+91-22-48913909

+91-22-48913909

Table of Contents

- टॉप 11 SIP फंडांमध्ये गुंतवणूक का करावी?

- SIP मध्ये गुंतवणूक कशी करावी?

- भारतातील टॉप 11 SIP म्युच्युअल फंड FY 22 - 23

- सर्वोत्कृष्ट पद्धतशीर गुंतवणूक योजनांमध्ये गुंतवणूक करताना विचारात घ्यायचे पॅरामीटर्स

- SIP MF मध्ये ऑनलाइन गुंतवणूक कशी करावी?

- वारंवार विचारले जाणारे प्रश्न

Top 11 Funds

- ICICI Prudential Infrastructure Fund

- Nippon India Power and Infra Fund

- IDFC Infrastructure Fund

- L&T Emerging Businesses Fund

- HDFC Infrastructure Fund

- DSP BlackRock India T.I.G.E.R Fund

- Franklin Build India Fund

- Franklin India Smaller Companies Fund

- Kotak Small Cap Fund

- IDFC Sterling Value Fund

- ICICI Prudential Smallcap Fund

SIP 2022 साठी 11 सर्वोत्तम म्युच्युअल फंड

SIP म्युच्युअल फंड (किंवा शीर्ष 11 SIP म्युच्युअल फंड) हे असे फंड आहेत जे शेअर बाजारातील अपरिहार्य चढ-उतारांदरम्यान चिंताग्रस्त विक्री टाळण्यासाठी नियतकालिक गुंतवणुकीच्या साध्या सूत्राचे पालन करतात.

सामान्यतः, SIP किंवा पद्धतशीरगुंतवणूक योजना म्युच्युअल फंडात पैसे गुंतवण्याचा हा एक प्रकार आहे.गुंतवणूक शीर्ष 11 मध्ये SIP म्युच्युअल फंड तुमच्या गुंतवणुकीसाठी पद्धतशीर आणि शिस्तबद्ध दृष्टिकोन आणतात. यामुळे तुमची गुंतवणूक दररोज व्यवस्थापित करण्याचा तुमचा प्रयत्न कमी होतोआधार. शिवाय, ते लाभ देतेकंपाउंडिंगची शक्ती कालांतराने इच्छित परतावा मिळवून देतो.

वेगवेगळे आहेतम्युच्युअल फंडाचे प्रकार SIP साठी ज्यात इक्विटी, कर्ज, संतुलित, अल्ट्रा-अल्पकालीन निधी, इ. तथापि, इक्विटी म्युच्युअल फंड एसआयपीद्वारे गुंतवणूक केल्यावर जास्तीत जास्त परतावा देतात. आर्थिक सल्लागार सुचवतात की, गुंतवणूकदारांनी गुंतवणूक करावीसर्वोत्तम म्युच्युअल फंड एसआयपीसाठी त्यांची गुंतवणूक उद्दिष्टे आणि कालावधीएसआयपी गुंतवणूक.

टॉप 11 SIP फंडांमध्ये गुंतवणूक का करावी?

एसआयपी म्युच्युअल फंडातील गुंतवणुकीसाठी शिस्तबद्ध दृष्टिकोन देतात

पद्धतशीर गुंतवणुकीमुळे भविष्यातील स्वप्न आणि प्रमुख उद्दिष्टे पूर्ण करण्यात मदत होते- सेवानिवृत्ती, मुलाचे करिअर, घर, कार किंवा इतर कोणत्याही मालमत्तेची खरेदी

एसआयपी अधिकाधिक चक्रवाढ करण्यात मदत करतात आणि तरुण गुंतवणूकदारांसाठी आदर्श आहेत

पद्धतशीर गुंतवणूक योजना इक्विटी चढउतारांचा धोका कमी करतात

SIP मध्ये गुंतवणूक कशी करावी?

पैसे गुंतवणे ही एक कला आहे, ती योग्य प्रकारे केली तर आश्चर्यकारक काम करू शकते. आता तुम्हाला माहीत आहे कीशीर्ष SIP योजना तुम्हाला त्यामध्ये गुंतवणूक कशी करावी हे माहित असणे आवश्यक आहे. आम्ही खाली SIP मध्ये गुंतवणूक करण्याच्या पायऱ्या नमूद केल्या आहेत.

1. तुमच्या आर्थिक उद्दिष्टांचे विश्लेषण करा

तुमच्यासाठी अनुकूल असलेली SIP गुंतवणूक निवडाआर्थिक उद्दिष्टे. उदाहरणार्थ, तुमचे ध्येय अल्प-मुदतीचे असल्यास (पुढील 2 वर्षांत कार खरेदी करायची असल्यास), तुम्ही डेट म्युच्युअल फंडात गुंतवणूक करावी. आणि, तुमचे ध्येय दीर्घकालीन असल्यास (जसेनिवृत्ती नियोजन) नंतर इक्विटी म्युच्युअल फंडामध्ये गुंतवणूक करण्यास प्राधान्य द्या.

2. गुंतवणुकीची टाइमलाइन निवडा

हे सुनिश्चित करेल की तुम्ही योग्य कालावधीसाठी योग्य प्रमाणात पैसे गुंतवाल.

