Table of Contents

A Guide to SEBI's New Mutual Fund Categorisation

On 6th October, 2017, SEBI (Securities and Exchange Board of India) announced the re-categorization and re-rationalized of Mutual Fund schemes. The primary purpose of this was to bring uniformity between schemes offered by Mutual Fund Houses.

SEBI intends to make Mutual Fund Investments easier for the investors. Investors should be able to easily understand schemes as per their investment objectives, needs and risk appetite. In the current scenario, there are a number of schemes of the same type within the AMC, which creates lot of confusion for the investors during fund selection. The new classification will clearly define the schemes, along with its allocations, etc.

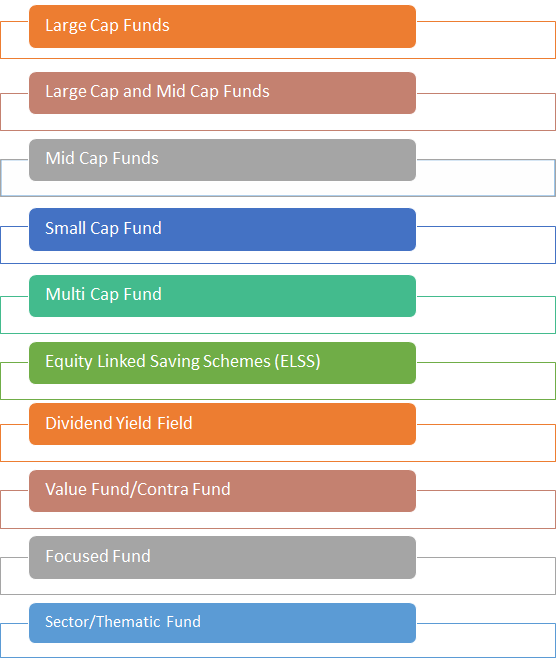

SEBI has classified 10 categories in Equity Funds, 16 categories in debt funds, six in hybrid funds and two each in solution-oriented scheme and other fund groups.

Equity Funds

SEBI has categorised equity mutual funds into 10 broad categories. In its rule, SEBI has redefined large-cap, mid-cap and Small cap funds:

Large-caps

First 100 companies on full market capitalisation basis

Mid-caps

All companies from 101st to 250th on full market capitalisation basis

Small-caps

All other companies from 251st onwards on full market capitalisation basis

As per the new rules, large-cap schemes should invest at least 80 percent of their total assets in large-cap stocks. Mid-cap and small-cap funds should invest minimum 65 percent of its total assets in the mid & small cap stocks.

Multi-cap fund, Value/contra fund, focused fund should invest at least 65 percent of its total assets in their equities. Equity Linked Saving Schemes (ELSS) and Thematic/Sector should invest minimum 80 percent of its assets in equities.

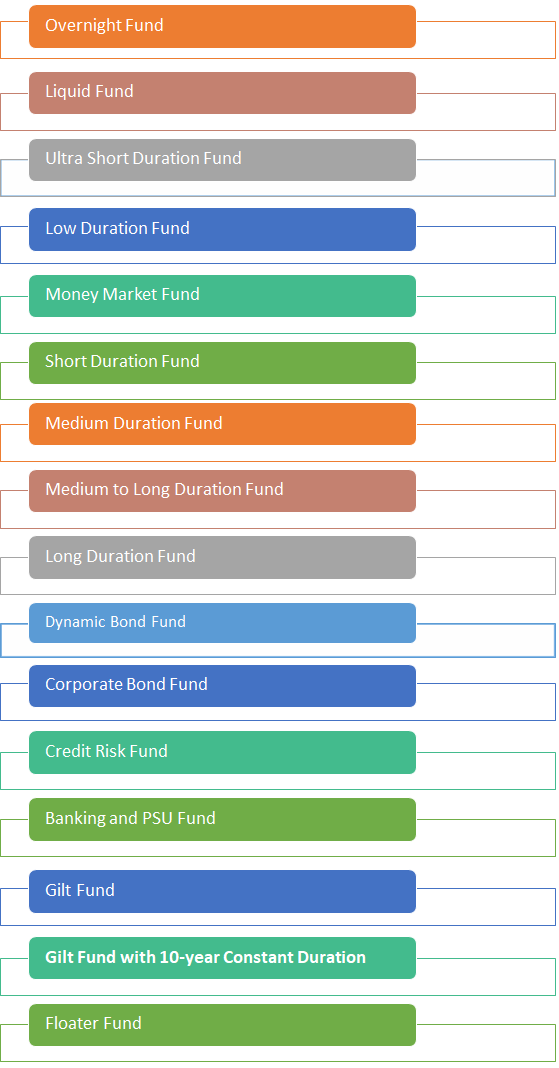

Debt Funds

SEBI has categorised debt funds into 16 broad categories. The classification of debt schemes is based on Macaulay duration, maturity and credit ratings. Macaulay duration is a measure of how the price of a bond will change in response to movement in interest rates.

