+91-22-48913909

+91-22-48913909

Table of Contents

- Why Invest in Top 11 SIP Funds?

- How to Invest in SIP?

- Top 11 SIP Mutual Funds in India FY 25 - 26

- Parameters to Consider While Investing in Best Systematic Investment Plans

- How to Invest in SIP MF Online?

- FAQs

Top 11 Funds

- ICICI Prudential Infrastructure Fund

- IDFC Infrastructure Fund

- Nippon India Power and Infra Fund

- L&T Emerging Businesses Fund

- HDFC Infrastructure Fund

- Franklin Build India Fund

- Franklin India Smaller Companies Fund

- DSP BlackRock India T.I.G.E.R Fund

- ICICI Prudential Smallcap Fund

- IDFC Sterling Value Fund

- ICICI Prudential Dividend Yield Equity Fund

11 Best Mutual Funds for SIP 2025

SIP Mutual Funds (or top 11 SIP Mutual Funds) are funds that adhere to the simple formula of periodic investment to avoid nervous selling during the inevitable ups and downs of the stock market.

Typically, SIP or Systematic Investment plan is a mode to invest money in Mutual Funds. Investing in top 11 SIP Mutual Funds brings a systematic and disciplined approach to your investment. It reduces your effort to manage your investment on daily Basis. Moreover, it offers leverage of the Power of Compounding leading to desired returns over time.

There are different Types of Mutual Funds for SIP that include equity, debt, balanced, ultra-short term funds, etc. However, equity Mutual Funds offer maximum returns when invested via a SIP. Financial advisors suggest that, the investors must invest in best mutual funds for SIP basis their investment objectives and the period of SIP investment.

Why Invest in Top 11 SIP Funds?

SIPs give a disciplined approach towards investing in Mutual Funds

Systematic investing helps in financing the future dream and major goals like- retirement, child's career, purchase of a house, car or any other assets

SIPs help in making the most of compounding and are ideal for young investors

Systematic Investment Plans minimize the risk of equity fluctuations

How to Invest in SIP?

Investing money is an art, it can work wonders if done correctly. Now that you know the Top SIP plans you must know how to invest in it. We have mentioned the steps to invest in SIP below.

1. Analyse your financial goals

Choose a SIP investment suiting your Financial goals. For example, if your goal is short-term (if want to buy a car in the next 2 years), you should invest in Debt Mutual Funds. And, if your goal is long-term (like Retirement planning) then prefer investing in Equity Mutual Funds.

2. Choose a timeline of investment

This will ensure that you invest a right amount of money for a right period of time.

3. Decide the amount you wish to invest monthly

As SIP is a monthly investment, you should choose an amount that you will be able to invest monthly without Fail. You can also calculate the suitable amount as per your goal using sip calculator or SIP return calculator.

4. Select the best SIP plan

Make a wise investment choice by consulting a financial advisor or by choosing Best SIP Plans offered by various online investment platforms.

