Table of Contents

- ڈیویڈنڈ ادا کرنے والے میوچل فنڈز میں کیوں سرمایہ کاری کریں؟

- آن لائن ڈیویڈنڈ ادا کرنے والے میوچل فنڈز میں کیسے سرمایہ کاری کی جائے؟

- مالی سال 22 - 23 کے لیے سرفہرست ڈیویڈنڈ ادا کرنے والے فنڈز

- ٹاپ 5 لارج کیپ ایکویٹی ڈیویڈنڈ فنڈز FY 22 - 23

- ٹاپ 5 مڈ کیپ ایکویٹی ڈیویڈنڈ فنڈز مالی سال 22 - 23

- سرفہرست 5 سمال کیپ ڈیویڈنڈ فنڈز مالی سال 22 - 23

- ٹاپ 5 متنوع/ملٹی کیپ ایکویٹی ڈیویڈنڈ فنڈ مالی سال 22 - 23

- ٹاپ 5 ڈیویڈنڈ (ELSS) Equity Linked Saving Scheme FY 22 - 23

- ٹاپ 5 سیکٹر ایکویٹی ڈیویڈنڈ فنڈز FY 22 - 23

- ٹاپ 5 ڈیویڈنڈ بیلنسڈ/ہائبرڈ فنڈز FY 22 - 23

- ٹاپ 5 ڈیویڈنڈ الٹرا شارٹ ٹرم ڈیبٹ فنڈز FY 22 - 23

- ٹاپ 5 ڈیویڈنڈ شارٹ ٹرم ڈیبٹ فنڈز FY 22 - 23

- ٹاپ 5 ڈیویڈنڈ لیکویڈ فنڈز FY 22 - 23

- ٹاپ 5 ڈیویڈنڈ گلٹ فنڈز FY 22 - 23

Top 5 Funds

بہترین ڈیویڈنڈ ادا کرنے والے میوچل فنڈز 2022 - 2023

چونکہ، آج کل بہت سے سرمایہ کارمیوچل فنڈز میں سرمایہ کاری کریں۔ باقاعدگی سے کمانے کے لئےآمدنی، میوچل فنڈ کے مشیر ان اسکیموں کو آگے بڑھانے کے لیے "باقاعدہ ڈیویڈنڈ" کا استعمال کرتے ہیں۔ اس طرح، ہم نے کچھ بہترین اسکیموں کو شارٹ لسٹ کیا ہے جنہوں نے موجودہ سال کے دوران زیادہ منافع کی پیش کش کی۔

![]()

ہندوستان میں میوچل فنڈ اسکیموں میں سالوں میں اضافہ ہوا ہے۔ نتیجے کے طور پر،بہترین کارکردگی کا مظاہرہ کرنے والے میوچل فنڈز میںمارکیٹ تبدیل کرتے رہیں. میوچل فنڈ اسکیم کا فیصلہ کرنے کے لیے مختلف درجہ بندی کے نظام موجود ہیں، یعنی CRISIL، مارننگ اسٹار، ICRA۔ یہ سسٹمز مختلف پیرامیٹرز جیسے کہ ماضی کے ریٹرن کے ذریعے میوچل فنڈ کا اندازہ لگاتے ہیں،معیاری انحراف، معلومات کا تناسب، وغیرہ۔ کچھ درجہ بندی کے نظام کے معیار اور مقداری عوامل پر بھی غور کرتے ہیں۔باہمی چندہ. ان تمام عوامل کا خلاصہ ہندوستان میں بہترین کارکردگی کا مظاہرہ کرنے والے میوچل فنڈز کی درجہ بندی کا باعث بنتا ہے۔

ڈیویڈنڈ ادا کرنے والے میوچل فنڈز میں کیوں سرمایہ کاری کریں؟

ڈیویڈنڈ ادا کرنے والے میوچل فنڈز سرمایہ کاروں کو سالانہ ادائیگی فراہم کرتے ہیں۔ یہ ادائیگیاں عام طور پر باقاعدگی سے کی جاتی ہیں۔بنیاد اور اس وجہ سے، ایکسرمایہ کار ان فنڈز کے ساتھ محفوظ اور محفوظ محسوس کرتے ہیں۔ یہ ڈیویڈنڈ پچھلے سال کے دوران اسکیم سے حاصل ہونے والی آمدنی سے ادا کیے جائیں گے۔

