+91-22-48913909

+91-22-48913909

ഫിൻകാഷ് »മ്യൂച്വൽ ഫണ്ടുകൾ ഇന്ത്യ »എസ്ഐപി കൈസെ സ്റ്റാർട്ട് കരേ

Table of Contents

- എന്താണ് SIP?

- വ്യവസ്ഥാപിത നിക്ഷേപ പദ്ധതിയിൽ നിക്ഷേപിക്കുന്നതിന്റെ പ്രയോജനങ്ങൾ

- എസ്ഐപി മേ ഇൻവെസ്റ്റ് കൈസെ കരേ?

- 2022 - 2023 ൽ നിക്ഷേപിക്കുന്നതിനുള്ള മികച്ച SIP മ്യൂച്വൽ ഫണ്ടുകൾ

Top 11 Funds

- ICICI Prudential Infrastructure Fund

- ICICI Prudential Technology Fund

- SBI Healthcare Opportunities Fund

- L&T Emerging Businesses Fund

- TATA Digital India Fund

- BOI AXA Manufacturing and Infrastructure Fund

- IDFC Infrastructure Fund

- Nippon India Power and Infra Fund

- DSP BlackRock Small Cap Fund

- Franklin India Smaller Companies Fund

- Franklin India Opportunities Fund

എസ്ഐപി കൈസെ സ്റ്റാർട്ട് കരേ?

എസ്.ഐ.പി കൈസെ സ്റ്റാർട്ട് കരേ? നിങ്ങൾ എങ്ങനെയാണ് ഒരു SIP ആരംഭിക്കുന്നത്? ആഗ്രഹിക്കുന്ന ആളുകൾ ചോദിക്കുന്ന ഏറ്റവും സാധാരണമായ ചോദ്യമാണിത്മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കുക. പക്ഷേ, മുന്നോട്ട് പോകുന്നതിനുമുമ്പ്, സിസ്റ്റമാറ്റിക് എന്താണെന്ന് ആദ്യം മനസ്സിലാക്കാംനിക്ഷേപ പദ്ധതി (SIP) എല്ലാം.

എന്താണ് SIP?

സാധാരണയായി SIP എന്നറിയപ്പെടുന്ന ഒരു സിസ്റ്റമാറ്റിക് ഇൻവെസ്റ്റ്മെന്റ് പ്ലാൻ ഒരു ജനപ്രിയ മോഡാണ്നിക്ഷേപിക്കുന്നു പണംമ്യൂച്വൽ ഫണ്ടുകൾ. നിങ്ങൾക്ക് ആഴ്ചയിലോ പ്രതിമാസത്തിലോ ത്രൈമാസത്തിലോ മുൻകൂട്ടി നിശ്ചയിച്ച തുക നിക്ഷേപിക്കാംഅടിസ്ഥാനം. സ്വയമേവ തിരഞ്ഞെടുക്കാൻ ഈ മോഡ് നിങ്ങളെ അനുവദിക്കുന്നുകിഴിവ് പ്രക്രിയ, അതിൽ തുക നേരിട്ട് നിങ്ങളിൽ നിന്ന് കുറയ്ക്കുന്നുബാങ്ക് അക്കൗണ്ട്, നിങ്ങൾ നിക്ഷേപിക്കാൻ തിരഞ്ഞെടുക്കുന്ന മ്യൂച്വൽ ഫണ്ട് സ്കീമിലേക്ക് നയിക്കപ്പെടുന്നു.

SIP നിക്ഷേപം മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കുന്നതിനുള്ള ഏറ്റവും സൗകര്യപ്രദമായ മാർഗമാണ് പ്ലാനുകൾ. പണം സ്ഥിരമായി കുറയ്ക്കുന്നതിനാൽ, സമ്പാദ്യശീലം വളർത്തിയെടുക്കാൻ ഇത് നിങ്ങളെ സഹായിക്കുന്നു. ഇതുവഴി നിങ്ങളുടെ നേട്ടങ്ങൾ കൈവരിക്കാൻ നിങ്ങൾക്ക് സമ്പത്ത് സൃഷ്ടിക്കാൻ കഴിയുംസാമ്പത്തിക ലക്ഷ്യങ്ങൾ.

Talk to our investment specialist

വ്യവസ്ഥാപിത നിക്ഷേപ പദ്ധതിയിൽ നിക്ഷേപിക്കുന്നതിന്റെ പ്രയോജനങ്ങൾ

പ്രധാനപ്പെട്ട ചിലത്എസ്ഐപിയുടെ പ്രയോജനങ്ങൾ ആകുന്നു:

നിക്ഷേപ തുക

SIP-യിലെ ഏറ്റവും കുറഞ്ഞ നിക്ഷേപ തുക പ്രതിമാസം 500 രൂപയിൽ താഴെയാണ്. കുറച്ച്എഎംസികൾ എല്ലാ മാസവും വെറും 100 രൂപ ഉപയോഗിച്ച് ഒരു SIP ആരംഭിക്കാനും നിങ്ങളെ അനുവദിക്കുന്നു. അതിനാൽ, നിങ്ങളുടെ സൗകര്യത്തിനനുസരിച്ച് ഈ തുക നിങ്ങൾക്ക് തിരഞ്ഞെടുക്കാം.