3. तुम्हाला मासिक गुंतवणूक करायची आहे ती रक्कम ठरवा

एसआयपी ही मासिक गुंतवणूक असल्याने, तुम्ही अशी रक्कम निवडावी ज्याशिवाय तुम्ही मासिक गुंतवणूक करू शकालअपयशी. वापरून तुम्ही तुमच्या ध्येयानुसार योग्य रकमेची गणना देखील करू शकतासिप कॅल्क्युलेटर किंवा SIP रिटर्न कॅल्क्युलेटर.

4. सर्वोत्तम SIP योजना निवडा

सल्लामसलत करून योग्य गुंतवणुकीची निवड कराआर्थिक सल्लागार किंवा निवडूनसर्वोत्तम SIP योजना विविध ऑनलाइन गुंतवणूक प्लॅटफॉर्मद्वारे ऑफर केले जाते.

Talk to our investment specialist

भारतातील टॉप 11 SIP म्युच्युअल फंड FY 22 - 23

To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. DSP BlackRock India T.I.G.E.R Fund is a Equity - Sectoral fund was launched on 11 Jun 04. It is a fund with High risk and has given a Below is the key information for DSP BlackRock India T.I.G.E.R Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Franklin Build India Fund is a Equity - Sectoral fund was launched on 4 Sep 09. It is a fund with High risk and has given a Below is the key information for Franklin Build India Fund Returns up to 1 year are on The Fund seeks to provide long-term capital appreciation by investing in mid and small cap companies. Franklin India Smaller Companies Fund is a Equity - Small Cap fund was launched on 13 Jan 06. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Smaller Companies Fund Returns up to 1 year are on (Erstwhile Kotak Midcap Scheme) The investment objective of the Scheme is to generate capital appreciation from a diversified portfolio of equity and equity related securities. Kotak Small Cap Fund is a Equity - Small Cap fund was launched on 24 Feb 05. It is a fund with Moderately High risk and has given a Below is the key information for Kotak Small Cap Fund Returns up to 1 year are on (Erstwhile IDFC Sterling Equity Fund) To generate capital appreciation from a diversified portfolio of equity and equity related instruments.It will predominantly invest in small and midcap equity and equity related instruments. Small and Midcap equity & equity related instruments will be the stocks included in the Nifty Free Float Midcap 100 or equity and equity related instruments of such companies which have a market capitalization lower than the highest components of Nifty Free Float Midcap 100. It may also invest in stocks other than mid cap stocks (i.e. in stocks, which have a market capitalisation of above the market capitalisation range of the defined small - midcap stocks) & derivatives. On defensive consideration,It may also invest in debt and money market instruments. In case of discontinuation /suspension of Nifty Free Float Midcap 100, the AMC reserves the right tomodify the definition of Mid cap and Small cap companies. In case of such amodification, the interest of investors will be of paramount importance. IDFC Sterling Value Fund is a Equity - Value fund was launched on 7 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for IDFC Sterling Value Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Indo Asia Equity Fund) ICICI Prudential Indo Asia Equity Fund is an OE equity scheme that seeks to generate long term capital appreciation by investing in equity, equity related securities and or share classes/units of equity funds of companies, which are incorporated or have their area of primary activity, in the Asia Pacific region. Initially the Scheme will invest in share classes of International Opportunities Fund Asian Equity Fund and thereafter the Fund Manager of the Indo Asia Equity Fund may choose to make investment in listed equity shares, securities in the Asia Pacific region. However, there can be no assurance that the investment objective of the Scheme will be realized. ICICI Prudential Smallcap Fund is a Equity - Small Cap fund was launched on 18 Oct 07. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Smallcap Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Infrastructure Fund Growth ₹178.17

↑ 0.82 ₹6,886 100 -0.8 -10.1 5.6 27 37.8 27.4 Nippon India Power and Infra Fund Growth ₹319.52

↑ 1.87 ₹6,125 100 -3.4 -14.3 1.5 26.8 35.3 26.9 IDFC Infrastructure Fund Growth ₹46.435

↑ 0.14 ₹1,400 100 -5.8 -15.8 3 24.2 35.2 39.3 L&T Emerging Businesses Fund Growth ₹73.2565

↑ 0.70 ₹13,334 500 -11.9 -19.9 1.4 16.4 35 28.5 HDFC Infrastructure Fund Growth ₹44.125

↑ 0.23 ₹2,105 300 -0.9 -9.9 4 27.8 34.7 23 DSP BlackRock India T.I.G.E.R Fund Growth ₹286.618

↑ 1.41 ₹4,465 500 -5.4 -17.6 3.1 24.4 34.4 32.4 Franklin Build India Fund Growth ₹129.62

↑ 0.90 ₹2,406 500 -2.4 -11.1 4.5 26.1 34.1 27.8 Franklin India Smaller Companies Fund Growth ₹156.106

↑ 1.58 ₹11,257 500 -7.6 -16.1 0.9 19.6 34 23.2 Kotak Small Cap Fund Growth ₹236.633

