Table of Contents

What is the Last Date to File ITR?

If you are an earning individual or are eligible to pay Taxes, you must mark down certain dates in your tax calendar so that you don’t miss the ITR last date at any cost. Further, whether you are self-employed or are a salaried person, paying taxes on time is something that you must not skip in case you are not much of a penalty person.

Now that the new financial year is about to begin, you must start with the preparations of your taxes. Basically, it is far more reasonable and more efficient to plan your taxes earlier rather than averting it till the end, so much so that you end up hoping to get an announcement regarding the ITR filing date getting extended.

July 31: ITR Filing Due Date

For the financial year that is ending by March 31st, the due date of filing the Income Tax Return is 31st July of the same year. If your total annual Income is more than Rs. 2.5 lakhs, before deductions, it becomes obligatory to file the ITR by this date.

The same conditions go for those with above 60 years and the ones above 80 years of age. However, the income limit for the former is Rs. 3 lakhs and for the latter is Rs. 5 lakhs.

Further, there is a certain category of people who don’t have to worry about July 31 as their ITR return last date, such as:

- Corporate assessee; or

- Non-corporate assessee or firm partners with accounts that need to be audited under the provisions of income tax; or

- Tax payers who are required to create reports under section 92E

If you could not file a return by July 31 of the financial year, you can then file it before the end of the forthcoming assessment year. Take the last date to File ITR for AY 2019-20 as an example, if you couldn’t file returns for FY 2018-2019 (AY 2019-20), you can file returns by March 31, 2020.

Talk to our investment specialist

March 31 of the Financial Year: Last Date for Tax-Saving Investments

If you are planning to have any sort of tax-saving investments, be it an FD, ELSS, PPF, insurance or more, you must do so by March 31st of the financial year so as to claim deductions.

Additional Last Date to File ITR for AY 2019-20

As per the assessment year 2019-20, below-mentioned are some additional dates to be remembered:

31st August

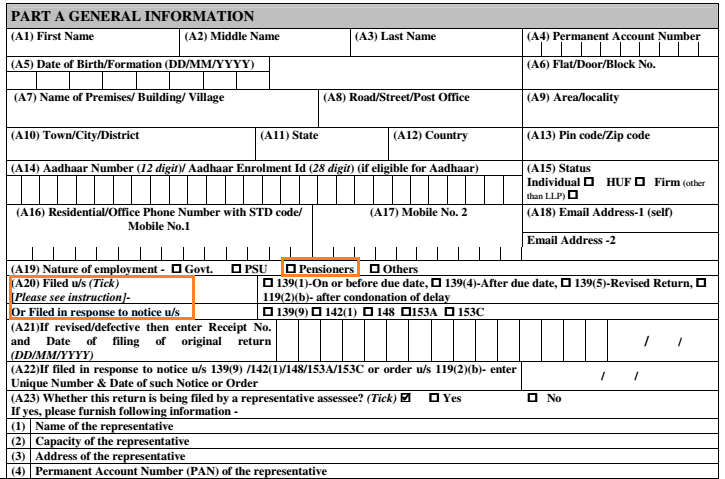

This last date is specifically for HUF (hindu undivided family), AOP (Association of Persons), BOI (Body of Individuals), and Individuals who don’t require Books of Account. This due date is also for those businesses whose books of account don’t need to be audited.

30th October

This due date of filing the income Tax Return is for those businesses who require to audit their books of account.

30th November

The assessee who need to furnish their reports under section 92E of the Income Tax Act must file their returns by 30th November.

Interests and Penalties on Late Filing

It is essential to keep in mind that not filing the income tax return on or before the date will result in severe repercussions. You would have to pay an interest rate of 1% every month on the unpaid tax amount as per the Section 234A.

Also, the beginning of FY 2018-19 has brought up a penalty fee for those who could not file the return as per the last date. The fee calculation starts from the immediate date after the deadline. This penalty for late filing of income tax return for AY 2018-19 and forthcoming years can go up to Rs. 10,000. Also, you must know that you would not be eligible to file the ITR if you have not paid the taxes.