വഴങ്ങുന്ന

നിക്ഷേപകർക്ക് എപ്പോൾ വേണമെങ്കിലും നിക്ഷേപ തുക കുറയ്ക്കാനോ വർദ്ധിപ്പിക്കാനോ തിരഞ്ഞെടുക്കാം. നിങ്ങൾ 1 രൂപ നിക്ഷേപിക്കുകയാണെങ്കിൽ, എന്ന് കരുതുക.000 ഇന്ന്, നിങ്ങൾക്ക് ഈ തുക ഭാവിയിൽ 10,000 രൂപയായി വർദ്ധിപ്പിക്കാം. അതേ തുക 500 രൂപയായി കുറയ്ക്കാം. നിങ്ങൾക്ക് ആവശ്യമുള്ളപ്പോഴെല്ലാം നിക്ഷേപം നിർത്താം. അതിനാൽ, നിങ്ങൾ ഇപ്പോൾ നിങ്ങളുടെ കരിയർ ആരംഭിച്ചതാണെങ്കിൽ, നിങ്ങൾക്ക് 500 രൂപ ഉപയോഗിച്ച് നിക്ഷേപം ആരംഭിക്കുകയും നിങ്ങൾ വളരുന്നതിനനുസരിച്ച് തുക വർദ്ധിപ്പിക്കുകയും ചെയ്യാം.

സംയുക്തത്തിന്റെ ശക്തി

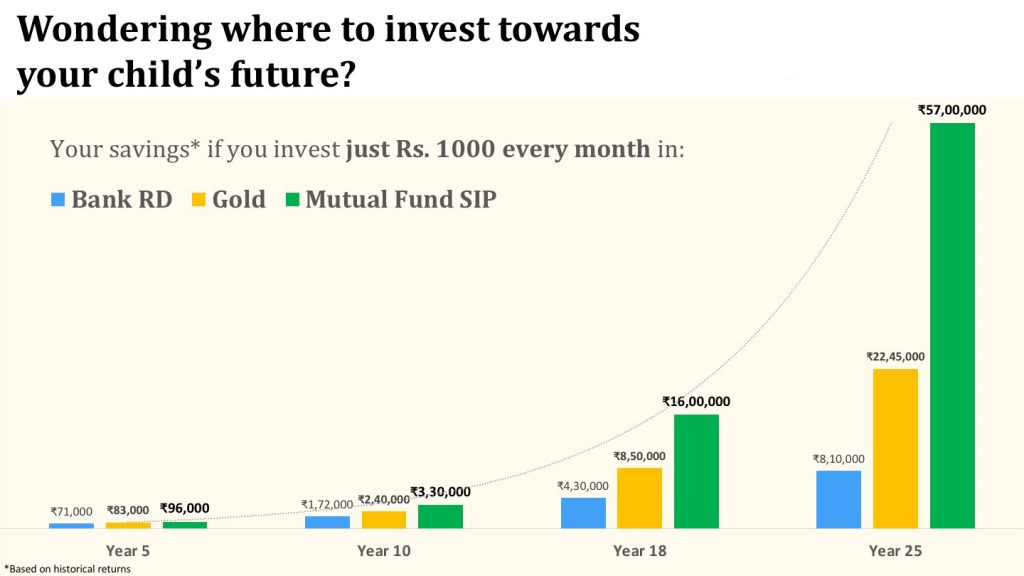

നിങ്ങൾ നിക്ഷേപിക്കുന്ന ഓരോ തുകയും നിങ്ങൾക്ക് പലിശ ലഭിക്കും. ഈ താൽപ്പര്യങ്ങൾ ഒരു നിശ്ചിത കാലയളവിൽ കൂട്ടിച്ചേർക്കപ്പെടുകയും ശേഖരിക്കപ്പെടുകയും ചെയ്യുന്നു. ഇതിനർത്ഥം, നിക്ഷേപത്തിന്റെ ദൈർഘ്യം കൂടുന്തോറും ഫണ്ടിന്റെ മൂല്യം ഉയർന്നതായിരിക്കും. അതിനാൽ, ഒരു SIP വഴി ദീർഘകാലത്തേക്ക് നിക്ഷേപിക്കാൻ എപ്പോഴും നിർദ്ദേശിക്കപ്പെടുന്നു. ഒരു SIP വഴി നിങ്ങൾക്ക് പൂർത്തിയാക്കാൻ കഴിയുന്ന നിരവധി ദീർഘകാല ലക്ഷ്യങ്ങളുണ്ട്വിരമിക്കൽ ആസൂത്രണം, ഡെസ്റ്റിനേഷൻ വെഡ്ഡിംഗ് മുതലായവ.

രൂപ-ചെലവ് ശരാശരി

പ്രവചനാതീതമായ കാര്യങ്ങളെക്കുറിച്ച് ആകുലപ്പെടാതെ നിക്ഷേപകർക്ക് പണം നിക്ഷേപിക്കാൻ ഇത് അനുവദിക്കുന്നുവിപണി ഓഹരികളുടെ. രൂപ-ചെലവ് ശരാശരി നിങ്ങളുടെ നിക്ഷേപ ഫണ്ടുകൾക്ക് വില കൂടുതലായിരിക്കുമ്പോൾ കുറഞ്ഞ യൂണിറ്റുകളും വില കുറയുമ്പോൾ കൂടുതൽ യൂണിറ്റുകളും നേടാൻ അനുവദിക്കുന്നു.

എസ്ഐപി മേ ഇൻവെസ്റ്റ് കൈസെ കരേ?

Fincash.com-ൽ ആജീവനാന്ത സൗജന്യ നിക്ഷേപ അക്കൗണ്ട് തുറക്കുക

നിങ്ങളുടെ രജിസ്ട്രേഷനും KYC പ്രക്രിയയും പൂർത്തിയാക്കുക

രേഖകൾ അപ്ലോഡ് ചെയ്യുക (പാൻ, ആധാർ മുതലായവ).കൂടാതെ, നിങ്ങൾ നിക്ഷേപിക്കാൻ തയ്യാറാണ്!

