+91-22-48913909

+91-22-48913909

Table of Contents

- टॉप 11 SIP फंडांमध्ये गुंतवणूक का करावी?

- SIP मध्ये गुंतवणूक कशी करावी?

- भारतातील टॉप 11 SIP म्युच्युअल फंड FY 22 - 23

- सर्वोत्कृष्ट पद्धतशीर गुंतवणूक योजनांमध्ये गुंतवणूक करताना विचारात घ्यायचे पॅरामीटर्स

- SIP MF मध्ये ऑनलाइन गुंतवणूक कशी करावी?

- वारंवार विचारले जाणारे प्रश्न

Top 11 Funds

- ICICI Prudential Infrastructure Fund

- ICICI Prudential Technology Fund

- IDFC Infrastructure Fund

- Nippon India Power and Infra Fund

- ICICI Prudential Dividend Yield Equity Fund

- L&T Emerging Businesses Fund

- TATA Digital India Fund

- BOI AXA Manufacturing and Infrastructure Fund

- Franklin India Opportunities Fund

- Franklin Build India Fund

- SBI Healthcare Opportunities Fund

SIP 2022 साठी 11 सर्वोत्तम म्युच्युअल फंड

SIP म्युच्युअल फंड (किंवा शीर्ष 11 SIP म्युच्युअल फंड) हे असे फंड आहेत जे शेअर बाजारातील अपरिहार्य चढ-उतारांदरम्यान चिंताग्रस्त विक्री टाळण्यासाठी नियतकालिक गुंतवणुकीच्या साध्या सूत्राचे पालन करतात.

सामान्यतः, SIP किंवा पद्धतशीरगुंतवणूक योजना म्युच्युअल फंडात पैसे गुंतवण्याचा हा एक प्रकार आहे.गुंतवणूक शीर्ष 11 मध्ये SIP म्युच्युअल फंड तुमच्या गुंतवणुकीसाठी पद्धतशीर आणि शिस्तबद्ध दृष्टिकोन आणतात. यामुळे तुमची गुंतवणूक दररोज व्यवस्थापित करण्याचा तुमचा प्रयत्न कमी होतोआधार. शिवाय, ते लाभ देतेकंपाउंडिंगची शक्ती कालांतराने इच्छित परतावा मिळवून देतो.

वेगवेगळे आहेतम्युच्युअल फंडाचे प्रकार SIP साठी ज्यात इक्विटी, कर्ज, संतुलित, अल्ट्रा-अल्पकालीन निधी, इ. तथापि, इक्विटी म्युच्युअल फंड एसआयपीद्वारे गुंतवणूक केल्यावर जास्तीत जास्त परतावा देतात. आर्थिक सल्लागार सुचवतात की, गुंतवणूकदारांनी गुंतवणूक करावीसर्वोत्तम म्युच्युअल फंड एसआयपीसाठी त्यांची गुंतवणूक उद्दिष्टे आणि कालावधीएसआयपी गुंतवणूक.

टॉप 11 SIP फंडांमध्ये गुंतवणूक का करावी?

एसआयपी म्युच्युअल फंडातील गुंतवणुकीसाठी शिस्तबद्ध दृष्टिकोन देतात

पद्धतशीर गुंतवणुकीमुळे भविष्यातील स्वप्न आणि प्रमुख उद्दिष्टे पूर्ण करण्यात मदत होते- सेवानिवृत्ती, मुलाचे करिअर, घर, कार किंवा इतर कोणत्याही मालमत्तेची खरेदी

एसआयपी अधिकाधिक चक्रवाढ करण्यात मदत करतात आणि तरुण गुंतवणूकदारांसाठी आदर्श आहेत

पद्धतशीर गुंतवणूक योजना इक्विटी चढउतारांचा धोका कमी करतात

SIP मध्ये गुंतवणूक कशी करावी?

पैसे गुंतवणे ही एक कला आहे, ती योग्य प्रकारे केली तर आश्चर्यकारक काम करू शकते. आता तुम्हाला माहीत आहे कीशीर्ष SIP योजना तुम्हाला त्यामध्ये गुंतवणूक कशी करावी हे माहित असणे आवश्यक आहे. आम्ही खाली SIP मध्ये गुंतवणूक करण्याच्या पायऱ्या नमूद केल्या आहेत.

1. तुमच्या आर्थिक उद्दिष्टांचे विश्लेषण करा

तुमच्यासाठी अनुकूल असलेली SIP गुंतवणूक निवडाआर्थिक उद्दिष्टे. उदाहरणार्थ, तुमचे ध्येय अल्प-मुदतीचे असल्यास (पुढील 2 वर्षांत कार खरेदी करायची असल्यास), तुम्ही डेट म्युच्युअल फंडात गुंतवणूक करावी. आणि, तुमचे ध्येय दीर्घकालीन असल्यास (जसेनिवृत्ती नियोजन) नंतर इक्विटी म्युच्युअल फंडामध्ये गुंतवणूक करण्यास प्राधान्य द्या.

2. गुंतवणुकीची टाइमलाइन निवडा

हे सुनिश्चित करेल की तुम्ही योग्य कालावधीसाठी योग्य प्रमाणात पैसे गुंतवाल.

