+91-22-48913909

+91-22-48913909

Table of Contents

6 सर्वोत्तम मासिक उत्पन्न योजना (MIP) 2022

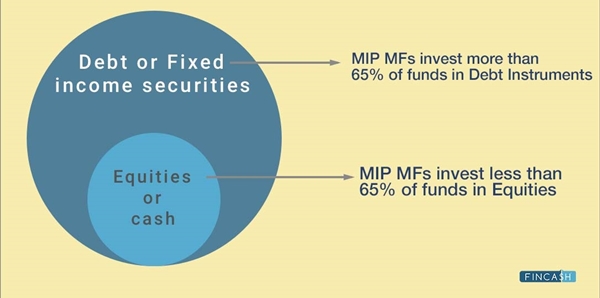

दमासिक उत्पन्न योजना हा एक ओपन-एंडेड म्युच्युअल फंड आहे जो प्रामुख्याने त्याच्या मालमत्तेमध्ये स्थिर गुंतवणूक करतोउत्पन्न साधने सामान्यतः, मासिक उत्पन्न योजना ही कर्ज आणि इक्विटी मालमत्तांचे संयोजन असते, ज्यामध्ये 65% अधिक मालमत्ता गुंतविली जातात.निश्चित उत्पन्न उत्पन्न देणारी साधने. तथापि, मासिक उत्पन्न योजनेची उर्वरित मालमत्ता इक्विटी-लिंक्ड साधनांमध्ये गुंतविली जाते, जसे की शेअर्स आणि स्टॉक, जे प्रदान करतातबाजार- लिंक्ड रिटर्न.

मासिक उत्पन्न योजनेचा मूळ उद्देश लोकांना नियमित उत्पन्न मिळवून देणे हा आहे. तसेच, एमआयपी म्युच्युअल फंड मासिक तसेच त्रैमासिक उत्पन्नाचा पर्याय देते, जे लोक त्यांच्या सोयीनुसार निवडू शकतात.

तुम्हाला मासिक उत्पन्न योजनेत गुंतवणूक करायची असल्यास, विविध म्युच्युअल फंड कंपन्यांनी ऑफर केलेल्या सर्वोत्तम मासिक उत्पन्न योजनेची यादी विचारात घेण्याचा सल्ला दिला जातो.

मासिक उत्पन्न योजनेत (MIP) कोणी गुंतवणूक करावी?

कोणताही मध्यम जोखीम-प्रतिरोधकगुंतवणूकदार जो निश्चित उत्पन्नासह इक्विटी मार्केटमध्ये काही एक्स्पोजर शोधत आहे ते मासिक उत्पन्न योजनेत गुंतवणूक करू शकतात. निश्चित उत्पन्न देण्याव्यतिरिक्त, मासिक उत्पन्न योजना मार्केट लिंक्ड रिटर्न ऑफर करते. शिवाय, मासिक उत्पन्न योजना ज्येष्ठ नागरिकांसाठीही योग्य आहे, जे जवळ आहेतसेवानिवृत्ती.

म्हणून, जर तुम्ही मासिक उत्पन्न शोधत असाल, तर आताच सर्वोत्तम मासिक उत्पन्न योजनेत गुंतवणूक करा!

भारतातील 6 सर्वोत्तम कामगिरी करणारे मासिक उत्पन्न म्युच्युअल फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Since launch (%) ICICI Prudential MIP 25 Growth ₹73.9204

↑ 0.03 ₹3,127 2.8 3.1 9.9 9.9 10.9 11.4 10 DSP BlackRock Regular Savings Fund Growth ₹58.0448

↑ 0.05 ₹164 4.1 4.2 11.7 9.7 10.5 11 8.8 Baroda Pioneer Conservative Hybrid Fund Growth ₹30.2092

↑ 0.02 ₹33 -1.7 -1.2 3.3 9.1 7.8 6.5 Aditya Birla Sun Life Regular Savings Fund Growth ₹65.4872

↑ 0.10 ₹1,377 3.6 3.2 10.9 8.6 12.3 10.5 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 25