2022 - 2023 ൽ നിക്ഷേപിക്കുന്നതിനുള്ള മികച്ച SIP മ്യൂച്വൽ ഫണ്ടുകൾ

To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate long-term capital appreciation for you from a portfolio made up predominantly of equity and equity-related securities of technology intensive companies. ICICI Prudential Technology Fund is a Equity - Sectoral fund was launched on 3 Mar 00. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Technology Fund Returns up to 1 year are on (Erstwhile SBI Pharma Fund) To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. SBI Healthcare Opportunities Fund is a Equity - Sectoral fund was launched on 31 Dec 04. It is a fund with High risk and has given a Below is the key information for SBI Healthcare Opportunities Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on The investment objective of the scheme is to seek long term capital appreciation by investing atleast 80% of its net assets in equity/equity related instruments of the companies in Information Technology Sector in India.However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.The Scheme does not assure or guarantee any returns. TATA Digital India Fund is a Equity - Sectoral fund was launched on 28 Dec 15. It is a fund with High risk and has given a Below is the key information for TATA Digital India Fund Returns up to 1 year are on The Scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure and related sectors. Further, there can be no assurance that the investment objectives of the scheme will be realized. The Scheme is not providing any assured or guaranteed returns BOI AXA Manufacturing and Infrastructure Fund is a Equity - Sectoral fund was launched on 5 Mar 10. It is a fund with High risk and has given a Below is the key information for BOI AXA Manufacturing and Infrastructure Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on (Erstwhile DSP BlackRock Micro Cap Fund) The primary investment objective is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities of small cap companies. From time to time, the fund manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction. There is no assurance that the investment objective of the Scheme will be realized DSP BlackRock Small Cap Fund is a Equity - Small Cap fund was launched on 14 Jun 07. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Small Cap Fund Returns up to 1 year are on The Fund seeks to provide long-term capital appreciation by investing in mid and small cap companies. Franklin India Smaller Companies Fund is a Equity - Small Cap fund was launched on 13 Jan 06. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Smaller Companies Fund Returns up to 1 year are on The investment objective of Franklin India Opportunities Fund (FIOF) is to generate capital appreciation by capitalizing on the long-term growth opportunities in the Indian economy. Franklin India Opportunities Fund is a Equity - Sectoral fund was launched on 21 Feb 00. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Opportunities Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Infrastructure Fund Growth ₹177.05

↓ -1.12 ₹6,911 100 -7.9 -7.4 10.8 28.4 28.3 27.4 ICICI Prudential Technology Fund Growth ₹212.05

↓ -0.30 ₹14,275 100 1 9.3 15.9 10.3 28.3 25.4 SBI Healthcare Opportunities Fund Growth ₹426.614

↓ -0.19 ₹3,628 500 -0.4 12.6 27.2 24 27.6 42.2 L&T Emerging Businesses Fund Growth ₹78.6906

↓ -0.69 ₹17,386 500 -10.4 -6 7.6 19.1 27.1 28.5 TATA Digital India Fund Growth ₹51.8432

↓ -0.06 ₹12,963 150 -0.7 6.7 18.2 12 26.8 30.6 BOI AXA Manufacturing and Infrastructure Fund Growth ₹52.61

↓ -0.22 ₹537 1,000 -7.7 -8.3 11.7 21.3 26.7 25.7 IDFC Infrastructure Fund Growth ₹46.519

↓ -0.15 ₹1,791 100 -12.3 -15.8 12.5 23.7 26.4 39.3 Nippon India Power and Infra Fund Growth ₹314.666

↓ -0.26 ₹7,453 100 -11.2 -14 5.8 26.6 26 26.9 DSP BlackRock Small Cap Fund Growth ₹181.667

↓ -1.05 ₹16,634 500 -9.4 -5.8 9.6 16.9 25.8 25.6 Franklin India Smaller Companies Fund Growth ₹164.163

↓ -1.32 ₹14,069 500 -8.7 -8.8 8.4 21.2 25.8 23.2 Franklin India Opportunities Fund Growth ₹237.796

↓ -0.53 ₹6,120 500 -4.9 -3.2 22.1 26.8 25.8 37.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Feb 25 200 കോടി 5 വർഷത്തെ അടിസ്ഥാനമാക്കി ഓർഡർ ചെയ്ത മ്യൂച്വൽ ഫണ്ടുകളുടെ ഇക്വിറ്റി വിഭാഗത്തിൽസിഎജിആർ മടങ്ങുന്നു.1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (07 Feb 25) ₹177.05 ↓ -1.12 (-0.63 %) Net Assets (Cr) ₹6,911 on 31 Dec 24 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 1.41 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,385 31 Jan 22 ₹16,659 31 Jan 23 ₹19,888 31 Jan 24 ₹30,973 31 Jan 25 ₹35,717 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -4.1% 3 Month -7.9% 6 Month -7.4% 1 Year 10.8% 3 Year 28.4% 5 Year 28.3% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% 2014 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.67 Yr. Sharmila D’mello 30 Jun 22 2.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 36.99% Basic Materials 18.93% Financial Services 16.99% Utility 10.73% Energy 7.04% Communication Services 1.26% Consumer Cyclical 1.11% Real Estate 0.75% Asset Allocation

Asset Class Value Cash 5.59% Equity 93.78% Debt 0.63% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹615 Cr 1,704,683 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325554% ₹257 Cr 7,710,775 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK4% ₹255 Cr 1,990,000 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹246 Cr 95,657 JM Financial Ltd (Financial Services)