چونکہ ڈیویڈنڈ ایک مخصوص سطح تک پہنچنے پر تقریباً فوراً ادا کر دیا جاتا ہے، اس لیے ڈیویڈنڈ کے آپشن والے میوچل فنڈز اپنی خالص اثاثہ کی قدر میں زیادہ اضافہ نہیں دکھاتے ہیں (نہیں ہیں)۔AMCs کی صورت میں 28.84 فیصد بطور ڈیویڈنڈ ڈسٹری بیوشن ٹیکس (DDT) ادا کرنا ہوگا۔قرض فنڈ اور یہ سیس اور سرچارج پر مشتمل ہے۔ایکوئٹیز ڈی ڈی ٹی کو متوجہ نہ کریں۔ یہ فنڈز ان لوگوں کے لیے مثالی ہیں جو خطرے کی بھوک نہیں رکھتے اور جو آمدنی کے ذریعہ باقاعدہ ادائیگی حاصل کرنا چاہتے ہیں۔

ڈیویڈنڈ کی پیداوار کا شمار اس کی موجودہ NAV (Net Asset Value) سے مدت کے دوران ادا کیے جانے والے منافع کی رقم کو تقسیم کر کے کیا جاتا ہے۔ نتیجہ پھر سالانہ ہوتا ہے۔ میوچل فنڈ اسکیمیں اپنے منافع میں سے ڈیویڈنڈ ادا کرتی ہیں۔ اس طرح، جب بھی کوئی اسکیم ڈیویڈنڈ کا اعلان کرتی ہے، اس کا NAV متناسب طور پر نیچے چلا جاتا ہے۔

آن لائن ڈیویڈنڈ ادا کرنے والے میوچل فنڈز میں کیسے سرمایہ کاری کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

Talk to our investment specialist

مالی سال 22 - 23 کے لیے سرفہرست ڈیویڈنڈ ادا کرنے والے فنڈز

ٹاپ 5 لارج کیپ ایکویٹی ڈیویڈنڈ فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Frontline Equity Fund Normal Dividend, Payout ₹36.88

↓ -0.89 ₹26,286 -7 -11.3 1.3 10.3 22.1 15 SBI Bluechip Fund Normal Dividend, Payout ₹46.2984

↓ -1.53 ₹46,140 -7.5 -10.8 0.9 10 21.9 12.5 ICICI Prudential Bluechip Fund Normal Dividend, Payout ₹28.56

↓ -0.87 ₹60,177 -6.9 -10.4 0.6 12.8 23.6 16.2 Nippon India Large Cap Fund Normal Dividend, Payout ₹24.1346

↓ -0.73 ₹34,212 -8.7 -10.4 -1.1 14.5 25.9 17.2 Essel Large Cap Equity Fund Normal Dividend, Payout ₹19.3792

↑ 0.13 ₹96 -8 -14.5 -2.6 10 7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 مڈ کیپ ایکویٹی ڈیویڈنڈ فنڈز مالی سال 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Emerging Equity Scheme Normal Dividend, Payout ₹60.362

↓ -2.24 ₹43,941 -18 -15.9 3 14.4 30.1 33.6 Sundaram Mid Cap Fund Normal Dividend, Payout ₹58.0114

↓ -1.82 ₹10,451 -14.7 -15 2.3 17.4 28.5 31.3 L&T Midcap Fund Normal Dividend, Payout ₹63.9673

↓ -2.83 ₹9,541 -22.2 -19.1 -4.4 14.3 25.3 38.7 Taurus Discovery (Midcap) Fund Normal Dividend, Payout ₹91.43

↓ -3.64 ₹106 -13.2 -17 -10.7 11 23.4 11.3 Edelweiss Mid Cap Fund Normal Dividend, Payout ₹48.46

↓ -1.87 ₹7,729 -16.3 -13.8 5.5 18.3 32.5 38.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

سرفہرست 5 سمال کیپ ڈیویڈنڈ فنڈز مالی سال 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Small Cap Fund Normal Dividend, Payout ₹88.9522

↓ -2.59 ₹28,453 -14.9 -16.9 -2.9 12.4 29.3 24.1 Aditya Birla Sun Life Small Cap Fund Normal Dividend, Payout ₹31.3247

↓ -1.26 ₹4,054 -18.8 -20.3 -6.3 9.7 28 20.9 L&T Emerging Businesses Fund Normal Dividend, Payout ₹36.7146

↓ -1.65 ₹13,334 -23.4 -20.8 -7.7 12.6 34 27.4 DSP BlackRock Small Cap Fund Normal Dividend, Payout ₹47.683

↓ -1.85 ₹13,277 -20.4 -17.9 -3 11.6 31.7 25.6 Nippon India Small Cap Fund Normal Dividend, Payout ₹75.4552

