SIP vs RD

Which is Better Investment Option?

SIP vs RD? where to invest for better wealth creation? An ultimate approach to generate wealth is saving money every month. Typically, a Systematic Investment plan (SIP) and an RD (Recurring deposit) are two of the most efficient investment options in India to save money every month. Both SIP and RD enable investors to invest small sums of money in regular intervals to earn good returns. With a Systematic Investment Plan (SIP), the investors have to invest a small amount of money, either monthly or quarterly, to earn Market-linked returns. While with an RD (Recurring Deposit), the investor invests fixed amount of money for a pre-decided period to yield fixed returns. Now, the investors can easily calculate SIP returns using a sip calculator and RD returns using an RD Calculator to estimate their investment needs.

In India, few of the most convenient periodic investment options include SIP, RD and PPF (SIP being the most popular one).

SIP Vs RD - Product Structure

Systematic Investment Plan (SIP)

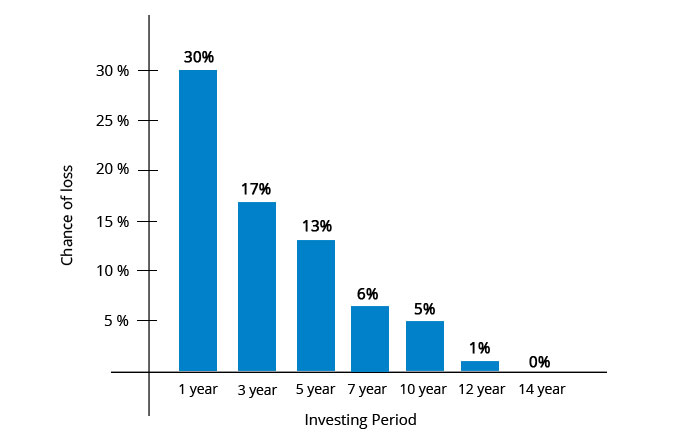

A SIP is an Investing mode to invest a certain amount in Mutual Funds periodically. The minimum amount to invest in a SIP is as less as INR 500. Usually, SIPs in equity are said to offer good returns because they are market linked and can give return commensurate to the market. As per various sources, the SIP returns over long periods can be as high as 12% to 22% p.a., which is much higher than the interest rates offered by an RD (Recurring Deposit). The only disadvantage of a SIP (Systematic Investment Plan) is that the SIP returns are volatile since they are market-linked, so the risk Factor is much higher. However, when invested for long-term, SIPs are considered to offer good returns.

Recurring Deposit (RD)

A Recurring Deposit or RD is an investment scheme in which the investor has to choose an investment amount and the tenure of investment before investing. Under an RD, the investor has to invest monthly over the selected tenure to earn some interest and the invested amount. Generally, the interest rate of RD varies from 7% to 9% p.a. and is consequently higher for senior citizens. The RD return rate is much less than a Fixed Deposit and SIP because an RD earns interest of the entire 12 months only on the first deposit. On the second deposit in an RD, the interest is earned for 11 months, on the third deposit for 10 months and so on. So, there are no compounding benefits in an RD, unlike FD and SIP. The RD returns are fixed and can be calculated easily using an RD calculator. The major disadvantage of a Recurring Deposit is that it is not tax efficient. TDS (Tax Deducted at Source) is applicable on the interest Income from RD.

Talk to our investment specialist

Top 7 Performing Balanced Fund SIP

As Balanced Fund have less riskier than Equity Mutual Funds, Balanced Funds can give stable returns over extended period of time. List of funds below are based on last 3 Years annualized returns (CAGR) and funds having net assets over 500 Crore & Fund Age > 3 years.

(Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. Research Highlights for ICICI Prudential Multi-Asset Fund Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Balanced Fund) To generate long term capital appreciation and current income from a portfolio

that is invested in equity and equity related securities as well as in fixed income

securities. Research Highlights for ICICI Prudential Equity and Debt Fund Below is the key information for ICICI Prudential Equity and Debt Fund Returns up to 1 year are on (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. Research Highlights for JM Equity Hybrid Fund Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on (Erstwhile SBI Magnum Monthly Income Plan Floater) To provide regular income, liquidity and attractive returns to investors in addition

to mitigating the impact of interest rate risk through an actively managed

portfolio of floating rate and fixed rate debt instruments, equity, money market

instruments and derivatives. Research Highlights for SBI Multi Asset Allocation Fund Below is the key information for SBI Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile BOI AXA Mid Cap Equity And Debt Fund) The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid cap equity and equity related securities as well as fixed income securities.However there can be no assurance that the investment objectives of the Scheme will be realized Research Highlights for BOI AXA Mid and Small Cap Equity and Debt Fund Below is the key information for BOI AXA Mid and Small Cap Equity and Debt Fund Returns up to 1 year are on (Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Research Highlights for Sundaram Equity Hybrid Fund Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on 1. UTI Multi Asset Fund