Equity, Since 31 Oct 21 | JMFINANCIL3% ₹231 Cr 17,763,241

↑ 400,000 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹214 Cr 1,740,091 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO3% ₹208 Cr 457,106

↓ -30,684 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹207 Cr 7,547,700 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹202 Cr 1,558,301 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹196 Cr 1,609,486 2. ICICI Prudential Technology Fund

CAGR/Annualized return of 13% since its launch. Ranked 37 in Sectoral category. Return for 2024 was 25.4% , 2023 was 27.5% and 2022 was -23.2% . ICICI Prudential Technology Fund

Growth Launch Date 3 Mar 00 NAV (06 Feb 25) ₹212.05 ↓ -0.30 (-0.14 %) Net Assets (Cr) ₹14,275 on 31 Dec 24 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk High Expense Ratio 1.96 Sharpe Ratio 0.97 Information Ratio -0.12 Alpha Ratio 1.16 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹16,325 31 Jan 22 ₹25,971 31 Jan 23 ₹22,408 31 Jan 24 ₹29,166 31 Jan 25 ₹34,454 Returns for ICICI Prudential Technology Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -1.1% 3 Month 1% 6 Month 9.3% 1 Year 15.9% 3 Year 10.3% 5 Year 28.3% 10 Year 15 Year Since launch 13% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.4% 2022 27.5% 2021 -23.2% 2020 75.7% 2019 70.6% 2018 2.3% 2017 19.1% 2016 19.8% 2015 -4% 2014 3.9% Fund Manager information for ICICI Prudential Technology Fund

Name Since Tenure Vaibhav Dusad 2 May 20 4.76 Yr. Sharmila D’mello 30 Jun 22 2.59 Yr. Data below for ICICI Prudential Technology Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Technology 71.4% Communication Services 16.22% Consumer Cyclical 4.97% Industrials 2.81% Health Care 0.69% Financial Services 0.5% Consumer Defensive 0.2% Asset Allocation

Asset Class Value Cash 2.98% Equity 97.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity Infosys Ltd (Technology)

Equity, Since 30 Apr 08 | INFY22% ₹3,152 Cr 16,768,086 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Sep 19 | TCS12% ₹1,742 Cr 4,254,724

↑ 270,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 20 | BHARTIARTL8% ₹1,167 Cr 7,348,806

↑ 200,000 LTIMindtree Ltd (Technology)

Equity, Since 31 Jul 16 | LTIM6% ₹847 Cr 1,515,919

↑ 207,126 HCL Technologies Ltd (Technology)

Equity, Since 30 Sep 20 | HCLTECH5% ₹721 Cr 3,758,139

↑ 108,689 Tech Mahindra Ltd (Technology)

Equity, Since 31 Oct 16 | 5327555% ₹713 Cr 4,176,250

↑ 391,032 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 31 Oct 21 | 8901574% ₹547 Cr 4,645,340 Wipro Ltd (Technology)

Equity, Since 30 Sep 19 | 5076853% ₹452 Cr 14,965,117

↑ 242,399 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 22 | 5433203% ₹402 Cr 14,473,026

↓ -1,085,383 Persistent Systems Ltd (Technology)

Equity, Since 31 May 20 | PERSISTENT2% ₹344 Cr 532,687

↓ -17,707 3. SBI Healthcare Opportunities Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 34 in Sectoral category. Return for 2024 was 42.2% , 2023 was 38.2% and 2022 was -6% . SBI Healthcare Opportunities Fund

Growth Launch Date 31 Dec 04 NAV (06 Feb 25) ₹426.614 ↓ -0.19 (-0.04 %) Net Assets (Cr) ₹3,628 on 31 Dec 24 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.09 Sharpe Ratio 2.76 Information Ratio 0.52 Alpha Ratio 4.09 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-15 Days (0.5%),15 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹15,535 31 Jan 22 ₹17,594 31 Jan 23 ₹17,709 31 Jan 24 ₹26,160 31 Jan 25 ₹33,176 Returns for SBI Healthcare Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -2.4% 3 Month -0.4% 6 Month 12.6% 1 Year 27.2% 3 Year 24% 5 Year 27.6% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 42.2% 2022 38.2% 2021 -6% 2020 20.1% 2019 65.8% 2018 -0.5% 2017 -9.9% 2016 2.1% 2015 -14% 2014 27.1% Fund Manager information for SBI Healthcare Opportunities Fund

Name Since Tenure Tanmaya Desai 1 Jun 11 13.68 Yr. Pradeep Kesavan 31 Dec 23 1.09 Yr. Data below for SBI Healthcare Opportunities Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Health Care 90.04% Basic Materials 6.53% Asset Allocation

Asset Class Value Cash 3.35% Equity 96.57% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 17 | SUNPHARMA13% ₹472 Cr 2,500,000 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 21 | MAXHEALTH6% ₹226 Cr 2,000,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB6% ₹220 Cr 360,000 Cipla Ltd (Healthcare)

Equity, Since 31 Aug 16 | 5000876% ₹214 Cr 1,400,000

↑ 120,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 23 | 5002575% ₹188 Cr 800,000 Lonza Group Ltd ADR (Healthcare)

Equity, Since 31 Jan 24 | LZAGY4% ₹151 Cr 300,000 Mankind Pharma Ltd (Healthcare)

Equity, Since 30 Apr 23 | MANKIND4% ₹151 Cr 523,016

↑ 123,016 Poly Medicure Ltd (Healthcare)