Talk to our investment specialist

Top 11 SIP Mutual Funds in India FY 25 - 26

To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Franklin Build India Fund is a Equity - Sectoral fund was launched on 4 Sep 09. It is a fund with High risk and has given a Below is the key information for Franklin Build India Fund Returns up to 1 year are on The Fund seeks to provide long-term capital appreciation by investing in mid and small cap companies. Franklin India Smaller Companies Fund is a Equity - Small Cap fund was launched on 13 Jan 06. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Smaller Companies Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. DSP BlackRock India T.I.G.E.R Fund is a Equity - Sectoral fund was launched on 11 Jun 04. It is a fund with High risk and has given a Below is the key information for DSP BlackRock India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Indo Asia Equity Fund) ICICI Prudential Indo Asia Equity Fund is an OE equity scheme that seeks to generate long term capital appreciation by investing in equity, equity related securities and or share classes/units of equity funds of companies, which are incorporated or have their area of primary activity, in the Asia Pacific region. Initially the Scheme will invest in share classes of International Opportunities Fund Asian Equity Fund and thereafter the Fund Manager of the Indo Asia Equity Fund may choose to make investment in listed equity shares, securities in the Asia Pacific region. However, there can be no assurance that the investment objective of the Scheme will be realized. ICICI Prudential Smallcap Fund is a Equity - Small Cap fund was launched on 18 Oct 07. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Smallcap Fund Returns up to 1 year are on (Erstwhile IDFC Sterling Equity Fund) To generate capital appreciation from a diversified portfolio of equity and equity related instruments.It will predominantly invest in small and midcap equity and equity related instruments. Small and Midcap equity & equity related instruments will be the stocks included in the Nifty Free Float Midcap 100 or equity and equity related instruments of such companies which have a market capitalization lower than the highest components of Nifty Free Float Midcap 100. It may also invest in stocks other than mid cap stocks (i.e. in stocks, which have a market capitalisation of above the market capitalisation range of the defined small - midcap stocks) & derivatives. On defensive consideration,It may also invest in debt and money market instruments. In case of discontinuation /suspension of Nifty Free Float Midcap 100, the AMC reserves the right tomodify the definition of Mid cap and Small cap companies. In case of such amodification, the interest of investors will be of paramount importance. IDFC Sterling Value Fund is a Equity - Value fund was launched on 7 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for IDFC Sterling Value Fund Returns up to 1 year are on The investment objective of ICICI Prudential Dividend Yield Equity Fund is to provide medium to long term capital gains and/or dividend distribution by investing in a well diversified portfolio of predominantly equity and equity related instruments, which offer attractive dividend yield ICICI Prudential Dividend Yield Equity Fund is a Equity - Dividend Yield fund was launched on 16 May 14. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Dividend Yield Equity Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Infrastructure Fund Growth ₹181.24

↓ -0.29 ₹7,214 100 3.1 -4.3 3.8 28.3 38.7 27.4 IDFC Infrastructure Fund Growth ₹47.368

↓ -0.04 ₹1,563 100 3.5 -7.3 1.2 26.1 35.7 39.3 Nippon India Power and Infra Fund Growth ₹328.152

↑ 0.56 ₹6,849 100 3.8 -5.8 0.5 28.9 35.5 26.9 L&T Emerging Businesses Fund Growth ₹74.4416

↑ 0.17 ₹13,334 500 -2.8 -12.6 -1.4 18.2 35 28.5 HDFC Infrastructure Fund Growth ₹44.772

↓ -0.01 ₹2,329 300 3.7 -5.2 0.8 29.1 34.9 23 Franklin Build India Fund Growth ₹132.846

↓ -0.24 ₹2,642 500 3.5 -5.5 2 28.1 34.8 27.8 Franklin India Smaller Companies Fund Growth ₹159.873

↑ 0.62 ₹11,970 500 -0.3 -9 -0.4 21.2 34.2 23.2 DSP BlackRock India T.I.G.E.R Fund Growth ₹289.465

↓ -0.68 ₹4,880 500 1.3 -10.3 -0.8 25.7 34.2 32.4 ICICI Prudential Smallcap Fund Growth ₹79.74

↑ 0.06 ₹7,392 100 -1.3 -8.5 1 16.3 33.5 15.6 IDFC Sterling Value Fund Growth ₹142.564

↓ -0.06 ₹9,430 100 3.6 -4 4.3 16.7 33.4 18 ICICI Prudential Dividend Yield Equity Fund Growth ₹50.57

↓ -0.23 ₹4,995 100 5.5 -1.1 8.9 23.4 33 21 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 29 Apr 25 200 Crore in Equity Category of mutual funds ordered based on 5 year calendar year returns.

1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (29 Apr 25) ₹181.24 ↓ -0.29 (-0.16 %) Net Assets (Cr) ₹7,214 on 31 Mar 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 0.14 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 31 Mar 25 ₹54,540 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 1.6% 3 Month 3.1% 6 Month -4.3% 1 Year 3.8% 3 Year 28.3% 5 Year 38.7% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% 2014 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.83 Yr. Sharmila D’mello 30 Jun 22 2.76 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 37.76% Basic Materials 20.96% Financial Services 15.36% Utility 9.33% Energy 6.59% Communication Services 1.87% Consumer Cyclical 0.9% Real Estate 0.82% Asset Allocation

Asset Class Value Cash 5.82% Equity 93.59% Debt 0.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹678 Cr 1,940,000

↓ -112,790 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹312 Cr 2,637,644

↓ -57,680 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹264 Cr 86,408

↓ -12,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC4% ₹262 Cr 12,522,005