↑ 1.21 ₹14,407 1,000 -9.3 -18.3 4.7 12.2 33.7 25.5 IDFC Sterling Value Fund Growth ₹138.202

↑ 1.01 ₹8,996 100 -1.8 -10.6 3.9 14.7 33.5 18 ICICI Prudential Smallcap Fund Growth ₹78.28

↑ 0.27 ₹6,912 100 -5.8 -15.2 1.6 14.9 33.4 15.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25 200 कोटी म्युच्युअल फंडाच्या इक्विटी श्रेणीमध्ये 5 वर्षांच्या कॅलेंडर वर्षाच्या परताव्याच्या आधारे ऑर्डर केले जाते.1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.8% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (16 Apr 25) ₹178.17 ↑ 0.82 (0.46 %) Net Assets (Cr) ₹6,886 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio -0.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 31 Mar 25 ₹54,540 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 6.5% 3 Month -0.8% 6 Month -10.1% 1 Year 5.6% 3 Year 27% 5 Year 37.8% 10 Year 15 Year Since launch 15.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.4% 2023 44.6% 2022 28.8% 2021 50.1% 2020 3.6% 2019 2.6% 2018 -14% 2017 40.8% 2016 2% 2015 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 36.49% Basic Materials 21.39% Financial Services 16.91% Utility 8.65% Energy 7.09% Communication Services 1.63% Consumer Cyclical 0.89% Real Estate 0.35% Asset Allocation

Asset Class Value Cash 5.98% Equity 93.39% Debt 0.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹649 Cr 2,052,790

↑ 126,940 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹288 Cr 2,695,324 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹268 Cr 98,408

↓ -10,339 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹240 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹226 Cr 7,260,775 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹212 Cr 1,225,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹210 Cr 12,006,117

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹205 Cr 1,709,486

↑ 100,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹194 Cr 4,923,662

↑ 100,000 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004803% ₹173 Cr 635,000 2. Nippon India Power and Infra Fund

CAGR/Annualized return of 18% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (16 Apr 25) ₹319.52 ↑ 1.87 (0.59 %) Net Assets (Cr) ₹6,125 on 28 Feb 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio -0.55 Information Ratio 1.03 Alpha Ratio 1.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,563 31 Mar 22 ₹23,186 31 Mar 23 ₹26,891 31 Mar 24 ₹47,550 31 Mar 25 ₹48,861 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 8.1% 3 Month -3.4% 6 Month -14.3% 1 Year 1.5% 3 Year 26.8% 5 Year 35.3% 10 Year 15 Year Since launch 18% Historical performance (Yearly) on absolute basis

Year Returns 2024 26.9% 2023 58% 2022 10.9% 2021 48.9% 2020 10.8% 2019 -2.9% 2018 -21.1% 2017 61.7% 2016 0.1% 2015 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.77 Yr. Rahul Modi 19 Aug 24 0.53 Yr. Data below for Nippon India Power and Infra Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 40.77% Utility 19.49% Energy 9.09% Basic Materials 9.08% Communication Services 8.44% Real Estate 3.99% Technology 2.14% Health Care 2.08% Consumer Cyclical 1.96% Financial Services 1.78% Asset Allocation

Asset Class Value Cash 1.18% Equity 98.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE8% ₹480 Cr 4,000,000

↑ 250,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325558% ₹480 Cr 15,400,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹472 Cr 1,492,001 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL7% ₹408 Cr 2,600,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹243 Cr 240,038 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004004% ₹237 Cr 6,975,789

↑ 500,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES3% ₹176 Cr 423,938 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹162 Cr 350,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | 5000932% ₹151 Cr 2,632,923

↑ 80,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV2% ₹150 Cr 1,800,000 3. IDFC Infrastructure Fund

CAGR/Annualized return of 11.5% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (16 Apr 25) ₹46.435 ↑ 0.14 (0.30 %) Net Assets (Cr) ₹1,400 on 28 Feb 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio -0.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 9.5% 3 Month -5.8% 6 Month -15.8% 1 Year 3% 3 Year 24.2% 5 Year 35.2% 10 Year 15 Year Since launch 11.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 54.7% Utility 13.22% Basic Materials 10.84% Communication Services 4.49% Energy 3.88% Consumer Cyclical 3.46% Financial Services 2.99% Technology 2.07% Health Care 1.9% Asset Allocation

Asset Class Value Cash 2.43% Equity 97.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹71 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹58 Cr 183,173

↑ 11,726 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE4% ₹54 Cr 452,706 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹52 Cr 330,018

↑ 40,855 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325384% ₹51 Cr 50,452

↑ 3,476 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹45 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹39 Cr 365,137

↓ -69,842 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹39 Cr 12,400,122 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹35 Cr 1,431,700 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹35 Cr 512,915 4. L&T Emerging Businesses Fund

