Table of Contents

- Overview on HDFC Internet Banking

- Features of HDFC Net Banking

- Benefits of Using HDFC Net Banking

- How to do HDFC Netbanking Registration?

- How to Reset HDFC Net Banking Password?

- Ways To Transfer Funds on HDFC Online Banking Portal

- Checking Account Balance

- Transaction Limit and Charges of HDFC

- Concluding Note

HDFC Net Banking: Everything to Know About It

In today’s era, when everything is going digital, net banking is a boon in the banking Industry. With net banking service, one can easily access all the important information online in a matter of seconds.

The Reserve Bank of India approved HDFC Bank in 1994, making it a private sector bank. Retail banking, wholesale banking, and treasury are among the services provided by the bank. Along with branch facilities, the bank offers a variety of ways for clients to communicate with them, including net banking, mobile banking, and phone banking.

HDFC net banking is a free service that allows you to transact without visiting the local branch. It allows account holders to save valuable time and money. The option to transfer money to loved ones 24 hours a day, wherever, and at any time is the most significant feature. In this article, you can find information related to net banking, various modes of HDFC netbanking registration, limits, charges and so on.

Overview on HDFC Internet Banking

Net banking, often known as internet banking, is a digital way to conduct transactions online. It is an electronic system that can be activated and used for financial transactions by anybody with a bank account. Services like deposits, transfers, and online bill payments are now accessible via net banking. It's accessible as a desktop version as well as a mobile app.

HDFC Customer ID or User ID

When you create an HDFC bank account, you will be given a customer or a user ID, which you can use to access the bank's different financial services. It's also noted on the first page of the bank's cheque book.

HDFC Bank IPIN

To access your HDFC net banking account, you'll need an Internet Personal Identification Number (IPIN). The bank generates the initial IPIN that you must change after the first login with the option of resetting the IPIN.

Get Best Credit Cards Online

Features of HDFC Net Banking

HDFC net banking provides you with a variety of features and perks that make managing savings accounts and conducting transactions easier. The features are listed below:

- Ease of checking account balance and downloading the statement of the previous 5 years

- Securing transfer of funds via online modes like RTGS, NEFT, IMPS or registered third-party apps

- Opening a fixed or recurring account

- Allowing investing in Mutual Funds

- Updating the PAN Card

- Enabling the application for an IPO

- Regenerating Debit Card PIN in a few easy steps

- Recharges, merchant payments at one click away

- Enabling online tax-related transactions

Benefits of Using HDFC Net Banking

To satisfy the banking needs of consumers, most Indian banks have embraced or are in the process of implementing technology. While conventional banking is still the most widely used and accessed in India, net banking is increasingly becoming a necessary part of banking operations. Here are the benefits listed:

- It saves time and effort, which is additionally required in traditional banking.

- It is accessible from anywhere, anytime.

- Net banking allows new account opening as well as transacting digitally.

- With net banking, all the important details related to bank transactions and requests are exchanged electronically.

- Net banking allows customers to learn about the ins and outs of their bank accounts, as well as the procedures that underpin transactions. As a result, it contributes to financial empowerment.

- Online banking is convenient and quick. Funds can be transferred between accounts relatively rapidly.

How to do HDFC Netbanking Registration?

A net banking account is nothing but a digital version of your regular bank account. Opening a net banking account necessitates the creation of unique digital passwords that allow you to transact over the internet. Customers can sign up for the service online, through an ATM, welcome kit, phone, or by downloading a form. The following are the steps for each channel:

Registration Via Online

Step1: Visit the official website

Step 2: Select the ‘Register’ option available at the bottom of the page.

Step 3: Enter customer ID, then select ‘Go’.

Step 4: Input the registered mobile number to generate OTP and enter the same.

Step 5: Enter the debit card details.

Step 6: Next, you can set IPIN to access net banking for future use.

Registration Via ATM

Step 1: Visit the local HDFC ATM.

Step 2: Insert debit card, then input ATM PIN.

Step 3: Select 'Other Option' from the main panel.

Step 4: Now, go to 'Net Banking Registration', press confirm.

Step 5: Your Net Banking request will be processed, and your IPIN will be sent to the mail address you provided.

