+91-22-48913909

+91-22-48913909

Table of Contents

Life Time Free Mutual Funds Investment Account

Welcome to the World of Fincash.com!

First of all, we would like to thank you for choosing us as your Mutual Fund investment channel.

Are you a beginner? Are you a seasoned investor? Don’t worry, all your needs will be catered. Be Rest Assured as we are always there to guide you at every step whether related to investments, product selection, registration or any other query. So, let’s move ahead to have a better understanding of the features of the Life Time Free Mutual Funds Investment Account along with the registration process.

Talk to our investment specialist

Why Fincash.com Investment Account?

Fincash.com always believes in “Customer First” policy. We always ensure to provide top-notch customer service by keeping in mind the client’s requirements and how effectively it can be fulfilled. Our aim is to create value for your money so that you can achieve your goals within the timeframe. Some of the investor-friendly features of Fincash.com include:

- User-friendly website so that you get maximum information in minimum clicks

- Lifetime Active & Free Account where investors need not pay any money even if they don’t transact.

- Easy Registration Process where people need not spend much time.

- KYC Compliance which can be done within our framework through eKYC and is indeed helpful for first-timers.

- Safety & Security are always on our priority where; we ensure that client’s data and all their transactions both are kept confidential.

- Wide Range of Schemes which people can choose as per their requirements.

- Customized Solutions of Fincash.com that helps investors to ease out their product selection process under the categories of ELSS, SIPs, and Tax Saving Scheme.

Registration Process for Fincash.com

Well, the registration process to open your Life Time Free Mutual Fund Investment Account is quite simple. To complete your registration, you require:

- An active mobile number

- PAN number

- Aadhar Number

- Scanned Copy/Image of personalized cancelled cheque, Bank statement, Front Page of Passbook

- Scanned Copy/Image of your Signature

let us look at the registration process:

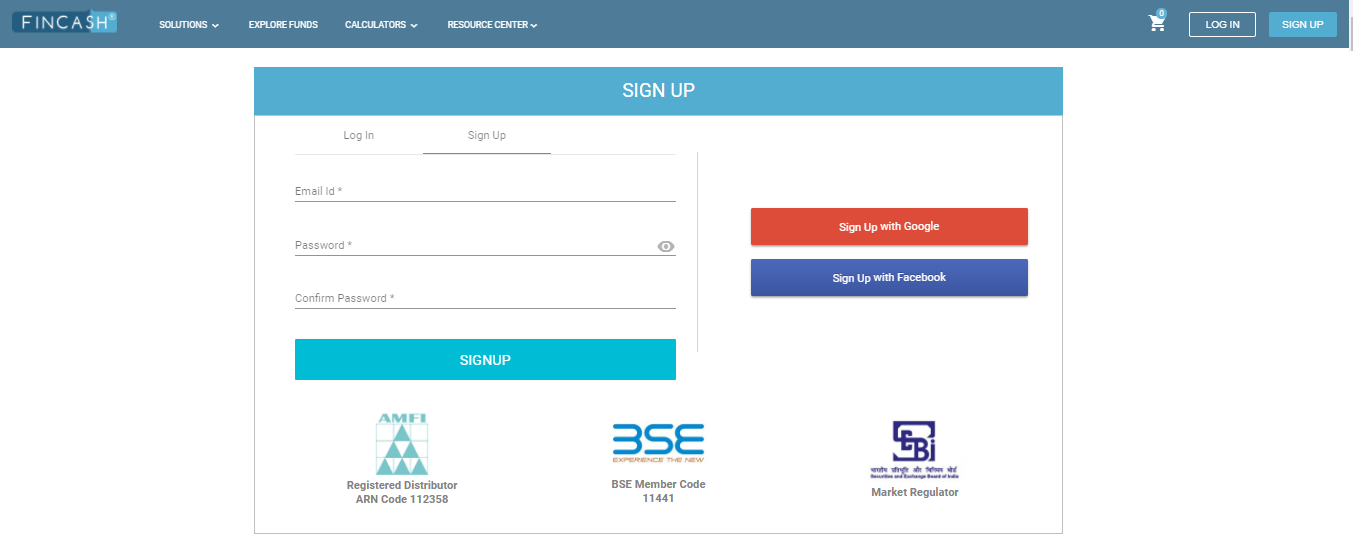

Step 1: Create Your Login

The First step begins with creating your login. To create your login id, first you need to visit the website of www.fincash.com and click on the SIGN UP button on the top right side of the screen After clicking on this button, you need to enter your email address and password. This login id will be used by you whenever while transacting. So, be sure that you give your correct and valid email address. You can even do social signup using Facebook or Gmail id. The image showing the login button tab and the login screen is shown below.

