ITR Refund Request- Intimation 143 (1) and Assessment Section 143(1)

There are various reasons for filing the Income Tax Return, one of the reasons can be to claim ITR refund. A taxpayer who has paid more tax to the Government than the actual liability can obtain an income tax refund. If you didn’t get the ITR refund, you can raise re-issue request for the same.

Reasons to File ITR Refund

Taxpayers file for ITR refund for the following reasons-

- When a taxpayer has paid Advance Tax on the Basis of self-assessment and if the amount turns out to be more than the actual Tax Liability of the taxpayer.

- If the TDS of a taxpayer has been deducted more than the actual amount.

- Double taxation of the Income of the taxpayer and in case the taxpayer has not been able to submit his investments proofs.

What is the Refund Banker Scheme?

The refund banker is a scheme which is operational for Indian taxpayers. If the refund requests are processed by the Income Tax Department then the refund of the amount will be issued to the taxpayers by State Bank of India (SBI).

Talk to our investment specialist

How you will get the Refund amount?

There are two options by which the IT Department will refund the money:

- The refund amount can be credited into the bank account of the assessee.

- The refund amount can be paid to the taxpayer through cheque. The cheque will be sent to the mailing address of the taxpayer.

How to submit Re-fund Reissue Request?

If you have received an intimation from the IT Department or Refund Banker (SBI) that the refund processing has failed because of wrong bank details. In case, you will have to submit a refund re-issue request online on the Income Tax Department website.

Follow the following steps to re-issue request:

- Login or Register on the Income-tax https://www.incometaxindiaefiling.gov.in

- From the top menu, select My Account and from the drop-down select Service Request

- In Request Type, select ‘New Request’ and Submit

- In Request category, select ‘Refund Re-issue’ and Submit

- Select Assessment Year and enter CPC Communication Reference Number (refer intimation 143 (1) notice from Income Tax Department) and Refund Sequence Number.

- Now, select the mode of refund reissue and update your new bank account number and Submit

After a few days, you will receive a refund in your bank account

Note: If you do not have intimation u/s 143(1) then submit a request for the same from the My Account >>Request if Intimation u/s 143(1)

Reasons for not receiving refund issued by the IT Department

If the bank details are incorrect then the refund cannot proceed ahead. Bank details including account number, IFSC code, mismatched account holder number etc. In these cases, you will not receive a refund from the income tax department.

Another scenario is when the communication address provided by the assessee is incorrect then the Refund Banker would not be able to send the cheque to the given address.

There can be a mismatch in the tax details mentioned in the Form 26AS and the details filled by the taxpayer while filing the ITR. By the way, Form 26AS is an annual statement issued by the Income Tax Department which provides details related to an assessee such as TDS, Advance tax payment by self-assessment, any Default TDS payment etc.

If BSR code, date of payment or challan is incorrect then there will be no refund to the assessee.

Taxpayers should regularly check their ITR refund status so that they will get an idea about the ongoing procedure.

Intimation under Section 143(1)

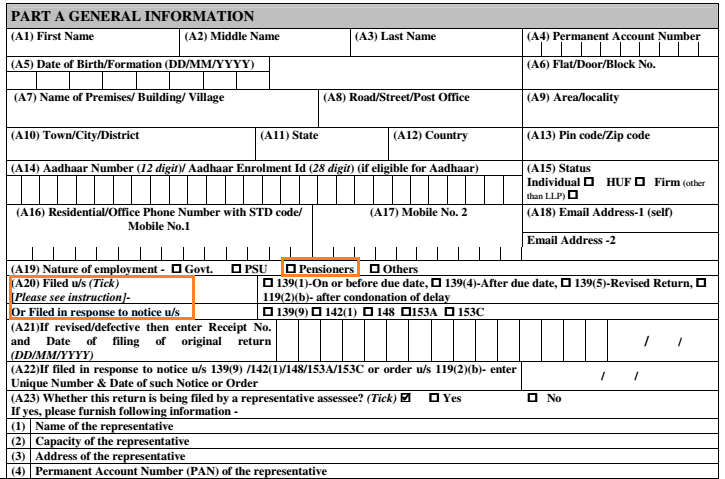

Mainly there are two conditions where an intimation 143(1) is issued by an Income Tax Department to an assessee:

- If there is any extra payment done by the taxpayer

- If the taxpayer has paid less tax, then the Income Tax Department will issue the Intimation 143(1) with the actual tax amount and Challan copy

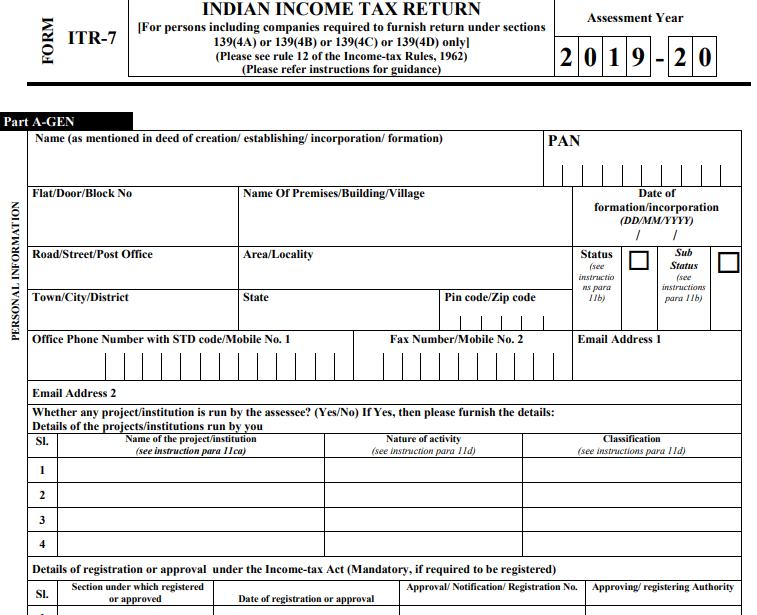

Assessment Under Section 143(1)

For each ITR request, the data is evaluated by the Centralized Processing Center(CPC) with the records of the Income Tax Department. These evaluated records contain the details of TDS, bank’s information, etc. In case there are any inconsistencies found during the evaluation, the intimation is issued with information on the inconsistency.

After the evaluation, the intimation is given on your email or via post and the taxpayer has given 30 days of time to file a response against the intimation. In case there is no response from the taxpayer then the Income Tax Department will make adjustments and will again send the intimation to the taxpayer. Generally, there are 3 types of intimation which are sent to the taxpayers mentioned below:

- Intimation with no refund or demand

- Intimation determining refund

- Intimation determining demand

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.