3. तुम्हाला मासिक गुंतवणूक करायची आहे ती रक्कम ठरवा

एसआयपी ही मासिक गुंतवणूक असल्याने, तुम्ही अशी रक्कम निवडावी ज्याशिवाय तुम्ही मासिक गुंतवणूक करू शकालअपयशी. वापरून तुम्ही तुमच्या ध्येयानुसार योग्य रकमेची गणना देखील करू शकतासिप कॅल्क्युलेटर किंवा SIP रिटर्न कॅल्क्युलेटर.

4. सर्वोत्तम SIP योजना निवडा

सल्लामसलत करून योग्य गुंतवणुकीची निवड कराआर्थिक सल्लागार किंवा निवडूनसर्वोत्तम SIP योजना विविध ऑनलाइन गुंतवणूक प्लॅटफॉर्मद्वारे ऑफर केले जाते.

Talk to our investment specialist

भारतातील टॉप 11 SIP म्युच्युअल फंड FY 22 - 23

To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate long-term capital appreciation for you from a portfolio made up predominantly of equity and equity-related securities of technology intensive companies. ICICI Prudential Technology Fund is a Equity - Sectoral fund was launched on 3 Mar 00. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Technology Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on The investment objective of ICICI Prudential Dividend Yield Equity Fund is to provide medium to long term capital gains and/or dividend distribution by investing in a well diversified portfolio of predominantly equity and equity related instruments, which offer attractive dividend yield ICICI Prudential Dividend Yield Equity Fund is a Equity - Dividend Yield fund was launched on 16 May 14. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Dividend Yield Equity Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on The investment objective of the scheme is to seek long term capital appreciation by investing atleast 80% of its net assets in equity/equity related instruments of the companies in Information Technology Sector in India.However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.The Scheme does not assure or guarantee any returns. TATA Digital India Fund is a Equity - Sectoral fund was launched on 28 Dec 15. It is a fund with High risk and has given a Below is the key information for TATA Digital India Fund Returns up to 1 year are on The Scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure and related sectors. Further, there can be no assurance that the investment objectives of the scheme will be realized. The Scheme is not providing any assured or guaranteed returns BOI AXA Manufacturing and Infrastructure Fund is a Equity - Sectoral fund was launched on 5 Mar 10. It is a fund with High risk and has given a Below is the key information for BOI AXA Manufacturing and Infrastructure Fund Returns up to 1 year are on The investment objective of Franklin India Opportunities Fund (FIOF) is to generate capital appreciation by capitalizing on the long-term growth opportunities in the Indian economy. Franklin India Opportunities Fund is a Equity - Sectoral fund was launched on 21 Feb 00. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Opportunities Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Franklin Build India Fund is a Equity - Sectoral fund was launched on 4 Sep 09. It is a fund with High risk and has given a Below is the key information for Franklin Build India Fund Returns up to 1 year are on (Erstwhile SBI Pharma Fund) To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. SBI Healthcare Opportunities Fund is a Equity - Sectoral fund was launched on 31 Dec 04. It is a fund with High risk and has given a Below is the key information for SBI Healthcare Opportunities Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Infrastructure Fund Growth ₹170.62

↓ -0.37 ₹7,435 100 -5.5 -10.8 6.1 28.1 28.2 27.4 ICICI Prudential Technology Fund Growth ₹202.18

↑ 0.20 ₹14,101 100 -1.6 -2 11.5 9.7 26.7 25.4 IDFC Infrastructure Fund Growth ₹43.411

↓ -0.19 ₹1,641 100 -12.2 -22.6 4.5 23.8 25.3 39.3 Nippon India Power and Infra Fund Growth ₹300.021

↓ -0.95 ₹7,001 100 -10.7 -18.8 0.2 27.1 25.3 26.9 ICICI Prudential Dividend Yield Equity Fund Growth ₹47.42

↓ -0.21 ₹4,835 100 -2.6 -8.8 7.2 21 25.2 21 L&T Emerging Businesses Fund Growth ₹71.6233

↓ -0.47 ₹17,386 500 -14.4 -17.2 -0.3 18.4 25.2 28.5 TATA Digital India Fund Growth ₹49.1539

↓ -0.41 ₹12,465 150 -4.8 -4.1 12.9 10.9 25 30.6 BOI AXA Manufacturing and Infrastructure Fund Growth ₹48.75

↓ -0.27 ₹524 1,000 -9.6 -17.3 3.8 20.9 24.7 25.7 Franklin India Opportunities Fund Growth ₹222.362

↓ -1.77 ₹5,948 500 -6.8 -12.2 12.8 25 24.6 37.3 Franklin Build India Fund Growth ₹123.049

↓ -0.36 ₹2,659 500 -9.3 -15 2.9 25.3 24.5 27.8 SBI Healthcare Opportunities Fund Growth ₹396.896

↑ 1.55 ₹3,522 500 -3.7 0.5 14.2 22.5 24.4 42.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 21 Feb 25 200 कोटी म्युच्युअल फंडाच्या इक्विटी श्रेणीमध्ये 5 वर्षांच्या कॅलेंडर वर्षाच्या परताव्याच्या आधारे ऑर्डर केले जाते.1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.7% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (21 Feb 25) ₹170.62 ↓ -0.37 (-0.22 %) Net Assets (Cr) ₹7,435 on 31 Jan 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 0.64 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,385 31 Jan 22 ₹16,659 31 Jan 23 ₹19,888 31 Jan 24 ₹30,973 31 Jan 25 ₹35,717 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -4.3% 3 Month -5.5% 6 Month -10.8% 1 Year 6.1% 3 Year 28.1% 5 Year 28.2% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% 2014 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.67 Yr. Sharmila D’mello 30 Jun 22 2.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 36.99% Basic Materials 18.93% Financial Services 16.99% Utility 10.73% Energy 7.04% Communication Services 1.26% Consumer Cyclical 1.11% Real Estate 0.75% Asset Allocation