↑ 515,888 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹250 Cr 7,000,000

↓ -260,775 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹219 Cr 4,723,662

↓ -200,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹216 Cr 1,600,000

↓ -390,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹199 Cr 1,559,486

↓ -150,000 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004803% ₹194 Cr 635,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | 5222873% ₹186 Cr 1,903,566 2. IDFC Infrastructure Fund

CAGR/Annualized return of 11.6% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (29 Apr 25) ₹47.368 ↓ -0.04 (-0.09 %) Net Assets (Cr) ₹1,563 on 31 Mar 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 0.11 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 3.1% 3 Month 3.5% 6 Month -7.3% 1 Year 1.2% 3 Year 26.1% 5 Year 35.7% 10 Year 15 Year Since launch 11.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 39.3% 2022 50.3% 2021 1.7% 2020 64.8% 2019 6.3% 2018 -5.3% 2017 -25.9% 2016 58.7% 2015 10.7% 2014 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.19 Yr. Ritika Behera 7 Oct 23 1.48 Yr. Gaurav Satra 7 Jun 24 0.82 Yr. Data below for IDFC Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 56.16% Utility 13.16% Basic Materials 9.87% Communication Services 4.63% Energy 3.69% Financial Services 2.72% Consumer Cyclical 2.55% Technology 2.5% Health Care 1.93% Asset Allocation

Asset Class Value Cash 2.79% Equity 97.21% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹76 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹64 Cr 183,173 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325384% ₹58 Cr 50,452 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE4% ₹58 Cr 452,706 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA4% ₹57 Cr 4,797,143 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹57 Cr 330,018 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹43 Cr 365,137 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹43 Cr 1,431,700 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹40 Cr 512,915 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS2% ₹39 Cr 12,400,122 3. Nippon India Power and Infra Fund

CAGR/Annualized return of 18.1% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (29 Apr 25) ₹328.152 ↑ 0.56 (0.17 %) Net Assets (Cr) ₹6,849 on 31 Mar 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio -0.05 Information Ratio 1.15 Alpha Ratio 2.34 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,563 31 Mar 22 ₹23,186 31 Mar 23 ₹26,891 31 Mar 24 ₹47,550 31 Mar 25 ₹48,861 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 3.2% 3 Month 3.8% 6 Month -5.8% 1 Year 0.5% 3 Year 28.9% 5 Year 35.5% 10 Year 15 Year Since launch 18.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% 2014 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.86 Yr. Rahul Modi 19 Aug 24 0.62 Yr. Data below for Nippon India Power and Infra Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 41.09% Utility 20.7% Energy 9.09% Basic Materials 8.27% Communication Services 7.84% Real Estate 3.46% Consumer Cyclical 2.88% Technology 2.17% Financial Services 2.11% Health Care 2.03% Asset Allocation

Asset Class Value Cash 0.35% Equity 99.65% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325558% ₹551 Cr 15,400,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE8% ₹523 Cr 4,100,000

↑ 100,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹514 Cr 1,472,001

↓ -20,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL7% ₹451 Cr 2,600,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹276 Cr 240,038 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004004% ₹268 Cr 7,130,789

↑ 155,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES3% ₹201 Cr 423,938 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹185 Cr 350,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV3% ₹183 Cr 1,800,000 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 24 | 5001033% ₹173 Cr 8,000,000

↑ 300,000 4. L&T Emerging Businesses Fund

CAGR/Annualized return of 20.1% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (29 Apr 25) ₹74.4416 ↑ 0.17 (0.23 %) Net Assets (Cr) ₹13,334 on 28 Feb 25 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio -0.4 Information Ratio -0.11 Alpha Ratio 1.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,010 31 Mar 22 ₹29,870 31 Mar 23 ₹31,289 31 Mar 24 ₹46,026 31 Mar 25 ₹48,026 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 2.6% 3 Month -2.8% 6 Month -12.6% 1 Year -1.4% 3 Year 18.2% 5 Year 35% 10 Year 15 Year Since launch 20.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 28.5% 2022 46.1% 2021 1% 2020 77.4% 2019 15.5% 2018 -8.1% 2017 -13.7% 2016 66.5% 2015 10.2% 2014 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.29 Yr. Cheenu Gupta 1 Oct 23 1.5 Yr. Sonal Gupta 1 Oct 23 1.5 Yr. Data below for L&T Emerging Businesses Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 26.11% Consumer Cyclical 15.8% Financial Services 13.58% Basic Materials 10.91% Technology 9.31% Health Care 5.7% Real Estate 4.71% Consumer Defensive 4.25% Energy 1.01% Asset Allocation

