Fincash » Income Tax Return » Documents Required for ITR Filing

Table of Contents

Important List of Documents Required for ITR Filing

Whether the dreaded date of filing ITR is nearing or you still have some time on hand, one of the precautionary steps that you must take is figuring out the list of documents required for ITR filing and keeping them handy beforehand.

Sure, when the list is huge, and you are a newbie, skipping out on one or the other document seems like a no big deal. However, this may create unnecessary delay in filing the return. And, sometimes, this delay may end up dragging you out of the deadline.

But, not anymore. This post comprises all the essential documents required to file the ITR so that you never miss out on anything.

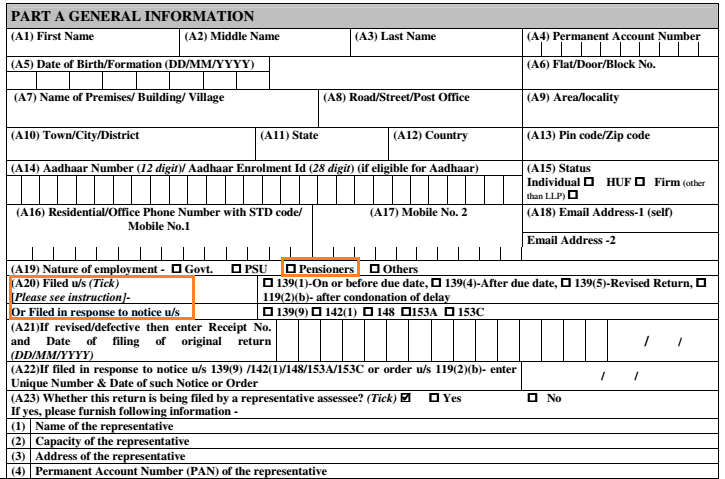

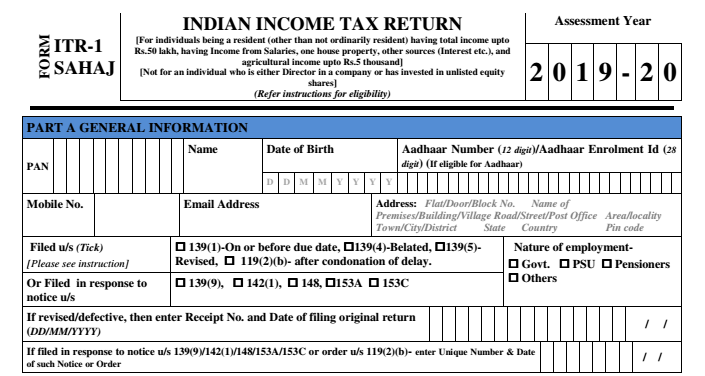

Basic documents required for ITR of an Individual

In case you are filing the ITR as an individual, you will require to have the following documents in hand:

- PAN Card number

- aadhaar card number

- Bank account details and IFSC code

- Form 16, 16A, and 26AS

- Self-assessment or Advance Tax payment challan

ITR Documents Required by First-Time Filers

In case you are filing your returns for the very first time, don’t be confused. You will require only a handful of documents, such as:

- Form 26AS

- Form 16

- Documents stating income from other sources

- Details of tax-saving investments

- Information of any additional deductions

- Basic documents

Talk to our investment specialist

ITR Filing Requirements for Salaried People

Depending on deductions, investments and more, salaried people have to acquire a different set of documents, such as:

- Form 16 from the employer

- Overdue salary (if available) and filing form 10e

- The final statement in case of a job change

- Foreign salary slips (if applicable) for an ordinary resident of India

- Foreign tax returns (if applicable) and filing Form 67

- Rent receipts and agreement for those who wish to claim HRA Exemption

- Travel bills (in case the employer doesn’t consider them)

- Details of the withdrawn PF (if available)

ITR Filing Documents Required for Tax Saving Investments

Irrespective of the type of investment that you have, there is a certain set of documents needed to File ITR against your tax-saving investments. The list includes:

- ELSS to claim up to Rs. 1.5 lakhs under Section 80C; or

- Medical/Life Insurance (if available) to claim the exemptions or deductions; or

- Details of PPF and passbook; or

- Repayment certificate for education or housing loan to claim deductions on your Income; or

- Receipts of Senior Citizen Saving Scheme; or

- Tax saving FD to claim up to Rs. 1.5 lakhs under section 80C; or

- Receipts of donation along with your name, address, and PAN details; or

- Receipts of additional investments; or

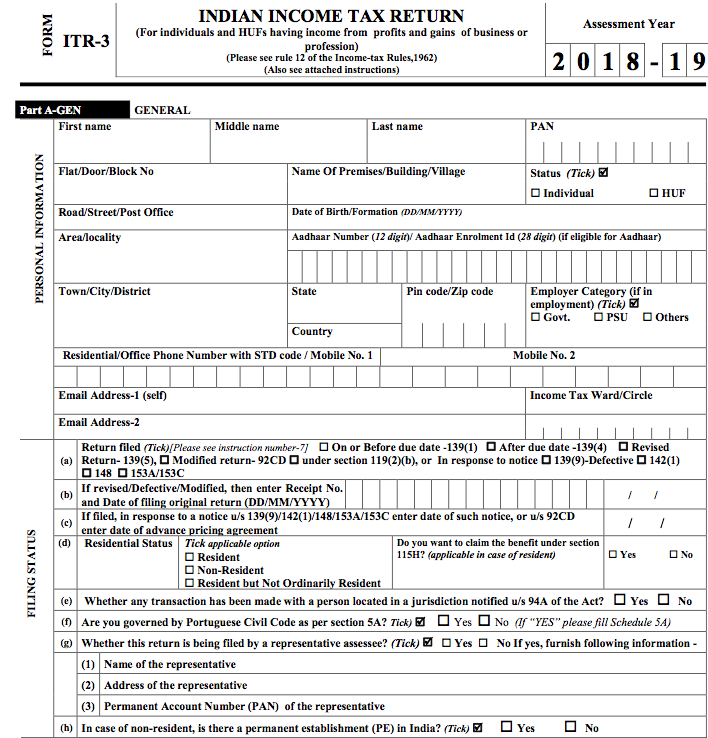

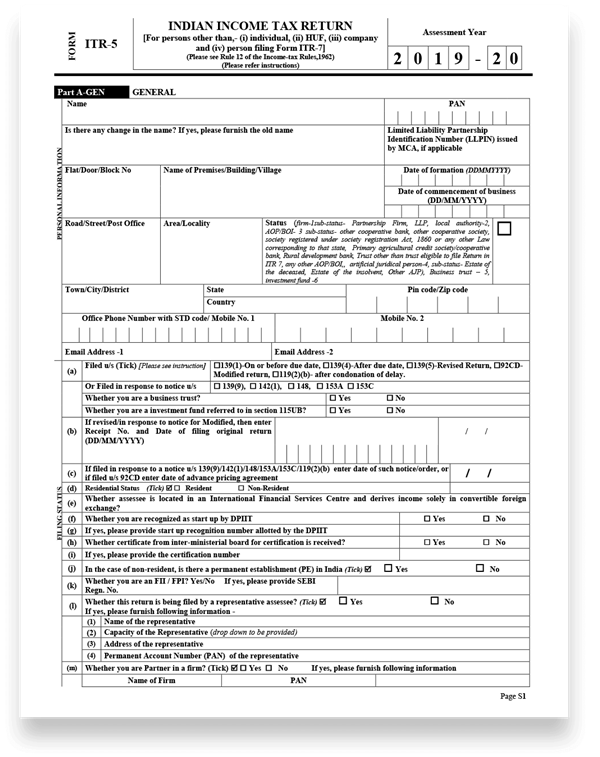

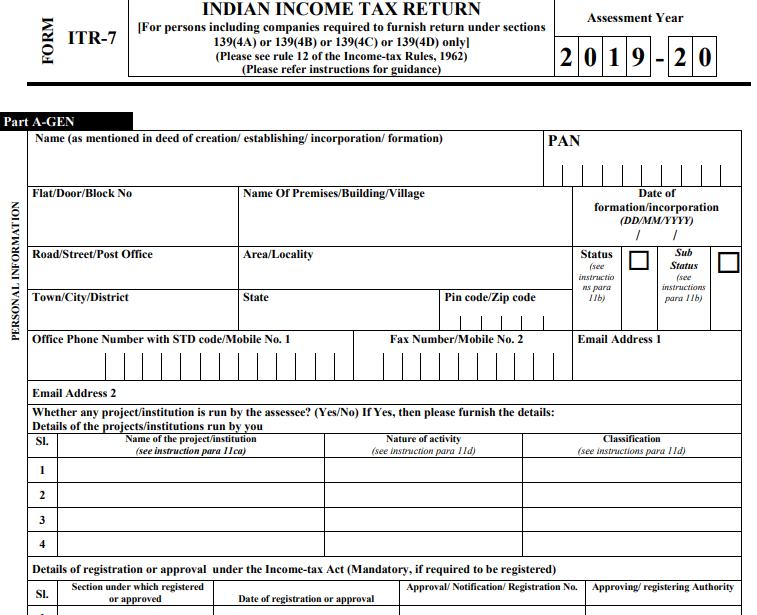

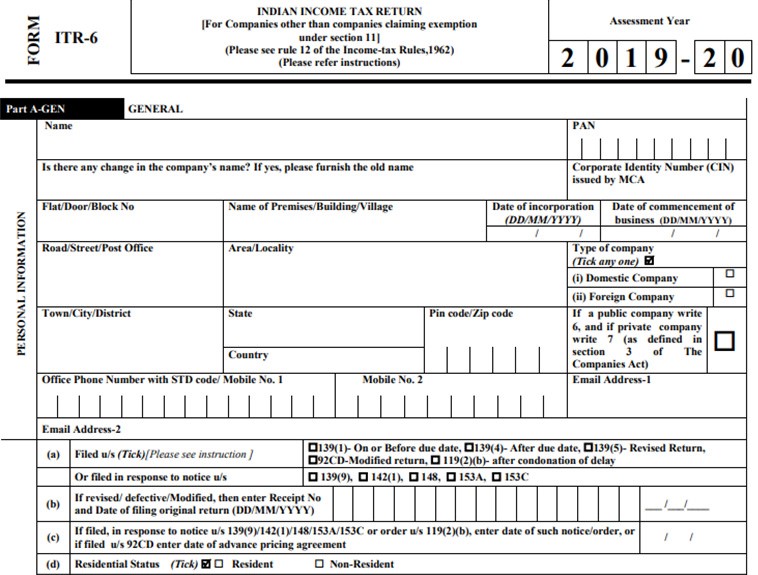

Documents Required for Filing ITR for Business

In case you are a businessman, you would require the following documents to file your Income Tax Return:

- The Balance Sheet of the financial year

- Records of audit (if applicable)

- Certificates of the tax Deduction on the source (TDS)

- Challan copy of income tax payment (advance tax, self-assessment tax)

Documents Required for File Capital Gains

For the ones who have Capital gains, ITR required documents are:

- Purchase or sale Deed of the property, including stamp valuation; or

- Receipts of any improvements made; or

- Information of sale, purchase or improvement cost of other capital assets; or

- Expenses incurred on transfer of any capital asset (ex. Commission, brokerage, transfer fees, etc.); or

- Demat account statement for the sale of securities

Conclusion

At the end of the day, all it matters is how prepared you are to file your income Tax Return. Once you have all the required documents in hand, it would not take more than a few minutes to file your ITR. So, be prepared and ready beforehand.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.