Asset Class Value Cash 5.59% Equity 93.78% Debt 0.63% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹615 Cr 1,704,683 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325554% ₹257 Cr 7,710,775 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK4% ₹255 Cr 1,990,000 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹246 Cr 95,657 JM Financial Ltd (Financial Services)

Equity, Since 31 Oct 21 | JMFINANCIL3% ₹231 Cr 17,763,241

↑ 400,000 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹214 Cr 1,740,091 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO3% ₹208 Cr 457,106

↓ -30,684 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹207 Cr 7,547,700 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹202 Cr 1,558,301 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹196 Cr 1,609,486 2. ICICI Prudential Technology Fund

CAGR/Annualized return of 12.8% since its launch. Ranked 37 in Sectoral category. Return for 2024 was 25.4% , 2023 was 27.5% and 2022 was -23.2% . ICICI Prudential Technology Fund

Growth Launch Date 3 Mar 00 NAV (20 Feb 25) ₹202.18 ↑ 0.20 (0.10 %) Net Assets (Cr) ₹14,101 on 31 Jan 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk High Expense Ratio 1.96 Sharpe Ratio 0.63 Information Ratio 0.21 Alpha Ratio 0.86 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹16,325 31 Jan 22 ₹25,971 31 Jan 23 ₹22,408 31 Jan 24 ₹29,166 31 Jan 25 ₹34,454 Returns for ICICI Prudential Technology Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -3.6% 3 Month -1.6% 6 Month -2% 1 Year 11.5% 3 Year 9.7% 5 Year 26.7% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.4% 2022 27.5% 2021 -23.2% 2020 75.7% 2019 70.6% 2018 2.3% 2017 19.1% 2016 19.8% 2015 -4% 2014 3.9% Fund Manager information for ICICI Prudential Technology Fund

Name Since Tenure Vaibhav Dusad 2 May 20 4.76 Yr. Sharmila D’mello 30 Jun 22 2.59 Yr. Data below for ICICI Prudential Technology Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Technology 71.4% Communication Services 16.22% Consumer Cyclical 4.97% Industrials 2.81% Health Care 0.69% Financial Services 0.5% Consumer Defensive 0.2% Asset Allocation

Asset Class Value Cash 2.98% Equity 97.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity Infosys Ltd (Technology)

Equity, Since 30 Apr 08 | INFY22% ₹3,152 Cr 16,768,086 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Sep 19 | TCS12% ₹1,742 Cr 4,254,724

↑ 270,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 20 | BHARTIARTL8% ₹1,167 Cr 7,348,806

↑ 200,000 LTIMindtree Ltd (Technology)

Equity, Since 31 Jul 16 | LTIM6% ₹847 Cr 1,515,919

↑ 207,126 HCL Technologies Ltd (Technology)

Equity, Since 30 Sep 20 | HCLTECH5% ₹721 Cr 3,758,139

↑ 108,689 Tech Mahindra Ltd (Technology)

Equity, Since 31 Oct 16 | 5327555% ₹713 Cr 4,176,250

↑ 391,032 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 31 Oct 21 | 8901574% ₹547 Cr 4,645,340 Wipro Ltd (Technology)

Equity, Since 30 Sep 19 | 5076853% ₹452 Cr 14,965,117

↑ 242,399 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 22 | 5433203% ₹402 Cr 14,473,026

↓ -1,085,383 Persistent Systems Ltd (Technology)

Equity, Since 31 May 20 | PERSISTENT2% ₹344 Cr 532,687

↓ -17,707 3. IDFC Infrastructure Fund

CAGR/Annualized return of 11.1% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (21 Feb 25) ₹43.411 ↓ -0.19 (-0.43 %) Net Assets (Cr) ₹1,641 on 31 Jan 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 0.49 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,449 31 Jan 22 ₹16,786 31 Jan 23 ₹16,915 31 Jan 24 ₹28,172 31 Jan 25 ₹32,572 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -10.5% 3 Month -12.2% 6 Month -22.6% 1 Year 4.5% 3 Year 23.8% 5 Year 25.3% 10 Year 15 Year Since launch 11.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 39.3% 2022 50.3% 2021 1.7% 2020 64.8% 2019 6.3% 2018 -5.3% 2017 -25.9% 2016 58.7% 2015 10.7% 2014 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.02 Yr. Ritika Behera 7 Oct 23 1.32 Yr. Gaurav Satra 7 Jun 24 0.65 Yr. Data below for IDFC Infrastructure Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 58.01% Utility 12.35% Basic Materials 8.64% Technology 4.18% Communication Services 3.82% Financial Services 3.21% Energy 3.07% Consumer Cyclical 2.58% Health Care 1.77% Asset Allocation

Asset Class Value Cash 2.38% Equity 97.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹92 Cr 443,385 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA4% ₹68 Cr 4,797,143 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT3% ₹62 Cr 171,447 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹57 Cr 475,362 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE3% ₹55 Cr 452,706 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325383% ₹54 Cr 46,976 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹54 Cr 434,979 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹53 Cr 12,400,122 H.G. Infra Engineering Ltd Ordinary Shares (Industrials)

