Table of Contents

What is Asset Management?

Generally, asset management is known as a systematic approach executed by a financial service institute, whether an individual or an investment Bank. The approach is directed toward handling either a part or an entire Portfolio of the client.

The process might be applied to both intangible and tangible assets, such as buildings, intellectual property, equipment, Financial Assets and more. Basically, the primary aim of asset management is to develop, operate, maintain, upgrade and dispose of assets in a cost-effective manner.

Explaining Asset Management

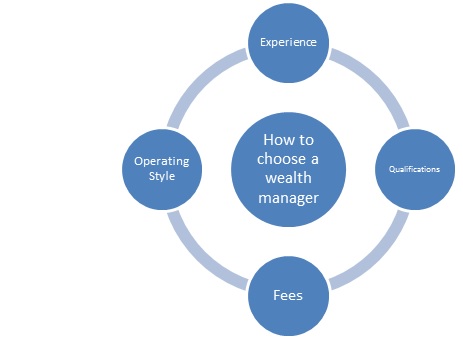

Essentially, this process has a double command that includes appreciating the assets of a client over a period of time while simultaneously mitigating all of the risks. However, with asset management, investment minimums come into the picture.

This means that this service is typically available only for high net-worth financial intermediaries, corporations, government entities and individuals. The role of an asset manager comprises figuring out the investments to avoid or make so as to grow the client’s portfolio.

By using both micro and macro analytical tools, the manager has to conduct rigorous research to find out:

- Existing Market trends

- Interviews with the officials of the company

- Strategies to achieve the said goal of client asset appreciation

Most commonly, advisors invest in multiple products at a time, such as Mutual Funds, commodities, Real Estate, fixed Income, equity and other alternative investments. Moreover, accounts that financial institutes hold generally include:

- Brokerage services

- Margin loans

- debit cards

- credit cards

- Cheque writing privileges

When somebody deposits money into an account, it is generally placed into a money market fund that provides a higher return. One of the additional advantages that account holders get to avail is that their extra Investing and banking needs get serviced by a similar institution instead of having different banking options and brokerage accounts.

Talk to our investment specialist

Types of Asset Management

There are different types of asset management. Some of the major ones are jotted down below:

* Financial Asset Management

The most common type is financial management, also known as investment management. This concept is applied to such part of the financial Industry that manages segregated client accounts and investment funds. From analysing the assets of the clients to planning and tracking the investment, everything is covered under this type.

* Physical and Infrastructure Asset Management

This one is a combination of engineering, economic, financial, management and other practices that are applied to physical assets. The objective behind this management type is to offer the best value services against the involved cost.

It comprises regulating the complete cycle, such as designing, construction, commissioning, operation, maintenance, repairing, modification, replacement and decommissioning or disposal.

* Enterprise Asset Management

The systems of Enterprise Asset Management (EAM) support the management of assets within an organization. This approach includes an asset registry (asset inventory and their attributes) along with a Computerized Maintenance Management System (CMMS) and additional modules, like materials management or inventory management.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like