Asset Class Value Cash 6.28% Equity 93.72% Top Securities Holdings / Portfolio

Name Holding Value Quantity Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹339 Cr 280,946

↓ -11,533 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹313 Cr 1,595,574 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | KPRMILL2% ₹312 Cr 3,445,300

↑ 158,403 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | FEDERALBNK2% ₹300 Cr 15,544,000

↑ 2,257,421 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹284 Cr 6,810,500 Suven Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Mar 20 | SUVENPHAR2% ₹265 Cr 2,298,085 Sumitomo Chemical India Ltd Ordinary Shares (Basic Materials)

Equity, Since 31 Oct 20 | SUMICHEM2% ₹261 Cr 4,672,221 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Jan 20 | AMBER2% ₹257 Cr 356,138 KFin Technologies Ltd (Technology)

Equity, Since 31 Aug 24 | KFINTECH2% ₹250 Cr 2,429,736 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | 5900032% ₹249 Cr 11,912,400 5. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (29 Apr 25) ₹44.772 ↓ -0.01 (-0.02 %) Net Assets (Cr) ₹2,329 on 31 Mar 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.01 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,356 31 Mar 22 ₹21,727 31 Mar 23 ₹25,279 31 Mar 24 ₹45,346 31 Mar 25 ₹47,548 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 3.5% 3 Month 3.7% 6 Month -5.2% 1 Year 0.8% 3 Year 29.1% 5 Year 34.9% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% 2014 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.22 Yr. Dhruv Muchhal 22 Jun 23 1.78 Yr. Data below for HDFC Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 38.73% Financial Services 20.42% Basic Materials 10.95% Utility 7.64% Energy 7.08% Communication Services 3.68% Health Care 1.7% Technology 1.31% Real Estate 0.84% Consumer Cyclical 0.48% Asset Allocation

Asset Class Value Cash 6.07% Equity 92.83% Debt 1.1% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK8% ₹175 Cr 1,300,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT6% ₹133 Cr 380,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹128 Cr 700,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL4% ₹92 Cr 1,450,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹79 Cr 2,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹77 Cr 150,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | 5222873% ₹74 Cr 758,285 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹68 Cr 1,700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹64 Cr 500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹61 Cr 350,000 6. Franklin Build India Fund

CAGR/Annualized return of 18% since its launch. Ranked 4 in Sectoral category. Return for 2024 was 27.8% , 2023 was 51.1% and 2022 was 11.2% . Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (29 Apr 25) ₹132.846 ↓ -0.24 (-0.18 %) Net Assets (Cr) ₹2,642 on 31 Mar 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.13 Sharpe Ratio 0.09 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,042 31 Mar 22 ₹22,684 31 Mar 23 ₹25,531 31 Mar 24 ₹43,699 31 Mar 25 ₹46,685 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 3% 3 Month 3.5% 6 Month -5.5% 1 Year 2% 3 Year 28.1% 5 Year 34.8% 10 Year 15 Year Since launch 18% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% 2014 2.1% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 3.45 Yr. Kiran Sebastian 7 Feb 22 3.15 Yr. Sandeep Manam 18 Oct 21 3.45 Yr. Data below for Franklin Build India Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 34.52% Utility 13.44% Energy 12.09% Financial Services 11.98% Communication Services 7.87% Basic Materials 7.07% Consumer Cyclical 3.06% Real Estate 2.9% Technology 1.74% Asset Allocation

Asset Class Value Cash 5.33% Equity 94.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹232 Cr 665,000

↓ -55,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | ICICIBANK6% ₹162 Cr 1,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO6% ₹153 Cr 300,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹153 Cr 1,200,000

↑ 150,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325556% ₹148 Cr 4,125,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003125% ₹123 Cr 5,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹123 Cr 710,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322154% ₹110 Cr 1,000,000

↑ 100,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 21 | 5328984% ₹98 Cr 3,365,000 Tata Power Co Ltd (Utilities)

