Oct 22 Category Equity - Large Cap AMC L&T Investment Management Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.48 Sharpe Ratio -0.1 Information Ratio -1.05 Alpha Ratio -2.34 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,213 31 Mar 22 ₹19,020 Returns for L&T India Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 2.1% 3 Month 4.4% 6 Month 16.7% 1 Year 2.9% 3 Year 13.6% 5 Year 10.5% 10 Year 15 Year Since launch 10% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for L&T India Large Cap Fund

Name Since Tenure Data below for L&T India Large Cap Fund as on 31 Oct 22

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 8. Invesco India Largecap Fund

CAGR/Annualized return of 12.5% since its launch. Ranked 39 in Large Cap category. Return for 2024 was 20% , 2023 was 27.8% and 2022 was -3% . Invesco India Largecap Fund

Growth Launch Date 21 Aug 09 NAV (15 Apr 25) ₹63.27 ↑ 1.70 (2.76 %) Net Assets (Cr) ₹1,229 on 28 Feb 25 Category Equity - Large Cap AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.21 Sharpe Ratio -0.29 Information Ratio 0.02 Alpha Ratio 1.01 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,980 31 Mar 22 ₹19,873 31 Mar 23 ₹19,104 31 Mar 24 ₹26,614 31 Mar 25 ₹28,560 Returns for Invesco India Largecap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 5.6% 3 Month -2.4% 6 Month -10.3% 1 Year 6.4% 3 Year 13.2% 5 Year 22.4% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 20% 2022 27.8% 2021 -3% 2020 32.5% 2019 14.1% 2018 10.5% 2017 -0.4% 2016 28.3% 2015 2.8% 2014 4.6% Fund Manager information for Invesco India Largecap Fund

Name Since Tenure Amit Nigam 3 Sep 20 4.49 Yr. Hiten Jain 1 Dec 23 1.25 Yr. Data below for Invesco India Largecap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 30.7% Consumer Cyclical 16.66% Technology 12.27% Consumer Defensive 10.41% Industrials 9.19% Health Care 6.36% Energy 6.28% Communication Services 4.28% Utility 2.15% Basic Materials 1.26% Asset Allocation

Asset Class Value Cash 0.43% Equity 99.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 09 | HDFCBANK10% ₹121 Cr 699,213 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIBANK7% ₹91 Cr 757,691

↓ -51,771 Infosys Ltd (Technology)

Equity, Since 30 Apr 18 | INFY5% ₹59 Cr 349,212 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 19 | BHARTIARTL4% ₹53 Cr 334,819

↑ 20,011 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 17 | RELIANCE4% ₹51 Cr 424,891

↓ -68,078 Tata Consumer Products Ltd (Consumer Defensive)

Equity, Since 31 Jul 24 | 5008004% ₹47 Cr 486,077 Axis Bank Ltd (Financial Services)

Equity, Since 30 Nov 20 | 5322154% ₹47 Cr 458,923 Eicher Motors Ltd (Consumer Cyclical)

Equity, Since 30 Nov 23 | EICHERMOT3% ₹36 Cr 74,457

↑ 28,882 Titan Co Ltd (Consumer Cyclical)

Equity, Since 30 Apr 23 | TITAN3% ₹35 Cr 114,075 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 25 | KOTAKBANK3% ₹35 Cr 183,609

↑ 183,609 9. Edelweiss Large Cap Fund

CAGR/Annualized return of 13.8% since its launch. Ranked 66 in Large Cap category. Return for 2024 was 14.6% , 2023 was 25.7% and 2022 was 3.4% . Edelweiss Large Cap Fund

