Table of Contents

Tactical Asset Allocation (TAA)

As per the tactical Asset Allocation strategy, it serves to be an active management methodology for shifting the overall volume of assets in holding across various categories for taking advantage of the respective strong Market vectors or anomalies related to market pricing. The strategy is known to allow Portfolio managers in the creation of extra value by leveraging the benefits of specific situations in the given marketplace.

It is referred to as an active strategy as managers are able to return to the original asset mix of the portfolio once they have reached the achievable short-term profits.

Basics of TAA

For understanding of the basics of tactical asset allocation, it is important to first understand strategic asset allocation. A professional portfolio manager is expected to create the IPS or investor Policy statement for setting the strategic mix of assets for proper inclusion in the respective holdings of the clients.

The manager will be looking into multiple factors including the acceptable risk levels, needed rate of return, liquidity & legal requirements, time horizon, Taxes, and specific investor conditions.

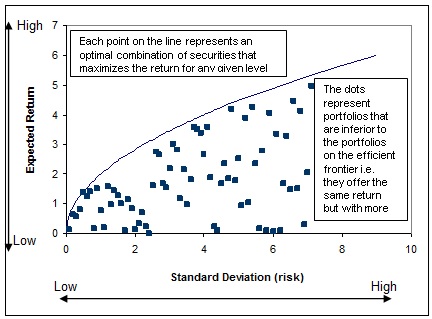

The overall percentage of weighing that every Asset Class tends to have on the long-term Basis is referred to as strategic asset allocation. The allocation serves to be the combination of weights and assets responsible for helping an investor in reaching the respective goals.

The following can be regarded as the perfect instance of proper portfolio allocation & the overall weight of the respective asset class:

- Stocks -45 percent

- Bonds -35 percent

- Cash -10 percent

- Commodities -10 percent

Talk to our investment specialist

Role of Tactical Asset Allocation (TAA)

TAA or Tactical asset allocation can be defined as the procedure of taking active stance with respect to strategic asset allocation while adjusting the long-term target weights for a considerably short period. This is done for capitalizing on the existing economic opportunities or the ongoing market. For instance, let us assume that the existing data suggests that there is going to be a significant increase in the overall demand for commodities in the coming span of 18 months. It would be regarded as prudent for the investor to consider shifting more Capital into the respective asset class for leverage the benefit of the given opportunity. While strategic allocation of the portfolio is going to be the same, the overall tactical allocation could become:

- Bonds – 35 percent

- Stocks -45 percent

- Cash -5 percent

- Commodities -15 percent

Tactical shifts are also known to come within the domain of an asset class. Let us assume that 45 percent of the stocks’ strategic allocation comprises of 15 percent of small cap holdings and 30 percent of large-cap holdings. If the respective outlook for small-cap holdings does not appear favorable, then it is regarded as a wide tactical choice to consider shifting the allocation within the existing stocks to 40 percent of large-cap holdings and 5 percent of small-cap holdings for a shorter period until the existing conditions would change.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.