The Scheme seeks to generate regular income through investments primarily in debt and money market instruments. As a secondary objective, the Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the Scheme. However, there can be no assurance that the investment objectives of the Scheme will be realized. ICICI Prudential MIP 25 is a Hybrid - Hybrid Debt fund was launched on 30 Mar 04. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential MIP 25 Returns up to 1 year are on (Erstwhile DSP BlackRock MIP Fund) The scheme is seeking to generate an attractive return, consistent with prudent risk, from a portfolio which is substantially constituted of quality debt securities. The scheme will also seek to generate capital appreciation by investing a smaller portion of its corpus in equity and equity related securities of the 100 largest corporates by market capitalisation, listed in India. DSP BlackRock Regular Savings Fund is a Hybrid - Hybrid Debt fund was launched on 11 Jun 04. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Regular Savings Fund Returns up to 1 year are on (Erstwhile Baroda Pioneer MIP Fund) To generate regular income through investment in debt and money market instruments and also to generate long term capital appreciation by investing a portion in equity and equity related instruments. Baroda Pioneer Conservative Hybrid Fund is a Hybrid - Hybrid Debt fund was launched on 8 Sep 04. It is a fund with Moderate risk and has given a Below is the key information for Baroda Pioneer Conservative Hybrid Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life MIP II - Wealth 25 Plan) An Open-ended income scheme with the objective to generate regular income so as to make monthly payment or distribution to unit holders with the secondary objective being growth of capital. Monthly Income is not assured and is subject to availability of distributable surplus. Aditya Birla Sun Life Regular Savings Fund is a Hybrid - Hybrid Debt fund was launched on 22 May 04. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Regular Savings Fund Returns up to 1 year are on 1. ICICI Prudential MIP 25

CAGR/Annualized return of 10% since its launch. Ranked 2 in Hybrid Debt category. Return for 2024 was 11.4% , 2023 was 11.4% and 2022 was 5.1% . ICICI Prudential MIP 25

Growth Launch Date 30 Mar 04 NAV (22 Apr 25) ₹73.9204 ↑ 0.03 (0.04 %) Net Assets (Cr) ₹3,127 on 31 Mar 25 Category Hybrid - Hybrid Debt AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.74 Sharpe Ratio 0.48 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹11,737 31 Mar 22 ₹12,839 31 Mar 23 ₹13,399 31 Mar 24 ₹15,374 31 Mar 25 ₹16,728 Returns for ICICI Prudential MIP 25

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 1.8% 3 Month 2.8% 6 Month 3.1% 1 Year 9.9% 3 Year 9.9% 5 Year 10.9% 10 Year 15 Year Since launch 10% Historical performance (Yearly) on absolute basis

Year Returns 2023 11.4% 2022 11.4% 2021 5.1% 2020 9.9% 2019 10.9% 2018 9.6% 2017 5.1% 2016 12.9% 2015 10.9% 2014 6.4% Fund Manager information for ICICI Prudential MIP 25

Name Since Tenure Manish Banthia 19 Sep 13 11.45 Yr. Akhil Kakkar 22 Jan 24 1.11 Yr. Roshan Chutkey 2 May 22 2.83 Yr. Sharmila D’mello 31 Jul 22 2.59 Yr. Data below for ICICI Prudential MIP 25 as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 8.32% Equity 22.06% Debt 69.31% Other 0.3% Equity Sector Allocation

Sector Value Financial Services 6.39% Consumer Cyclical 3.53% Health Care 3.32% Basic Materials 2.53% Consumer Defensive 1.79% Communication Services 1.57% Utility 0.88% Energy 0.75% Industrials 0.74% Technology 0.53% Debt Sector Allocation

Sector Value Corporate 45.9% Government 22.68% Cash Equivalent 7.56% Securitized 1.5% Credit Quality

Rating Value A 8.38% AA 38.71% AAA 52.9% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.18% Govt Stock 2033

Sovereign Bonds | -9% ₹265 Cr 25,815,500 7.53% Govt Stock 2034

Sovereign Bonds | -5% ₹167 Cr 16,574,750 State Bank Of India

Debentures | -3% ₹98 Cr 1,000 7.38% Govt Stock 2027

Sovereign Bonds | -3% ₹92 Cr 9,000,000 L&T Metro Rail (Hyderabad) Limited

Debentures | -3% ₹79 Cr 800 360 One Prime Limited

Debentures | -2% ₹75 Cr 7,500 Small Industries Development Bank of India

Debentures | -2% ₹70 Cr 1,500

↑ 1,500 Yes Bank Limited

Debentures | -2% ₹64 Cr 650 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 19 | ICICIBANK2% ₹61 Cr 489,871 7.26% Govt Stock 2033

Sovereign Bonds | -2% ₹55 Cr 5,297,450 2. DSP BlackRock Regular Savings Fund

CAGR/Annualized return of 8.8% since its launch. Ranked 22 in Hybrid Debt category. Return for 2024 was 11% , 2023 was 12% and 2022 was 3.5% . DSP BlackRock Regular Savings Fund