Growth Launch Date 20 May 09 NAV (15 Apr 25) ₹78.34 ↑ 1.69 (2.20 %) Net Assets (Cr) ₹1,059 on 28 Feb 25 Category Equity - Large Cap AMC Edelweiss Asset Management Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.36 Sharpe Ratio -0.37 Information Ratio 0.59 Alpha Ratio -0.02 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,490 31 Mar 22 ₹19,329 31 Mar 23 ₹19,817 31 Mar 24 ₹26,762 31 Mar 25 ₹28,320 Returns for Edelweiss Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.7% 3 Month -0.5% 6 Month -9% 1 Year 4.7% 3 Year 13.1% 5 Year 21.8% 10 Year 15 Year Since launch 13.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 14.6% 2022 25.7% 2021 3.4% 2020 23.4% 2019 17.3% 2018 11.5% 2017 1.7% 2016 33.8% 2015 0.4% 2014 0.8% Fund Manager information for Edelweiss Large Cap Fund

Name Since Tenure Bhavesh Jain 2 May 17 7.84 Yr. Bharat Lahoti 1 Oct 21 3.42 Yr. Data below for Edelweiss Large Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 32.73% Consumer Cyclical 11.15% Health Care 10.56% Technology 10.23% Consumer Defensive 7.42% Industrials 6.58% Basic Materials 6.33% Energy 4.53% Communication Services 3.57% Utility 3.12% Asset Allocation

Asset Class Value Cash 2.6% Equity 97.4% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 18 | ICICIBANK8% ₹80 Cr 661,958 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 20 | HDFCBANK7% ₹75 Cr 433,985 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Aug 21 | 5000344% ₹41 Cr 48,387 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 10 | RELIANCE4% ₹40 Cr 336,114 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY4% ₹40 Cr 236,600

↑ 37,801 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 10 | LT4% ₹38 Cr 121,338 Tata Consultancy Services Ltd (Technology)

Equity, Since 28 Feb 15 | TCS4% ₹38 Cr 108,341

↑ 19,756 ITC Ltd (Consumer Defensive)

Equity, Since 31 Dec 10 | ITC3% ₹30 Cr 766,588 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹30 Cr 291,526 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Jun 15 | MARUTI3% ₹29 Cr 24,559 10. Canara Robeco Bluechip Equity Fund

CAGR/Annualized return of 12.9% since its launch. Ranked 52 in Large Cap category. Return for 2024 was 17.8% , 2023 was 22.2% and 2022 was 0.8% . Canara Robeco Bluechip Equity Fund

Growth Launch Date 20 Aug 10 NAV (15 Apr 25) ₹58.82 ↑ 1.31 (2.28 %) Net Assets (Cr) ₹13,848 on 28 Feb 25 Category Equity - Large Cap AMC Canara Robeco Asset Management Co. Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 1.71 Sharpe Ratio -0.11 Information Ratio -0.2 Alpha Ratio 2.69 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,361 31 Mar 22 ₹18,939 31 Mar 23 ₹18,902 31 Mar 24 ₹25,179 31 Mar 25 ₹27,431 Returns for Canara Robeco Bluechip Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.8% 3 Month 0.5% 6 Month -6.6% 1 Year 8.8% 3 Year 13% 5 Year 21.2% 10 Year 15 Year Since launch 12.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 17.8% 2022 22.2% 2021 0.8% 2020 24.5% 2019 23.1% 2018 15.7% 2017 3.4% 2016 31.4% 2015 1.9% 2014 -0.5% Fund Manager information for Canara Robeco Bluechip Equity Fund

Name Since Tenure Vishal Mishra 1 Jun 21 3.75 Yr. Shridatta Bhandwaldar 5 Jul 16 8.66 Yr. Data below for Canara Robeco Bluechip Equity Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 32.01% Consumer Cyclical 12.83% Technology 10.45% Industrials 8.37% Consumer Defensive 7.91% Health Care 7.63% Energy 5% Communication Services 3.95% Basic Materials 3.92% Utility 3.28% Real Estate 0.46% Asset Allocation

Asset Class Value Cash 4.18% Equity 95.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | HDFCBANK9% ₹1,265 Cr 7,301,256 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK8% ₹1,118 Cr 9,285,600 Infosys Ltd (Technology)

Equity, Since 30 Sep 10 | INFY5% ₹701 Cr 4,154,142 Reliance Industries Ltd (Energy)