↓ -2.49 ₹50,826 -18.4 -18.2 -3.3 16.6 39.3 25.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 متنوع/ملٹی کیپ ایکویٹی ڈیویڈنڈ فنڈ مالی سال 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Mirae Asset India Equity Fund Normal Dividend, Payout ₹27.462

↓ -0.85 ₹35,533 -7.5 -10.7 1.3 7.7 19.7 12 Kotak Standard Multicap Fund Normal Dividend, Payout ₹43.892

↓ -1.51 ₹45,433 -8 -10.7 -0.3 11.2 21.5 16.5 Motilal Oswal Multicap 35 Fund Normal Dividend, Payout ₹29.9421

↓ -0.94 ₹11,172 -21.8 -19.7 -0.9 13.7 19.3 45 BNP Paribas Multi Cap Fund Normal Dividend, Payout ₹19.0914

↓ 0.00 ₹588 -4.5 -2.6 19.3 15 11.5 L&T Equity Fund Normal Dividend, Payout ₹36.2712

↑ 0.00 ₹2,884 3.3 15.6 1.8 13.4 6.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 ڈیویڈنڈ (ELSS) Equity Linked Saving Scheme FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Normal Dividend, Payout ₹86.3098

↓ -3.09 ₹4,053 -12.6 -13.6 0.1 9.9 21.9 19.2 IDFC Tax Advantage (ELSS) Fund Normal Dividend, Payout ₹28.795

↓ -0.87 ₹6,232 -9.6 -13.8 -5.1 9.6 28 12.6 DSP BlackRock Tax Saver Fund Normal Dividend, Payout ₹22.326

↓ -0.72 ₹14,981 -10.3 -12.8 4.5 13.7 25.9 23.8 L&T Tax Advantage Fund Normal Dividend, Payout ₹23.9799

↓ -1.00 ₹3,604 -15.6 -14.1 1.1 11.7 22.6 32 Aditya Birla Sun Life Tax Relief '96 Normal Dividend, Payout ₹168.2

↓ -5.57 ₹13,629 -10.3 -14.2 -1.2 7.6 15.2 15.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 سیکٹر ایکویٹی ڈیویڈنڈ فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sundaram Rural and Consumption Fund Normal Dividend, Payout ₹26.368

↓ -0.59 ₹1,398 -11.7 -14.9 5 14.5 21.3 19.5 ICICI Prudential Banking and Financial Services Fund Normal Dividend, Payout ₹27.56

↓ -0.86 ₹8,843 -4 -5.7 4.4 9.3 21.5 8.9 Aditya Birla Sun Life Banking And Financial Services Fund Normal Dividend, Payout ₹20.86

↓ -0.74 ₹3,011 -3 -5 2.3 11.4 23.4 8.3 Franklin Build India Fund Normal Dividend, Payout ₹38.0633

↓ -1.30 ₹2,406 -11.6 -14.1 -2.3 22.6 33.1 27 IDFC Infrastructure Fund Normal Dividend, Payout ₹34.479

↓ -1.32 ₹1,400 -16.6 -18.4 -4.5 21.3 36 39.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

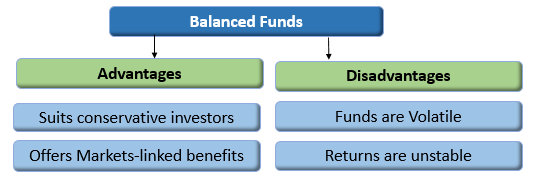

ٹاپ 5 ڈیویڈنڈ بیلنسڈ/ہائبرڈ فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Edelweiss Arbitrage Fund Normal Dividend, Payout ₹14.0281

↓ 0.00 ₹13,644 1.8 3.7 7.2 6.7 5.5 7.7 Aditya Birla Sun Life Equity Hybrid 95 Fund Normal Dividend, Payout ₹162.24

↓ -4.01 ₹6,874 -9.3 -11 -0.2 5.2 17.2 15.1 DSP BlackRock Equity and Bond Fund Normal Dividend, Payout ₹28.088

↓ -0.62 ₹9,795 -4.4 -5 10.5 12.4 19.3 17.7 UTI Regular Savings Fund Normal Dividend, Payout ₹43.3899

↓ -0.34 ₹1,610 -0.1 -0.2 8.4 8.4 12 11.5 Nippon India Arbitrage Fund Normal Dividend, Payout ₹15.6917