Equity, Since 31 Aug 24 | POLYMED4% ₹131 Cr 500,000 Krishna Institute of Medical Sciences Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5433083% ₹126 Cr 2,100,000

↓ -100,000 Jupiter Life Line Hospitals Ltd (Healthcare)

Equity, Since 31 Aug 23 | JLHL3% ₹125 Cr 800,000

↓ -32,871 4. L&T Emerging Businesses Fund

CAGR/Annualized return of 21.2% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (07 Feb 25) ₹78.6906 ↓ -0.69 (-0.87 %) Net Assets (Cr) ₹17,386 on 31 Dec 24 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio 1.32 Information Ratio 0.19 Alpha Ratio 3.87 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹11,113 31 Jan 22 ₹19,683 31 Jan 23 ₹19,960 31 Jan 24 ₹30,763 31 Jan 25 ₹33,089 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -11.1% 3 Month -10.4% 6 Month -6% 1 Year 7.6% 3 Year 19.1% 5 Year 27.1% 10 Year 15 Year Since launch 21.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 28.5% 2022 46.1% 2021 1% 2020 77.4% 2019 15.5% 2018 -8.1% 2017 -13.7% 2016 66.5% 2015 10.2% 2014 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.13 Yr. Cheenu Gupta 1 Oct 23 1.34 Yr. Sonal Gupta 1 Oct 23 1.34 Yr. Data below for L&T Emerging Businesses Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 30.48% Consumer Cyclical 16.51% Financial Services 14.26% Technology 10.64% Basic Materials 10.36% Real Estate 5.3% Health Care 4.2% Consumer Defensive 3.21% Energy 1.5% Asset Allocation

Asset Class Value Cash 1.16% Equity 98.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS3% ₹470 Cr 455,400 BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE3% ₹454 Cr 852,600

↓ -31,900 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Jul 20 | DIXON2% ₹427 Cr 238,273 Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹410 Cr 299,000

↑ 17,978 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹403 Cr 1,607,279 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Jan 19 | TECHNOE2% ₹388 Cr 2,473,042 Kirloskar Pneumatic Co Ltd (Industrials)

Equity, Since 31 Aug 22 | 5052832% ₹376 Cr 2,444,924 KFin Technologies Ltd (Technology)

Equity, Since 31 Aug 24 | KFINTECH2% ₹374 Cr 2,429,736

↑ 139,336 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Jan 17 | 5002512% ₹338 Cr 474,400

↓ -63,150 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹336 Cr 6,810,500

↑ 656,671 5. TATA Digital India Fund

CAGR/Annualized return of 19.8% since its launch. Return for 2024 was 30.6% , 2023 was 31.9% and 2022 was -23.3% . TATA Digital India Fund

Growth Launch Date 28 Dec 15 NAV (07 Feb 25) ₹51.8432 ↓ -0.06 (-0.12 %) Net Assets (Cr) ₹12,963 on 31 Dec 24 Category Equity - Sectoral AMC Tata Asset Management Limited Rating Risk High Expense Ratio 0 Sharpe Ratio 1.21 Information Ratio 0.89 Alpha Ratio 7.66 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-3 Months (0.25%),3 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹15,254 31 Jan 22 ₹23,775 31 Jan 23 ₹20,584 31 Jan 24 ₹27,482 31 Jan 25 ₹32,904 Returns for TATA Digital India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -3.4% 3 Month -0.7% 6 Month 6.7% 1 Year 18.2% 3 Year 12% 5 Year 26.8% 10 Year 15 Year Since launch 19.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 30.6% 2022 31.9% 2021 -23.3% 2020 74.4% 2019 54.8% 2018 7.5% 2017 24.9% 2016 19.6% 2015 -6% 2014 Fund Manager information for TATA Digital India Fund

Name Since Tenure Meeta Shetty 9 Mar 21 3.9 Yr. Kapil Malhotra 19 Dec 23 1.12 Yr. Data below for TATA Digital India Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Technology 74.43% Consumer Cyclical 7.89% Industrials 4.94% Communication Services 4.21% Financial Services 3.86% Asset Allocation

Asset Class Value Cash 4.67% Equity 95.33% Top Securities Holdings / Portfolio

Name Holding Value Quantity Infosys Ltd (Technology)

Equity, Since 31 Jan 16 | INFY17% ₹2,168 Cr 11,530,857 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Jan 16 | TCS11% ₹1,485 Cr 3,626,873 Tech Mahindra Ltd (Technology)

Equity, Since 30 Apr 16 | 5327559% ₹1,219 Cr 7,145,933 Wipro Ltd (Technology)

Equity, Since 31 Jul 18 | 5076858% ₹990 Cr 32,787,324 HCL Technologies Ltd (Technology)

Equity, Since 31 Jan 16 | HCLTECH7% ₹956 Cr 4,983,886 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Oct 22 | 5433206% ₹808 Cr 29,067,000 LTIMindtree Ltd (Technology)

Equity, Since 28 Feb 21 | LTIM4% ₹552 Cr 988,062 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 16 | PERSISTENT4% ₹490 Cr 759,192 Firstsource Solutions Ltd (Technology)

Equity, Since 30 Nov 21 | FSL3% ₹381 Cr 10,123,112 Sonata Software Ltd (Technology)

Equity, Since 30 Jun 23 | SONATSOFTW2% ₹307 Cr 5,125,514 6. BOI AXA Manufacturing and Infrastructure Fund

CAGR/Annualized return of 11.8% since its launch. Return for 2024 was 25.7% , 2023 was 44.7% and 2022 was 3.3% . BOI AXA Manufacturing and Infrastructure Fund