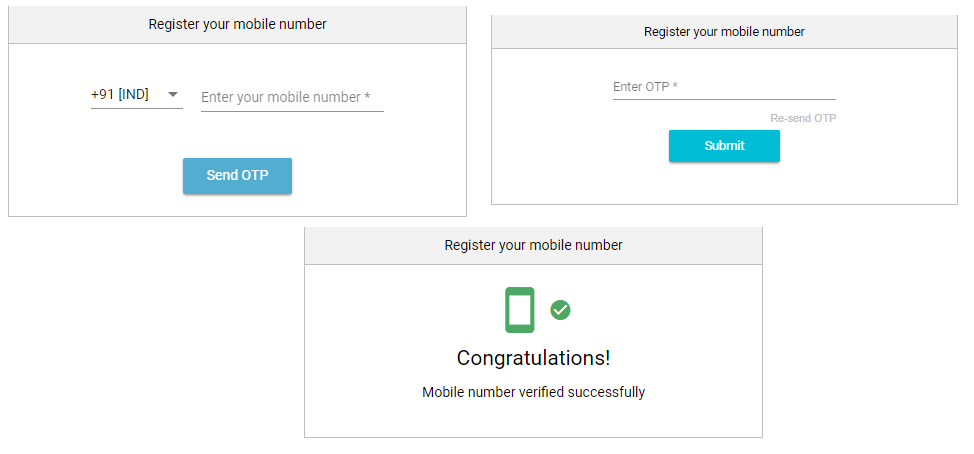

Step 2: Mobile Verification

After creating your login id, the next step deals with verification of mobile number. In other words, post creation of login id, the screen gets redirected to mobile number verification where people need to enter their mobile number. Upon entering the mobile number, they receive a One Time Password (OTP) through SMS which again needs to be entered on the screen. So, be careful that you enter your correct and active mobile number. Also, while entering the OTP, ensure that all the characters are entered correctly. The image for the second step is as follows.