↓ -0.01 ₹14,436 1.7 3.6 7 6.6 5.5 7.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 ڈیویڈنڈ الٹرا شارٹ ٹرم ڈیبٹ فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP BlackRock Money Manager Fund Normal Dividend, Payout ₹1,114.23

↑ 0.52 ₹2,902 0.3 0.3 3.7 5.1 5.2 7.64% 5M 8D 5M 23D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 ڈیویڈنڈ شارٹ ٹرم ڈیبٹ فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Nippon India Short Term Fund Normal Dividend, Payout ₹21.0819

↑ 0.00 ₹6,340 3.7 6.5 13.4 10.3 12.7 7.65% 2Y 9M 3Y 7M 13D Aditya Birla Sun Life Short Term Opportunities Fund Normal Dividend, Payout ₹14.8668

↑ 0.00 ₹8,689 2.6 4.4 7.9 6.2 6.6 7.72% 2Y 10M 13D 3Y 11M 5D HDFC Short Term Debt Fund Normal Dividend, Payout ₹18.6951

↑ 0.00 ₹14,391 2.6 4.4 8.8 7 8.3 2.96% 2Y 9M 18D 4Y 23D Axis Short Term Fund Normal Dividend, Payout ₹20.3044

↑ 0.01 ₹8,825 2.7 4.6 8.8 6.8 8 7.57% 2Y 9M 14D 3Y 7M 10D L&T Short Term Bond Fund Normal Dividend, Payout ₹11.145

↓ 0.00 ₹3,688 2.6 4.3 8.4 6.2 7.5 7.37% 2Y 9M 25D 3Y 7M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 ڈیویڈنڈ لیکویڈ فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity LIC MF Liquid Fund Normal Dividend, Payout ₹1,000.18 ₹11,549 0.7 1.8 3.5 6.5 6.6 7.41% 1M 18D 1M 18D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25

ٹاپ 5 ڈیویڈنڈ گلٹ فنڈز FY 22 - 23

To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." DSP BlackRock World Gold Fund is a Equity - Global fund was launched on 14 Sep 07. It is a fund with High risk and has given a Below is the key information for DSP BlackRock World Gold Fund Returns up to 1 year are on To generate steady stream of income either by way of regular dividends or by capital appreciation. Franklin India Dynamic Accrual Fund is a Debt - Dynamic Bond fund was launched on 5 Mar 97. It is a fund with Moderate risk and has given a Below is the key information for Franklin India Dynamic Accrual Fund Returns up to 1 year are on (Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Sundaram Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 23 Jun 00. It is a fund with Moderately High risk and has given a Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on The primary objective of the Scheme will be to generate capital appreciation by investing predominantly in a diversified portfolio of equity and equity related securities of growth oriented mid cap stocks. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. Baroda Pioneer Mid-Cap Fund is a Equity - Mid Cap fund was launched on 4 Oct 10. It is a fund with High risk and has given a Below is the key information for Baroda Pioneer Mid-Cap Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Magnum Gilt Fund Normal Dividend, Payout ₹20.2527

↓ -0.02 ₹11,257 3.5 4.9 10.4 8.1 8.9 7.11% 9Y 11M 1D 23Y 10M 28D Nippon India Gilt Securities Fund Normal Dividend, Payout ₹37.9754

↓ -0.05 ₹2,126 3.3 4.6 9.9 7.1 8.9 7.1% 9Y 3M 22D 20Y 10M 24D Canara Robeco Gilt Fund Normal Dividend, Payout ₹15.6365

↓ -0.02 ₹132 3.4 4.5 9.6 6.8 5.9 7.13% 10Y 6M 11D 25Y 9M 12D ICICI Prudential Gilt Fund Normal Dividend, Payout ₹17.4871

↓ -0.01 ₹6,356 2.7 4.4 9 7.8 8.1 7.05% 5Y 3M 22D 13Y 4M 28D UTI Gilt Fund Normal Dividend, Payout ₹37.7265

↓ -0.04 ₹644 2 3.4 8.4 6.5 7.4 6.99% 9Y 8M 23D 22Y 9M Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Apr 25 1. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.3% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Normal Dividend, Payout Launch Date 2 Jan 01 NAV (14 Jan 22) ₹51.722 ↑ 0.03 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.36 Alpha Ratio 1.8 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,795

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 14 Jan 22 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.6% 3 Year 19.6% 5 Year 16.8% 10 Year 15 Year Since launch 21.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. DSP BlackRock World Gold Fund