Growth Launch Date 5 Mar 10 NAV (07 Feb 25) ₹52.61 ↓ -0.22 (-0.42 %) Net Assets (Cr) ₹537 on 31 Dec 24 Category Equity - Sectoral AMC BOI AXA Investment Mngrs Private Ltd Rating Risk High Expense Ratio 2.57 Sharpe Ratio 1.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,210 31 Jan 22 ₹18,356 31 Jan 23 ₹18,974 31 Jan 24 ₹29,005 31 Jan 25 ₹33,073 Returns for BOI AXA Manufacturing and Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -4.7% 3 Month -7.7% 6 Month -8.3% 1 Year 11.7% 3 Year 21.3% 5 Year 26.7% 10 Year 15 Year Since launch 11.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.7% 2022 44.7% 2021 3.3% 2020 52.5% 2019 28.1% 2018 2.5% 2017 -22.8% 2016 56% 2015 1% 2014 0.3% Fund Manager information for BOI AXA Manufacturing and Infrastructure Fund

Name Since Tenure Nitin Gosar 27 Sep 22 2.35 Yr. Data below for BOI AXA Manufacturing and Infrastructure Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 28.83% Basic Materials 21.97% Consumer Cyclical 12.11% Utility 6.41% Health Care 5.61% Energy 5.16% Communication Services 4.47% Technology 4.11% Consumer Defensive 3.88% Real Estate 3% Asset Allocation

Asset Class Value Cash 4.46% Equity 95.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT7% ₹35 Cr 97,169

↑ 21,367 NTPC Ltd (Utilities)

Equity, Since 31 May 21 | 5325555% ₹26 Cr 773,906 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 24 | 5002954% ₹22 Cr 487,680

↑ 10,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE3% ₹18 Cr 150,806 Manorama Industries Ltd (Consumer Defensive)

Equity, Since 31 May 24 | 5419743% ₹15 Cr 137,935 Swan Energy Ltd (Industrials)

Equity, Since 31 Dec 23 | SWANENERGY2% ₹13 Cr 178,821

↑ 19,195 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Jan 24 | 5348162% ₹13 Cr 375,411 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS2% ₹12 Cr 84,903 Sterling and Wilson Renewable Energy Ltd (Technology)

Equity, Since 31 Mar 24 | SWSOLAR2% ₹11 Cr 244,992 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 22 | BHARTIARTL2% ₹11 Cr 70,260

↑ 42,631 7. IDFC Infrastructure Fund

CAGR/Annualized return of 11.7% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (07 Feb 25) ₹46.519 ↓ -0.15 (-0.32 %) Net Assets (Cr) ₹1,791 on 31 Dec 24 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 1.59 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,449 31 Jan 22 ₹16,786 31 Jan 23 ₹16,915 31 Jan 24 ₹28,172 31 Jan 25 ₹32,572 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -10% 3 Month -12.3% 6 Month -15.8% 1 Year 12.5% 3 Year 23.7% 5 Year 26.4% 10 Year 15 Year Since launch 11.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 39.3% 2022 50.3% 2021 1.7% 2020 64.8% 2019 6.3% 2018 -5.3% 2017 -25.9% 2016 58.7% 2015 10.7% 2014 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.02 Yr. Ritika Behera 7 Oct 23 1.32 Yr. Gaurav Satra 7 Jun 24 0.65 Yr. Data below for IDFC Infrastructure Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 58.01% Utility 12.35% Basic Materials 8.64% Technology 4.18% Communication Services 3.82% Financial Services 3.21% Energy 3.07% Consumer Cyclical 2.58% Health Care 1.77% Asset Allocation

Asset Class Value Cash 2.38% Equity 97.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹92 Cr 443,385 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA4% ₹68 Cr 4,797,143 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT3% ₹62 Cr 171,447 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹57 Cr 475,362 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE3% ₹55 Cr 452,706 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325383% ₹54 Cr 46,976 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹54 Cr 434,979 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹53 Cr 12,400,122 H.G. Infra Engineering Ltd Ordinary Shares (Industrials)

Equity, Since 28 Feb 18 | HGINFRA3% ₹49 Cr 321,984 Ahluwalia Contracts (India) Ltd (Industrials)

Equity, Since 30 Apr 15 | AHLUCONT3% ₹48 Cr 470,125 8. Nippon India Power and Infra Fund

CAGR/Annualized return of 18.1% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (07 Feb 25) ₹314.666 ↓ -0.26 (-0.08 %) Net Assets (Cr) ₹7,453 on 31 Dec 24 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio 1.21 Information Ratio 1.64 Alpha Ratio 8.9 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,728 31 Jan 22 ₹16,044 31 Jan 23 ₹17,651 31 Jan 24 ₹29,963 31 Jan 25 ₹33,188 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -8.4% 3 Month -11.2% 6 Month -14% 1 Year 5.8% 3 Year 26.6% 5 Year 26% 10 Year 15 Year Since launch 18.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% 2014 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.7 Yr. Rahul Modi 19 Aug 24 0.45 Yr. Data below for Nippon India Power and Infra Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 44.95% Utility 15.89% Basic Materials 10.1% Communication Services 7.08% Energy 6.43% Consumer Cyclical 3.98% Real Estate 3.78% Technology 2.94% Health Care 2.45% Financial Services 1.62% Asset Allocation

Asset Class Value Cash 0.77% Equity 99.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹612 Cr 1,697,001

↓ -302,999 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325556% ₹467 Cr 13,999,999