Equity, Since 28 Feb 18 | HGINFRA3% ₹49 Cr 321,984 Ahluwalia Contracts (India) Ltd (Industrials)

Equity, Since 30 Apr 15 | AHLUCONT3% ₹48 Cr 470,125 4. Nippon India Power and Infra Fund

CAGR/Annualized return of 17.8% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (21 Feb 25) ₹300.021 ↓ -0.95 (-0.32 %) Net Assets (Cr) ₹7,001 on 31 Jan 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio 0.29 Information Ratio 1.18 Alpha Ratio 3.79 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,728 31 Jan 22 ₹16,044 31 Jan 23 ₹17,651 31 Jan 24 ₹29,963 31 Jan 25 ₹33,188 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -8.5% 3 Month -10.7% 6 Month -18.8% 1 Year 0.2% 3 Year 27.1% 5 Year 25.3% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% 2014 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.7 Yr. Rahul Modi 19 Aug 24 0.45 Yr. Data below for Nippon India Power and Infra Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 44.95% Utility 15.89% Basic Materials 10.1% Communication Services 7.08% Energy 6.43% Consumer Cyclical 3.98% Real Estate 3.78% Technology 2.94% Health Care 2.45% Financial Services 1.62% Asset Allocation

Asset Class Value Cash 0.77% Equity 99.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹612 Cr 1,697,001

↓ -302,999 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325556% ₹467 Cr 13,999,999

↑ 999,999 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE6% ₹431 Cr 3,550,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL6% ₹413 Cr 2,600,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES5% ₹365 Cr 492,204 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹309 Cr 270,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV3% ₹230 Cr 1,800,000 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹229 Cr 350,000 Cyient DLM Ltd (Technology)

Equity, Since 31 Jul 23 | CYIENTDLM3% ₹209 Cr 3,114,722 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 May 23 | 5329293% ₹199 Cr 1,600,000 5. ICICI Prudential Dividend Yield Equity Fund

CAGR/Annualized return of 15.5% since its launch. Ranked 38 in Dividend Yield category. Return for 2024 was 21% , 2023 was 38.8% and 2022 was 9.2% . ICICI Prudential Dividend Yield Equity Fund

Growth Launch Date 16 May 14 NAV (21 Feb 25) ₹47.42 ↓ -0.21 (-0.44 %) Net Assets (Cr) ₹4,835 on 31 Jan 25 Category Equity - Dividend Yield AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.41 Sharpe Ratio 0.65 Information Ratio 1.45 Alpha Ratio 4.75 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹11,169 31 Jan 22 ₹17,140 31 Jan 23 ₹18,385 31 Jan 24 ₹26,656 31 Jan 25 ₹30,654 Returns for ICICI Prudential Dividend Yield Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -1.5% 3 Month -2.6% 6 Month -8.8% 1 Year 7.2% 3 Year 21% 5 Year 25.2% 10 Year 15 Year Since launch 15.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 21% 2022 38.8% 2021 9.2% 2020 47.1% 2019 14.1% 2018 -2.9% 2017 -11.9% 2016 40.7% 2015 9.7% 2014 -5.2% Fund Manager information for ICICI Prudential Dividend Yield Equity Fund

Name Since Tenure Mittul Kalawadia 29 Jan 18 7.01 Yr. Sharmila D’mello 31 Jul 22 2.51 Yr. Data below for ICICI Prudential Dividend Yield Equity Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Financial Services 29.96% Consumer Cyclical 10.06% Energy 9.03% Consumer Defensive 8% Utility 7.35% Health Care 7.02% Industrials 6.57% Basic Materials 5.59% Technology 5% Communication Services 4.73% Real Estate 1.54% Asset Allocation

Asset Class Value Cash 3.06% Equity 94.85% Debt 1.77% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK8% ₹394 Cr 2,222,624 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | ICICIBANK8% ₹372 Cr 2,905,184 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 30 Apr 21 | SUNPHARMA7% ₹335 Cr 1,774,051 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jan 22 | MARUTI7% ₹311 Cr 286,610 NTPC Ltd (Utilities)

Equity, Since 31 Oct 16 | 5325556% ₹273 Cr 8,201,022 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 20 | BHARTIARTL4% ₹208 Cr 1,312,548

↑ 250,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Dec 21 | 5003124% ₹194 Cr 8,094,802 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322154% ₹173 Cr 1,621,099 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Aug 21 | LT3% ₹154 Cr 428,013 Britannia Industries Ltd (Consumer Defensive)

Equity, Since 31 Jul 23 | 5008252% ₹105 Cr 219,613 6. L&T Emerging Businesses Fund

CAGR/Annualized return of 20% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (21 Feb 25) ₹71.6233 ↓ -0.47 (-0.65 %) Net Assets (Cr) ₹17,386 on 31 Dec 24 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio 1.32 Information Ratio 0.19 Alpha Ratio 3.87 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹11,113 31 Jan 22 ₹19,683 31 Jan 23 ₹19,960 31 Jan 24 ₹30,763 31 Jan 25 ₹33,089 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -11.5% 3 Month -14.4% 6 Month -17.2% 1 Year -0.3% 3 Year 18.4% 5 Year 25.2% 10 Year 15 Year Since launch 20% Historical performance (Yearly) on absolute basis