Equity, Since 28 Feb 17 | RELIANCE5% ₹674 Cr 5,616,500

↑ 175,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹547 Cr 3,485,316

↓ -125,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 16 | LT3% ₹470 Cr 1,485,992 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jul 19 | 5000343% ₹419 Cr 490,934 State Bank of India (Financial Services)

Equity, Since 30 Nov 20 | SBIN3% ₹418 Cr 6,075,000

↑ 100,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Jun 22 | M&M3% ₹415 Cr 1,606,515

↑ 95,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 12 | 5325383% ₹385 Cr 379,652

↑ 18,000 11. Aditya Birla Sun Life Frontline Equity Fund

CAGR/Annualized return of 18.7% since its launch. Ranked 14 in Large Cap category. Return for 2024 was 15.6% , 2023 was 23.1% and 2022 was 3.5% . Aditya Birla Sun Life Frontline Equity Fund

Growth Launch Date 30 Aug 02 NAV (15 Apr 25) ₹488.22 ↑ 9.85 (2.06 %) Net Assets (Cr) ₹26,286 on 28 Feb 25 Category Equity - Large Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.67 Sharpe Ratio -0.24 Information Ratio 0.35 Alpha Ratio 1.74 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,018 31 Mar 22 ₹20,441 31 Mar 23 ₹20,490 31 Mar 24 ₹27,424 31 Mar 25 ₹29,595 Returns for Aditya Birla Sun Life Frontline Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 5% 3 Month 0.2% 6 Month -8.3% 1 Year 7.8% 3 Year 12.9% 5 Year 22.8% 10 Year 15 Year Since launch 18.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 15.6% 2022 23.1% 2021 3.5% 2020 27.9% 2019 14.2% 2018 7.6% 2017 -2.9% 2016 30.6% 2015 7.4% 2014 1.1% Fund Manager information for Aditya Birla Sun Life Frontline Equity Fund

Name Since Tenure Mahesh Patil 17 Nov 05 19.3 Yr. Dhaval Joshi 21 Nov 22 2.28 Yr. Data below for Aditya Birla Sun Life Frontline Equity Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 31.94% Consumer Cyclical 12.41% Technology 9.6% Industrials 8.66% Consumer Defensive 6.99% Health Care 6.41% Energy 5.93% Basic Materials 4.94% Communication Services 4.46% Utility 2.68% Real Estate 1.41% Asset Allocation

Asset Class Value Cash 4.31% Equity 95.45% Debt 0.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 07 | HDFCBANK8% ₹2,198 Cr 12,689,852 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK8% ₹1,990 Cr 16,528,292 Infosys Ltd (Technology)

Equity, Since 30 Apr 05 | INFY6% ₹1,693 Cr 10,033,663 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 05 | RELIANCE5% ₹1,295 Cr 10,787,510 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 08 | LT5% ₹1,195 Cr 3,778,215 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 17 | BHARTIARTL4% ₹999 Cr 6,360,389 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 13 | 5322153% ₹827 Cr 8,147,062 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | M&M3% ₹776 Cr 3,003,365 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Apr 15 | KOTAKBANK3% ₹743 Cr 3,904,807

↑ 141,600 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹669 Cr 21,468,779

എന്തുകൊണ്ട് മികച്ച ലാർജ് ക്യാപ് മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കണം

1. സ്ഥിരതയുള്ള നിക്ഷേപം

വലിയ കമ്പനികൾ നന്നായി സ്ഥാപിതമാണ്, അതിനർത്ഥം അവയ്ക്ക് കൂടുതൽ സ്ഥിരതയുണ്ട് എന്നാണ്വരുമാനം. ലാർജ് ക്യാപ് ഫണ്ട് വലിയ കമ്പനികളിൽ നിക്ഷേപിക്കുന്നു, വർഷങ്ങളായി നിലനിൽക്കുന്നതും സ്ഥിരതയുള്ള തൊഴിലാളികളുള്ളതും വരുമാനം ഉണ്ടാക്കുന്ന ഒരു സ്ഥാപിത ഉൽപ്പന്നം/സേവനവുമാണ്. അതുകൊണ്ടാണ് വലിയ ക്യാപ് സ്റ്റോക്കുകളുടെ ഏറ്റവും വലിയ നേട്ടങ്ങളിലൊന്ന് അവ നൽകുന്ന സ്ഥിരത. ഇത് വലിയ ക്യാപ് മ്യൂച്വൽ ഫണ്ടിന്റെ പോർട്ട്ഫോളിയോയിലും അതിന്റെ പോർട്ട്ഫോളിയോയിലും പ്രതിഫലിക്കുന്നു.അല്ല അതും.