As per SEBI, the medium duration funds will invest in debt and money market instruments such that Macaulay duration of the portfolio is between three to four years. In medium duration funds, the portfolio Macaulay duration under adverse situation is one to four years.

The medium to long duration fund will invest debt and money market securities such that the Macaulay duration of the portfolio is between four to seven years. Under the adverse situation, the portfolio Macaulay duration is one to seven years.

Overnight funds, Liquid Funds, Money market funds, Gilt Funds are classified under maturity based funds.

Corporate Bonds would be allowed to invest in AA+ and above-rated instruments. The Credit Risk Funds can invest in AA and below rated instruments, excluding AA+ rated instruments.

The other schemes added by SEBI are the Banking and PSU Fund, which will invest about 80 percent of its investment in PSUs, public sector banks, etc., and Floater Fund that will invest about 65 percent in floating rate instruments.

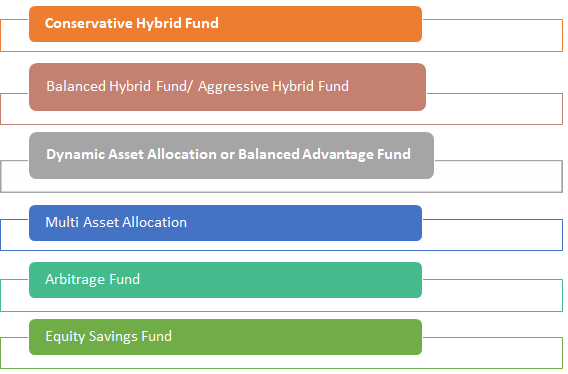

Hybrid Funds

SEBI has introduced five categories to Hybrid Funds. These are the funds that will invest in both debt and equity funds. SEBI has set a particular allocation for these schemes. The Conservative Hybrid Fund would invest 10-25 percent in equities and 75-90 percent in debt instruments. A fund house can only offer either Balanced Hybrid Fund or Aggressive Hybrid Fund.

The Multi Asset Allocation Fund can invest in at least three asset classes with a minimum allocation of 10 percent each in three asset classes. Arbitrage Fund can invest 65 percent of total assets in equities. Equity Savings can invest a minimum of 65 percent in equities and 10 percent in debt assets.

Investment in debt/equity can be dynamically managed for Dynamic Asset Allocation or Balanced Advantage schemes.

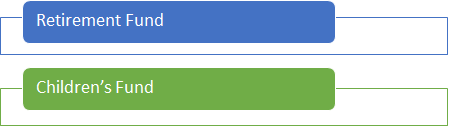

Solution Oriented Schemes

SEBI has introduced retirement Fund and Children’s Fund schemes under this category. Retirement schemes have a minimum lock-in of five years or till retirement, whichever is earlier. Children’s schemes will have a lock-in of at least five years or till the child attains the age of majority, whichever is earlier.

Other Schemes

SEBI has categories Index Funds/ETFs and FOFs (Overseas/Domestic) in other schemes. These schemes can invest in a minimum of 95 percent of their total assets.

Talk to our investment specialist

Top Mutual Fund Houses Schemes that got New Names

Mutual fund houses are making changes in the schemes to comply with SEBI's new re-categorisation norms. Here is the list of existing mutual fund schemes that got new names.

| Existing Scheme Name | New Scheme Name |

|---|---|

| ADITYA Birla Sun Life Mutual Fund | |

| Aditya Birla Sun Life Enhanced Arbitrage Fund | Aditya Birla Sun Life Arbitrage Fund |

| Aditya Birla Sun Life MIP II - Wealth 25 Plan | Aditya Birla Sun Life Regular Savings Fund |

| Aditya Birla Sun Life Small & Midcap Fund | Aditya Birla Sun Life Small Cap Fund |

| Aditya Birla Sun Life Top 100 Fund | Aditya Birla Sun Life Focused Equity Fund |

| Aditya Birla Sun Life Advantage Fund | Aditya Birla Sun Life Equity Advantage Fund |

| Aditya Birla Sun Life Balanced '95 Fund | Aditya Birla Sun Life Equity Hybrid '95 Fund |

| Aditya Birla Sun Life Cash Manager | Aditya Birla Sun Life Low Duration Fund |

| Aditya Birla Sun Life Corporate Bond Fund | Aditya Birla Sun Life Credit Risk Fund |

| Aditya Birla Sun Life Dividend Yield Plus | Aditya Birla Sun Life Dividend Yield Fund |

