Table of Contents

- Online SBI Internet Banking Portal

- SBI Retail Net Banking

- SBI Corporate Net banking

- SBI Net Banking Registration

- SBI Net Banking Login

- Checking Account Balance via SBI Net Banking

- Transferring Money via SBI Net Banking Portal

- Transferring Money to Home Loan Account from Savings Account

- SBI Credit Card Net Banking Bill Payments

- State Bank Net Banking Customer Care Number

- Conclusion

SBI Net Banking: Everything To Know About It!

The net banking Facility of SBI enables you to perform multiple tasks anytime and from anywhere. Net banking allows you to do things like sending money to friends and family, pay bills, open a Fixed Deposit, Recurring deposit, or PPF account, and request a cheque book or issue a Demand Draft, among other things.

With the modern digital trend, the emergence of SBI net banking ensures easier transactions and payments from all across the world. Henceforth, to be updated and ease the entire payments’ mechanism, it is essential to use the facility for your betterment. And here is a detailed guide on how to perform various actions using SBI online portal.

Online SBI Internet Banking Portal

The SBI online portal, a highly secure online platform for making transactions, is used by SBI to provide all online services to both retail and business clientele. The site is run by programs that protect clients' internet data with cutting-edge technology. SBI net banking uses sophisticated and reliable software architecture to protect data.

SBI Retail Net Banking

The retail service essentially comprises one-on-one interactions between the Bank and the consumers. In corporate banking, the bank collaborates with larger corporations for various services. SBI's retail net banking service provides a wide Range of services to its customers, such as:

- Without visiting the branch, you can transfer money from one account to another.

- You can also open various forms of deposit accounts, such as fixed deposits, recurring deposits, or a flexible option, etc.

- SBI bank’s net banking allows you to buy plane, train, and bus tickets and pay for them directly through net banking. Additionally, you can also pay for other investment schemes and carry out several financial transactions.

- You can also pay for SBI Online hotel reservations via net banking.

- Online shopping can be done by going to a website, selecting the things you want to buy, and paying with SBI online banking.

- SBI's net banking system offers several services, including payments of bills and mobile or DTH recharges.

- You may send money across borders instantaneously by linking your SBI account to Western Union Services.

- As tax filing is time-consuming for people, you do it in just a few minutes using SBI's net banking services.

