Table of Contents

- What is an EPF Payment?

- Monthly PF Contribution by Employers and Employees

- Who can Make the PF Online Payment?

- Steps for PF Payment Online

- List of Banks that Accept EPF Challan Payment

- EPF Payment Due Date

- Late PF Payment Penalty

- Which EPF rules have been changed as a result of the Covid-19 crises?

- PF Withdrawal Online

- EPF Withdrawal Without Employer Signature

- With an Aadhaar Card

- Without an Aadhaar Card

- EPFO Grievance

- PF Toll-Free Number

- Conclusion

- Frequently Asked Questions (FAQs)

- 1. Are there any initial requirements for making an online EPF payment?

- 2. What is the best way to check my EPF balance or EPF payment status online?

- 3. Who has online access to the EPF passbook?

- 4. Is it correct that both employee and employer contributions to my EPF account are tax-free?

- 5. Is it feasible for an employee to join a Provident Fund Scheme independently?

How to Make EPF Online Payment?

The Miscellaneous Provisions Act and the Employees' Provident Funds govern the Employees' Provident Fund (EPF) provisions. It tries to mobilize employee and employer savings through mandatory contributions to the provident fund. The EPFO administers and manages the PF Fund and aids the Central Board of Trustees.

This article contains a brief guide on making online EPF payments and a list of banks that offer the service. Go through it briefly to know everything and the major changes brought to EPF with the Covid-19 pandemic.

What is an EPF Payment?

The EPF is a retirement savings program that helps people build a sufficient corpus. The EPF Act of 1952 created the plan now managed by the Employees' Provident Fund Organisation (EPFO).

Under this program, a person would contribute 12% of their basic monthly salary to the fund. The boss matches this balance by donating an equal amount. You will take a lump sum payment when you retire, which will include all of your personal and business costs, as well as interest. The EPF is a low-risk fund because it is managed by the Indian government and pays a fixed return.

EPF accounts are necessary for employees in organizations with at least 20 employees. However, several organizations with fewer than 20 employees also frequently use EPF as well.

Employees with a salary of Rs. 15,000 or more must additionally open an EPF account. On the other hand, most businesses make the facilities available to all employees, regardless of remuneration. You can also shift the EPF corpus from one task to the next fast. It is made possible by the UAN system.

Monthly PF Contribution by Employers and Employees

The contribution of employers is divided into varying categories, such as:

- Employees Provident Fund: 3.67%

- Employees’ Pension Scheme (EPS): 8.33%

- Employee’s Deposit Link insurance Scheme (EDLIS): 0.50%

- EPF Admin Charges: 1.10%

- EDLIS Admin Charges: 0.01%

The employee's minimum wage and dearness allowance are used to calculate the EPF contribution amount. The following are the details of employee and company contributions to the EPF:

Employee contributions to the EPF: The employer deducts 12% of the employee's monthly pay (basic + dearness allowance) as an EPF contribution each month. The total donation is deposited into the EPF account of the employee.

Employer contribution to the EPF: Similarly, the corporation contributes 12% of the employee's Earnings to the EPF.

Talk to our investment specialist

Who can Make the PF Online Payment?

Though the employer and the employee both contribute to the PF account, only the employer registered with the PF Act can make payments to the account.