Equity, Since 31 Jan 25 | 5004003% ₹75 Cr 2,000,000 7. Franklin India Smaller Companies Fund

CAGR/Annualized return of 15.5% since its launch. Ranked 11 in Small Cap category. Return for 2024 was 23.2% , 2023 was 52.1% and 2022 was 3.6% . Franklin India Smaller Companies Fund

Growth Launch Date 13 Jan 06 NAV (29 Apr 25) ₹159.873 ↑ 0.62 (0.39 %) Net Assets (Cr) ₹11,970 on 31 Mar 25 Category Equity - Small Cap AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio -0.06 Information Ratio 0.27 Alpha Ratio -3.3 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹19,999 31 Mar 22 ₹26,272 31 Mar 23 ₹28,549 31 Mar 24 ₹43,647 31 Mar 25 ₹44,921 Returns for Franklin India Smaller Companies Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 5.4% 3 Month -0.3% 6 Month -9% 1 Year -0.4% 3 Year 21.2% 5 Year 34.2% 10 Year 15 Year Since launch 15.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.2% 2022 52.1% 2021 3.6% 2020 56.4% 2019 18.7% 2018 -5% 2017 -17.4% 2016 43.5% 2015 10.2% 2014 9.6% Fund Manager information for Franklin India Smaller Companies Fund

Name Since Tenure R. Janakiraman 1 Feb 11 14.17 Yr. Sandeep Manam 18 Oct 21 3.45 Yr. Akhil Kalluri 8 Sep 22 2.56 Yr. Data below for Franklin India Smaller Companies Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 19.26% Financial Services 18.94% Consumer Cyclical 15.15% Health Care 11.27% Basic Materials 10.48% Technology 4.67% Real Estate 4.54% Consumer Defensive 3.5% Utility 2.72% Energy 0.93% Communication Services 0.01% Asset Allocation

Asset Class Value Cash 7.22% Equity 92.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 23 | ASTERDM3% ₹388 Cr 8,018,630 Brigade Enterprises Ltd (Real Estate)

Equity, Since 30 Jun 14 | 5329293% ₹378 Cr 3,868,691 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | 5900032% ₹293 Cr 13,998,917 Deepak Nitrite Ltd (Basic Materials)

Equity, Since 31 Jan 16 | DEEPAKNTR2% ₹275 Cr 1,387,967 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 30 Sep 19 | ERIS2% ₹265 Cr 1,866,828 Equitas Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 20 | EQUITASBNK2% ₹264 Cr 48,064,081 Crompton Greaves Consumer Electricals Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | CROMPTON2% ₹244 Cr 6,900,000 ICICI Bank Ltd (Financial Services)

Equity, Since 28 Feb 21 | ICICIBANK2% ₹237 Cr 1,759,945 J.B. Chemicals & Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 14 | JBCHEPHARM2% ₹235 Cr 1,448,723 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 May 22 | KALYANKJIL2% ₹232 Cr 4,963,469 8. DSP BlackRock India T.I.G.E.R Fund

CAGR/Annualized return of 17.5% since its launch. Ranked 12 in Sectoral category. Return for 2024 was 32.4% , 2023 was 49% and 2022 was 13.9% . DSP BlackRock India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (29 Apr 25) ₹289.465 ↓ -0.68 (-0.24 %) Net Assets (Cr) ₹4,880 on 31 Mar 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio 0.14 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,218 31 Mar 22 ₹23,467 31 Mar 23 ₹26,460 31 Mar 24 ₹43,618 31 Mar 25 ₹46,898 Returns for DSP BlackRock India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 1.4% 3 Month 1.3% 6 Month -10.3% 1 Year -0.8% 3 Year 25.7% 5 Year 34.2% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% 2014 0.7% Fund Manager information for DSP BlackRock India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 14.79 Yr. Data below for DSP BlackRock India T.I.G.E.R Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 31.06% Basic Materials 15.26% Consumer Cyclical 9.15% Utility 8.67% Financial Services 6.66% Health Care 6.6% Energy 5.71% Communication Services 4.44% Technology 2.67% Real Estate 1.73% Consumer Defensive 1.46% Asset Allocation