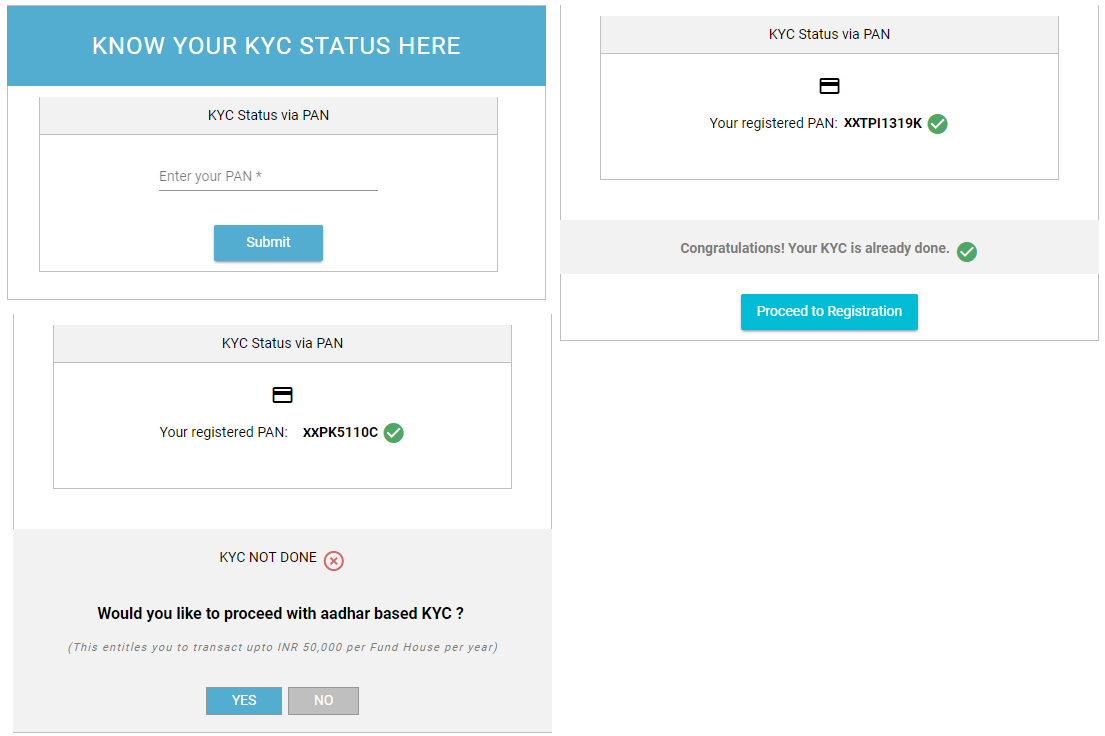

Step 3: PAN MF KYC Status Check

The Third step ensures that, whether you are a KYC compliant investor or not. MF KYC or Know-Your-Customer is a one-time process that you need to complete before Investing money in Mutual Funds. The KYC Status is verified using your PAN. If you have already completed your KYC process, then you will get a pop up for the same and can proceed with the registration process.

Step 4: Registration Form

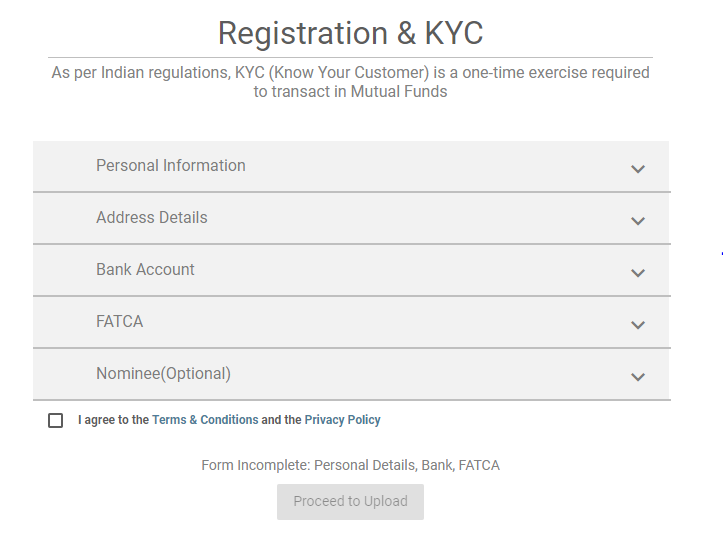

This process needs to be completed by all individuals. For registration purposes, you need to fill in the form, that is spread out into 5 different tabs. These tabs include personal information, address details, bank account, FATCA details, and nominee. By filling all the tabs and uploading the relevant documents, you complete the complete KYC process and can invest up to any amount in Mutual Funds. After filling all the details, you need to click on the check box, to proceed to the next step. The image showing the various tabs of registration form along with the check box is as shown below.

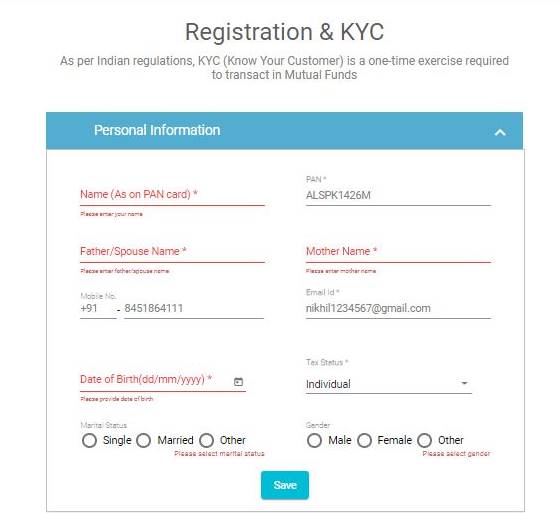

4:1- Fill Personal Information

When you click on the Personal Information option, you will have to fill details like

- Name (as on PAN Card)

- PAN number

- Father/Spouse name

- Mobile number

- Email address

- Date of Birth (DD/mm/yyyy format)

- Tax status (options in drop-down)

At the bottom if have to choose your martial status and gender. Click on the save button.