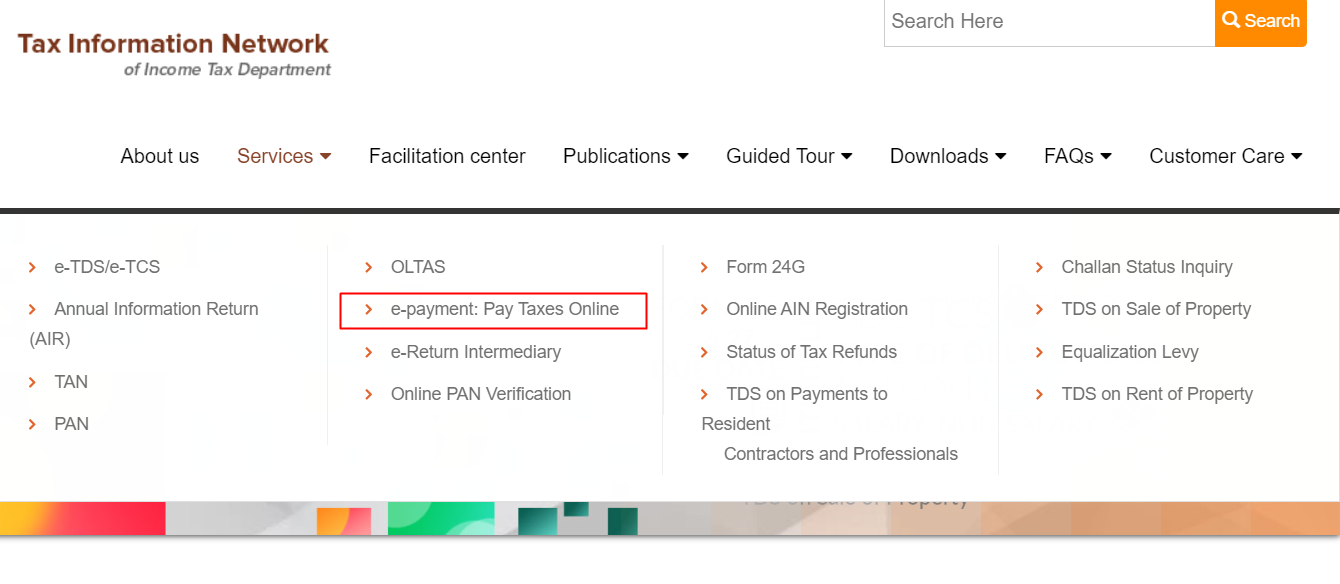

Employers can make online PF payments through EPFO online payment website or an authorized Bank's website (if the bank enables direct payment through their website) where the employer has a bank account and net banking.

Steps for PF Payment Online

Here are the steps for EPF e-payment:

- Login to EPFO's unified portal.

- Verify the establishment's PF details, such as establishment ID, name, address, exemption status, and so on, are accurate.

- Select the ECR upload option from the Payment drop-down menu.

- Choose a Wage Month, a Salary Disbursal Date, and a contribution rate before uploading an ECR text file.

- A screen will show File Validation Successful message when the uploaded ECR file has been validated. If the ECR file isn't validated, an error will appear. Correct the ECR text file for the requested format and re-upload until it is confirmed successfully.

- The TRRN created for the submitted ECR file will be displayed on the same page. Select Verify from the drop-down menu.

- To generate an ECR summary sheet, click the Prepare Challan option.

- Enter the Admin/Inspection Fees and select the Generate Challan option.

- After validating the challan amount, select the Finalise option.

- To make a payment against a TRRN, select the payment option.

- Select online as the payment mechanism, then select any banks from the drop-down menu before proceeding.

- This action will redirect you to your bank's internet banking login page, where you must log in and make a net-banking payment.

- Payment/Transaction-id will be produced, and an e-Receipt for transaction confirmation will be generated upon successful payment.

- The EPFO Portal will get updated with the transaction.

- EPFO will offer payment confirmation based on the TRRN number.

List of Banks that Accept EPF Challan Payment

Here is a list of authorized banks that are available on their websites to ensure online EPF payments:

- SBI

- PNB

- Indian Bank

- ICICI

- HDFC

- Kotak Mahindra

- Axis Bank

- Bank of Baroda

EPF Payment Due Date

The date on which employers deduct and pay the PF amount is known as the EPF payment due date. On or before the 15th, a Deduction is made from an employee's salary every month.

Late PF Payment Penalty

If you pay your EPF Challan payment late, you will be charged a penalty. There are two sorts of penalties that apply to late EPF payments.

- Interest for late payment under Section 7Q

If an employer fails to deposit EPF contributions before the deadline, a penalty in the form of interest is imposed. The employer is subjected to a daily interest rate of 12% per annum.

- Penalty for late payment under Section 14B

The following penalties apply if the employer fails to pay the Challan.

| Duration of delay | Rate of interest (per annum) |

|---|---|

| Up to 2 months | 5% |

| 2-4 months | 10% |

| 4-6 months | 15% |

| More than six months | 25% |

Which EPF rules have been changed as a result of the Covid-19 crises?

The following are some of the adjustments implemented by the finance ministry to mitigate the adverse effects of the country's covid-19 shutdown.

- Employees will be able to take 75% of their PF balance or three months of their Income, whichever is smaller, to settle their liquidity concerns.

- For a fixed period, the Indian government paid the EPF contribution on behalf of the employer and the employee, i.e., 24% of the employee's salary (basic wages + DA + Retaining allowance). This was during the first lockdown’s initial three months only.

- However, these will only apply to businesses with fewer than 100 employees, with 90% of them earning less than INR 15,000 per month.

PF Withdrawal Online

Partially withdrawing from the EPF account for purchasing a home, wedding expenditures, or medical expenses is possible. The cause for the withdrawal determines the amount that can be removed. It's worth noting that partial withdrawals have a lock-in period, which varies depending on the reason for the withdrawal.