Final Words

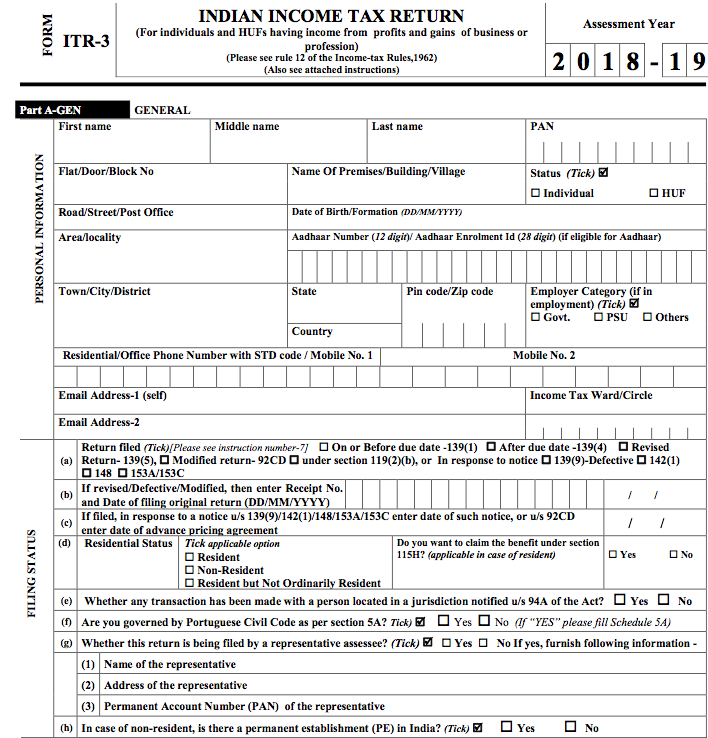

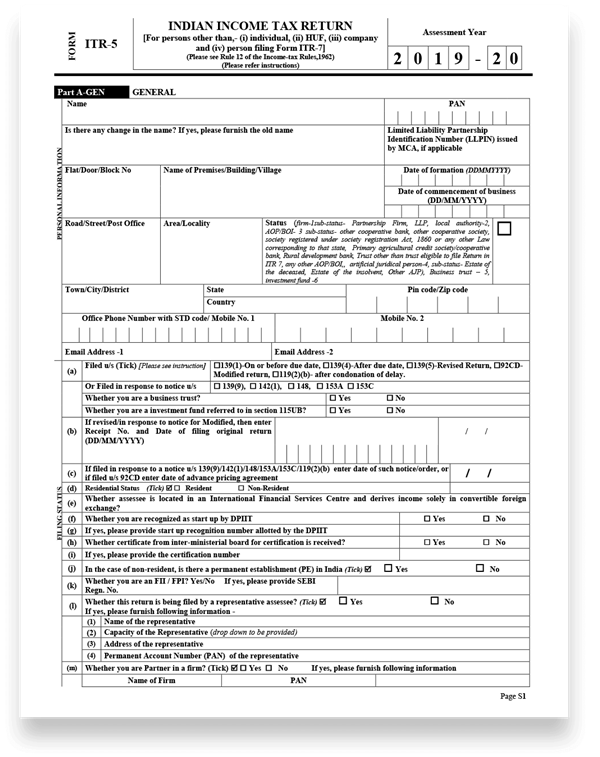

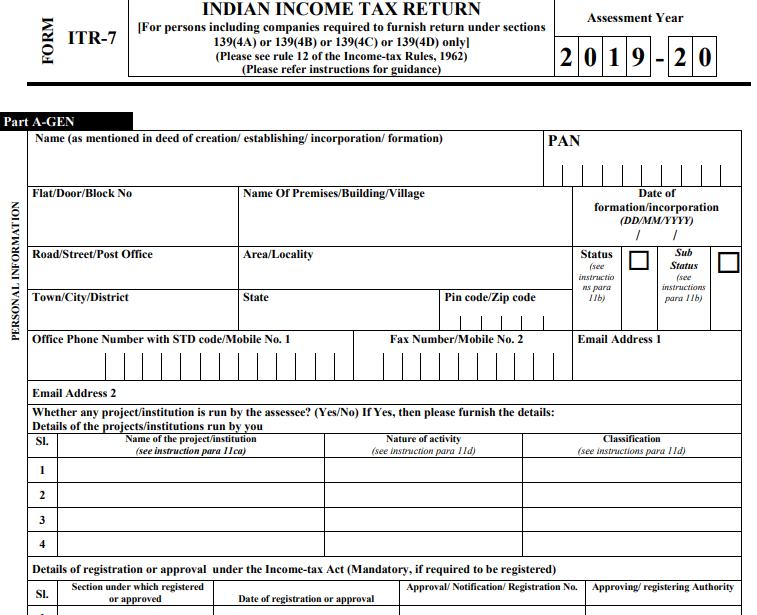

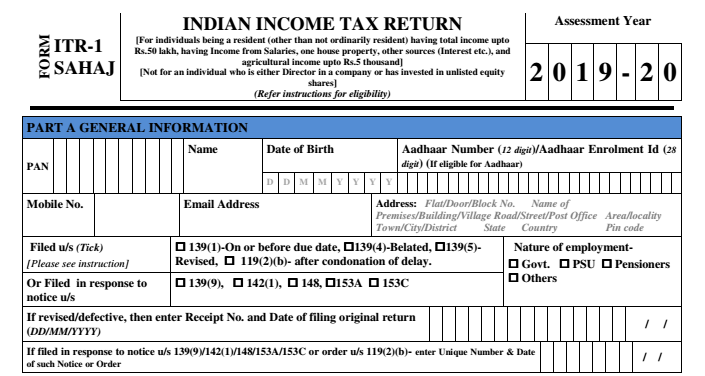

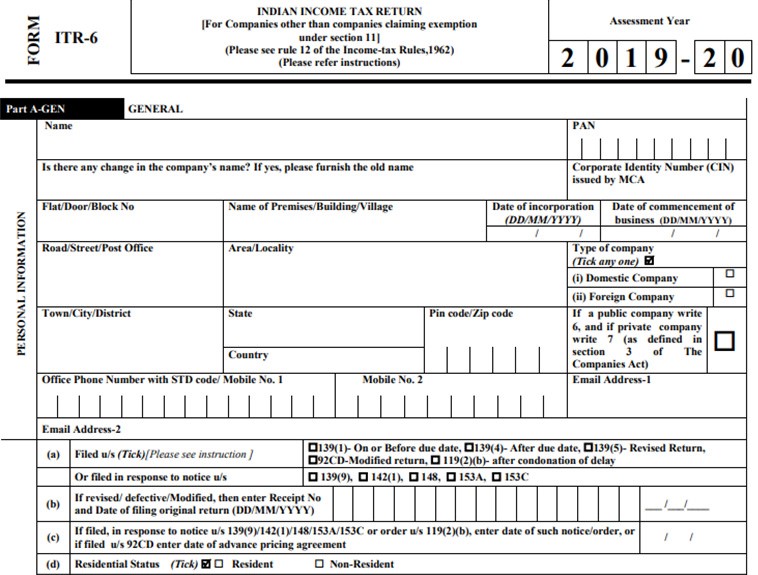

There is no denying the fact that tax is an essential Factor for the satisfactory governance of not just the state but the entire country. And, to simplify the tax filing process, the government has already categorized forms and eligibility criteria.

All you would have to do is keep a tab on income tax India efiling portal last date so that you would not have to put anything extra from your pocket later on.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.