Table of Contents

What is an Asset Management Company (AMC)?

An Asset Management Company (AMC) is such a firm that invests collective funds received from clients by putting this Capital to work via varying investments, such as master limited partnerships, Real Estate, Bonds, stocks and more.

Such a company manages high-net-worth portfolios, pension plans, hedge fund and more to serve small investors and create pooled structures, like exchange-traded funds, Index Funds, and Mutual Funds. Colloquially, AMC is referred to as money management firms. The ones that provide Exchange-Traded Funds (ETFs) or public mutual funds are also known as a mutual fund or investment companies.

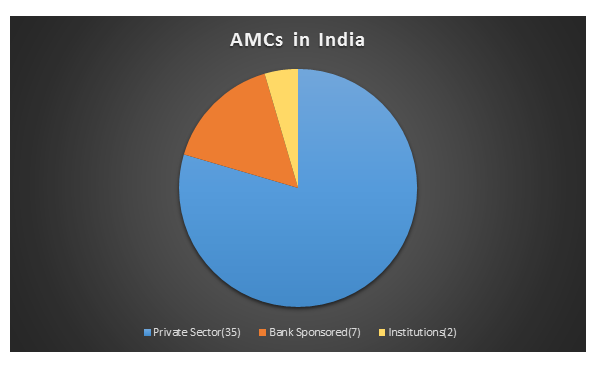

Types of Asset Management Companies

Asset Management Companies are available in different structures and forms, like:

- Hedge funds

- Private Equity Funds

- Mutual funds

- Exchange-traded funds

- Index funds

- Other funds

Along with that, they even invest on behalf of different types of clients, like:

- Retail investors

- High-net-worth clients

- Institutional investors

- Private sector

- Public sector (government organizations)

Talk to our investment specialist

How an Asset Management Company Works?

When Investing in an AMC, you are basically investing in a fund that the AMC manages. The returns here are Market-linked, thus, based on the fund’s performance. In such a scenario, a fund that is managed well has better potential to provide high returns.

In return, the fund charges a small fee, known as the fund Management Fee. For AMC, it is the primary source to generate revenue. When choosing a fund to invest in, the market reputation of the AMC plays a vital role. So, to establish credibility, an AMC follows this below-mentioned process.

Allocation of Asset

To maintain the trust of investors, an AMC has to carefully invest the money in various instruments. This asset distribution amongst equity and debt depends upon the conditions of the market and the potential interest rate. Here, the professional experience and expertise of the fund manager play an important role in allocating resources.

Creating an Investment Portfolio

For an AMC, the decision to construct an investment Portfolio is the most important one. It comprises a comprehensive amount of analysis and research to create a portfolio that adjusts the risk and doesn’t Underperform during times of the turbulent market.

Performance Assessment

Finally, irrespective of how old or trusted, an AMC is always liable to answer trustees and investors for its investment decisions. For this, frequent evaluation of fund performance is done by taking the Asset Allocation, NAV value, fund returns and more such factors in mind.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.