CAGR/Annualized return of 20% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (16 Apr 25) ₹73.2565 ↑ 0.70 (0.97 %) Net Assets (Cr) ₹13,334 on 28 Feb 25 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio -0.4 Information Ratio -0.11 Alpha Ratio 1.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,010 31 Mar 22 ₹29,870 31 Mar 23 ₹31,289 31 Mar 24 ₹46,026 31 Mar 25 ₹48,026 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 7.1% 3 Month -11.9% 6 Month -19.9% 1 Year 1.4% 3 Year 16.4% 5 Year 35% 10 Year 15 Year Since launch 20% Historical performance (Yearly) on absolute basis

Year Returns 2024 28.5% 2023 46.1% 2022 1% 2021 77.4% 2020 15.5% 2019 -8.1% 2018 -13.7% 2017 66.5% 2016 10.2% 2015 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.21 Yr. Cheenu Gupta 1 Oct 23 1.42 Yr. Sonal Gupta 1 Oct 23 1.42 Yr. Data below for L&T Emerging Businesses Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 24.78% Consumer Cyclical 15.58% Financial Services 14.01% Basic Materials 10.75% Technology 9.78% Health Care 5.55% Real Estate 4.98% Consumer Defensive 4.06% Energy 1.26% Asset Allocation

Asset Class Value Cash 6.91% Equity 93.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹310 Cr 292,479

↓ -6,521 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹297 Cr 1,595,574 Suven Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Mar 20 | SUVENPHAR2% ₹279 Cr 2,298,085 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | KPRMILL2% ₹263 Cr 3,286,897 BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE2% ₹257 Cr 555,021

↓ -297,579 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹243 Cr 6,810,500 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | 5900032% ₹240 Cr 11,912,400 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 Jul 19 | 5329292% ₹237 Cr 2,499,622 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | FEDERALBNK2% ₹236 Cr 13,286,579 Sumitomo Chemical India Ltd Ordinary Shares (Basic Materials)

Equity, Since 31 Oct 20 | SUMICHEM2% ₹215 Cr 4,672,221 5. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (16 Apr 25) ₹44.125 ↑ 0.23 (0.52 %) Net Assets (Cr) ₹2,105 on 28 Feb 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,356 31 Mar 22 ₹21,727 31 Mar 23 ₹25,279 31 Mar 24 ₹45,346 31 Mar 25 ₹47,548 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 9.2% 3 Month -0.9% 6 Month -9.9% 1 Year 4% 3 Year 27.8% 5 Year 34.7% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 23% 2023 55.4% 2022 19.3% 2021 43.2% 2020 -7.5% 2019 -3.4% 2018 -29% 2017 43.3% 2016 -1.9% 2015 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.13 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 38.42% Financial Services 20.62% Basic Materials 10.93% Utility 7.4% Energy 6.96% Communication Services 3.76% Health Care 1.73% Technology 0.98% Real Estate 0.94% Consumer Cyclical 0.58% Asset Allocation

Asset Class Value Cash 6.48% Equity 92.31% Debt 1.21% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹157 Cr 1,300,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK6% ₹121 Cr 700,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT6% ₹120 Cr 380,000

↑ 30,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL5% ₹98 Cr 1,450,000

↓ -50,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹69 Cr 2,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹67 Cr 150,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL3% ₹67 Cr 758,285 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹63 Cr 1,700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹60 Cr 500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹55 Cr 350,000

↓ -50,000 6. DSP BlackRock India T.I.G.E.R Fund

CAGR/Annualized return of 17.5% since its launch. Ranked 12 in Sectoral category. Return for 2024 was 32.4% , 2023 was 49% and 2022 was 13.9% . DSP BlackRock India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (16 Apr 25) ₹286.618 ↑ 1.41 (0.49 %) Net Assets (Cr) ₹4,465 on 28 Feb 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio -0.22 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,218 31 Mar 22 ₹23,467 31 Mar 23 ₹26,460 31 Mar 24 ₹43,618 31 Mar 25 ₹46,898 Returns for DSP BlackRock India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 7.6% 3 Month -5.4% 6 Month -17.6% 1 Year 3.1% 3 Year 24.4% 5 Year 34.4% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 32.4% 2023 49% 2022 13.9% 2021 51.6% 2020 2.7% 2019 6.7% 2018 -17.2% 2017 47% 2016 4.1% 2015 0.7% Fund Manager information for DSP BlackRock India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 14.7 Yr. Data below for DSP BlackRock India T.I.G.E.R Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 31% Basic Materials 14.85% Consumer Cyclical 7.91% Utility 6.95% Energy 5.73% Financial Services 5.59% Communication Services 3.89% Health Care 3.66% Technology 2.56% Real Estate 1.49% Consumer Defensive 1.45% Asset Allocation

Asset Class Value Cash 14.93% Equity 85.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325555% ₹223 Cr 7,145,883 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT4% ₹177 Cr 559,286

↓ -32,099 Siemens Ltd (Industrials)

Equity, Since 30 Nov 18 | 5005504% ₹171 Cr 369,482 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL4% ₹170 Cr 1,080,606 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA3% ₹123 Cr 3,321,453 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 22 | KPIL2% ₹92 Cr 1,045,339

↓ -114,092 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP2% ₹91 Cr 150,959

↑ 19,956 INOX India Ltd (Industrials)

Equity, Since 31 Dec 23 | INOXINDIA2% ₹90 Cr 940,841 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG2% ₹87 Cr 1,502,475 Welspun Corp Ltd (Basic Materials)

