विवाह नियोजन कॅल्क्युलेटर

विवाह हा जीवनातील सर्वात प्रलंबीत घटनांपैकी एक आहे आणि प्रत्येक पालक ज्याची आतुरतेने वाट पाहत असतो. तथापि, विवाह दिवसेंदिवस भव्य होत आहेत आणि वाढत्या प्रमाणातमहागाई, तुम्ही करू शकताजमीन जर तुम्ही तुमच्या खर्चाची पूर्व-नियोजन करत नसाल तर एका घट्ट जागेवर. म्हणून, लग्न नियोजन कॅल्क्युलेटर तुम्हाला मोठ्या दिवसासाठी तुमच्या पैशाची योजना आणि गुंतवणूक करण्यात मदत करते.

वेडिंग प्लॅनिंग कॅल्क्युलेटर म्हणजे काय?

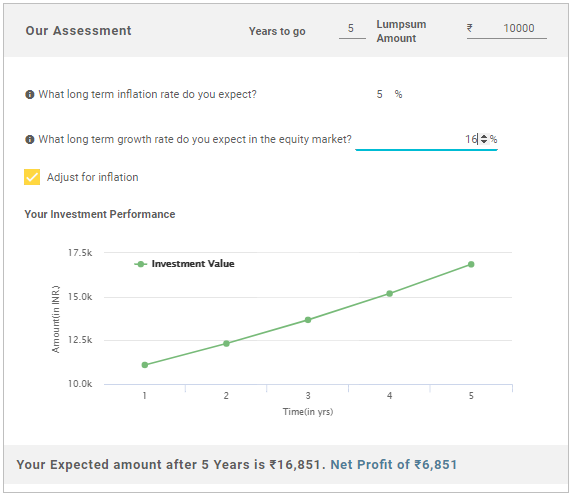

कॅल्क्युलेटर तुम्हाला लग्नासाठी तुमच्या गुंतवणुकीतून किती परतावा अपेक्षित आहे याचा अंदाज देतो.

Know Your Monthly SIP Amount

कॅल्क्युलेटर कसे कार्य करते?

कॅल्क्युलेटरचे कार्य अगदी सोपे आहे. तुम्हाला फक्त तुमच्या मुलाचे वय, त्याचे लग्नाचे अंदाजे वय, तुम्हाला लग्नासाठी लागणारी रक्कम आणि व्याजदर यांचा तपशील प्रविष्ट करायचा आहे. कॅल्क्युलेटर एंटर केलेल्या मूल्यांच्या आधारे त्वरीत परिणाम तयार करेल आणि तुम्हाला ध्येय गाठण्यासाठी मासिक किती बचत करायची आहे याची कल्पना येईल.

मॅरेज कॅल्क्युलेटरचे फायदे

- मोजणी मिनिटांत विनामूल्य ऑनलाइन करता येते

- कॅल्क्युलेटर तुमच्या आर्थिक स्थितीवर परिणाम करू शकणार्या सर्व घटकांचा विचार करतो आणि वास्तववादी अंदाज देतो

- व्युत्पन्न केलेल्या परिणामांवर आधारित तुम्ही सर्वात योग्य गुंतवणूक निवडू शकता

टीप/ अस्वीकरण: 6% महागाई दर गृहीत धरून गणना तयार केली जाते आणि मूल्ये उदाहरणात्मक आहेत. वास्तविक खर्च तुमच्या गुंतवणुकीच्या भविष्यातील कामगिरीवर अवलंबून असेल आणि त्याच्या अधीन असेलबाजार परिस्थिती

Talk to our investment specialist

तुम्ही तुमच्या मुलाच्या लग्नाची आधीच योजना का करावी?

- आगाऊ नियोजन मदत करतेहाताळा लग्नाशी संबंधित छुपे खर्च

- वेळेवर गुंतवणुकीमुळे वाढत्या महागाई दरांच्या प्रभावाचा सामना करण्यास मदत होते

- लवकरगुंतवणूक तुमचे आर्थिक जीवन शिस्तबद्ध राहील

- तुम्हाला तुमचा त्रास होणार नाहीसेवानिवृत्ती अतिरिक्त पैसे आवश्यक असल्यास निधी

- दरमहा एक निश्चित रक्कम ठेवून स्थिर निधी तयार केल्याने आर्थिक ताण कमी होण्यास मदत होईल

2022 साठी शीर्ष निधी

*सर्वोत्तम निधी ३ वर्षांच्या कामगिरीवर आधारित.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (10 Dec 25) ₹49.6734 ↑ 0.69 (1.41 %) Net Assets (Cr) ₹1,498 on 31 Oct 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 1.83 Information Ratio -1.04 Alpha Ratio -4.16 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month 11.2% 3 Month 24% 6 Month 62.3% 1 Year 127.2% 3 Year 45.5% 5 Year 21.1% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.9% 2023 7% 2022 -7.7% 2021 -9% 2020 31.4% 2019 35.1% 2018 -10.7% 2017 -4% 2016 52.7% 2015 -18.5% Fund Manager information for DSP World Gold Fund

Name Since Tenure Data below for DSP World Gold Fund as on 31 Oct 25

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (11 Dec 25) ₹63.63 ↓ -0.05 (-0.08 %) Net Assets (Cr) ₹1,466 on 31 Oct 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.09 Information Ratio -0.6 Alpha Ratio -0.54 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month -4.8% 3 Month 2.5% 6 Month -2.6% 1 Year -2.2% 3 Year 26.1% 5 Year 26.5% 10 Year 15 Year Since launch 12.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 25.6% 2023 54.5% 2022 20.5% 2021 31.1% 2020 6.1% 2019 10.1% 2018 -16.9% 2017 24.3% 2016 17.9% 2015 2.5% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Data below for Invesco India PSU Equity Fund as on 31 Oct 25

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Research Highlights for DSP World Gold Fund