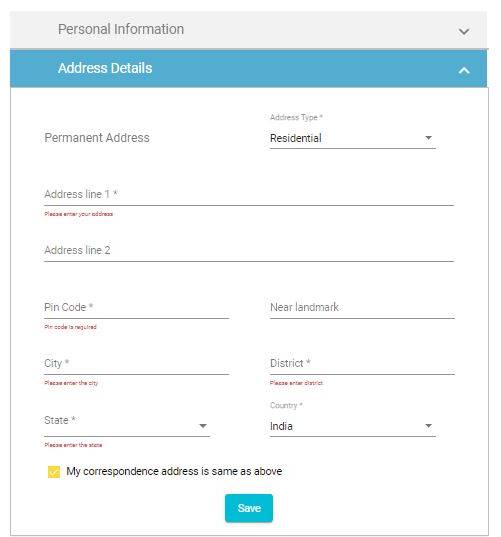

4:2- Fill Address Details

In the address details section, fill the following information:

- Address types (the options are given in the drop-down)

- Address details

- Pin code

- Landmark

- City

- District

- State

- Country

At the bottom, click on the yellow button and save the details.

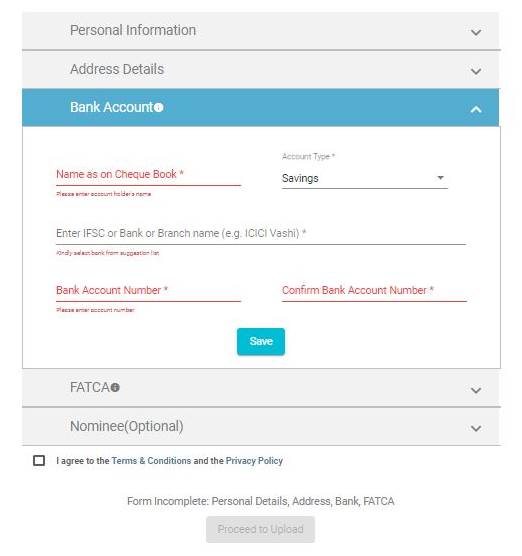

4:3- Bank Details

For registration, you need to fill your bank details like:

- Name (as on bank cheque)

- Account type (options in the drop-down)

- IFSC code

- Bank account number

- Confirm bank account number

Once you fill all the information, save the details.

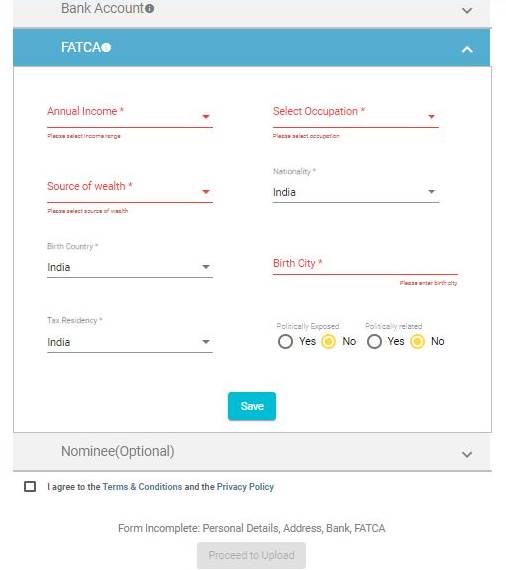

4:4- FATCA

In FATCA, following are the information to fill, there are drop-downs given:

- Annual Income

- Occupation

- Source of wealth

- Nationality

- Birth country

- Birth city

- Tax residency

At the bottom you need to select if you are politically exposed or politically related.

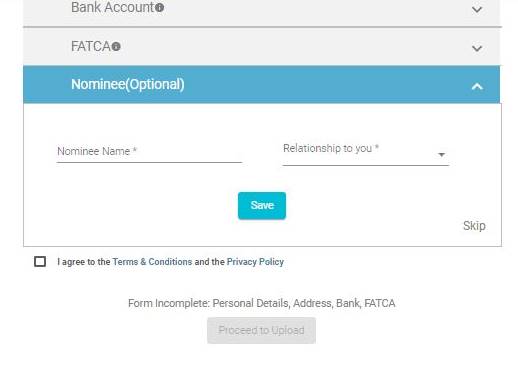

4:4- Nominee (Optional)

Adding nominee is optional. If you choose to fill, add the nominee name and choose the relation you share.