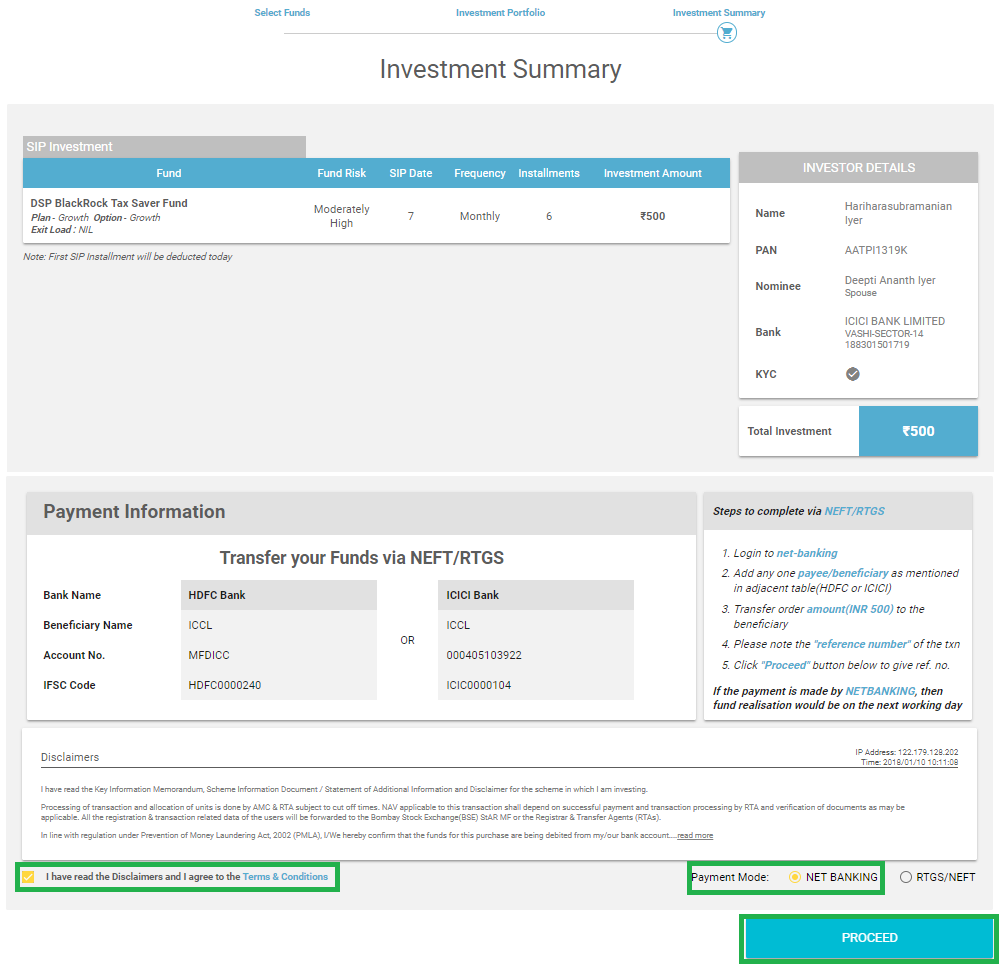

- Clients who are actively involved in the stock Market and are searching for a solid investment can use SBI net banking to open a Demat account and participate in an IPO.

Talk to our investment specialist

SBI Corporate Net banking

SBI caters to both retail and business consumers. Some of the most important aspects of SBI corporate net banking are as follows:

- It's easy to access the account from nearly anywhere.

- The SBI online banking service helps to expedite monetary operations that would otherwise take a longer time.

- Because corporate transactions entail large sums of money to be moved in a single transaction, it's vital to ensure that they're done safely. For this reason, the State Bank of India ensures that all transactions are entirely safe and secure.

- SBI provides access to the portal for transactions to corporate customers 24 hours a day, seven days a week.

- Utility bills and various Taxes are higher enough for a corporation. SBI online banking allows customers to make both of these payments from a single location.

- If you need to execute a transaction or make a payment, such as completing tax returns, you can upload files to SBI online.

- You can also transfer funds between SBI accounts or use the intrabank money transfer facility.

- Business clients can also use an interbank money transfer service. This transfer is particularly useful because the merchant or seller does not need to have an SBI account.

- SBI allows its corporate clients to make payments to registered vendors through the internet. They can ensure that the company functions well without having to worry about outstanding debts.

- Corporate clients can use SBI internet banking to not only send but also receive payments.

- Businesses can also apply for Initial Public Offerings (IPOs) through SBI online.

SBI Net Banking Registration

To register for SBI Net Banking, you must follow the given steps:

- Visit the online SBI portal.

- Select the ‘New User Registration' option.

- Click the ‘OK' option.

- From the selection menu, choose ‘New User Registration.

- Click ‘Next'.

- Account number, CIF number, branch code, country, registered phone number, required facility, and captcha are all required fields. Fill them and select the ‘Submit' option.

- Click on ‘Confirm' after entering the One-Time Password (OTP) sent to your mobile number.

- Click on ‘Submit' after selecting ‘I have my ATM card (online registration without branch visit)'.

- Validate the ATM credentials and then press the ‘Proceed' option.

- You must create a permanent username and password for login.

- Click on ‘Submit' after entering the login password the second time. The registration will be successful.

SBI Net Banking Login

To access your SBI Net banking account, follow the instructions below:

- Visit the online SBI portal.

- Select ‘Login' from the dropdown menu.

- Click ‘Continue to Login'.

- Enter your username, password, and captcha.

- Select ‘Login'.

- Resetting SBI Net Banking Password via Forgot Login Password option

You can follow the procedure outlined below to reset your SBI Net banking password:

- Visit the online SBI portal.

- Select ‘Login'.

- Click ‘Continue to Login'.

- Select the ‘Forgot Login Password' option.

- Click on ‘Next' after selecting ‘Forgot My Login Password' from the dropdown menu.

- Username, country, account number, date of birth, mobile number, and captcha are required to be precisely filled.

- Click on ‘Submit' after entering the One-Time Password (OTP).

- You can now change your password.

Checking Account Balance via SBI Net Banking

The steps to check your account balance via SBI Net banking are as follows:

- Visit the online SBI portal.

- Use the username and password to log in.

- Choose the ‘Click here for balance' option.

- The account's available balance will be shown on the screen.