Equity, Since 30 Nov 23 | 5321442% ₹83 Cr 1,129,878

↓ -193,415 7. Franklin Build India Fund

CAGR/Annualized return of 17.8% since its launch. Ranked 4 in Sectoral category. Return for 2024 was 27.8% , 2023 was 51.1% and 2022 was 11.2% . Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (16 Apr 25) ₹129.62 ↑ 0.90 (0.70 %) Net Assets (Cr) ₹2,406 on 28 Feb 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.13 Sharpe Ratio -0.41 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,042 31 Mar 22 ₹22,684 31 Mar 23 ₹25,531 31 Mar 24 ₹43,699 31 Mar 25 ₹46,685 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 7.4% 3 Month -2.4% 6 Month -11.1% 1 Year 4.5% 3 Year 26.1% 5 Year 34.1% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.8% 2023 51.1% 2022 11.2% 2021 45.9% 2020 5.4% 2019 6% 2018 -10.7% 2017 43.3% 2016 8.4% 2015 2.1% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 3.37 Yr. Kiran Sebastian 7 Feb 22 3.06 Yr. Sandeep Manam 18 Oct 21 3.37 Yr. Data below for Franklin Build India Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 35.61% Utility 12.65% Financial Services 11.45% Energy 11.44% Communication Services 8.02% Basic Materials 7.35% Real Estate 3.12% Consumer Cyclical 2.86% Technology 1.72% Asset Allocation

Asset Class Value Cash 5.78% Equity 94.22% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹228 Cr 720,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | ICICIBANK6% ₹144 Cr 1,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO6% ₹134 Cr 300,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325555% ₹128 Cr 4,125,000

↑ 195,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE5% ₹126 Cr 1,050,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003125% ₹113 Cr 5,000,000

↑ 500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹111 Cr 710,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322154% ₹91 Cr 900,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 21 | 5328984% ₹84 Cr 3,365,000 Tata Power Co Ltd (Utilities)

Equity, Since 31 Jan 25 | 5004003% ₹68 Cr 2,000,000

↑ 545,843 8. Franklin India Smaller Companies Fund

CAGR/Annualized return of 15.3% since its launch. Ranked 11 in Small Cap category. Return for 2024 was 23.2% , 2023 was 52.1% and 2022 was 3.6% . Franklin India Smaller Companies Fund

Growth Launch Date 13 Jan 06 NAV (16 Apr 25) ₹156.106 ↑ 1.58 (1.02 %) Net Assets (Cr) ₹11,257 on 28 Feb 25 Category Equity - Small Cap AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio -0.43 Information Ratio 0.28 Alpha Ratio 0.6 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹19,999 31 Mar 22 ₹26,272 31 Mar 23 ₹28,549 31 Mar 24 ₹43,647 31 Mar 25 ₹44,921 Returns for Franklin India Smaller Companies Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 8.4% 3 Month -7.6% 6 Month -16.1% 1 Year 0.9% 3 Year 19.6% 5 Year 34% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 23.2% 2023 52.1% 2022 3.6% 2021 56.4% 2020 18.7% 2019 -5% 2018 -17.4% 2017 43.5% 2016 10.2% 2015 9.6% Fund Manager information for Franklin India Smaller Companies Fund

Name Since Tenure R. Janakiraman 1 Feb 11 14.09 Yr. Sandeep Manam 18 Oct 21 3.37 Yr. Akhil Kalluri 8 Sep 22 2.48 Yr. Data below for Franklin India Smaller Companies Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 19.73% Industrials 19.62% Consumer Cyclical 14.7% Health Care 10.79% Basic Materials 10.23% Technology 4.9% Real Estate 4.7% Consumer Defensive 3.61% Utility 2.57% Energy 0.9% Communication Services 0.05% Asset Allocation

Asset Class Value Cash 6.86% Equity 92.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity Brigade Enterprises Ltd (Real Estate)

Equity, Since 30 Jun 14 | 5329293% ₹366 Cr 3,868,691 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 23 | ASTERDM3% ₹323 Cr 8,018,630 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | 5900033% ₹282 Cr 13,998,917

↓ -156,763 Equitas Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 20 | EQUITASBNK2% ₹273 Cr 48,064,081 Deepak Nitrite Ltd (Basic Materials)

Equity, Since 31 Jan 16 | DEEPAKNTR2% ₹257 Cr 1,387,967 J.B. Chemicals & Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 14 | JBCHEPHARM2% ₹238 Cr 1,448,723 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 May 22 | KALYANKJIL2% ₹229 Cr 4,963,469 Zensar Technologies Ltd (Technology)

Equity, Since 28 Feb 23 | ZENSARTECH2% ₹226 Cr 3,062,700

↓ -200,000 Crompton Greaves Consumer Electricals Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | CROMPTON2% ₹222 Cr 6,900,000 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 30 Sep 19 | ERIS2% ₹221 Cr 1,866,828 9. Kotak Small Cap Fund