Once filled, accept the Terms & Conditions and proceed to upload documents.

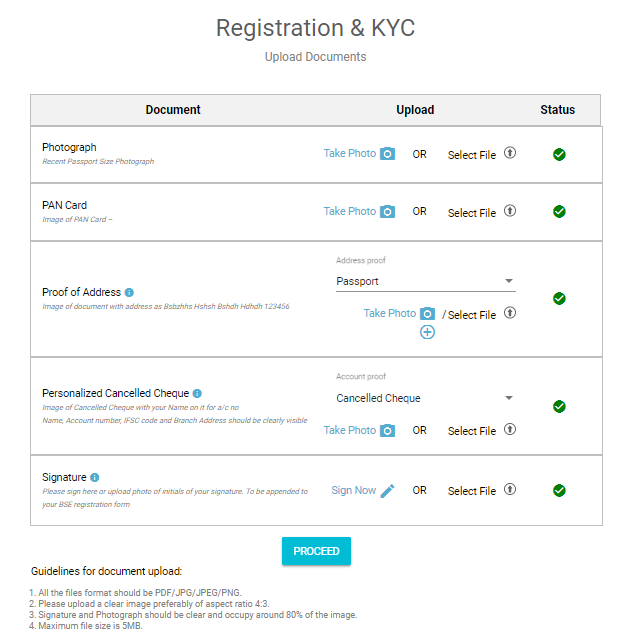

Step 5: Upload Documents

This is the final step in your registration process. If you have completed the KYC process, then you just need to upload:

- Scanned copy/Image of your signature and

- Scanned copy/Image of your personalized cheque.

However, if you have not completed the eKYC and you are not KYC compliant then along with the above-mentioned documents, you need to upload

- Photograph

- Scanned copy/Image of PAN card and

- Scanned copy/Image of Address Proof

In case of upload documents, the display of the screen is given below as follows.

Thus, we can see that the registration process is quite simple. Now the final part that is the customized solutions of Fincash.com. The USP of Fincash.com is its customized solutions that help in easing out the product selection process.

Fincash Solutions

These three solutions are for general investment need are :

SavingsPlus

This solution is suitable for people having idle money in their savings bank account and are looking for avenues to augment more income. savingsplus is a bundle of top three Liquid Fund schemes that offer more returns as compared to the Savings Account. Additionally, these funds are considered as a safe investment avenue. Some of the features of SavingsPlus are:

- Higher returns

- Instant Redemption

- No lock-in or exit load

- Invest and redeem in a click

SmartSIP

smartsip is a bundle of top three equity fund schemes that are considered to be stable and have earned good returns over a period of time. Its apt for people having long-term investment period. As the name suggests SIP, people can invest small amounts in this schemes to attain their objectives. The features of SmartSIP include:

- Pre-selected top 3 SIP schemes

- Schemes selected after an analysis of 20,000 schemes

- Earn healthy returns

TaxSaver

The third solution taxsaver is a bundle of two Equity Mutual Funds that give the advantages of investing and tax benefits. Through TaxSaver, people can claim a tax Deduction up to INR 1,50,000 under Section 80C of income tax Act, 1961 for a particular Financial Year. Being Tax Saving Investments, they have a lock-in period of three years. Their features include:

- Selected after analysis across ELSS category

- Pre-selected top 2 best Equity Linked Saving Schemes(ELSS)

- Save tax and earn healthy returns

Best Mutual Funds to Start Investments

Below is the list of best mutual funds once can invest having Net Assets/ AUM above 500 Crore.

The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. SBI PSU Fund is a Equity - Sectoral fund was launched on 7 Jul 10. It is a fund with High risk and has given a Below is the key information for SBI PSU Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Invesco India PSU Equity Fund is a Equity - Sectoral fund was launched on 18 Nov 09. It is a fund with High risk and has given a Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on The investment objective of Franklin India Opportunities Fund (FIOF) is to generate capital appreciation by capitalizing on the long-term growth opportunities in the Indian economy. Franklin India Opportunities Fund is a Equity - Sectoral fund was launched on 21 Feb 00. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Opportunities Fund Returns up to 1 year are on 1. SBI PSU Fund