Year Returns 2023 28.5% 2022 46.1% 2021 1% 2020 77.4% 2019 15.5% 2018 -8.1% 2017 -13.7% 2016 66.5% 2015 10.2% 2014 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.13 Yr. Cheenu Gupta 1 Oct 23 1.34 Yr. Sonal Gupta 1 Oct 23 1.34 Yr. Data below for L&T Emerging Businesses Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 30.48% Consumer Cyclical 16.51% Financial Services 14.26% Technology 10.64% Basic Materials 10.36% Real Estate 5.3% Health Care 4.2% Consumer Defensive 3.21% Energy 1.5% Asset Allocation

Asset Class Value Cash 1.16% Equity 98.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS3% ₹470 Cr 455,400 BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE3% ₹454 Cr 852,600

↓ -31,900 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Jul 20 | DIXON2% ₹427 Cr 238,273 Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹410 Cr 299,000

↑ 17,978 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹403 Cr 1,607,279 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Jan 19 | TECHNOE2% ₹388 Cr 2,473,042 Kirloskar Pneumatic Co Ltd (Industrials)

Equity, Since 31 Aug 22 | 5052832% ₹376 Cr 2,444,924 KFin Technologies Ltd (Technology)

Equity, Since 31 Aug 24 | KFINTECH2% ₹374 Cr 2,429,736

↑ 139,336 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Jan 17 | 5002512% ₹338 Cr 474,400

↓ -63,150 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹336 Cr 6,810,500

↑ 656,671 7. TATA Digital India Fund

CAGR/Annualized return of 19% since its launch. Return for 2024 was 30.6% , 2023 was 31.9% and 2022 was -23.3% . TATA Digital India Fund

Growth Launch Date 28 Dec 15 NAV (21 Feb 25) ₹49.1539 ↓ -0.41 (-0.83 %) Net Assets (Cr) ₹12,465 on 31 Jan 25 Category Equity - Sectoral AMC Tata Asset Management Limited Rating Risk High Expense Ratio 0 Sharpe Ratio 0.68 Information Ratio 0.44 Alpha Ratio 2.22 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-3 Months (0.25%),3 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹15,254 31 Jan 22 ₹23,775 31 Jan 23 ₹20,584 31 Jan 24 ₹27,482 31 Jan 25 ₹32,904 Returns for TATA Digital India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -3.6% 3 Month -4.8% 6 Month -4.1% 1 Year 12.9% 3 Year 10.9% 5 Year 25% 10 Year 15 Year Since launch 19% Historical performance (Yearly) on absolute basis

Year Returns 2023 30.6% 2022 31.9% 2021 -23.3% 2020 74.4% 2019 54.8% 2018 7.5% 2017 24.9% 2016 19.6% 2015 -6% 2014 Fund Manager information for TATA Digital India Fund

Name Since Tenure Meeta Shetty 9 Mar 21 3.9 Yr. Kapil Malhotra 19 Dec 23 1.12 Yr. Data below for TATA Digital India Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Technology 74.43% Consumer Cyclical 7.89% Industrials 4.94% Communication Services 4.21% Financial Services 3.86% Asset Allocation

Asset Class Value Cash 4.67% Equity 95.33% Top Securities Holdings / Portfolio

Name Holding Value Quantity Infosys Ltd (Technology)

Equity, Since 31 Jan 16 | INFY17% ₹2,168 Cr 11,530,857 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Jan 16 | TCS11% ₹1,485 Cr 3,626,873 Tech Mahindra Ltd (Technology)

Equity, Since 30 Apr 16 | 5327559% ₹1,219 Cr 7,145,933 Wipro Ltd (Technology)

Equity, Since 31 Jul 18 | 5076858% ₹990 Cr 32,787,324 HCL Technologies Ltd (Technology)

Equity, Since 31 Jan 16 | HCLTECH7% ₹956 Cr 4,983,886 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Oct 22 | 5433206% ₹808 Cr 29,067,000 LTIMindtree Ltd (Technology)

Equity, Since 28 Feb 21 | LTIM4% ₹552 Cr 988,062 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 16 | PERSISTENT4% ₹490 Cr 759,192 Firstsource Solutions Ltd (Technology)

Equity, Since 30 Nov 21 | FSL3% ₹381 Cr 10,123,112 Sonata Software Ltd (Technology)

Equity, Since 30 Jun 23 | SONATSOFTW2% ₹307 Cr 5,125,514 8. BOI AXA Manufacturing and Infrastructure Fund

CAGR/Annualized return of 11.2% since its launch. Return for 2024 was 25.7% , 2023 was 44.7% and 2022 was 3.3% . BOI AXA Manufacturing and Infrastructure Fund

Growth Launch Date 5 Mar 10 NAV (21 Feb 25) ₹48.75 ↓ -0.27 (-0.55 %) Net Assets (Cr) ₹524 on 31 Jan 25 Category Equity - Sectoral AMC BOI AXA Investment Mngrs Private Ltd Rating Risk High Expense Ratio 2.57 Sharpe Ratio 0.5 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,210 31 Jan 22 ₹18,356 31 Jan 23 ₹18,974 31 Jan 24 ₹29,005 31 Jan 25 ₹33,073 Returns for BOI AXA Manufacturing and Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -8.5% 3 Month -9.6% 6 Month -17.3% 1 Year 3.8% 3 Year 20.9% 5 Year 24.7% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.7% 2022 44.7% 2021 3.3% 2020 52.5% 2019 28.1% 2018 2.5% 2017 -22.8% 2016 56% 2015 1% 2014 0.3% Fund Manager information for BOI AXA Manufacturing and Infrastructure Fund