CAGR/Annualized return of 17% since its launch. Ranked 23 in Small Cap category. Return for 2024 was 25.5% , 2023 was 34.8% and 2022 was -3.1% . Kotak Small Cap Fund

Growth Launch Date 24 Feb 05 NAV (16 Apr 25) ₹236.633 ↑ 1.21 (0.51 %) Net Assets (Cr) ₹14,407 on 28 Feb 25 Category Equity - Small Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.67 Sharpe Ratio -0.22 Information Ratio -0.66 Alpha Ratio 4.91 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹22,777 31 Mar 22 ₹31,078 31 Mar 23 ₹29,901 31 Mar 24 ₹41,373 31 Mar 25 ₹44,967 Returns for Kotak Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 6.5% 3 Month -9.3% 6 Month -18.3% 1 Year 4.7% 3 Year 12.2% 5 Year 33.7% 10 Year 15 Year Since launch 17% Historical performance (Yearly) on absolute basis

Year Returns 2024 25.5% 2023 34.8% 2022 -3.1% 2021 70.9% 2020 34.2% 2019 5% 2018 -17.3% 2017 44% 2016 8.9% 2015 7.4% Fund Manager information for Kotak Small Cap Fund

Name Since Tenure Harish Bihani 20 Oct 23 1.36 Yr. Data below for Kotak Small Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 30.46% Consumer Cyclical 21.56% Health Care 19.17% Basic Materials 14.29% Real Estate 4.3% Financial Services 3.6% Consumer Defensive 2.73% Communication Services 2.24% Technology 0.16% Asset Allocation

Asset Class Value Cash 1.51% Equity 98.49% Top Securities Holdings / Portfolio

Name Holding Value Quantity Blue Star Ltd (Industrials)

Equity, Since 31 May 18 | BLUESTARCO3% ₹483 Cr 2,518,929 Century Plyboards (India) Ltd (Basic Materials)

Equity, Since 31 Oct 18 | 5325483% ₹475 Cr 6,590,679

↑ 21,212 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 24 | ASTERDM3% ₹474 Cr 11,757,234

↑ 1,712,815 Cyient Ltd (Industrials)

Equity, Since 31 Dec 19 | CYIENT3% ₹453 Cr 3,574,852 Vijaya Diagnostic Centre Ltd (Healthcare)

Equity, Since 31 Mar 24 | 5433503% ₹450 Cr 4,918,037 Krishna Institute of Medical Sciences Ltd (Healthcare)

Equity, Since 31 Dec 23 | 5433083% ₹442 Cr 8,473,425

↑ 376,495 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 Aug 24 | 5329293% ₹386 Cr 4,078,404

↑ 400,000 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Dec 18 | TECHNOE2% ₹360 Cr 3,691,305

↑ 100,000 Garware Technical Fibres Ltd (Consumer Cyclical)

Equity, Since 30 Jun 21 | GARFIBRES2% ₹350 Cr 4,643,002

↑ 7,370 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Jan 18 | AMBER2% ₹347 Cr 616,512 10. IDFC Sterling Value Fund

CAGR/Annualized return of 16.6% since its launch. Ranked 21 in Value category. Return for 2024 was 18% , 2023 was 32.6% and 2022 was 3.2% . IDFC Sterling Value Fund

Growth Launch Date 7 Mar 08 NAV (16 Apr 25) ₹138.202 ↑ 1.01 (0.73 %) Net Assets (Cr) ₹8,996 on 28 Feb 25 Category Equity - Value AMC IDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.81 Sharpe Ratio -0.44 Information Ratio 0.75 Alpha Ratio -0.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,593 31 Mar 22 ₹29,489 31 Mar 23 ₹30,476 31 Mar 24 ₹44,072 31 Mar 25 ₹46,095 Returns for IDFC Sterling Value Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 5% 3 Month -1.8% 6 Month -10.6% 1 Year 3.9% 3 Year 14.7% 5 Year 33.5% 10 Year 15 Year Since launch 16.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 18% 2023 32.6% 2022 3.2% 2021 64.5% 2020 15.2% 2019 -6.2% 2018 -13% 2017 61.3% 2016 1.1% 2015 -0.3% Fund Manager information for IDFC Sterling Value Fund

Name Since Tenure Daylynn Pinto 20 Oct 16 8.37 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Sterling Value Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 30.38% Consumer Cyclical 10.49% Basic Materials 9.09% Energy 8.05% Technology 7.78% Industrials 7.26% Consumer Defensive 6.91% Health Care 5.72% Utility 2.53% Real Estate 1.64% Asset Allocation

Asset Class Value Cash 6% Equity 94% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 22 | HDFCBANK8% ₹710 Cr 4,100,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 22 | RELIANCE7% ₹600 Cr 5,000,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322155% ₹457 Cr 4,500,000

↑ 200,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK3% ₹301 Cr 2,500,000

↓ -500,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 21 | TCS3% ₹277 Cr 795,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 23 | INFY3% ₹253 Cr 1,500,000 Jindal Steel & Power Ltd (Basic Materials)

Equity, Since 30 Apr 17 | 5322862% ₹214 Cr 2,500,000 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | INDUSINDBK2% ₹198 Cr 2,000,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 25 | KOTAKBANK2% ₹190 Cr 1,000,000

