Table of Contents

A Complete Guide to ITR U: How to File, Download and Avoid Penalties

income tax Return - Updated (ITR-U) is a crucial provision for taxpayers who need to rectify or update their previously filed Income Tax Returns. Introduced under Section 139(8A) of the Income Tax Act, ITR-U allows individuals to correct errors, disclose omitted income, or revise returns within a specified period. In this comprehensive guide, we will cover everything about ITR U, including how to file it, penalties, downloading the ITR U form, and more.

What is ITR U?

ITR U is a Facility introduced by the Income Tax Department of India that allows taxpayers to update their income tax returns within 24 months from the end of the relevant assessment year. It provides a way to rectify mistakes made in the original ITR filing.

Who Can File ITR U?

You can file an updated return (ITR U) if:

- You missed declaring any income in your original ITR.

- You filed an incorrect Income Tax Return.

- You need to revise your tax computation.

However, you cannot File ITR-U if:

- Your updated return results in a refund or reduction in Tax Liability.

- The return is filed due to search and seizure by tax authorities.

- The updated return involves an assessment under specific sections like 132 or 133.

Recent Updates on ITR U

The Income Tax Department has been actively encouraging taxpayers to use ITR U for compliance. Recent updates include:

- Easier online filing process through the Income Tax portal.

- Clarification on penalty structure to ensure taxpayers are aware of additional charges.

- Improved utility tools for easier computation of additional tax liabilities.

- Always check the latest government notifications for updates before filing.

How to File ITR U Online

Filing ITR U online is a straightforward process. Here’s a step-by-step guide:

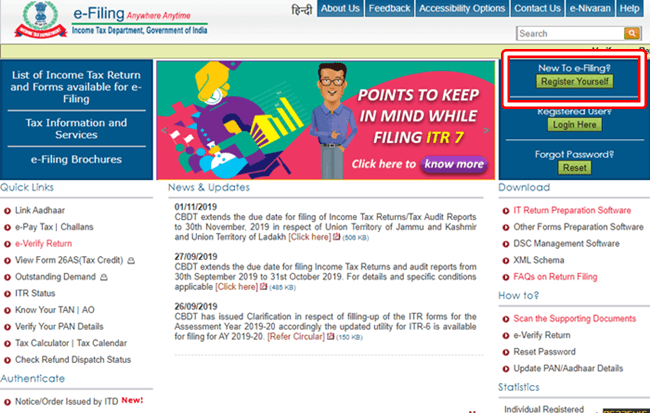

Step 1: Login to the Income Tax e-Filing Portal

- Visit the official ITR U login page at www.incometax.gov.in.

- Enter your PAN, password, and captcha to sign in.

Step 2: Select the ‘File Income Tax Return’ Option

- Click on ‘File Income Tax Return’ and choose ‘Assessment Year’.

- Select ‘ITR U’ as the return type.

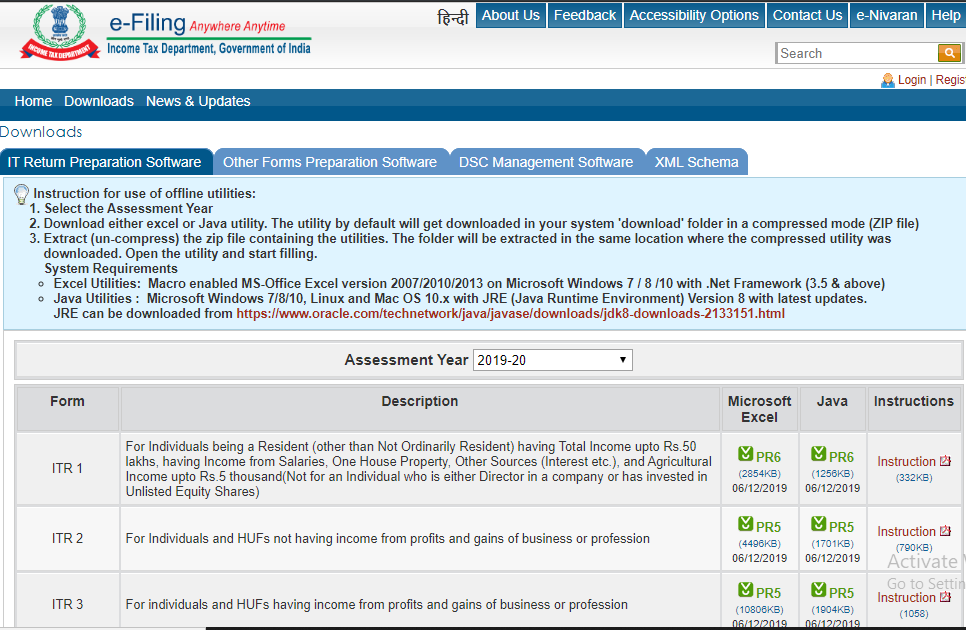

Step 3: Download ITR U Form

- You can download the ITR U utility from the official website.

- Fill in the required details, including the reason for updating the return.

Step 4: Compute Additional Tax Liability

- If the updated return leads to additional tax liability, calculate the tax payable.