Name Since Tenure Nitin Gosar 27 Sep 22 2.35 Yr. Data below for BOI AXA Manufacturing and Infrastructure Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 28.83% Basic Materials 21.97% Consumer Cyclical 12.11% Utility 6.41% Health Care 5.61% Energy 5.16% Communication Services 4.47% Technology 4.11% Consumer Defensive 3.88% Real Estate 3% Asset Allocation

Asset Class Value Cash 4.46% Equity 95.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT7% ₹35 Cr 97,169

↑ 21,367 NTPC Ltd (Utilities)

Equity, Since 31 May 21 | 5325555% ₹26 Cr 773,906 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 24 | 5002954% ₹22 Cr 487,680

↑ 10,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE3% ₹18 Cr 150,806 Manorama Industries Ltd (Consumer Defensive)

Equity, Since 31 May 24 | 5419743% ₹15 Cr 137,935 Swan Energy Ltd (Industrials)

Equity, Since 31 Dec 23 | SWANENERGY2% ₹13 Cr 178,821

↑ 19,195 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Jan 24 | 5348162% ₹13 Cr 375,411 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS2% ₹12 Cr 84,903 Sterling and Wilson Renewable Energy Ltd (Technology)

Equity, Since 31 Mar 24 | SWSOLAR2% ₹11 Cr 244,992 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 22 | BHARTIARTL2% ₹11 Cr 70,260

↑ 42,631 9. Franklin India Opportunities Fund

CAGR/Annualized return of 13.2% since its launch. Ranked 47 in Sectoral category. Return for 2024 was 37.3% , 2023 was 53.6% and 2022 was -1.9% . Franklin India Opportunities Fund

Growth Launch Date 21 Feb 00 NAV (21 Feb 25) ₹222.362 ↓ -1.77 (-0.79 %) Net Assets (Cr) ₹5,948 on 31 Jan 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.12 Sharpe Ratio 0.94 Information Ratio 1.44 Alpha Ratio 10.74 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,591 31 Jan 22 ₹15,887 31 Jan 23 ₹15,681 31 Jan 24 ₹26,031 31 Jan 25 ₹31,795 Returns for Franklin India Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -6.2% 3 Month -6.8% 6 Month -12.2% 1 Year 12.8% 3 Year 25% 5 Year 24.6% 10 Year 15 Year Since launch 13.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 37.3% 2022 53.6% 2021 -1.9% 2020 29.7% 2019 27.3% 2018 5.4% 2017 -10.1% 2016 35.6% 2015 4.2% 2014 2.3% Fund Manager information for Franklin India Opportunities Fund

Name Since Tenure Kiran Sebastian 7 Feb 22 2.99 Yr. R. Janakiraman 1 Apr 13 11.85 Yr. Sandeep Manam 18 Oct 21 3.29 Yr. Data below for Franklin India Opportunities Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Consumer Cyclical 19.42% Health Care 13.81% Financial Services 11.43% Industrials 10.29% Communication Services 10.06% Technology 7.7% Basic Materials 5.08% Consumer Defensive 3.31% Real Estate 2.83% Energy 2.22% Utility 1.96% Asset Allocation

Asset Class Value Cash 10.36% Equity 89.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL3% ₹213 Cr 1,342,233 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹211 Cr 7,590,491 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 24 | M&M3% ₹192 Cr 637,966 HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 24 | HDFCBANK3% ₹188 Cr 1,058,931

↓ -500,163 Info Edge (India) Ltd (Communication Services)

Equity, Since 31 Jul 24 | NAUKRI3% ₹188 Cr 216,138 PB Fintech Ltd (Financial Services)

Equity, Since 30 Nov 21 | 5433903% ₹176 Cr 833,638 Lemon Tree Hotels Ltd (Consumer Cyclical)

Equity, Since 31 Aug 24 | LEMONTREE3% ₹168 Cr 10,951,216 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Aug 23 | ASTERDM3% ₹157 Cr 3,049,105 APL Apollo Tubes Ltd (Basic Materials)

Equity, Since 31 Oct 24 | APLAPOLLO3% ₹154 Cr 981,985

↑ 448,634 Sudarshan Chemical Industries Ltd (Basic Materials)

Equity, Since 30 Apr 24 | SUDARSCHEM2% ₹149 Cr 1,303,298 10. Franklin Build India Fund

CAGR/Annualized return of 17.6% since its launch. Ranked 4 in Sectoral category. Return for 2024 was 27.8% , 2023 was 51.1% and 2022 was 11.2% . Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (21 Feb 25) ₹123.049 ↓ -0.36 (-0.29 %) Net Assets (Cr) ₹2,659 on 31 Jan 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.13 Sharpe Ratio 0.47 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,683 31 Jan 22 ₹15,739 31 Jan 23 ₹16,876 31 Jan 24 ₹27,633 31 Jan 25 ₹31,246 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -6.2% 3 Month -9.3% 6 Month -15% 1 Year 2.9% 3 Year 25.3% 5 Year 24.5% 10 Year 15 Year Since launch 17.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% 2014 2.1% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 3.29 Yr. Kiran Sebastian 7 Feb 22 2.99 Yr. Sandeep Manam 18 Oct 21 3.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 38.96% Financial Services 13.52% Energy 9.34% Utility 8.44% Communication Services 7.08% Basic Materials 6.8% Consumer Cyclical 3.9% Real Estate 3.36% Technology 2.72% Asset Allocation

