Fincash » Mutual Funds India » How Today’s Youth Can Start Building Wealth Early

Table of Contents

Investing 101: How Today’s Youth Can Start Building Wealth Early

Investing is not just for the wealthy or the experienced; it's a powerful tool that can help young people secure their financial future.

Whether you're saving for a house, a dream holiday, or retirement, the earlier you start, the better. Let's dive into the basics of investing and how you can begin building wealth today.

Why Start Investing Early?

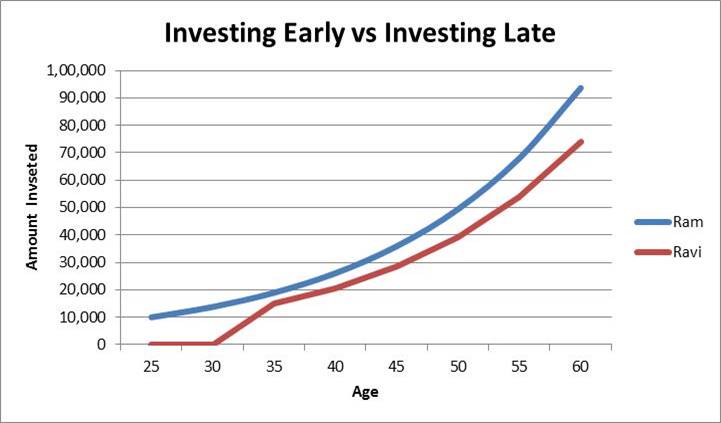

Time is your greatest ally when it comes to investing. The sooner you start, the more time your money has to grow through the power of compound interest. Compound interest means earning interest on your initial investment and the interest it accumulates over time. Even small amounts can grow significantly if invested wisely over a long period.

For example, if you start investing ₹5,000 a month at age 20 with an Average Annual Return of 12% (which is a reasonable expectation from Equity Mutual Funds in India), you could have over ₹2.5 crore by the time you’re 60. Starting at 30 would still leave you with a considerable amount, but it would be significantly less—around ₹1 crore. The difference is the Power of Compounding over an extra decade.

Getting Started: The Basics of Mutual Funds

Mutual Funds

What are they? A mutual fund pools money from many investors to buy a diversified Portfolio of stocks, Bonds, or other securities.

Why invest in them? Mutual Funds offer a way to invest in a variety of assets, which can help spread out risk. They are managed by professionals, so you don’t need to pick individual stocks yourself. SIPs (Systematic Investment Plans) in mutual funds are particularly popular in India for their disciplined approach to investing.

Talk to our investment specialist

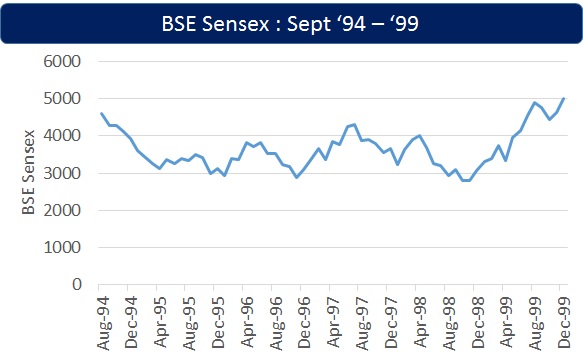

Understanding Risk and Diversification

Investing always involves some level of risk. Stocks can go up, but they can also go down. That’s why it’s essential to diversify your investments—meaning, don’t put all your money into one stock or one type of asset. Diversification reduces risk by spreading your investments across different assets, such as stocks, bonds, and Real Estate. If one investment underperforms, others might do well, balancing out your portfolio.

The Power of Compound Interest

Compound interest is the key to building wealth over time. It allows your investments to grow exponentially, as you earn interest on both your original investment and the interest it has already earned.

