Difference Between AOP & BOI

An Association of Persons (AOP) and Body of Individuals (BOI) are the two different segments in the income tax Act 1961. Both segments have a different meaning and different objectives. Let’s learn about AOP and BOI.

What is AOP?

Association of Persons (AOP) means a group of persons coming together to accomplish a common objective with the same mindset. Primarily, objective of earning some Income.

What is BOI?

Body of Individuals (BOI) has a similar goal as AOP, but in BOI individuals come together intending to earn some income.

AOP vs BOI

The only difference between these segments is the composition of members. These two segments can be formed by simply entering into a Deed, which consists objectives, names of members, the share of members in profit, date of creation, rules, laws, frequency of meetings, power of the management etc. This can be registered with the registrar of society by paying applicable fees.

There is no separate governing body for these segments. They are self-driven with the help of the Natural Law of justice, customs and cultures. For AOP/BOI, there is no governing body, the Income Tax Act 1961 has included AOP/BOI under the Person definition in section 2 (31).

| AOP | BOI |

|---|---|

| It has two or more persons | It has only individuals |

| Join for a common purpose | Joins for earning income |

| Companies, Individual, Firm, HUF can be a member | Companies, HUF cannot be a member of BOI |

| No governing body | No governing body |

| AOP is chargeable at the higher marginal rate | The highest income will be charged at the 30% marginal rate |

Talk to our investment specialist

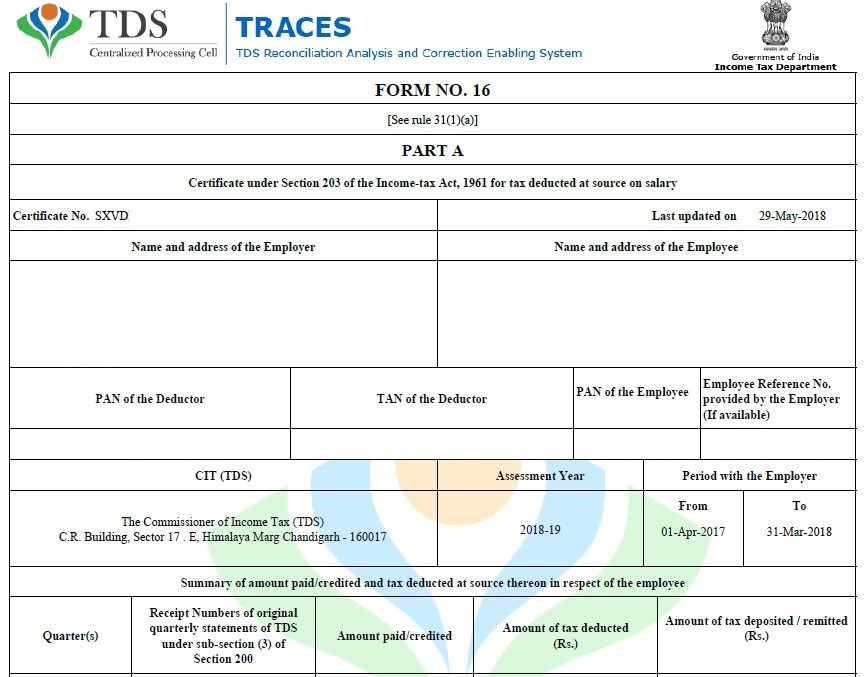

AOP & BOI Taxation

Individual shares in AOP or BOI could be unknown/intermediate or known/determinate. In such cases the tax payable by AOP&BOI will be calculated as given below:

Share of profits of members is unknown/intermediate

If the individual shares of the member’s income of AOP/BOI are wholly or partially unknown/intermediate, then the tax will be charged on the total income at the maximum marginal rate of AOP/BOI. In case if the income of any member of AOP is chargeable at a rate which is higher than the marginal rate the former rates will apply.

Share profits of members is known/determinate

If the total income of any member of AOP/BOI exceeds the maximum exemption limit than a particular member holding a higher income will be charged at the maximum marginal rate of 30% plus surcharge 10.5%.

In case none of the members are exceeding the maximum exemption limit, then none of the members is liable to pay tax at the marginal rate. The AOP will pay the Taxes as per the income tax rates applicable to the individual. Also, the AOP will gain the benefits of the basic exemption of Rs. 2,50,000.

Alternate Minimum Tax Applicable for AOP/BOI

The tax payable by AOP/BOI cannot be less than 18.5% of the total income as per section 115JC. Alternate minimum tax should not apply for AOP/BOI if the total income does not exceed Rs. 20 lakh.

Tax Relief in AOP/BOI for a Share of Income

The AOP/BOI will get the payment relief under section 86 of the Income Tax Act 1961, it provides relief on the share of income received from AOP/BOI if the AOP/BOI pays tax at the maximum marginal rate (maximum marginal rate 30%+SC+Cess)

Implications of Other Acts in AOP/BOI

There are other acts which will be imposed on AOP/BOI along with the Income Tax Act 1961 as follows:

- Central Goods and Service Tax Act 2017 (CGST)

- professional tax Act of the respective state

- Employees provident funds and miscellaneous provision act 1952

- Employees state insurance Act 1948

Share of Income and Exemption

In case the AOP/BOI pays tax at the higher or marginal rate than the share of profit of the AOP/BOI will not be included in the income of the members. Therefore, it will be exempted.

In this case, if the AOP/BOI pays tax at the existing income tax rates as applicable to the individual, then the resulting share of income will be included in the Total Income of each member.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.