Asset Class Value Cash 5.88% Equity 94.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹260 Cr 720,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | ICICIBANK6% ₹154 Cr 1,200,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325555% ₹131 Cr 3,930,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL4% ₹113 Cr 710,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003124% ₹108 Cr 4,500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO4% ₹107 Cr 235,000

↑ 102,500 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE4% ₹107 Cr 880,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 21 | 5328984% ₹104 Cr 3,365,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322153% ₹96 Cr 900,000 KEI Industries Ltd (Industrials)

Equity, Since 31 Dec 15 | KEI3% ₹89 Cr 200,000 11. SBI Healthcare Opportunities Fund

CAGR/Annualized return of 15.4% since its launch. Ranked 34 in Sectoral category. Return for 2024 was 42.2% , 2023 was 38.2% and 2022 was -6% . SBI Healthcare Opportunities Fund

Growth Launch Date 31 Dec 04 NAV (20 Feb 25) ₹396.896 ↑ 1.55 (0.39 %) Net Assets (Cr) ₹3,522 on 31 Jan 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.09 Sharpe Ratio 1.36 Information Ratio 0.67 Alpha Ratio 4.66 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-15 Days (0.5%),15 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹15,535 31 Jan 22 ₹17,594 31 Jan 23 ₹17,709 31 Jan 24 ₹26,160 31 Jan 25 ₹33,176 Returns for SBI Healthcare Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Feb 25 Duration Returns 1 Month -5.5% 3 Month -3.7% 6 Month 0.5% 1 Year 14.2% 3 Year 22.5% 5 Year 24.4% 10 Year 15 Year Since launch 15.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 42.2% 2022 38.2% 2021 -6% 2020 20.1% 2019 65.8% 2018 -0.5% 2017 -9.9% 2016 2.1% 2015 -14% 2014 27.1% Fund Manager information for SBI Healthcare Opportunities Fund

Name Since Tenure Tanmaya Desai 1 Jun 11 13.68 Yr. Pradeep Kesavan 31 Dec 23 1.09 Yr. Data below for SBI Healthcare Opportunities Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Health Care 90.04% Basic Materials 6.53% Asset Allocation

Asset Class Value Cash 3.35% Equity 96.57% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 17 | SUNPHARMA13% ₹472 Cr 2,500,000 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 21 | MAXHEALTH6% ₹226 Cr 2,000,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB6% ₹220 Cr 360,000 Cipla Ltd (Healthcare)

Equity, Since 31 Aug 16 | 5000876% ₹214 Cr 1,400,000

↑ 120,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 23 | 5002575% ₹188 Cr 800,000 Lonza Group Ltd ADR (Healthcare)

Equity, Since 31 Jan 24 | LZAGY4% ₹151 Cr 300,000 Mankind Pharma Ltd (Healthcare)

Equity, Since 30 Apr 23 | MANKIND4% ₹151 Cr 523,016

↑ 123,016 Poly Medicure Ltd (Healthcare)

Equity, Since 31 Aug 24 | POLYMED4% ₹131 Cr 500,000 Krishna Institute of Medical Sciences Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5433083% ₹126 Cr 2,100,000

↓ -100,000 Jupiter Life Line Hospitals Ltd (Healthcare)

Equity, Since 31 Aug 23 | JLHL3% ₹125 Cr 800,000

↓ -32,871

गुंतवणूकदारांना त्यांच्या आवडीच्या SIP योजनांमध्ये गुंतवणूक करण्याचे सुचवले जाते. वर नमूद केलेले शीर्ष 11 म्युच्युअल फंड सर्व प्रकारच्या गुंतवणूकदारांसाठी योग्य आहेत. तर, एकतर तुम्ही उच्च-जोखीम आहातगुंतवणूकदार किंवा तुलनेने कमी, हे SIP फंड आहेतगुंतवणुकीसाठी सर्वोत्तम म्युच्युअल फंड. म्हणून, प्रतीक्षा करू नका, आता गुंतवणूक करा!

सर्वोत्कृष्ट पद्धतशीर गुंतवणूक योजनांमध्ये गुंतवणूक करताना विचारात घ्यायचे पॅरामीटर्स

सर्वोत्तम कामगिरी करणाऱ्या SIP फंडांचे मूल्यमापन करण्यासाठी, गुंतवणुकीपूर्वी कोणते घटक विचारात घेतले पाहिजेत ते जाणून घेऊया.