Asset Class Value Cash 6.59% Equity 93.41% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325555% ₹256 Cr 7,145,883 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL4% ₹212 Cr 1,223,115

↑ 142,509 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT4% ₹195 Cr 559,286 Siemens Ltd (Industrials)

Equity, Since 30 Nov 18 | 5005504% ₹195 Cr 369,482 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP3% ₹163 Cr 245,928

↑ 94,969 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Dec 24 | AMBER3% ₹148 Cr 205,752

↑ 76,624 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA3% ₹132 Cr 3,321,453 Rainbow Childrens Medicare Ltd (Healthcare)

Equity, Since 31 Jan 25 | 5435243% ₹131 Cr 935,870

↑ 587,697 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | 5328982% ₹114 Cr 3,920,048

↑ 2,342,026 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG2% ₹113 Cr 1,570,529

↑ 68,054 9. ICICI Prudential Smallcap Fund

CAGR/Annualized return of 12.6% since its launch. Ranked 26 in Small Cap category. Return for 2024 was 15.6% , 2023 was 37.9% and 2022 was 5.7% . ICICI Prudential Smallcap Fund

Growth Launch Date 18 Oct 07 NAV (29 Apr 25) ₹79.74 ↑ 0.06 (0.08 %) Net Assets (Cr) ₹7,392 on 31 Mar 25 Category Equity - Small Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.04 Sharpe Ratio -0.08 Information Ratio -0.36 Alpha Ratio -3.16 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,420 31 Mar 22 ₹28,527 31 Mar 23 ₹29,468 31 Mar 24 ₹41,702 31 Mar 25 ₹43,091 Returns for ICICI Prudential Smallcap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 3.6% 3 Month -1.3% 6 Month -8.5% 1 Year 1% 3 Year 16.3% 5 Year 33.5% 10 Year 15 Year Since launch 12.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 15.6% 2022 37.9% 2021 5.7% 2020 61% 2019 22.8% 2018 10% 2017 -22.4% 2016 42.7% 2015 6% 2014 0.5% Fund Manager information for ICICI Prudential Smallcap Fund

Name Since Tenure Anish Tawakley 18 Sep 23 1.54 Yr. Sharmila D’mello 30 Jun 22 2.76 Yr. Aatur Shah 21 Apr 25 0 Yr. Data below for ICICI Prudential Smallcap Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Basic Materials 27.85% Industrials 21.89% Consumer Cyclical 11.84% Health Care 8.13% Financial Services 5.42% Utility 3.42% Consumer Defensive 2.94% Communication Services 1.52% Technology 1.36% Energy 1.22% Real Estate 1.11% Asset Allocation

Asset Class Value Cash 13.3% Equity 86.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 23 | 5325385% ₹339 Cr 294,742

↑ 05 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Oct 23 | LT3% ₹215 Cr 616,614 Gujarat Pipavav Port Ltd (Industrials)

Equity, Since 31 Mar 18 | 5332483% ₹188 Cr 13,629,398 Atul Ltd (Basic Materials)

Equity, Since 31 Oct 23 | ATUL2% ₹183 Cr 298,228

↑ 15,064 Procter & Gamble Health Ltd (Healthcare)

Equity, Since 29 Feb 24 | PGHL2% ₹179 Cr 347,671 Tata Chemicals Ltd (Basic Materials)

Equity, Since 31 Aug 24 | TATACHEM2% ₹168 Cr 1,946,151

↑ 144,535 Cummins India Ltd (Industrials)

Equity, Since 30 Sep 23 | 5004802% ₹155 Cr 507,918 Gujarat State Petronet Ltd (Utilities)

Equity, Since 31 Jan 24 | 5327022% ₹155 Cr 5,316,113

↓ -153,988 Gillette India Ltd (Consumer Defensive)

Equity, Since 31 Dec 23 | GILLETTE2% ₹148 Cr 184,649 TVS Holdings Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | 5200562% ₹137 Cr 159,482 10. IDFC Sterling Value Fund

CAGR/Annualized return of 16.8% since its launch. Ranked 21 in Value category. Return for 2024 was 18% , 2023 was 32.6% and 2022 was 3.2% . IDFC Sterling Value Fund

