Table of Contents

- New Categorisation in Debt Schemes

- 1. Overnight Fund

- 2. Liquid Fund

- 3. Ultra Short Duration Fund

- 4. Low Duration Fund

- 5. Money Market Fund

- 6. Short Duration Fund

- 7. Medium Duration Fund

- 8. Medium to Long Duration Fund

- 9. Long Duration Fund

- 10. Dynamic Bond Fund

- 11. Corporate Bond Fund

- 13. Banking and PSU Fund

- 14. Gilt Fund

- 15. Gilt Fund with 10-year Constant Duration

- 16. Floater Fund

- Best Debt Mutual Funds to Invest 2025

16 New Debt Mutual Fund Categories Introduced by SEBI

Securities and Exchange Board of India (SEBI) introduced new and broad categories in Mutual Funds in order to bring uniformity in similar schemes launched by the different Mutual Funds. This is to aim and ensure that investors can find it easier to compare the products and evaluate the different options available before Investing in a scheme.

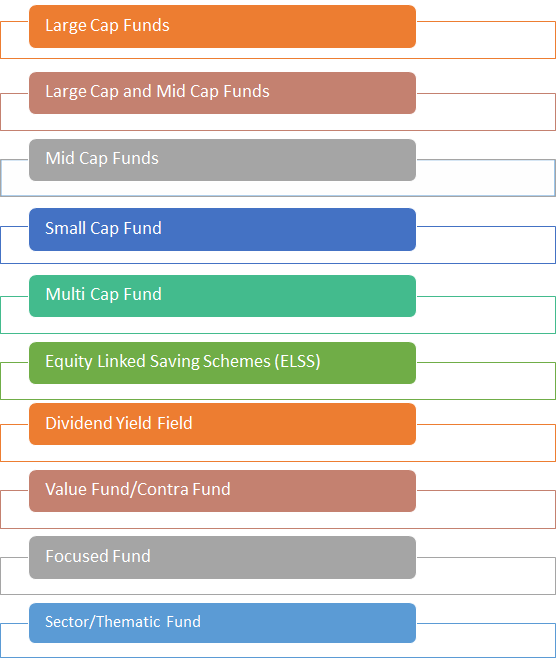

SEBI intends to make Mutual Fund investment easier for the investors. Investors could invest according to their needs, Financial goals and risk ability. SEBI has circulated new Mutual Fund categorisation on 6th October 2017. This mandates Mutual Fund Houses to categories all their debt schemes (existing & future scheme) into 16 distinct categories. SEBI has also introduced 10 new categories in Equity Mutual Funds.

New Categorisation in Debt Schemes

As per SEBI’s new categorisation, Debt fund schemes will have 16 categories. Here’s the list:

1. Overnight Fund

This debt scheme will invest in overnight securities having a maturity of one day.

2. Liquid Fund

These schemes will invest in debt and money market securities with a maturity of up to 91 days.

3. Ultra Short Duration Fund

This scheme will invest in debt and money Market securities with a Macaulay duration between three to six months. Macaulay duration measures how long it will take the scheme to recoup the investment.

4. Low Duration Fund

The scheme will invest in debt and money market securities with a Macaulay duration between six to 12 months.

5. Money Market Fund

This scheme will invest in money market instruments having a maturity up to one year.

6. Short Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of one to three years.

7. Medium Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of three to four years.

8. Medium to Long Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of four to seven years.

9. Long Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration greater than seven years.

10. Dynamic Bond Fund

This is a debt scheme that invests across all the duration.

Talk to our investment specialist

11. Corporate Bond Fund

This debt scheme mainly invests in the highest rated corporate Bonds. The fund can invest a minimum 80 percent of its total assets in the highest-rated corporate bonds

12. Credit Risk Fund

This scheme will invest in below the high-rated corporate bonds. The Credit Risk Fund should invest at least 65 percent of its assets below the highest-rated instruments.

13. Banking and PSU Fund

This scheme predominantly invests in debt instruments of Banks, Public Financial Institutional, Public Sector Undertakings.

14. Gilt Fund

This scheme invests in government securities across maturity. Gilt Funds will invest a minimum 80 percent of its total assets in government securities.

15. Gilt Fund with 10-year Constant Duration

This scheme will invest in government securities with a maturity of 10 years. 15. Gilt Fund with 10-year Constant Duration will invest a minimum 80 percent in government securities.

16. Floater Fund

This debt scheme mainly invests in Floating Rate instruments. Floater Fund will invest a minimum of 65 percent of its total assets in floating rate instruments.

Best Debt Mutual Funds to Invest 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Long Term Plan Growth ₹36.5985

↑ 0.03 ₹14,049 3.3 4.9 10.1 8 8.2 7.82% 4Y 4M 2D 8Y 11M 5D UTI Dynamic Bond Fund Growth ₹30.7564

↑ 0.03 ₹626 3.5 4.4 10.1 9.7 8.6 7.09% 6Y 5M 5D 14Y 7M 13D Aditya Birla Sun Life Corporate Bond Fund Growth ₹111.729

↑ 0.10 ₹25,293 3.1 4.7 9.8 7.6 8.5 7.48% 3Y 9M 14D 5Y 8M 19D HDFC Corporate Bond Fund Growth ₹32.186

↑ 0.03 ₹32,191 3.1 4.5 9.6 7.5 8.6 4.03% 3Y 9M 19D 5Y 11M 12D HDFC Banking and PSU Debt Fund Growth ₹22.7368

↑ 0.02 ₹5,837 3.1 4.5 9.1 7 7.9 4.03% 3Y 9M 14D 5Y 4M 30D Axis Credit Risk Fund Growth ₹21.0731

↑ 0.01 ₹381 2.7 4.3 8.8 7.1 8 8.5% 2Y 3M 2Y 10M 20D UTI Banking & PSU Debt Fund Growth ₹21.6087

↑ 0.02 ₹825 2.8 4.2 8.7 9.1 7.6 7.32% 2Y 2M 8D 2Y 6M 25D PGIM India Credit Risk Fund Growth ₹15.5876

↑ 0.00 ₹39 0.6 4.4 8.4 3 5.01% 6M 14D 7M 2D Aditya Birla Sun Life Money Manager Fund Growth ₹365.059

↑ 0.07 ₹26,752 2.3 4.1 7.9 7.2 7.8 7.6% 6M 22D 6M 22D Aditya Birla Sun Life Savings Fund Growth ₹540.054

↑ 0.15 ₹14,988 2.1 4 7.8 7 7.9 7.84% 5M 19D 7M 20D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.