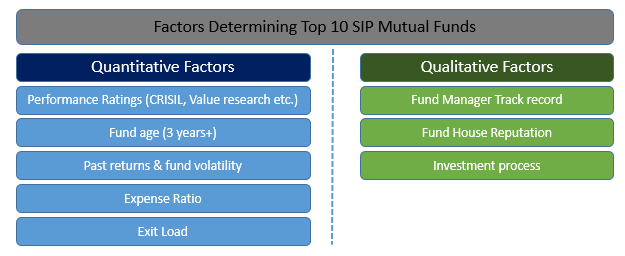

शीर्ष SIP मध्ये गुंतवणूक करण्यासाठी परिमाणात्मक घटक

SIP द्वारे गुंतवणूक करण्यापूर्वी ज्या परिमाणात्मक घटकांचा विचार केला पाहिजे त्यात कामगिरी रेटिंग (क्रिसिल, व्हॅल्यू रिसर्च इ. नुसार), फंड वय, मागील परतावा आणि निधीची अस्थिरता, खर्चाचे प्रमाण आणि एक्झिट लोड यांचा समावेश होतो.

शीर्ष SIP मध्ये गुंतवणूक करण्यासाठी गुणात्मक घटक

विश्लेषणासाठी गुणात्मक मुख्य आकडेवारीमध्ये फंड व्यवस्थापकाचा ट्रॅक रेकॉर्ड, फंड हाउसची प्रतिष्ठा आणि SIP फंडाची गुंतवणूक प्रक्रिया यांचा समावेश होतो.

SIP MF मध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

आजच SIP सह तुमचा गुंतवणूक प्रवास सुरू करा!

वारंवार विचारले जाणारे प्रश्न

1. म्युच्युअल फंड म्हणजे काय?

अ: म्युच्युअल फंड हे सिस्टिमॅटिक इन्व्हेस्टमेंट प्लॅन किंवा SIP चा एक भाग आहेत जे सहसा नंतर उत्कृष्ट परतावा देतात. जेव्हा आपणम्युच्युअल फंडात गुंतवणूक करा, तुम्ही तुमच्या गुंतवणूक पोर्टफोलिओमध्ये विविधता आणता. म्युच्युअल फंड हे गुंतवणुकीचे साधन मानले जाऊ शकतेमालमत्ता व्यवस्थापन कंपनी एकाधिक गुंतवणूकदार आणि कंपन्यांच्या गुंतवणुकीमध्ये एकत्र करून.

2. म्युच्युअल फंडाचे विविध प्रकार कोणते आहेत?

अ: म्युच्युअल फंडांचे स्थूलमानाने खालील प्रकारांमध्ये वर्गीकरण करता येते:

- इक्विटी किंवा ग्रोथ फंड

- निश्चित उत्पन्न निधी किंवाकर्ज निधी

- कर बचत निधी

- लिक्विड फंड

- संतुलित निधी

- गिल्ट फंड

- एक्सचेंज-ट्रेडेड फंड किंवाईटीएफ

3. ग्रोथ इक्विटी फंड म्हणजे काय?

अ: वाढइक्विटी फंड सर्वात सामान्य म्युच्युअल फंड आहेत. तथापि, या पोर्टफोलिओमध्ये अस्थिर गुंतवणुकीचा समावेश असेल. असे असले तरी, गुंतवणूकदार अनेकदा ग्रोथ इक्विटी फंडांना प्राधान्य देतात कारण यामध्ये जास्त परतावा असतो आणि कमी कालावधीसाठी गुंतवणूक करता येते.

4. तुम्ही डेट फंडात गुंतवणूक का करावी?

अ: गुंतवणुकीवर निश्चित परतावा शोधणाऱ्या व्यक्तींसाठी ही गुंतवणूक आदर्श आहे. डिबेंचर्स, डेट सिक्युरिटीज, कमर्शियल पेपर्स आणि सरकारी सिक्युरिटीजमधून निश्चित उत्पन्न मिळवता येते. म्युच्युअल फंड विविध प्रकारच्या गुंतवणुकीचा पोर्टफोलिओ तयार करतात आणि जोखीम नष्ट करतात.

5. तुम्ही SIP मध्ये गुंतवणूक का करावी?

अ: एसआयपी गुंतवणूकदाराला खात्रीशीर उत्पन्न देऊ शकतात. जर तुम्हाला निष्क्रिय उत्पन्न मिळवण्यात स्वारस्य असेल आणि तुमच्या गुंतवणुकीत नियमित उत्पन्न मिळेल याची खात्री करायची असेल, तर तुम्ही SIP मध्ये गुंतवणूक करण्याचा विचार करू शकता. .

6. कर बचत म्युच्युअल फंडात गुंतवणूक का करावी?

अ: जर तुम्ही तुमची वाढ करू इच्छित असालभांडवल आणि त्याच वेळी कर सवलतींचा आनंद घ्यायचा असेल, तर तुम्ही कर बचत म्युच्युअल फंडात गुंतवणूक करू शकता. अंतर्गतकलम 80C याआयकर 1861 चा कायदा, जर तुम्ही इक्विटी-लिंक्ड टॅक्स सेव्हिंग म्युच्युअल फंडांमध्ये गुंतवणूक केली तर तुम्ही तुमच्या गुंतवणुकीवर कर सवलत मिळवू शकता.

7. म्युच्युअल फंडात गुंतवणूक करण्यासाठी मला ब्रोकरची गरज आहे का?

अ: गुंतवणुकीत मदत करण्यासाठी तुम्हाला ब्रोकर किंवा वित्तीय संस्थेचा पाठिंबा आवश्यक असेल. योग्य एसआयपी ओळखण्यासाठी आणि गुंतवणूक योग्यरित्या केली गेली आहे याची खात्री करण्यासाठी तुम्हाला समर्थनाची आवश्यकता असेल.

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.