| Aditya Birla Sun Life Floating Rate Fund - Short Term | Aditya Birla Sun Life Money Manager Fund |

| Aditya Birla Sun Life Gilt Plus Fund - PF Plan | Aditya Birla Sun Life Government Securities Fund |

| Aditya Birla Sun Life Income Plus | Aditya Birla Sun Life Income Fund |

| Aditya Birla Sun Life New Millennium Fund | Aditya Birla Sun Life Digital India Fund |

| Aditya Birla Sun Life Short Term Fund | Aditya Birla Sun Life Corporate Bond Fund |

| Aditya Birla Sun Life Treasury Optimizer Fund | Aditya Birla Sun Life Banking & PSU Debt fund |

| ICICI Prudential Mutual Fund | |

| ICICI Prudential Balanced Fund | ICICI Prudential Equity and Debt Fund |

| ICICI Prudential Advisor Series - Cautious Plan | ICICI Prudential Advisor Series - Hybrid Fund |

| ICICI Prudential Advisor Series - Dynamic Accrual Plan | ICICI Prudential Advisor Series - Debt Management Fund |

| ICICI Prudential Advisor Series - Long Term Savings | ICICI Prudential Advisor Series - Passive Strategy Fund |

| ICICI Prudential Moderate | ICICI Prudential Advisor Series - Conservative Fund |

| ICICI Prudential Very Aggressive | ICICI Prudential Advisor Series - thematic fund |

| ICICI Prudential Corporate Bond Fund | ICICI Prudential Medium Term Bond Fund |

| ICICI Prudential Equity Income Fund Cumulative | ICICI Prudential Equity Savings Fund |

| ICICI Prudential Focused Bluechip Equity Fund | ICICI Prudential Bluechip Fund |

| ICICI Prudential Income Opportunities Fund | ICICI Prudential Bond Fund |

| ICICI Prudential Income | ICICI Prudential Long Term Bond Fund |

| ICICI Prudential Liquid Plan | ICICI Prudential Liquid Fund |

| ICICI Prudential Dynamic Plan | ICICI Prudential Multi-Asset Fund |

| ICICI Prudential Flexible Income | ICICI Prudential Savings Fund |

| ICICI Prudential Nifty 100 iWIN ETF | ICICI Prudential Nifty 100 ETF |

| ICICI Prudential Nifty Index Fund | ICICI Prudential Nifty Index Plan |

| ICICI Prudential Nifty iWIN ETF | ICICI Prudential Nifty ETF |

| ICICI Prudential Regular Income Fund | ICICI Prudential Ultra Short Term fund |

| ICICI Prudential Savings Fund | ICICI Prudential Floating Interest Fund |

| ICICI Prudential Select Large cap fund | ICICI Prudential Focused Equity Fund |

| ICICI Prudential Top 100 Fund | ICICI Prudential Large & mid cap fund |

| ICICI Prudential Ultra Short Term | ICICI Prudential Corporate Bond Fund |

| HDFC Mutual Fund | |

| HDFC Cash Management Fund - Treasury Advantage Plan | HDFC Low Duration Fund |

| HDFC Corporate Debt Opportunities Fund | HDFC Credit Risk Debt Fund |

| HDFC Floating Rate Income Fund - Short Term Plan | HDFC Floating Rate Debt Fund - Retail Plan |