↑ 500,000 Nifty March 2025 Future

- | -2% ₹184 Cr 82,500

↑ 82,500 11. ICICI Prudential Smallcap Fund

CAGR/Annualized return of 12.5% since its launch. Ranked 26 in Small Cap category. Return for 2024 was 15.6% , 2023 was 37.9% and 2022 was 5.7% . ICICI Prudential Smallcap Fund

Growth Launch Date 18 Oct 07 NAV (16 Apr 25) ₹78.28 ↑ 0.27 (0.35 %) Net Assets (Cr) ₹6,912 on 28 Feb 25 Category Equity - Small Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.04 Sharpe Ratio -0.57 Information Ratio -0.2 Alpha Ratio -2.42 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,420 31 Mar 22 ₹28,527 31 Mar 23 ₹29,468 31 Mar 24 ₹41,702 31 Mar 25 ₹43,091 Returns for ICICI Prudential Smallcap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 6.5% 3 Month -5.8% 6 Month -15.2% 1 Year 1.6% 3 Year 14.9% 5 Year 33.4% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.6% 2023 37.9% 2022 5.7% 2021 61% 2020 22.8% 2019 10% 2018 -22.4% 2017 42.7% 2016 6% 2015 0.5% Fund Manager information for ICICI Prudential Smallcap Fund

Name Since Tenure Anish Tawakley 18 Sep 23 1.45 Yr. Sri Sharma 18 Sep 23 1.45 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Smallcap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Basic Materials 28.13% Industrials 21.14% Consumer Cyclical 11.84% Health Care 8.42% Financial Services 5.23% Utility 3.36% Consumer Defensive 3.08% Real Estate 1.69% Communication Services 1.67% Technology 1.39% Energy 1.02% Asset Allocation

Asset Class Value Cash 13.04% Equity 86.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Oct 23 | LT3% ₹195 Cr 616,614

↑ 22,837 Procter & Gamble Health Ltd (Healthcare)

Equity, Since 29 Feb 24 | PGHL3% ₹175 Cr 347,671 Gujarat Pipavav Port Ltd (Industrials)

Equity, Since 31 Mar 18 | 5332482% ₹170 Cr 13,629,398

↑ 1,537,601 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 23 | 5325382% ₹152 Cr 149,768 Atul Ltd (Basic Materials)

Equity, Since 31 Oct 23 | ATUL2% ₹150 Cr 283,164

↑ 154,274 Gujarat State Petronet Ltd (Utilities)

Equity, Since 31 Jan 24 | 5327022% ₹149 Cr 5,470,101

↓ -686,743 Kesoram Industries Ltd (Basic Materials)

Equity, Since 30 Apr 24 | KESORAMIND2% ₹148 Cr 7,538,679 Gillette India Ltd (Consumer Defensive)

Equity, Since 31 Dec 23 | GILLETTE2% ₹146 Cr 184,649

↑ 11,465 Tata Chemicals Ltd (Basic Materials)

Equity, Since 31 Aug 24 | TATACHEM2% ₹140 Cr 1,801,616

↑ 163,000 Cummins India Ltd (Industrials)

Equity, Since 30 Sep 23 | 5004802% ₹138 Cr 507,918

↑ 6,948

गुंतवणूकदारांना त्यांच्या आवडीच्या SIP योजनांमध्ये गुंतवणूक करण्याचे सुचवले जाते. वर नमूद केलेले शीर्ष 11 म्युच्युअल फंड सर्व प्रकारच्या गुंतवणूकदारांसाठी योग्य आहेत. तर, एकतर तुम्ही उच्च-जोखीम आहातगुंतवणूकदार किंवा तुलनेने कमी, हे SIP फंड आहेतगुंतवणुकीसाठी सर्वोत्तम म्युच्युअल फंड. म्हणून, प्रतीक्षा करू नका, आता गुंतवणूक करा!

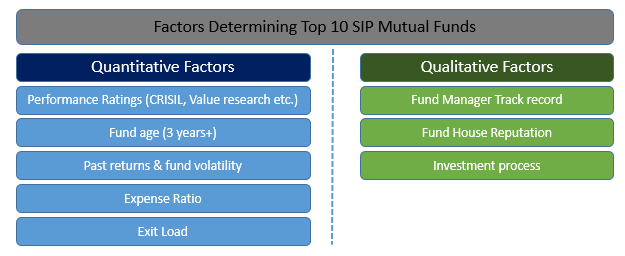

सर्वोत्कृष्ट पद्धतशीर गुंतवणूक योजनांमध्ये गुंतवणूक करताना विचारात घ्यायचे पॅरामीटर्स

सर्वोत्तम कामगिरी करणाऱ्या SIP फंडांचे मूल्यमापन करण्यासाठी, गुंतवणुकीपूर्वी कोणते घटक विचारात घेतले पाहिजेत ते जाणून घेऊया.