Growth Launch Date 7 Mar 08 NAV (29 Apr 25) ₹142.564 ↓ -0.06 (-0.04 %) Net Assets (Cr) ₹9,430 on 31 Mar 25 Category Equity - Value AMC IDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.81 Sharpe Ratio -0.08 Information Ratio 0.56 Alpha Ratio -1.51 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,593 31 Mar 22 ₹29,489 31 Mar 23 ₹30,476 31 Mar 24 ₹44,072 31 Mar 25 ₹46,095 Returns for IDFC Sterling Value Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 3.3% 3 Month 3.6% 6 Month -4% 1 Year 4.3% 3 Year 16.7% 5 Year 33.4% 10 Year 15 Year Since launch 16.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 18% 2022 32.6% 2021 3.2% 2020 64.5% 2019 15.2% 2018 -6.2% 2017 -13% 2016 61.3% 2015 1.1% 2014 -0.3% Fund Manager information for IDFC Sterling Value Fund

Name Since Tenure Daylynn Pinto 20 Oct 16 8.45 Yr. Ritika Behera 7 Oct 23 1.48 Yr. Gaurav Satra 7 Jun 24 0.82 Yr. Data below for IDFC Sterling Value Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 30.99% Consumer Cyclical 10.27% Basic Materials 9.15% Energy 8.2% Technology 7.77% Consumer Defensive 7.16% Industrials 7.12% Health Care 5.89% Utility 2.63% Real Estate 1.62% Asset Allocation

Asset Class Value Cash 9.2% Equity 90.8% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 22 | HDFCBANK8% ₹750 Cr 4,100,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 22 | RELIANCE7% ₹638 Cr 5,000,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322155% ₹518 Cr 4,700,000

↑ 200,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK4% ₹337 Cr 2,500,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 21 | TCS3% ₹287 Cr 795,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 23 | INFY2% ₹236 Cr 1,500,000 Jindal Steel & Power Ltd (Basic Materials)

Equity, Since 30 Apr 17 | 5322862% ₹228 Cr 2,500,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 25 | KOTAKBANK2% ₹228 Cr 1,050,000

↑ 50,000 Avanti Feeds Ltd (Consumer Defensive)

Equity, Since 31 Jul 21 | AVANTIFEED2% ₹201 Cr 2,200,000

↓ -300,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Aug 15 | 5000932% ₹192 Cr 3,000,000 11. ICICI Prudential Dividend Yield Equity Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 38 in Dividend Yield category. Return for 2024 was 21% , 2023 was 38.8% and 2022 was 9.2% . ICICI Prudential Dividend Yield Equity Fund

Growth Launch Date 16 May 14 NAV (29 Apr 25) ₹50.57 ↓ -0.23 (-0.45 %) Net Assets (Cr) ₹4,995 on 31 Mar 25 Category Equity - Dividend Yield AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.41 Sharpe Ratio 0.21 Information Ratio 1.53 Alpha Ratio 2.64 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,380 31 Mar 22 ₹23,864 31 Mar 23 ₹25,387 31 Mar 24 ₹39,112 31 Mar 25 ₹42,750 Returns for ICICI Prudential Dividend Yield Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 29 Apr 25 Duration Returns 1 Month 2.9% 3 Month 5.5% 6 Month -1.1% 1 Year 8.9% 3 Year 23.4% 5 Year 33% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 21% 2022 38.8% 2021 9.2% 2020 47.1% 2019 14.1% 2018 -2.9% 2017 -11.9% 2016 40.7% 2015 9.7% 2014 -5.2% Fund Manager information for ICICI Prudential Dividend Yield Equity Fund

Name Since Tenure Mittul Kalawadia 29 Jan 18 7.18 Yr. Sharmila D’mello 31 Jul 22 2.67 Yr. Data below for ICICI Prudential Dividend Yield Equity Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 27.11% Consumer Cyclical 10.66% Energy 10.4% Utility 8.13% Basic Materials 7.29% Consumer Defensive 6.7% Industrials 6.42% Health Care 6.29% Technology 4.7% Communication Services 4.35% Real Estate 1.41% Asset Allocation

Asset Class Value Cash 4.57% Equity 93.46% Debt 1.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK8% ₹406 Cr 2,222,624 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | ICICIBANK8% ₹392 Cr 2,905,184 NTPC Ltd (Utilities)