Growth Launch Date 11 Jun 04 NAV (22 Apr 25) ₹58.0448 ↑ 0.05 (0.09 %) Net Assets (Cr) ₹164 on 31 Mar 25 Category Hybrid - Hybrid Debt AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 1.14 Sharpe Ratio 0.84 Information Ratio 0.59 Alpha Ratio 1.81 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹11,955 31 Mar 22 ₹12,825 31 Mar 23 ₹13,152 31 Mar 24 ₹14,990 31 Mar 25 ₹16,604 Returns for DSP BlackRock Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 1.7% 3 Month 4.1% 6 Month 4.2% 1 Year 11.7% 3 Year 9.7% 5 Year 10.5% 10 Year 15 Year Since launch 8.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 11% 2022 12% 2021 3.5% 2020 7.8% 2019 9.3% 2018 6.9% 2017 -5.3% 2016 11% 2015 10.7% 2014 4.8% Fund Manager information for DSP BlackRock Regular Savings Fund

Name Since Tenure Abhishek Singh 31 May 21 3.84 Yr. Shantanu Godambe 1 Aug 24 0.66 Yr. Data below for DSP BlackRock Regular Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 21.39% Equity 22.72% Debt 54.61% Other 1.28% Equity Sector Allocation

Sector Value Financial Services 10.7% Consumer Cyclical 3.02% Health Care 2.54% Utility 1.44% Consumer Defensive 1.15% Basic Materials 0.92% Energy 0.85% Technology 0.77% Industrials 0.76% Communication Services 0.57% Debt Sector Allocation

Sector Value Government 49.83% Cash Equivalent 21.39% Corporate 4.78% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.32% Govt Stock 2030

Sovereign Bonds | -13% ₹21 Cr 2,000,000 7.1% Govt Stock 2029

Sovereign Bonds | -6% ₹10 Cr 1,000,000 7.06% Govt Stock 2028

Sovereign Bonds | -6% ₹10 Cr 1,000,000 Power Grid Corporation Of India Limited

Debentures | -6% ₹10 Cr 100 Rural Electrification Corporation Limited

Debentures | -6% ₹10 Cr 100 Power Finance Corporation Limited

Debentures | -5% ₹8 Cr 250 7.1% Govt Stock 2034

Sovereign Bonds | -3% ₹5 Cr 500,000 7.37% Govt Stock 2028

Sovereign Bonds | -3% ₹5 Cr 500,000 7.02% Govt Stock 2031

Sovereign Bonds | -3% ₹5 Cr 500,000 5.74% Govt Stock 2026

Sovereign Bonds | -3% ₹5 Cr 500,000 3. Baroda Pioneer Conservative Hybrid Fund

CAGR/Annualized return of 6.5% since its launch. Ranked 44 in Hybrid Debt category. . Baroda Pioneer Conservative Hybrid Fund

Growth Launch Date 8 Sep 04 NAV (11 Mar 22) ₹30.2092 ↑ 0.02 (0.06 %) Net Assets (Cr) ₹33 on 31 Jan 22 Category Hybrid - Hybrid Debt AMC Baroda Pioneer Asset Management Co. Ltd. Rating ☆☆ Risk Moderate Expense Ratio 2.08 Sharpe Ratio 0.85 Information Ratio -0.38 Alpha Ratio 0.25 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹11,222 Returns for Baroda Pioneer Conservative Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month -1.1% 3 Month -1.7% 6 Month -1.2% 1 Year 3.3% 3 Year 9.1% 5 Year 7.8% 10 Year 15 Year Since launch 6.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Baroda Pioneer Conservative Hybrid Fund

Name Since Tenure Data below for Baroda Pioneer Conservative Hybrid Fund as on 31 Jan 22

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 4. Aditya Birla Sun Life Regular Savings Fund

CAGR/Annualized return of 9.4% since its launch. Ranked 4 in Hybrid Debt category. Return for 2024 was 10.5% , 2023 was 9.6% and 2022 was 5.3% . Aditya Birla Sun Life Regular Savings Fund

Growth Launch Date 22 May 04 NAV (22 Apr 25) ₹65.4872 ↑ 0.10 (0.16 %) Net Assets (Cr) ₹1,377 on 31 Mar 25 Category Hybrid - Hybrid Debt AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.89 Sharpe Ratio 0.67 Information Ratio -0.12 Alpha Ratio 0.91 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹12,856 31 Mar 22 ₹14,310 31 Mar 23 ₹14,672 31 Mar 24 ₹16,387 31 Mar 25 ₹17,944 Returns for Aditya Birla Sun Life Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 2.4% 3 Month 3.6% 6 Month 3.2% 1 Year 10.9% 3 Year 8.6% 5 Year 12.3% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.5% 2022 9.6% 2021 5.3% 2020 13.4% 2019 9.2% 2018 5.8% 2017 -2.2% 2016 15.5% 2015 13.1% 2014 5.4% Fund Manager information for Aditya Birla Sun Life Regular Savings Fund

Name Since Tenure Mohit Sharma 31 Oct 24 0.33 Yr. Harshil Suvarnkar 22 Mar 21 3.95 Yr. Data below for Aditya Birla Sun Life Regular Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 2.87% Equity 23.86% Debt 72.93% Other 0.34% Equity Sector Allocation