CAGR/Annualized return of 5.1% since its launch. Ranked 11 in Global category. Return for 2024 was 15.7% , 2023 was 6.9% and 2022 was -7.9% . DSP BlackRock World Gold Fund

Normal Dividend, Payout Launch Date 14 Sep 07 NAV (04 Apr 25) ₹14.9698 ↓ -0.89 (-5.60 %) Net Assets (Cr) ₹1,058 on 28 Feb 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.35 Sharpe Ratio 1.55 Information Ratio -0.38 Alpha Ratio 0.57 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,604 31 Mar 22 ₹15,118 31 Mar 23 ₹14,222 31 Mar 24 ₹13,850 31 Mar 25 ₹20,689 Returns for DSP BlackRock World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 14 Jan 22 Duration Returns 1 Month 4.6% 3 Month 19.1% 6 Month 10.6% 1 Year 35% 3 Year 8.6% 5 Year 12.9% 10 Year 15 Year Since launch 5.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.7% 2023 6.9% 2022 -7.9% 2021 -9% 2020 31.4% 2019 35.1% 2018 -10.7% 2017 -4% 2016 52.7% 2015 -18.5% Fund Manager information for DSP BlackRock World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.09 Yr. Data below for DSP BlackRock World Gold Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Basic Materials 92.86% Asset Allocation

Asset Class Value Cash 3.12% Equity 93.16% Debt 0.02% Other 3.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -80% ₹844 Cr 1,880,211

↓ -73,489 VanEck Gold Miners ETF

- | GDX19% ₹199 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹19 Cr Net Receivables/Payables

CBLO | -0% -₹4 Cr 3. Franklin India Dynamic Accrual Fund

CAGR/Annualized return of 8% since its launch. Ranked 1 in Dynamic Bond category. . Franklin India Dynamic Accrual Fund

Normal Dividend, Payout Launch Date 5 Mar 97 NAV (07 Aug 22) ₹15.6675 ↑ 0.14 (0.90 %) Net Assets (Cr) ₹99 on 31 Jul 22 Category Debt - Dynamic Bond AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆ Risk Moderate Expense Ratio 0.85 Sharpe Ratio 1.19 Information Ratio 0.33 Alpha Ratio 26.93 Min Investment 10,000 Min SIP Investment 500 Exit Load 0-12 Months (3%),12-24 Months (2%),24-36 Months (1%),36-48 Months (0.5%),48 Months and above(NIL) Yield to Maturity 0% Effective Maturity 3 Months 18 Days Modified Duration Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,540 31 Mar 22 ₹13,904

Purchase not allowed Returns for Franklin India Dynamic Accrual Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 14 Jan 22 Duration Returns 1 Month 1.4% 3 Month 2.4% 6 Month 22.4% 1 Year 31.9% 3 Year 10.6% 5 Year 8.1% 10 Year 15 Year Since launch 8% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Franklin India Dynamic Accrual Fund

Name Since Tenure Data below for Franklin India Dynamic Accrual Fund as on 31 Jul 22

Asset Allocation

Asset Class Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 4. Sundaram Equity Hybrid Fund

CAGR/Annualized return of 12.7% since its launch. Ranked 25 in Hybrid Equity category. . Sundaram Equity Hybrid Fund

Normal Dividend, Payout Launch Date 23 Jun 00 NAV (31 Dec 21) ₹16.3588 ↑ 0.09 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.63 Information Ratio -0.26 Alpha Ratio 5.7 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,621 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 14 Jan 22 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27% 3 Year 15.5% 5 Year 13.6% 10 Year 15 Year Since launch 12.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. Baroda Pioneer Mid-Cap Fund

CAGR/Annualized return of 4.5% since its launch. Ranked 42 in Mid Cap category. . Baroda Pioneer Mid-Cap Fund

Normal Dividend, Payout Launch Date 4 Oct 10 NAV (11 Mar 22) ₹16.5124 ↑ 0.15 (0.91 %) Net Assets (Cr) ₹97 on 31 Jan 22 Category Equity - Mid Cap AMC Baroda Pioneer Asset Management Co. Ltd. Rating ☆ Risk High Expense Ratio 2.54 Sharpe Ratio 3.23 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,227 Returns for Baroda Pioneer Mid-Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 14 Jan 22 Duration Returns 1 Month -3.8% 3 Month -8.1% 6 Month 0.1% 1 Year 26.2% 3 Year 22.5% 5 Year 15.9% 10 Year 15 Year Since launch 4.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Baroda Pioneer Mid-Cap Fund

Name Since Tenure Data below for Baroda Pioneer Mid-Cap Fund as on 31 Jan 22

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