2. സ്ഥിരമായ റിട്ടേണുകൾ

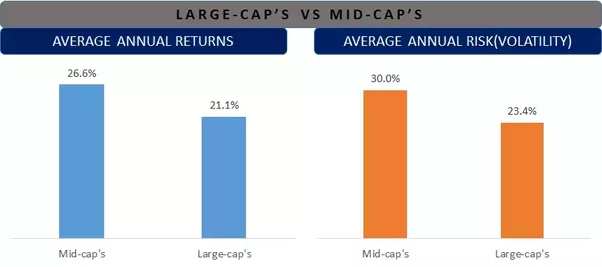

ദീർഘകാലാടിസ്ഥാനത്തിൽ, ലാർജ് ക്യാപ് ഫണ്ടുകൾക്ക് മിഡ്-സ്മോൾ-ക്യാപ് ഫണ്ടുകളേക്കാൾ കുറഞ്ഞ റിട്ടേൺ ഉണ്ടെങ്കിലും, വലിയ ക്യാപ്പിലെ വരുമാനം കൂടുതൽ സ്ഥിരതയുള്ളതാണ്. മിഡ് ക്യാപ്പുകളിലെ ചാഞ്ചാട്ടം വളരെ കൂടുതലാണ്, കൂടാതെ വലിയ ക്യാപ്പുകളേക്കാൾ കൂടുതൽ നഷ്ടങ്ങൾ മിഡ് ക്യാപ്പുകളിൽ ഒരാൾ കാണുന്നു. ഒരു പോലെനിക്ഷേപകൻ ഒരാൾക്ക് ഇക്വിറ്റികളിൽ നിക്ഷേപിക്കാൻ താൽപ്പര്യമുണ്ടെങ്കിൽ, വലിയ ക്യാപ് മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കുന്നത് ഒരു തുടക്കമാണ്.

3. കുറഞ്ഞ അസ്ഥിരത

മിഡ്, സ്മോൾ ക്യാപ് ഫണ്ടുകളേക്കാൾ ലാർജ് ക്യാപ് ഫണ്ടുകൾ അസ്ഥിരമാണ്. ചരിത്രപരമായ വിവരങ്ങളാലും ഇത് തെളിയിക്കപ്പെട്ടിട്ടുണ്ട്. താഴെയുള്ള ചിത്രത്തിൽ ലാർജ് ക്യാപ്പിന്റെ കഴിഞ്ഞ 15 വർഷത്തെ ശരാശരി വാർഷിക വരുമാനത്തിന്റെ വിശകലനമുണ്ട്. ലാർജ് ക്യാപ്, ബിഎസ്ഇ എന്നിവയുടെ പ്രോക്സിയായി ബിഎസ്ഇ സെൻസെക്സ് ഉപയോഗിച്ചാണ് ഇത് ചെയ്യുന്നത്മിഡ് ക്യാപ് മിഡ് ക്യാപ്സിന്.

4. മിതമായ ഉയർന്ന അപകടസാധ്യത

വലിയ കമ്പനികളിൽ നിക്ഷേപം നടത്തുന്നതിനാൽ, മിഡ്-സ്മോൾ-ക്യാപ് ഫണ്ടുകളുമായി താരതമ്യപ്പെടുത്തുമ്പോൾ ഈ ഫണ്ടുകൾക്ക് റിസ്ക് കുറവാണ്. പക്ഷേ, ഇക്വിറ്റികൾ ഹ്രസ്വകാലത്തേക്ക് നഷ്ടത്തിലേക്ക് നയിച്ചേക്കാം. അതിനാൽ, നഷ്ടങ്ങൾ കാണാനും ഉറക്കം നഷ്ടപ്പെടാതിരിക്കാനും ഒരാൾ തയ്യാറാകണം. ഒരാൾക്ക് ദീർഘകാല ഹോൾഡിങ്ങ് കാലയളവ് ഉണ്ടെങ്കിൽ (കുറഞ്ഞത് 5 വർഷത്തിൽ കൂടുതൽ) നിക്ഷേപത്തിന്റെ ചില അടിസ്ഥാനകാര്യങ്ങൾ പിന്തുടരുകയാണെങ്കിൽ, ഒരാൾക്ക് നല്ല ലാഭം നേടാനാകും.