- You may need to pay an ITR-U penalty based on the delay in filing.

Step 5: Upload and Submit

- Upload the filled ITR U form online.

- Verify using Aadhaar OTP or DSC (Digital Signature Certificate).

- Submit and note the acknowledgment number for future reference.

ITR U Penalty: What You Need to Know

Filing ITR U after the due date comes with additional tax liabilities and penalties. The penalty structure is as follows:

- Within 12 months: Additional 25% of the tax due.

- After 12 months but within 24 months: Additional 50% of the tax due.

- Timely filing of ITR U helps avoid unnecessary penalties and ensures compliance with tax laws.

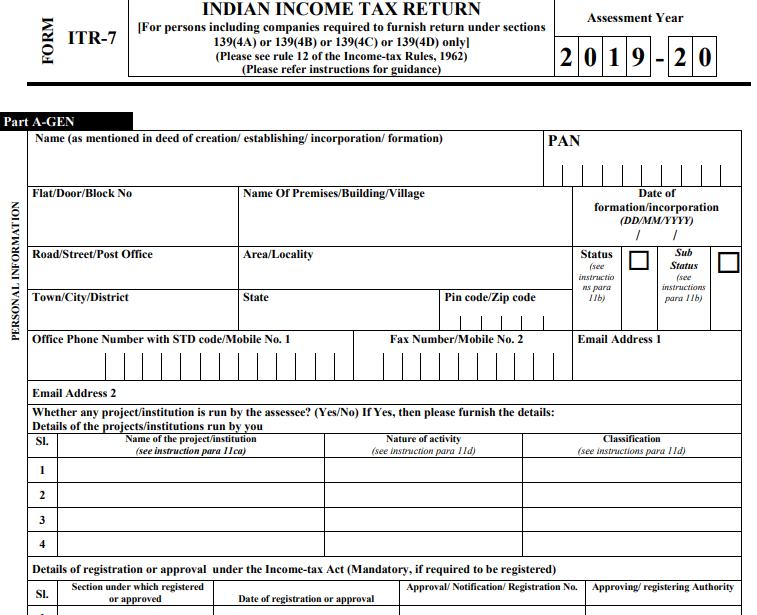

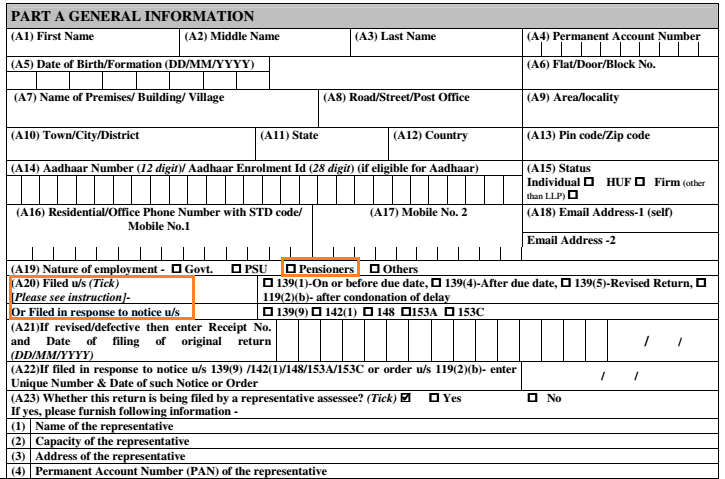

ITR U Form: Key Components

The ITR U form consists of:

- Personal Information (Name, PAN, Address, Assessment Year)

- Reason for Filing Updated Return

- Income Tax Computation Details

- Details of Additional Tax Paid

Real-Life Example: When to Use ITR U

Case Study: Raj’s Updated Return

Raj, a salaried individual, filed his ITR for AY 2022-23 but forgot to include Rs. 50,000 in interest income from his fixed deposit. Later, he received a tax notice. To avoid penalties, he used ITR U to update his return and paid the additional tax liability along with a 25% penalty. This saved him from potential legal consequences.

How to Avoid Errors in ITR Filing (Pro Tips)

To prevent the need for filing ITR U, consider these expert tips:

Double-check income sources (salary, FD interest, rental income, etc.).

Verify Form 26AS and AIS (Annual Information statement) before filing.

Ensure correct Deduction claims (80c, 80D, etc.).

Use the official Income Tax utility for error-free calculations.

File returns before the deadline to avoid missing details in a rush.

Frequently Asked Questions (FAQs)

- How to File ITR U if I missed declaring income?

You can file an updated return online through the Income Tax portal by selecting ITR U and paying the additional tax due.

- Can I claim a refund in ITR U?

No, ITR U cannot be used to claim a refund or reduce tax liability.

- Is there a deadline for ITR U filing?

Yes, you can file within 24 months from the end of the relevant assessment year.

- Where can I download the ITR U form?

You can download the ITR U utility from the official Income Tax website.

Conclusion

ITR U is an essential facility for taxpayers who need to update their income tax returns. By following the correct filing process, paying applicable penalties, and ensuring compliance, you can avoid legal hassles. Always check the latest government updates to stay informed.

For more updates on income tax filings, stay tuned!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.