↑ 999,999 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE6% ₹431 Cr 3,550,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL6% ₹413 Cr 2,600,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES5% ₹365 Cr 492,204 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹309 Cr 270,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV3% ₹230 Cr 1,800,000 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹229 Cr 350,000 Cyient DLM Ltd (Technology)

Equity, Since 31 Jul 23 | CYIENTDLM3% ₹209 Cr 3,114,722 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 May 23 | 5329293% ₹199 Cr 1,600,000 9. DSP BlackRock Small Cap Fund

CAGR/Annualized return of 17.9% since its launch. Ranked 7 in Small Cap category. Return for 2024 was 25.6% , 2023 was 41.2% and 2022 was 0.5% . DSP BlackRock Small Cap Fund

Growth Launch Date 14 Jun 07 NAV (07 Feb 25) ₹181.667 ↓ -1.05 (-0.57 %) Net Assets (Cr) ₹16,634 on 31 Dec 24 Category Equity - Small Cap AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.86 Sharpe Ratio 1.09 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,249 31 Jan 22 ₹19,631 31 Jan 23 ₹19,487 31 Jan 24 ₹28,654 31 Jan 25 ₹31,355 Returns for DSP BlackRock Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -9.9% 3 Month -9.4% 6 Month -5.8% 1 Year 9.6% 3 Year 16.9% 5 Year 25.8% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.6% 2022 41.2% 2021 0.5% 2020 58.9% 2019 33.1% 2018 0.7% 2017 -25.5% 2016 42.8% 2015 12.7% 2014 20.4% Fund Manager information for DSP BlackRock Small Cap Fund

Name Since Tenure Vinit Sambre 21 Jun 10 14.63 Yr. Resham Jain 16 Mar 18 6.89 Yr. Data below for DSP BlackRock Small Cap Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Consumer Cyclical 32.19% Basic Materials 20% Industrials 17.18% Health Care 8.21% Consumer Defensive 7.69% Technology 3.87% Financial Services 3.79% Communication Services 0.92% Utility 0.17% Asset Allocation

Asset Class Value Cash 5.99% Equity 94.01% Top Securities Holdings / Portfolio

Name Holding Value Quantity Jubilant Ingrevia Ltd Ordinary Shares (Basic Materials)

Equity, Since 31 Dec 22 | JUBLINGREA4% ₹653 Cr 7,937,996 eClerx Services Ltd (Technology)

Equity, Since 28 Feb 18 | ECLERX3% ₹553 Cr 1,586,315

↓ -175,035 Welspun Corp Ltd (Basic Materials)

Equity, Since 31 Mar 21 | 5321443% ₹529 Cr 6,500,000 Dodla Dairy Ltd (Consumer Defensive)

Equity, Since 30 Jun 21 | 5433063% ₹463 Cr 3,638,348

↑ 17,379 Cyient Ltd (Industrials)

Equity, Since 30 Sep 21 | CYIENT3% ₹450 Cr 2,447,699

↑ 347,699 Suprajit Engineering Ltd (Consumer Cyclical)

Equity, Since 30 Jun 14 | SUPRAJIT3% ₹425 Cr 9,260,495 Safari Industries (India) Ltd (Consumer Cyclical)

Equity, Since 31 Dec 21 | 5230253% ₹424 Cr 1,629,601 Triveni Engineering & Industries Ltd (Consumer Defensive)

Equity, Since 31 Aug 17 | 5323562% ₹414 Cr 9,143,737 LT Foods Ltd (Consumer Defensive)

Equity, Since 31 Dec 17 | 5327832% ₹402 Cr 9,587,705

↓ -35,413 Lumax Auto Technologies Ltd (Consumer Cyclical)

Equity, Since 30 Jun 18 | LUMAXTECH2% ₹397 Cr 6,150,000 10. Franklin India Smaller Companies Fund

CAGR/Annualized return of 15.8% since its launch. Ranked 11 in Small Cap category. Return for 2024 was 23.2% , 2023 was 52.1% and 2022 was 3.6% . Franklin India Smaller Companies Fund

Growth Launch Date 13 Jan 06 NAV (07 Feb 25) ₹164.163 ↓ -1.32 (-0.80 %) Net Assets (Cr) ₹14,069 on 31 Dec 24 Category Equity - Small Cap AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio 1.06 Information Ratio 0.3 Alpha Ratio 0.36 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹11,477 31 Jan 22 ₹17,479 31 Jan 23 ₹18,112 31 Jan 24 ₹28,927 31 Jan 25 ₹31,406 Returns for Franklin India Smaller Companies Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -8% 3 Month -8.7% 6 Month -8.8% 1 Year 8.4% 3 Year 21.2% 5 Year 25.8% 10 Year 15 Year Since launch 15.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.2% 2022 52.1% 2021 3.6% 2020 56.4% 2019 18.7% 2018 -5% 2017 -17.4% 2016 43.5% 2015 10.2% 2014 9.6% Fund Manager information for Franklin India Smaller Companies Fund

Name Since Tenure R. Janakiraman 1 Feb 11 14.01 Yr. Sandeep Manam 18 Oct 21 3.29 Yr. Akhil Kalluri 8 Sep 22 2.4 Yr. Data below for Franklin India Smaller Companies Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 23.01% Financial Services 17.87% Consumer Cyclical 14.69% Health Care 10.46% Basic Materials 9.44% Technology 5.59% Real Estate 4.84% Consumer Defensive 3.45% Utility 2.52% Energy 0.77% Communication Services 0.16% Asset Allocation

Asset Class Value Cash 5.72% Equity 94.14% Top Securities Holdings / Portfolio

Name Holding Value Quantity Brigade Enterprises Ltd (Real Estate)