CAGR/Annualized return of 7.6% since its launch. Ranked 31 in Sectoral category. Return for 2024 was 23.5% , 2023 was 54% and 2022 was 29% . SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (11 Apr 25) ₹29.2899 ↑ 0.57 (1.97 %) Net Assets (Cr) ₹4,149 on 28 Feb 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.3 Sharpe Ratio -0.57 Information Ratio -0.1 Alpha Ratio 3.02 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,883 31 Mar 22 ₹17,382 31 Mar 23 ₹19,831 31 Mar 24 ₹37,078 31 Mar 25 ₹39,285 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 5.4% 3 Month 0.4% 6 Month -11.2% 1 Year -3% 3 Year 27.2% 5 Year 29.9% 10 Year 15 Year Since launch 7.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% 2014 -11.1% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 0.75 Yr. Data below for SBI PSU Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 35.9% Utility 24.13% Energy 17.02% Industrials 10.67% Basic Materials 6.34% Asset Allocation

Asset Class Value Cash 5.81% Equity 94.07% Debt 0.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN14% ₹591 Cr 8,577,500 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹380 Cr 24,350,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328989% ₹380 Cr 15,135,554

↑ 950,000 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL8% ₹334 Cr 13,575,000

↑ 800,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹230 Cr 9,700,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹174 Cr 27,900,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325554% ₹170 Cr 5,443,244 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321344% ₹154 Cr 7,800,000 General Insurance Corp of India (Financial Services)

Equity, Since 31 May 24 | GICRE4% ₹153 Cr 4,150,000

↑ 550,000 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 24 | SBICARD3% ₹138 Cr 1,650,000 2. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (11 Apr 25) ₹42.756 ↑ 0.81 (1.94 %) Net Assets (Cr) ₹2,105 on 28 Feb 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,356 31 Mar 22 ₹21,727 31 Mar 23 ₹25,279 31 Mar 24 ₹45,346 31 Mar 25 ₹47,548 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 4.9% 3 Month -3.4% 6 Month -11.9% 1 Year -1.1% 3 Year 26% 5 Year 35.5% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% 2014 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.13 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 38.42% Financial Services 20.62% Basic Materials 10.93% Utility 7.4% Energy 6.96% Communication Services 3.76% Health Care 1.73% Technology 0.98% Real Estate 0.94% Consumer Cyclical 0.58% Asset Allocation

Asset Class Value Cash 6.48% Equity 92.31% Debt 1.21% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹157 Cr 1,300,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK6% ₹121 Cr 700,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT6% ₹120 Cr 380,000

↑ 30,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL5% ₹98 Cr 1,450,000

↓ -50,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹69 Cr 2,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹67 Cr 150,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL3% ₹67 Cr 758,285 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹63 Cr 1,700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹60 Cr 500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹55 Cr 350,000

↓ -50,000 3. Invesco India PSU Equity Fund

CAGR/Annualized return of 11.9% since its launch. Ranked 33 in Sectoral category. Return for 2024 was 25.6% , 2023 was 54.5% and 2022 was 20.5% . Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (11 Apr 25) ₹56.39 ↑ 1.07 (1.93 %) Net Assets (Cr) ₹1,047 on 28 Feb 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.39 Sharpe Ratio -0.67 Information Ratio -0.53 Alpha Ratio 0.52 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,149 31 Mar 22 ₹17,370 31 Mar 23 ₹19,711 31 Mar 24 ₹36,141 31 Mar 25 ₹37,811 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 6.9% 3 Month -1.3% 6 Month -13.8% 1 Year -2.4% 3 Year 25.7% 5 Year 28.3% 10 Year 15 Year Since launch 11.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% 2014 2.5% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Dhimant Kothari 19 May 20 4.79 Yr. Data below for Invesco India PSU Equity Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 27.81% Utility 24.59% Financial Services 21.69% Energy 18.38% Basic Materials 6.48% Asset Allocation

Asset Class Value Cash 1.06% Equity 98.94% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹96 Cr 3,894,619 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 22 | 5328989% ₹90 Cr 3,599,413 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN8% ₹86 Cr 1,251,543 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005478% ₹82 Cr 3,445,961 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5003126% ₹65 Cr 2,868,783 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL5% ₹54 Cr 175,355

↑ 22,180 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹52 Cr 5,911,723 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | 5325555% ₹49 Cr 1,570,631 National Aluminium Co Ltd (Basic Materials)