Here’s a simple example: If you invest ₹10,000 at an annual interest rate of 10%, after one year, you’ll have ₹11,000. In the second year, you’ll earn 10% on ₹11,000, and so on. Over time, this compounding effect can turn a small investment into a significant sum.

How to Start Investing

Set Your Goals: Determine why you’re investing. Is it for a specific goal, like buying a house, or for general wealth building?

Choose Your Investment Platform: There are many online platforms in India, like Fincash.com, where you can start investing with just a small amount of money, the best part is it is a user-friendly interface.

Start Small: If you’re new to investing, start with a small amount that you’re comfortable with. You can increase your investments as you become more confident.

Stay Consistent: Investing regularly, even with small amounts, can build significant wealth over time. Setting up an SIP (Systematic Investment plan) in a mutual fund is an excellent way to stay consistent.

Educate Yourself: Continue learning about investing. The more you know, the better decisions you’ll make.

5 Reasons Why Every Young Adult Should Start Investing Today

Power of Compounding: Starting early allows your money to grow exponentially through compound interest, turning small investments into substantial amounts and providing future financial security.

Financial Independence: Investing builds wealth over time, giving you control over your financial future and the freedom to make life choices without relying on others.

Beating Inflation: Investments, especially in equities, offer returns that outpace Inflation, preserving and enhancing your purchasing power compared to traditional savings accounts.

Building Wealth for Life Goals: early investing helps you accumulate funds for significant life goals, making it easier to achieve milestones like buying a home or retiring early without Financial Stress.

Learning Financial Discipline: Regular investing cultivates the habit of saving and financial discipline, essential for wealth creation and effective financial management throughout life.

Top 11 SIP Mutual Funds in India FY 25 - 26

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Infrastructure Fund Growth ₹173.11

↑ 3.09 ₹6,886 100 -3.3 -11.8 0.4 25.5 38 27.4 IDFC Infrastructure Fund Growth ₹44.791

↑ 1.00 ₹1,400 100 -8.6 -18.3 -1.4 22.3 36 39.3 Nippon India Power and Infra Fund Growth ₹307.974

↑ 6.25 ₹6,125 100 -6.6 -16.5 -3.2 24.9 35.6 26.9 HDFC Infrastructure Fund Growth ₹42.756

↑ 0.81 ₹2,105 300 -3.4 -11.9 -1.1 26 35.5 23 L&T Emerging Businesses Fund Growth ₹70.2958

↑ 1.97 ₹13,334 500 -16 -21.4 -3.7 14.2 34.5 28.5 DSP BlackRock India T.I.G.E.R Fund Growth ₹278.387

↑ 6.61 ₹4,465 500 -8.9 -19.3 -0.2 22.7 34.3 32.4 Franklin Build India Fund Growth ₹125.543

↑ 2.56 ₹2,406 500 -5.7 -13.1 0.2 24.3 34 27.8 Franklin India Smaller Companies Fund Growth ₹150.917

↑ 3.94 ₹11,257 500 -11.4 -17.5 -2.8 17.7 33.4 23.2 Kotak Small Cap Fund Growth ₹229.866

↑ 4.84 ₹14,407 1,000 -13.4 -19.8 1.2 10.9 33.4 25.5 IDFC Sterling Value Fund Growth ₹133.846

↑ 2.09 ₹8,996 100 -5.3 -13.4 -1.5 13.2 33.3 18 ICICI Prudential Smallcap Fund Growth ₹76.3

↑ 1.75 ₹6,912 100 -8.6 -16.4 -2.4 13.4 33 15.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25 200 Crore in Equity Category of mutual funds ordered based on 5 year calendar year returns.

Final Thoughts

Investing is a journey, and the earlier you start, the more you can benefit from the power of compound interest. By understanding the basics of stocks, mutual funds, and diversification, you can begin building wealth and securing your financial future. Remember, every investment, no matter how small, is a step towards achieving your Financial goals.

Start today, and let time work in your favour.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.