Registration Via Form

Step1: Visit the official website and download the form.

Step2: Complete the form with the necessary information, print it, and send it to your local HDFC branch.

Step 3: After you submit your request, an IPIN will be delivered to your registered postal address.

Registration Via Phone Banking

Step 1: Contact the HDFC phone banking number.

Step 2: Enter your customer ID, HDFC Debit Card number, and PIN or Telephone Identification Number in the box below (TIN).

Step 3: Once registration is requested, bank representatives will begin the approval procedure.

Step 4: Within 5 working days, you will get the IPIN by mail at the registered address.

Registration Via HDFC Welcome Kit

You'll receive an online banking password with your HDFC welcome kit, and that will act as your initial HDFC net banking access. All that remains is for you to complete the login process and create a new password. Here is the step-by-step guide for the same.

Step 1: Visit HDFC internet banking site

Step 2: Enter your HDFC customer ID/ user ID

Step 3: Click ‘Continue’

Step 4: In your HDFC welcome kit, open a net banking PIN envelope. There you can see your login IPIN. Enter the same and hit the Login button

Step 5: Next, set a new login password.

Step 6: Then, tick ‘Accept the terms and condition of using HDFC net banking service’

Step 7: Click ‘Confirm’, and you’re set to start net banking

How to Reset HDFC Net Banking Password?

There can be situations when you might forget your net banking password or your password has been hacked or stolen, and your login is hampered. To avoid this situation and ease your net banking experience, below is a step-by-step process to resetting HDFC net banking password.

Step 1: Visit the official website

Step 2: Enter the customer Id, click ‘Continue’

Step 3: Now, click on Forget Password

Step 4: Enter the User Id/customer Id, click on the ‘Go’ button

Step 5: Next, select one option from the two mentioned below:

- OTP sent to the registered mobile number and enter debit card details

- OTP sent to the registered mobile number and email ID

Step 6: Once the OTP is received, enter the relevant details

Step 7: Enter the new PIN and confirm it

Step 8: Now, login with a user ID and new IPIN

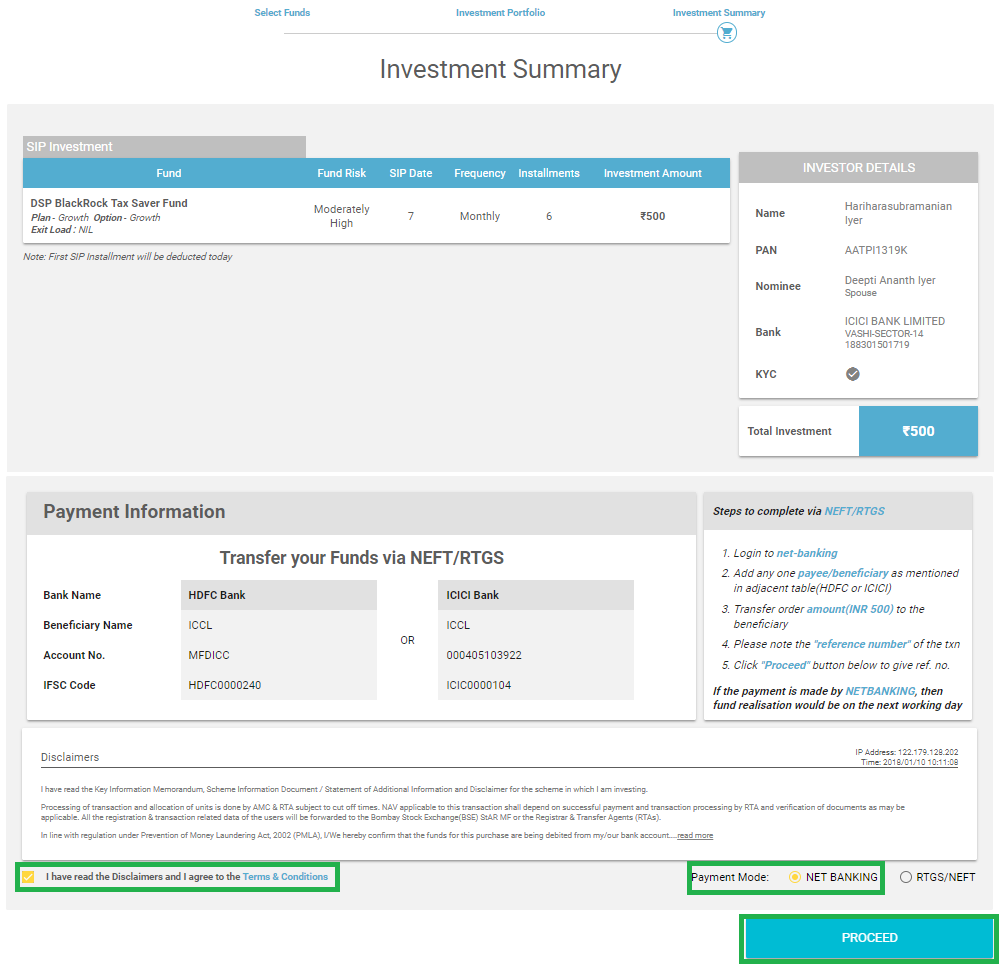

Ways To Transfer Funds on HDFC Online Banking Portal

Net banking allows you to transfer money from one account to another. Customers can use this service to transfer money to their own accounts and conduct third-party transactions. Third-party transfers can be conducted once an HDFC Bank client has finished the internet banking procedure. Following are some of the ways to transfer funds through net banking:

- National Electronic Funds Transfer (NEFT)

It is a payment mechanism that allows payments to be electronically transferred from one bank to another. Money transfers can be made by an individual or company to an individual or company's bank account through net banking. The amount transferred ranges from Rs.1 lakh to Rs.10 lakhs. The account to which an amount needs to be sent should be listed as a beneficiary account in this process. In most cases, money is securely transferred via NEFT in around 30 minutes. The duration can, however, extend to as much as 2-3 hours.

- Real-time Gross Settlement (RTGS)

It is a method of settling money in real-time on an order-by-order Basis. This means that the RTGS system ensures that the money is credited to the beneficiary's account as soon as possible. The RBI monitors RTGS transactions, implying that successful transfers are irreversible. A minimum of Rs.2 lakhs must be sent using this technique. Under this Facility, funds will be paid to the beneficiary’s bank within RBIs stipulated time but accessible 24×7 via net banking.

- Immediate Payment System (IMPS)

It also handles real-time money transfers. It's most often used to send money between banks in India immediately by mobile, internet, and ATM. The beneficiary's cell phone number is all that is required to send money using IMPS. It enables you to transfer money on bank holidays as well.

- Bank Transfers

You can directly transfer from your own account to other HDFC customers' accounts by using their Customer Id. The transfer done through customer id are directly done and show the immediate transaction on both party account

Checking Account Balance

Net banking enables you to check the account balance anytime, anywhere on any device. You just need to follow the steps listed below:

Step 1: Log in to your HDFC net banking account.

Step 2: Under the Accounts tab, select ‘Accounts Summary'.

Step 3: All of your accounts will be displayed on the screen.

Step 4: Choose the account you want to check the balance for.

Step 5: The selected account's balance and other information will be shown.

Transaction Limit and Charges of HDFC

There is a transaction limit to protect both merchants and customers from huge potential losses. Also, there are charges for those transactions to be carried out. The following table lists the transaction limitations offered by HDFC bank's online banking portal:

| Mode Of Transfer | Transaction Limit | Charges |

|---|---|---|

| NEFT | 25 Lacs | Below 1 Lacs: Rs.1 + GST / Above 1 Lacs: Rs. 10 + GST |

| RTGS | 25 Lacs | Rs.15 + GST |

| IMPS | 2 Lacs | Between Rs. 1 - 1 Lacs: Rs.5 + GST / Between 1 Lacs - 2 Lacs: Rs. 15 + GST |

Concluding Note

With digitization, net banking has become increasingly popular in India. The 2016 demonetization campaign boosted its appeal, and the government's digital push has improved its adaptability even more. After a clear picture about what net banking is and how to use it, you can anytime, in future, contact your bank to open an online banking account if you don't already have one. Online banking's security, ease, and simplicity are guaranteed to amaze you and make it your favourite method of handling financial transactions.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.