Table of Contents

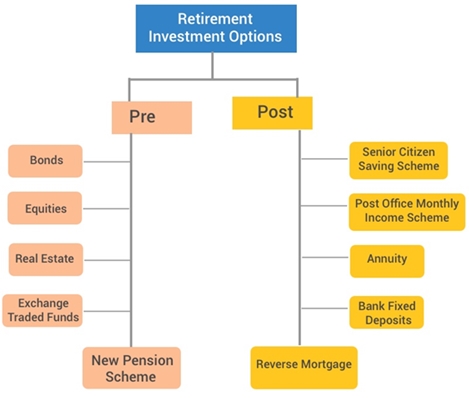

Post Retirement Options in India

Looking for post Retirement investment options? Well, it becomes essential for retirees, to make the best use of their retirement corpus. Thus, when it comes to investment, it is advisable to consider avenues that would help you to keep your Tax Liability at bay and provide you with a regular source of Income. When planning for ways to invest after retirement, consider the below-mentioned parameters following with investment options that would help you to create a strong and balanced Portfolio.

Post Retirement Planning: Things to Keep in Mind

Here are some of the parameters to keep in mind when planning for the post retirement corpus.

Basic living expenses

Your future expenses can be determined by assessing the current expenses. To get the exact figure, take into consideration regular expenses like utility payments, food, housing & travel expenses along with other miscellaneous expenses that might incur after retiring.

Asset-based investment

Post Retirement planning is directly linked to your Financial goals. A well-planned financial goal can help you to decide how much money you can accumulate for retirement in line with other goals. One can broadly invest 15-20% in debt and equity instruments. But, an investor shouldn’t invest in these products without understanding what they are gettnig into.

Liquidity

Requirement of liquid cash for medical expenses, etc., can come up at any time. Thus, it is advisable for investors to invest in an avenue that offers high liquidity. Avoid investments with lock-in periods and invest in an avenue where you can redeem your funds quickly.

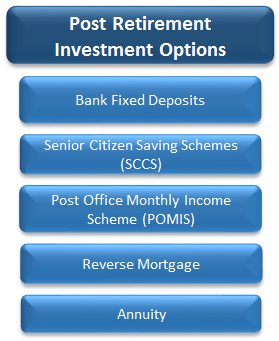

Post Retirement Options

1. Bank Fixed Deposit

A Bank FD (fixed deposit) is one of the popular choices with the retirees. The safety and fixed returns along with ease of operation makes it a reliable avenue. For better returns, it is advisable for investors to compare FD rates with various banks/institutions. Currently, FD Interest Rates stand at around 6-7% p.a. for tenures ranging from 1-10 years. Senior citizens get an extra 0.25-0.5% p.a., depending on the bank.

As a part of the benefits, FDs offers the flexibility to choose the tenure of the deposit. Investors can also decide the frequency of their returns. Returns can be received monthly, quarterly or annually. Since FD interest received over INR 10,000 is fully taxable, those looking to save tax can invest in tax saving FD for 5 years. The investment made here qualifies for Section 80C tax benefits. However, such a deposit will have a lock-in of five years and but in this case- early withdrawal is permitted.

Talk to our investment specialist

2. Senior Citizen Saving Schemes (SCSS)

When it comes to post retirement investments, the Senior Citizens' Saving Scheme (SCSS) is a must-have in portfolios. SCSS is specially designed for retirees. This scheme can be availed from a Post Office or a bank by anyone above 60. This scheme has a five-year tenure; upon the maturity, it can be further extended to three years.

The investment limit under this scheme is INR 15 lakh and one may open more than one account. Currently (FY 2017-18), the interest rate in SCSS is 8.1% per annum, payable quarterly and is fully taxable. The interest rates of this scheme are Market linked and 100 Basis Points above the five-year government bond yield. The money invested and the interest payout has a sovereign guarantee. Furthermore, SCSS is eligible for tax benefits under Section 80C and the scheme also allows premature withdrawals.

3. Post Office Monthly Income Scheme (POMIS)

It is a five-year savings scheme offered by designated post offices. The account can be opened singly or jointly, with a minimum investment of INR 1,500. The maximum amount one can invest is up to INR 4.5 lakh (in a single account), but if held jointly it is up to INR 9 lakh.

The interest rate is set each quarter and is currently at 7.3% per cent per annum (FY 2017-18), payable monthly. The investment in this scheme doesn't qualify for any tax benefit and the interest is fully taxable.

4. Reverse Mortgage

A reverse mortgage is a wonderful post retirement option given to senior citizens for a regular source of income. In this avenue, one can pledge their house with a bank to receive income from the bank regularly over a period of time. Any house owner who is 60 years of age (and above) is eligible for this. The amount received will depend on the valuation of the house and the term opted. A recent ruling on this scheme has made the income received from house property totally tax-free.

5. Annuity

An annuity is a contract aimed at generating steady income during retirement, wherein a lump sum payment is made by a policyholder to obtain a certain amount immediately or after some point in time. Annuities do not offer any tax benefits. It is added to income and taxed at the marginal rate of taxation. The minimum age entry for any investor in this scheme is 40 years with maximum up to 100 years.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.