Equity, Since 30 Jun 14 | 5329293% ₹481 Cr 3,868,691 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 23 | ASTERDM3% ₹436 Cr 8,473,781 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 May 22 | KALYANKJIL3% ₹380 Cr 4,963,469 Deepak Nitrite Ltd (Basic Materials)

Equity, Since 31 Jan 16 | DEEPAKNTR2% ₹346 Cr 1,387,967 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | 5900032% ₹334 Cr 15,398,917 360 One Wam Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Jun 23 | 360ONE2% ₹308 Cr 2,452,684 Equitas Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 20 | EQUITASBNK2% ₹308 Cr 48,064,081 Crompton Greaves Consumer Electricals Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | CROMPTON2% ₹273 Cr 6,900,000 J.B. Chemicals & Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 14 | JBCHEPHARM2% ₹267 Cr 1,448,723 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 30 Sep 19 | ERIS2% ₹256 Cr 1,866,828 11. Franklin India Opportunities Fund

CAGR/Annualized return of 13.5% since its launch. Ranked 47 in Sectoral category. Return for 2024 was 37.3% , 2023 was 53.6% and 2022 was -1.9% . Franklin India Opportunities Fund

Growth Launch Date 21 Feb 00 NAV (07 Feb 25) ₹237.796 ↓ -0.53 (-0.22 %) Net Assets (Cr) ₹6,120 on 31 Dec 24 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.12 Sharpe Ratio 1.98 Information Ratio 1.47 Alpha Ratio 17.76 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,591 31 Jan 22 ₹15,887 31 Jan 23 ₹15,681 31 Jan 24 ₹26,031 31 Jan 25 ₹31,795 Returns for Franklin India Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -5.2% 3 Month -4.9% 6 Month -3.2% 1 Year 22.1% 3 Year 26.8% 5 Year 25.8% 10 Year 15 Year Since launch 13.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 37.3% 2022 53.6% 2021 -1.9% 2020 29.7% 2019 27.3% 2018 5.4% 2017 -10.1% 2016 35.6% 2015 4.2% 2014 2.3% Fund Manager information for Franklin India Opportunities Fund

Name Since Tenure Kiran Sebastian 7 Feb 22 2.99 Yr. R. Janakiraman 1 Apr 13 11.85 Yr. Sandeep Manam 18 Oct 21 3.29 Yr. Data below for Franklin India Opportunities Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Consumer Cyclical 19.42% Health Care 13.81% Financial Services 11.43% Industrials 10.29% Communication Services 10.06% Technology 7.7% Basic Materials 5.08% Consumer Defensive 3.31% Real Estate 2.83% Energy 2.22% Utility 1.96% Asset Allocation

Asset Class Value Cash 10.36% Equity 89.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL3% ₹213 Cr 1,342,233 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹211 Cr 7,590,491 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 24 | M&M3% ₹192 Cr 637,966 HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 24 | HDFCBANK3% ₹188 Cr 1,058,931

↓ -500,163 Info Edge (India) Ltd (Communication Services)

Equity, Since 31 Jul 24 | NAUKRI3% ₹188 Cr 216,138 PB Fintech Ltd (Financial Services)

Equity, Since 30 Nov 21 | 5433903% ₹176 Cr 833,638 Lemon Tree Hotels Ltd (Consumer Cyclical)

Equity, Since 31 Aug 24 | LEMONTREE3% ₹168 Cr 10,951,216 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Aug 23 | ASTERDM3% ₹157 Cr 3,049,105 APL Apollo Tubes Ltd (Basic Materials)

Equity, Since 31 Oct 24 | APLAPOLLO3% ₹154 Cr 981,985

↑ 448,634 Sudarshan Chemical Industries Ltd (Basic Materials)

Equity, Since 30 Apr 24 | SUDARSCHEM2% ₹149 Cr 1,303,298

നിക്ഷേപകർ അവർക്കിഷ്ടമുള്ള SIP പ്ലാനുകളിൽ നിക്ഷേപിക്കാൻ നിർദ്ദേശിക്കുന്നു. മുകളിൽ സൂചിപ്പിച്ച മികച്ച 11 മ്യൂച്വൽ ഫണ്ടുകൾ എല്ലാ തരത്തിലുമുള്ള നിക്ഷേപകർക്ക് അനുയോജ്യമാണ്. അതിനാൽ, ഒന്നുകിൽ നിങ്ങൾ ഉയർന്ന അപകടസാധ്യതയുള്ള ആളാണ്നിക്ഷേപകൻ അല്ലെങ്കിൽ താരതമ്യേന താഴ്ന്നത്, ഈ SIP ഫണ്ടുകളാണ്നിക്ഷേപിക്കാൻ മികച്ച മ്യൂച്വൽ ഫണ്ടുകൾ. അതിനാൽ, കാത്തിരിക്കരുത്, ഇപ്പോൾ നിക്ഷേപിക്കുക!

ഇവിടെ നൽകിയിരിക്കുന്ന വിവരങ്ങൾ കൃത്യമാണെന്ന് ഉറപ്പാക്കാൻ എല്ലാ ശ്രമങ്ങളും നടത്തിയിട്ടുണ്ട്. എന്നിരുന്നാലും, ഡാറ്റയുടെ കൃത്യത സംബന്ധിച്ച് യാതൊരു ഉറപ്പും നൽകുന്നില്ല. എന്തെങ്കിലും നിക്ഷേപം നടത്തുന്നതിന് മുമ്പ് സ്കീം വിവര രേഖ ഉപയോഗിച്ച് പരിശോധിക്കുക.