| HDFC Gilt Fund - Long Term Plan | HDFC Gilt Fund |

| HDFC High Interest Fund - Dynamic Plan | HDFC Dynamic Debt Fund |

| HDFC High Interest Fund - Short Term Plan | HDFC Medium Term Debt Fund |

| HDFC Medium Term Opportunities Fund | HDFC Corporate Bond Fund |

| HDFC Short Term Opportunities Fund | HDFC Short Term Debt Fund |

| HDFC Capital Builder Fund | HDFC Capital Builder value fund |

| HDFC Cash Management Fund - Call Plan | HDFC Overnight Fund |

| HDFC Cash Management Fund - Savings Plan | HDFC Money Market Fund |

| HDFC Core & Satellite Fund | HDFC Focused 30 Fund |

| HDFC Growth Fund | HDFC Balanced Advantage Fund |

| HDFC Index Fund- Nifty Plan | HDFC Index Fund - NIFTY 50 Plan |

| HDFC Large Cap Fund | HDFC Growth Opportunities Fund |

| HDFC MF Monthly Income Plan - LTP | HDFC Hybrid Debt Fund |

| HDFC Multiple Yield Fund - Plan 2005 | HDFC Multi-Asset Fund |

| HDFC Premier Multi-Cap Fund | HDFC Hybrid Equity Fund |

| HDFC Top 200 | HDFC Top 100 Fund |

| HDFC Index Fund – SENSEX Plus Plan | HDFC Index Fund-SENSEX Plan |

| SBI Mutual Fund | |

| SBI Corporate Bond Fund | SBI Credit Risk Fund |

| SBI Emerging Businesses Fund | SBI Focused Equity Fund |

| SBI FMCG Fund | SBI Consumption Opportunities Fund |

| SBI IT Fund | SBI Technology Opportunities Fund |

| SBI Magnum Balanced Fund | SBI Equity Hybrid Fund |

| SBI Magnum Equity Fund | SBI Magnum Equity ESG Fund |

| SBI Magnum Gilt Fund - Long Term Plan | SBI Magnum Gilt Fund |

| SBI Magnum Gilt Fund - Long Term Growth - PF Fixed 2 Years | SBI Magnum Gilt Fund - PF Fixed 2 Years |

| SBI Magnum Gilt Fund - Long Term Growth - PF Fixed 3 Years | SBI Magnum Gilt Fund - PF Fixed 3 Years |

| SBI Magnum Gilt Fund Short Term | SBI Magnum Constant Maturity Fund |

| SBI Magnum InstaCash Fund - Liquid Floater Plan | SBI Overnight Fund |

| SBI Magnum InstaCash Fund | SBI Magnum Ultra Short Duration Fund |

| SBI Magnum Monthly Income Plan Floater | SBI Multi Asset Allocation Fund |

| SBI Magnum Monthly Income Plan | SBI Debt Hybrid Fund |

| SBI Magnum Multiplier Fund | SBI Large and Midcap Fund |

| SBI Pharma Fund | SBI Healthcare Opportunities Fund |

| SBI - Premier Liquid Fund | SBI Liquid Fund |

| SBI Regular Savings Fund | SBI Magnum Medium Duration Fund |

| SBI Small & Midcap Fund | SBI Small Cap Fund |

| SBI Treasury Advantage Fund | SBI Banking and PSU Fund |

| SBI-Short Horizon Fund - Ultra Short Term | SBI Magnum Low Duration Fund |

| NIPPON INDIA MUTUAL FUND | |

| Reliance Arbitrage Advantage Fund | Nippon India Arbitrage Fund |

| Reliance Corporate Bond Fund | Nippon India Classic Bond Fund |

| Reliance Diversified Power Sector Fund | Nippon India Power and Infra Fund |

| Reliance Equity Opportunities Fund | Nippon India Multi Cap Fund |

| Reliance Floating Rate Fund - Short Term Plan | Nippon India Floating Rate Fund |

| Reliance Liquid Fund - Cash Plan | Nippon India Ultra Short Duration Fund |

| Reliance Liquid Fund - Treasury Plan | Nippon India Liquid Fund |

| Reliance Liquidity Fund | Nippon India Money Market Fund |

| Reliance Media & Entertainment Fund | Nippon India Consumption Fund |

| Reliance Medium Term Fund | Nippon India Prime Debt Fund |

| Reliance Mid & Small Cap Fund | Nippon India Focused Equity Fund |

| Reliance Monthly Income Plan | Nippon India Hybrid Bond Fund |

| Reliance Money Manager Fund | Nippon India Low Duration Fund |

| Reliance NRI Equity Fund | Nippon India Balanced Advantage Fund |

| Reliance Quant Plus Fund | Nippon India Quant Fund |

| Reliance Regular Savings Fund - Balanced Plan | Nippon India Equity Hybrid Fund |

| Reliance Regular Savings Fund - Debt Plan | Nippon India Credit Risk Fund |

| Reliance Regular Savings Fund - Equity Plan | Nippon India Value Fund |

| Reliance Top 200 Fund | Nippon India Large Cap Fund |

| DSP BlackRock Mutual Fund | |

| DSP BlackRock Balanced Fund | DSP BlackRock Equity and Bond Fund |

| DSP BlackRock Constant Maturity 10Y G-Sec Fund | DSP BlackRock 10Y G-Sec Fund |

| DSP BlackRock Focus 25 Fund | DSP BlackRock Focus Fund |

| DSP BlackRock Income Opportunities Fund | DSP BlackRock Credit Risk Fund |

| DSP BlackRock Micro Cap Fund | DSP BlackRock Small Cap Fund |

| DSP BlackRock MIP Fund | DSP BlackRock Regular Savings Fund |

| DSP BlackRock Opportunities Fund | DSP BlackRock Equity Opportunities Fund |

| DSP BlackRock Small and Mid Cap Fund | DSP BlackRock Midcap Fund |

| DSP BlackRock Treasury Bill Fund | DSP BlackRock Savings Fund |

| DSP BlackRock Ultra Short Term Fund | DSP BlackRock Low Duration Fund |

*Note-The list will be updated as and when we get an insight about the changes in the scheme names.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.