Equity, Since 31 Oct 16 | 5325557% ₹337 Cr 9,420,524 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jan 22 | MARUTI7% ₹330 Cr 286,610 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 30 Apr 21 | SUNPHARMA6% ₹306 Cr 1,764,101

↓ -99,950 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Dec 21 | 5003124% ₹219 Cr 8,878,322 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 20 | BHARTIARTL4% ₹202 Cr 1,162,923

↓ -149,625 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Aug 21 | LT4% ₹184 Cr 525,555 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322154% ₹183 Cr 1,656,380 Avenue Supermarts Ltd (Consumer Defensive)

Equity, Since 31 Oct 24 | 5403762% ₹118 Cr 288,647

The investors are suggested to invest in the SIP plans of their choice. The above-mentioned top 11 Mutual Funds are suitable for investors of all kind. So, either you are a high-risk investor or a relatively lower one, these SIP funds are the Best Mutual Funds to Invest. So, don’t wait, invest now!

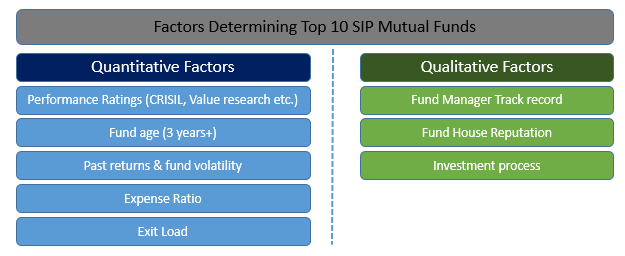

Parameters to Consider While Investing in Best Systematic Investment Plans

To evaluate best performing SIP Funds, let’s know the factors that one must consider before investing.

Quantitative Factors to Invest in Top SIP

The quantitative factors one must consider before investing via SIP include performance rating (as per CRISIL, Value Research etc.), fund age, past returns and fund volatility, expense ratio and exit load.

Qualitative Factors to Invest in Top SIP

Qualitative key statistics to analyse include the track record of the fund manager, reputation of the fund house and the investment process of the SIP fund.

How to Invest in SIP MF Online?

Open Free Investment Account for Lifetime at Fincash.com

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Begin your investment journey with SIP today!

FAQs

1. What are mutual funds?

A: Mutual funds are a part of the Systematic Investment Plan or SIPs that usually produce excellent returns later. When you invest in Mutual Funds, you diversify your investment portfolio. A mutual fund can be considered an investment tool developed by an Asset Management Company by pooling in multiple investors and companies' investments.

2. What are the different types of mutual funds?

A: Mutual funds can be broadly classified into the following types:

- Equity or growth funds

- Fixed income funds or Debt fund

- Tax saving funds

- Liquid Funds

- Balanced Fund

- Gilt Funds

- Exchange-Traded Funds or ETFs

3. What are growth equity funds?

A: The growth Equity Funds are the most common mutual funds. However, this portfolio will consist of volatile investments. Nevertheless, investors often prefer the growth equity funds as these have higher returns and can be invested for a shorter period.

4. Why should you invest in a debt fund?

A: These investments are ideal for individuals who are looking for fixed returns on investment. The fixed income can be earned from debentures, debt securities, commercial papers, and government securities. Mutual funds would create a portfolio of various types of investments and dissipate the risk.

5. Why should you invest in SIPs?

A: SIPs can provide the investor with assured income. If you are interested in earning passive income and want to ensure that your investment produces regular income, then you can consider investing in SIPs. .

6. Why invest in a tax saving mutual fund?

A: If you are looking to grow your Capital and at the same time want to enjoy tax exemptions, then you could invest in a tax saving mutual fund. Under Section 80C of the income tax Act of 1861, if you invest in equity-linked tax saving mutual funds, you can enjoy tax exemptions on your investment.

7. Do I need a broker to invest in mutual funds?

A: You will need the support of a broker or a financial institute to help you with the investment. You will need the support to identify the suitable SIPs and ensure that the investments have been made correctly.

By Rohini Hiremath

By Rohini Hiremath

Rohini Hiremath works as a Content Head at Fincash.com. Her passion is to deliver financial knowledge to the masses in simple language. She has a strong background in start-ups and diverse content. Rohini is also an SEO expert, coach and motivating team head!

You can connect with her at rohini.hiremath@fincash.com

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.