Under some conditions, the whole PF balance can be withdrawn. Retirement age, resignation owing to permanent total mental/physical disability, permanent relocation to another nation, death of the member are just a few examples.

A few reasons why EPF should not be withdrawn before five years of service are listed below:

Benefits under IT Act's Section 80C are not available: If individuals claim benefits under IT Act's Section 80C and withdraw their PF amount, the interest gained on the employee's contribution must be taxed.

The following sum will be taxed: If a PF withdrawal is made within the first five years of employment, the amount withdrawn gets added to the Taxable Income. If the amount withdrawn exceeds Rs.50,000 and the withdrawal is made within five years, the amount is subject to a 10% tax reduction. Individuals are exempt from paying this sum if they file Forms 15G and 15H with the IT Department.

EPF Withdrawal Without Employer Signature

After discovering that obtaining an employer's consent or attestation to assist a PF withdrawal was causing a lot of headaches for many employees, the EPFO bypassed the process, and now employees can withdraw without their employers' attestation. The introduction of UAN brought this shift in the EPF, considering employees now only need to link their Aadhaar to their UAN for a withdrawal. After that, there are two options for withdrawing without the employer's signature: with or without an aadhaar card.

With an Aadhaar Card

Here are the steps to withdraw the amount with an aadhaar card:

- First, you must ensure that your aadhaar card details are embedded and verified in your EPFO member login portal along with your bank details.

- Next, you must also ensure that your UAN is activated before initiating the withdrawal.

- After meeting these conditions, download Form 10C -UAN and Form 19-UAN to withdraw from one's pension scheme and initiate the PF withdrawals, respectively.

- Enter the required details and attach a cancelled cheque with the filled form.

- Further, submit it to the regional EPF office for further processing.

Without an Aadhaar Card

Here are the steps to withdraw the amount without an aadhaar card:

- Download Form 19, Form 10C, or Form 31 from the EPFO member portal based on where you will make the withdrawal.

- The form must be signed by an approved signatory, such as a Gazetted officer, bank manager, magistrate, etc., after it has been filled out. The authorized signatory must sign each page of the form while doing so.

- Because you'll need to explain why you didn't receive the employer's signature, write Non-cooperation.

- The employer must then attach an indemnification bond with a stamp paper of 100 Rupees and the employee's payslips, employment ID, appointment letter, and Form 19.

- Submit your usual KYC paperwork, along with the attested form, Cancelled Check, and other verification papers, to the regional EPF office as confirmation of address and identity.

EPFO Grievance

Employees who want to raise a complaint can do so using the EPFO's member site, which has a specific section for them to fill out a grievance registration form and file a complaint. Employees frequently have complaints about withdrawals, PF settlements, account transfers, and pension settlements, among other things. To file an EPF complaint, follow these steps:

- Visit the EPFO grievance portal.

- Select the option of Register grievance from the top bar.

- The grievance registration form will open, fill in all the required details.

- Lastly, enter the grievance category, whether a pension settlement issue, transfer/ withdrawal-related issue, or anything else.

- Select the grievance from the drop-down menu.

- Upload the filled grievance letter, enter the captcha details, and then submit your grievance registration.

PF Toll-Free Number

Individuals can Call EPFO's toll-free number 1800 118 005 if they have questions about their UAN or Know Your Customer (KYC).

Conclusion

You can easily make an EPF payment online by following a few simple steps. Because you'll be requested to submit your ECR file at some point, it's a good idea to have it ready ahead of time. Furthermore, it is also advisable to keep your UAN and password handy and secure at all times as it helps in various steps while accessing the EPFO portal.

Frequently Asked Questions (FAQs)

1. Are there any initial requirements for making an online EPF payment?

A: When making an EPF payment online, you will be requested to upload your ECR file.

2. What is the best way to check my EPF balance or EPF payment status online?

A: You can quickly check your EPF balance by using the EPFO website to access your EPF Passbook.

3. Who has online access to the EPF passbook?

A: The EPF passbook can be seen or downloaded by EPF members who have completed their UAN Registration on the EPFO portal.

4. Is it correct that both employee and employer contributions to my EPF account are tax-free?

A: Your employer makes a tax-free contribution to your EPF, and your payment is tax-Deductible under Section 80C of the income tax Act.

5. Is it feasible for an employee to join a Provident Fund Scheme independently?

A: Employees cannot contribute to the EPF on their own. They must be employed by a company covered by the EPF and MF Act of 1952.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.