शीर्ष SIP मध्ये गुंतवणूक करण्यासाठी परिमाणात्मक घटक

SIP द्वारे गुंतवणूक करण्यापूर्वी ज्या परिमाणात्मक घटकांचा विचार केला पाहिजे त्यात कामगिरी रेटिंग (क्रिसिल, व्हॅल्यू रिसर्च इ. नुसार), फंड वय, मागील परतावा आणि निधीची अस्थिरता, खर्चाचे प्रमाण आणि एक्झिट लोड यांचा समावेश होतो.

शीर्ष SIP मध्ये गुंतवणूक करण्यासाठी गुणात्मक घटक

विश्लेषणासाठी गुणात्मक मुख्य आकडेवारीमध्ये फंड व्यवस्थापकाचा ट्रॅक रेकॉर्ड, फंड हाउसची प्रतिष्ठा आणि SIP फंडाची गुंतवणूक प्रक्रिया यांचा समावेश होतो.

SIP MF मध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

आजच SIP सह तुमचा गुंतवणूक प्रवास सुरू करा!

वारंवार विचारले जाणारे प्रश्न

1. म्युच्युअल फंड म्हणजे काय?

अ: म्युच्युअल फंड हे सिस्टिमॅटिक इन्व्हेस्टमेंट प्लॅन किंवा SIP चा एक भाग आहेत जे सहसा नंतर उत्कृष्ट परतावा देतात. जेव्हा आपणम्युच्युअल फंडात गुंतवणूक करा, तुम्ही तुमच्या गुंतवणूक पोर्टफोलिओमध्ये विविधता आणता. म्युच्युअल फंड हे गुंतवणुकीचे साधन मानले जाऊ शकतेमालमत्ता व्यवस्थापन कंपनी एकाधिक गुंतवणूकदार आणि कंपन्यांच्या गुंतवणुकीमध्ये एकत्र करून.

2. म्युच्युअल फंडाचे विविध प्रकार कोणते आहेत?

अ: म्युच्युअल फंडांचे स्थूलमानाने खालील प्रकारांमध्ये वर्गीकरण करता येते:

- इक्विटी किंवा ग्रोथ फंड

- निश्चित उत्पन्न निधी किंवाकर्ज निधी

- कर बचत निधी

- लिक्विड फंड

- संतुलित निधी

- गिल्ट फंड

- एक्सचेंज-ट्रेडेड फंड किंवाईटीएफ

3. ग्रोथ इक्विटी फंड म्हणजे काय?

अ: वाढइक्विटी फंड सर्वात सामान्य म्युच्युअल फंड आहेत. तथापि, या पोर्टफोलिओमध्ये अस्थिर गुंतवणुकीचा समावेश असेल. असे असले तरी, गुंतवणूकदार अनेकदा ग्रोथ इक्विटी फंडांना प्राधान्य देतात कारण यामध्ये जास्त परतावा असतो आणि कमी कालावधीसाठी गुंतवणूक करता येते.

4. तुम्ही डेट फंडात गुंतवणूक का करावी?

अ: गुंतवणुकीवर निश्चित परतावा शोधणाऱ्या व्यक्तींसाठी ही गुंतवणूक आदर्श आहे. डिबेंचर्स, डेट सिक्युरिटीज, कमर्शियल पेपर्स आणि सरकारी सिक्युरिटीजमधून निश्चित उत्पन्न मिळवता येते. म्युच्युअल फंड विविध प्रकारच्या गुंतवणुकीचा पोर्टफोलिओ तयार करतात आणि जोखीम नष्ट करतात.

5. तुम्ही SIP मध्ये गुंतवणूक का करावी?

अ: एसआयपी गुंतवणूकदाराला खात्रीशीर उत्पन्न देऊ शकतात. जर तुम्हाला निष्क्रिय उत्पन्न मिळवण्यात स्वारस्य असेल आणि तुमच्या गुंतवणुकीत नियमित उत्पन्न मिळेल याची खात्री करायची असेल, तर तुम्ही SIP मध्ये गुंतवणूक करण्याचा विचार करू शकता. .

6. कर बचत म्युच्युअल फंडात गुंतवणूक का करावी?

अ: जर तुम्ही तुमची वाढ करू इच्छित असालभांडवल आणि त्याच वेळी कर सवलतींचा आनंद घ्यायचा असेल, तर तुम्ही कर बचत म्युच्युअल फंडात गुंतवणूक करू शकता. अंतर्गतकलम 80C याआयकर 1861 चा कायदा, जर तुम्ही इक्विटी-लिंक्ड टॅक्स सेव्हिंग म्युच्युअल फंडांमध्ये गुंतवणूक केली तर तुम्ही तुमच्या गुंतवणुकीवर कर सवलत मिळवू शकता.

7. म्युच्युअल फंडात गुंतवणूक करण्यासाठी मला ब्रोकरची गरज आहे का?

अ: गुंतवणुकीत मदत करण्यासाठी तुम्हाला ब्रोकर किंवा वित्तीय संस्थेचा पाठिंबा आवश्यक असेल. योग्य एसआयपी ओळखण्यासाठी आणि गुंतवणूक योग्यरित्या केली गेली आहे याची खात्री करण्यासाठी तुम्हाला समर्थनाची आवश्यकता असेल.

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.