Equity, Since 31 Aug 24 | 5322344% ₹46 Cr 2,604,332 Hindustan Petroleum Corp Ltd (Energy)

Equity, Since 30 Nov 23 | HINDPETRO4% ₹46 Cr 1,564,169 4. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.6% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (11 Apr 25) ₹173.11 ↑ 3.09 (1.82 %) Net Assets (Cr) ₹6,886 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio -0.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 31 Mar 25 ₹54,540 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 2.9% 3 Month -3.3% 6 Month -11.8% 1 Year 0.4% 3 Year 25.5% 5 Year 38% 10 Year 15 Year Since launch 15.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% 2014 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 36.49% Basic Materials 21.39% Financial Services 16.91% Utility 8.65% Energy 7.09% Communication Services 1.63% Consumer Cyclical 0.89% Real Estate 0.35% Asset Allocation

Asset Class Value Cash 5.98% Equity 93.39% Debt 0.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹649 Cr 2,052,790

↑ 126,940 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹288 Cr 2,695,324 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹268 Cr 98,408

↓ -10,339 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹240 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹226 Cr 7,260,775 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹212 Cr 1,225,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹210 Cr 12,006,117

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹205 Cr 1,709,486

↑ 100,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹194 Cr 4,923,662

↑ 100,000 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004803% ₹173 Cr 635,000 5. Franklin India Opportunities Fund

CAGR/Annualized return of 13.2% since its launch. Ranked 47 in Sectoral category. Return for 2024 was 37.3% , 2023 was 53.6% and 2022 was -1.9% . Franklin India Opportunities Fund

Growth Launch Date 21 Feb 00 NAV (11 Apr 25) ₹224.029 ↑ 4.86 (2.22 %) Net Assets (Cr) ₹5,517 on 28 Feb 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.12 Sharpe Ratio 0.12 Information Ratio 1.45 Alpha Ratio 8.88 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,903 31 Mar 22 ₹21,132 31 Mar 23 ₹23,026 31 Mar 24 ₹37,539 31 Mar 25 ₹43,201 Returns for Franklin India Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 2.9% 3 Month -7.6% 6 Month -12% 1 Year 7.6% 3 Year 24.9% 5 Year 31.8% 10 Year 15 Year Since launch 13.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 37.3% 2022 53.6% 2021 -1.9% 2020 29.7% 2019 27.3% 2018 5.4% 2017 -10.1% 2016 35.6% 2015 4.2% 2014 2.3% Fund Manager information for Franklin India Opportunities Fund

Name Since Tenure Kiran Sebastian 7 Feb 22 3.06 Yr. R. Janakiraman 1 Apr 13 11.92 Yr. Sandeep Manam 18 Oct 21 3.37 Yr. Data below for Franklin India Opportunities Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Consumer Cyclical 19.47% Financial Services 13.37% Health Care 11.56% Communication Services 9.09% Basic Materials 8.49% Technology 7.97% Industrials 6.9% Energy 4.32% Consumer Defensive 3.74% Real Estate 2.22% Utility 1.37% Asset Allocation

Asset Class Value Cash 8.98% Equity 91.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 24 | HDFCBANK5% ₹301 Cr 1,735,296

↑ 676,365 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE4% ₹238 Cr 1,987,098 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL4% ₹211 Cr 1,342,233 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 24 | M&M3% ₹165 Cr 637,966 Mphasis Ltd (Technology)

Equity, Since 30 Nov 24 | 5262993% ₹160 Cr 710,533 Lemon Tree Hotels Ltd (Consumer Cyclical)

Equity, Since 31 Aug 24 | LEMONTREE3% ₹156 Cr 12,833,401 Info Edge (India) Ltd (Communication Services)

Equity, Since 31 Jul 24 | NAUKRI3% ₹151 Cr 216,138 APL Apollo Tubes Ltd (Basic Materials)

Equity, Since 31 Oct 24 | APLAPOLLO3% ₹144 Cr 998,385 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹142 Cr 6,398,413 CE Info Systems Ltd (Technology)

Equity, Since 31 Mar 24 | 5434253% ₹139 Cr 835,883

↑ 76,164

So, do you want to be a smart investor and make money? Register and invest with Fincash.com and create wealth for your future.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.