Transferring Money via SBI Net Banking Portal

Check that the recipient has been added to your account as a beneficiary before transferring money online. You'll need the beneficiary's name, account number, bank name, and IFSC code, among other things. Follow the steps below to make a money transfer:

- Visit the online SBI portal.

- If you want to transfer money to another bank's account, go to the 'Payments/Transfer' tab and select 'Other Bank Transfer'.

- Click ‘Accounts of Others – Within SBI' if you want to transfer to an account within the same bank.

- Choose the sort of transaction you want to make and click ‘Proceed'.

- Choose the account you want to transfer money from.

- Now, enter the amount you want to transfer and any notes you might have

- To transfer funds, select a beneficiary account.

- You can also use the option to specify when the fund transfer should take place.

- By checking the box, you agree to the terms and conditions. Then click the "Submit" option.

- The next screen will display all of the information you provided for evaluation. Click ‘Confirm' once you've double-checked everything.

- On the registered mobile number, you will receive a high-security password. To complete the authentication procedure, enter this password and click "Confirm".

- To indicate that the task has been completed, a confirmation message will appear on the screen.

Transferring Money to Home Loan Account from Savings Account

Instead of manually transferring money from your Savings Account to your Home Loan account regularly, you can use ECS and NACH services. When you make a manual money transfer, the bank may mistakenly believe you're making a loan prepayment. As a result, you must notify the bank before executing such a manual transfer unless the automated EMI payment system has failed.

You must be registered for the SBI Net Banking service to transfer funds from your savings account to your home loan account.

- Use your login credentials to access the SBI Net Banking platform.

- At the top of the main page, select the ‘Payments/Transfers' tab.

- A new window will open. Under the ‘Within SBI' section, select the ‘Funds Transfer (Own SBI A/c)' option.

- You'll see a list of your SBI accounts. Choose the account number for your home loan from the dropdown menu.

- Enter the loan amount to be transferred and choose the transfer's purpose from the dropdown box.

- Choose a payment option for when you want to make the transfer, such as whether you want to pay right away or schedule it for later.

- Then click the 'Submit' option.

- The screen will show all of the information you've entered. Verify the information and click "Confirm" if everything appears to be in order.

- A message of success will appear. The funds will be transferred from your savings account to your loan account.

SBI Credit Card Net Banking Bill Payments

You can use the SBI net banking feature to pay the card dues. The Paynet-Pay Online option helps you with this.

- User ID and password are essential for accessing the online SBI Card portal

- On the dashboard, select the ‘Pay Now' option.

- Decide on a payment amount.

- Select the payment mechanism and bank name from the dropdown menu.

- Confirm the information you've entered and move on.

- To authorise the payment, you will be redirected to the bank's payment interface. After a successful payment, you will receive a confirmation message.

The outstanding bill can also be paid without logging into the SBI card online account. Here is how you can pay SBI Credit Card bill via Billdesk:

- Visit the SBI’s Billdesk Card page.

- Enter information, such as the SBI card number, email address, phone number, and payment amount.

- Select the ‘Net Banking' option and the bank account to be debited from the dropdown menu.

- To log in, enter your net banking credentials (User ID and Password).

- Confirm the amount of the payment.

- You will receive an online transaction confirmation with the transaction Reference Number and an email acknowledgement of the transaction after successful payment.

The steps for paying SBI Visa Card dues using Visa Card Pay are as follows:

- Use your user ID and password to access the net banking page.

- Select the option for ‘Third Party Funds Transfer' and then ‘VISA credit card Pay'.

- To start a fund transfer, enter the sender and recipient information.

- Continue by clicking on the ‘Confirm' button.

- The sum will be deducted from the account after completion, and the payment will be scheduled to the card.

State Bank Net Banking Customer Care Number

If you have any questions about SBI net banking, you can Call SBI's 24-hour hotline. Both landlines and cell phones can dial toll-free numbers, which are as follows:

1800 11 2211 or 1800 425 3800

Conclusion

SBI net banking app, named Yono, is also released to ensure easier access to SBI net banking facility. Yono SBI login is also a lot easier and follows the same steps as mentioned above. The only difference is that you have to log in via the mobile application instead of the website. Online SBI internet banking is a must-have amid the modern busy and hectic schedules to make sure that you can take care of all your transactions and payments from any corner of the world without having to physically visit the bank branch.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.