Table of Contents

Difference Between Fundamental and Technical Analysis

When you decide upon Investing in the stock Market, it is quite obvious you would be told to research and be prepared as much as you can, right? While you will be engrossed in the technicalities of this market, you will definitely come across two terms – fundamental analysis and Technical Analysis.

To put it in simple words, these are two common methods that investors use for assessing their stocks. These two play a crucial in helping investors make a thoughtful judgement. Although these are two different strategies; however, often, they are used for a single goal, which is researching and predicting the growth trends of stock in the future.

In this post, let’s find out the substantial difference between fundamental and technical analysis strategies and how they can turn to be advantageous.

Defining Fundamental and Technical Analysis

Before diving deep into the difference between fundamental analysis and technical analysis, let’s find out what these mean in reality.

What is Fundamental Analysis?

Fundamental analysis is a strategy used for a comprehensive examination of the fundamental factors that can impact the interest of a company, Industry, and the entire Economy. This analysis is used to assess the Intrinsic Value of a stock or a share by computing the financial, economic and other factors (both quantitative and qualitative) to comprehend the chances where the share’s value differs from the current market price.

If you are choosing this analysis, you must execute:

- Economic analysis

- Industry analysis

- Company analysis

Talk to our investment specialist

What is Technical Analysis?

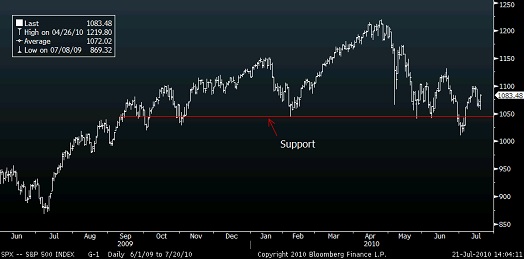

Technical analysis, on the other hand, is a methodology that helps to predict the future price of a stock or a share active in the market. All of this prediction is highly based on the previous performance statistics of the stock.

And, for this specific purpose, the price changes of the stock are ascertained to comprehend how the value will alter in the coming days. If using technical analysis, there are three golden rules that you would have to keep in mind, such as:

- Prices discount every information that is available for the public

- Price movements will not be random, and trends behind the actions of price can be implemented with the help of technical tools

- Price trends can repeat themselves

Key Difference Between Fundamental Analysis and Technical Analysis:

You can easily draw out the fundamental analysis and technical analysis difference on the Basis of below-mentioned justifications:

Fundamental analysis is a way of assessing security to comprehend its intrinsic value for opportunities leading to long term investments. Contrary to this, technical analysis is a way of evaluating and predicting the security’s future price based on the movement of the current as well as previous price and the transaction volumes. This is also a substantial way to understand how the stock will be working in the future.

In comparison to technical analysis that is used for short term trades, the fundamental analysis uses more extended periods to analyse stocks. Thus, this strategy is integrated by such investors who wish to invest in those stocks that have more probability of having an increased value in a few years.

Another significant fundamental and technical analysis difference is while in fundamental analysis decisions are taken on the basis of available statistics and information evaluation; technical analysis allows investors to decide by keeping the stock price and market trends in mind.

Technical analysis only regards the past data and is based on price movements and charts; however, the fundamental analysis concentrates on both past as well as present data and is dependent upon financial statements.

Moving forward with the difference between financial analysis and technical analysis is that in fundamental analysis, you can assess the intrinsic value of a stock by looking into the Balance Sheet, Income statement, profit margin, cash flow statement, price to Earnings ratio, return on equity, and more. But, in technical analysis, investors have to only depend upon chart patterns like reverse patterns and continuation pattern, technical indicator, price actions, support, and resistance.

Conclusion

If you are still wondering how is technical analysis different from fundamental analysis in investment programme, then know that fundamental analysis helps investors buying stocks when its market price is lesser than its intrinsic value. However, technical analysis allows investors to buy shares when there is an expectation of selling the same at a higher price. In the end, irrespective of the strategy that you use, make sure that you are well-aware of the advantages and drawbacks of both, only then go ahead to make a decision.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.