മികച്ച ലാർജ് ക്യാപ് ഫണ്ടുകളിൽ ഓൺലൈനിൽ എങ്ങനെ നിക്ഷേപിക്കാം?

Fincash.com-ൽ ആജീവനാന്ത സൗജന്യ നിക്ഷേപ അക്കൗണ്ട് തുറക്കുക

നിങ്ങളുടെ രജിസ്ട്രേഷനും KYC പ്രക്രിയയും പൂർത്തിയാക്കുക

രേഖകൾ അപ്ലോഡ് ചെയ്യുക (പാൻ, ആധാർ മുതലായവ).കൂടാതെ, നിങ്ങൾ നിക്ഷേപിക്കാൻ തയ്യാറാണ്!

ഉപസംഹാരം

വലിയ വിപണി മൂലധനവൽക്കരണമുള്ള കമ്പനികളിൽ ലാർജ് ക്യാപ് ഫണ്ടുകൾ നിക്ഷേപിക്കുന്നതിനാൽ, ഈ സ്ഥാപനങ്ങൾക്ക് മോശം വിപണികളെയും സാമ്പത്തിക ചക്രങ്ങളെയും അതിജീവിക്കാനുള്ള വലുപ്പവും അളവും ഉണ്ട്. അതിനാൽ, എല്ലാ ഇക്വിറ്റി മ്യൂച്വൽ ഫണ്ട് വിഭാഗങ്ങളിലും ഏറ്റവും സുരക്ഷിതമായ നിക്ഷേപമായി വലിയ ക്യാപ്പുകളിലെ നിക്ഷേപം കണക്കാക്കപ്പെടുന്നു. എന്നിരുന്നാലും, ഒരാൾ എപ്പോഴും ഓർക്കണംഅടിവരയിടുന്നു നിക്ഷേപം ഇക്വിറ്റിയാണ്, അതിന് അപകടസാധ്യതകളുണ്ട്. ലാർജ് ക്യാപ്സിന്റെ അപകടസാധ്യതകൾ താരതമ്യേന കുറവാണെങ്കിലും, ബുൾ മാർക്കറ്റ് ഘട്ടങ്ങളിൽ വരുമാനം സ്ഥിരതയുള്ളതും അസാധാരണമായ വരുമാനവുമല്ല. ഒരു നിശ്ചിത അളവിലുള്ള അപകടസാധ്യതയുള്ള മിതമായതും എന്നാൽ സുസ്ഥിരവുമായ വരുമാനം ഇഷ്ടപ്പെടുന്ന നിക്ഷേപകർ; മികച്ച വലിയ ക്യാപ് ഫണ്ടുകളിൽ നിക്ഷേപിക്കാം!

ഇവിടെ നൽകിയിരിക്കുന്ന വിവരങ്ങൾ കൃത്യമാണെന്ന് ഉറപ്പാക്കാൻ എല്ലാ ശ്രമങ്ങളും നടത്തിയിട്ടുണ്ട്. എന്നിരുന്നാലും, ഡാറ്റയുടെ കൃത്യത സംബന്ധിച്ച് യാതൊരു ഉറപ്പും നൽകുന്നില്ല. എന്തെങ്കിലും നിക്ഷേപം നടത്തുന്നതിന് മുമ്പ് സ്കീം വിവര രേഖ ഉപയോഗിച്ച് പരിശോധിക്കുക.

Superb. Gave very depth information.

Very good and give us about best largecap fund somtimes