Sector Value Financial Services 8.15% Technology 3.07% Energy 2.02% Basic Materials 1.93% Industrials 1.81% Consumer Cyclical 1.69% Health Care 1.61% Real Estate 1.27% Communication Services 1.07% Consumer Defensive 0.92% Utility 0.32% Debt Sector Allocation

Sector Value Corporate 44.02% Government 28.91% Cash Equivalent 2.87% Credit Quality

Rating Value AA 15.13% AAA 84.87% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cholamandalam Investment And Fin. Co. Ltd

Debentures | -4% ₹60 Cr 6,000 07.49 Tn SDL 2034

Sovereign Bonds | -2% ₹31 Cr 3,000,000 Bajaj Housing Finance Limited

Debentures | -2% ₹30 Cr 300 LIC Housing Finance Limited

Debentures | -2% ₹30 Cr 3,000 Nuvama Wealth Finance Ltd

Debentures | -2% ₹30 Cr 3,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK2% ₹29 Cr 232,335 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 17 | HDFCBANK2% ₹29 Cr 169,353 Rural Electrification Corporation Limited

Debentures | -2% ₹26 Cr 250 Bharti Telecom Limited

Debentures | -2% ₹25 Cr 2,500 Tata Capital Housing Finance Limited

Debentures | -2% ₹25 Cr 2,500

एमआयपी म्युच्युअल फंड योजनेतील जोखीम

आधीगुंतवणूक वर नमूद केलेल्या कोणत्याही सर्वोत्तम मासिक उत्पन्न योजनेमध्ये, तुम्हाला मासिक उत्पन्न योजनेचे धोके माहित असणे आवश्यक आहे.

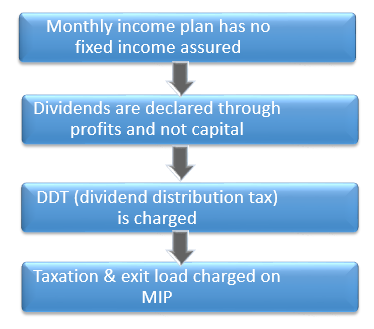

निश्चित आश्वासन नाही

असा सामान्य समज आहे की मासिक उत्पन्न योजना मासिक निश्चित उत्पन्न प्रदान करते. परंतु, अशा म्युच्युअल फंडांमध्ये खात्रीशीर परताव्याची हमी नसते. कारण या योजनेतही गुंतवणूक होतेइक्विटी, परतावा फंडाच्या कामगिरीवर आणि बाजाराच्या स्थितीवर अवलंबून असतो.

Talk to our investment specialist

लाभांश भांडवलाद्वारे नव्हे तर नफ्याद्वारे घोषित केला जातो

मासिक उत्पन्न योजनेसाठी लाभांश केवळ अतिरिक्त उत्पन्नातूनच दिला जाऊ शकतो आणि त्यातून नाहीभांडवल गुंतवणूक उदाहरणार्थ, जर निव्वळ मालमत्ता मूल्य (नाही) पासून निधी वाढतोINR 10 ते INR 13, योजना केवळ भांडवली वाढीमध्ये कमावलेल्या INR 3 पैकी घोषित करू शकते. त्यामुळे, जर या योजनेचा एनएव्ही हळूहळू वाढला किंवा बाजारातील हालचालींमुळे घसरला, तर तो लाभांश जाहीर करू शकत नाही.

डीडीटी आकारला जातो

तुम्ही लाभांश पर्यायासह MIP ची निवड केल्यास, तुम्ही वेळोवेळी लाभांशाच्या रूपात कमावलेल्या उत्पन्नावर लाभांश वितरण कर (DDT) आकारला जातो. त्यामुळे, परतावा पूर्णपणे करमुक्त नाही.

MIP वर कर आकारणी आणि एक्झिट लोड

ठराविक मासिक उत्पन्न योजनांचा लॉक-इन कालावधी तीन वर्षांपेक्षा जास्त असतो, त्यामुळे जर योजना मुदतपूर्तीच्या आधी विकली गेली तर एक विशिष्ट निर्गमन भार लागू होतो. तसेच, एमआयपी त्यांच्या बहुतेक मालमत्तेची गुंतवणूक कर्ज साधनांमध्ये करतात, त्यामुळे कर्ज गुंतवणुकीनुसार त्यांच्यावर कर आकारला जातो.

मासिक उत्पन्न योजनांमध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

You clarified nicely that MIP is not about regular monthly income as its returns works like regular mutual fund schemes. But is this MIP having risk with the capital too. Do we lose capital in case market performance is poor ie same as MFs

Best information is given for investment

Please advise for investment regards

Excellent understand ing