UTI Multi Asset Fund

Growth Launch Date 21 Oct 08 NAV (10 Dec 25) ₹78.0652 ↓ -0.31 (-0.40 %) Net Assets (Cr) ₹6,376 on 31 Oct 25 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.24 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹11,462 30 Nov 22 ₹12,099 30 Nov 23 ₹14,869 30 Nov 24 ₹18,825 30 Nov 25 ₹20,811 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month 1.5% 3 Month 4.1% 6 Month 5.7% 1 Year 8.4% 3 Year 19% 5 Year 15.1% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 20.7% 2023 29.1% 2022 4.4% 2021 11.8% 2020 13.1% 2019 3.9% 2018 -0.5% 2017 17.1% 2016 7.3% 2015 -3.7% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 3.97 Yr. Jaydeep Bhowal 1 Oct 24 1.08 Yr. Data below for UTI Multi Asset Fund as on 31 Oct 25

Asset Allocation

Asset Class Value Cash 9.14% Equity 68.77% Debt 10.1% Other 11.99% Equity Sector Allocation

Sector Value Financial Services 15.73% Technology 11.37% Consumer Defensive 9.54% Consumer Cyclical 7.16% Basic Materials 6.31% Industrials 5.41% Health Care 5.2% Real Estate 3.05% Communication Services 2.92% Energy 2.85% Utility 0.02% Debt Sector Allocation

Sector Value Cash Equivalent 9.11% Government 7.29% Corporate 2.82% Securitized 0.01% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -12% ₹771 Cr 76,018,936

↓ -958,380 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC3% ₹175 Cr 4,169,825

↑ 196,609 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY2% ₹151 Cr 1,016,937

↑ 743 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL2% ₹141 Cr 688,325

↓ -316,467 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 25 | HDFCBANK2% ₹135 Cr 1,368,622

↓ -202,460 Nestle India Ltd (Consumer Defensive)

Equity, Since 29 Feb 24 | NESTLEIND2% ₹133 Cr 1,046,197

↑ 37,133 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS2% ₹132 Cr 431,841

↑ 1,355 State Bank of India (Financial Services)

Equity, Since 31 Oct 25 | SBIN2% ₹128 Cr 1,362,565

↑ 1,362,565 Asian Paints Ltd (Basic Materials)

Equity, Since 31 Oct 24 | 5008202% ₹125 Cr 496,319

↑ 108,551 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Apr 24 | DIXON2% ₹118 Cr 76,262

↑ 26,089 2. ICICI Prudential Multi-Asset Fund

ICICI Prudential Multi-Asset Fund

Growth Launch Date 31 Oct 02 NAV (09 Dec 25) ₹807.358 ↓ -1.30 (-0.16 %) Net Assets (Cr) ₹71,900 on 31 Oct 25 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 0.86 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹14,477 30 Nov 22 ₹17,132 30 Nov 23 ₹20,420 30 Nov 24 ₹24,957 30 Nov 25 ₹28,881 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month 1.6% 3 Month 4.9% 6 Month 6.6% 1 Year 13.9% 3 Year 18.9% 5 Year 22% 10 Year 15 Year Since launch 20.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 16.1% 2023 24.1% 2022 16.8% 2021 34.7% 2020 9.9% 2019 7.7% 2018 -2.2% 2017 28.2% 2016 12.5% 2015 -1.4% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 13.76 Yr. Manish Banthia 22 Jan 24 1.78 Yr. Ihab Dalwai 3 Jun 17 8.42 Yr. Akhil Kakkar 22 Jan 24 1.78 Yr. Sri Sharma 30 Apr 21 4.51 Yr. Gaurav Chikane 2 Aug 21 4.25 Yr. Sharmila D’mello 31 Jul 22 3.26 Yr. Masoomi Jhurmarvala 4 Nov 24 0.99 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Oct 25

Asset Allocation

Asset Class Value Cash 21.24% Equity 58.46% Debt 10.23% Other 10.07% Equity Sector Allocation

Sector Value Financial Services 19.36% Consumer Cyclical 8.88% Basic Materials 7.02% Industrials 5.94% Technology 5.9% Energy 5.23% Health Care 4.4% Consumer Defensive 4.29% Communication Services 2.56% Utility 2.14% Real Estate 1.62% Debt Sector Allocation

Sector Value Cash Equivalent 18.92% Government 7.38% Corporate 5.18% Credit Quality

Rating Value A 1.3% AA 17.6% AAA 81.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Gold (1 Kg-1000 Gms) Commodity December 2025 Future

- | -4% ₹2,788 Cr 2,300

↑ 2,300 ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | ICICIBANK3% ₹2,501 Cr 18,592,905

↑ 2,596,105 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹2,350 Cr 15,813,305

↓ -1,777,000 ICICI Pru Gold ETF

- | -3% ₹2,321 Cr 224,590,882 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | 5322153% ₹2,201 Cr 17,852,267

↑ 558,686 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹1,827 Cr 18,502,364

↑ 2,800,000 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY2% ₹1,780 Cr 12,009,213

↑ 800,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI2% ₹1,542 Cr 952,730 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 19 | LT2% ₹1,391 Cr 3,450,617

↓ -916,475 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 22 | SBICARD2% ₹1,347 Cr 15,329,366 3. ICICI Prudential Equity and Debt Fund

ICICI Prudential Equity and Debt Fund

Growth Launch Date 3 Nov 99 NAV (10 Dec 25) ₹406.95 ↓ -1.25 (-0.31 %) Net Assets (Cr) ₹48,071 on 31 Oct 25 Category Hybrid - Hybrid Equity AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.6 Sharpe Ratio 0.36 Information Ratio 1.89 Alpha Ratio 2.46 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹15,156 30 Nov 22 ₹17,515 30 Nov 23 ₹20,852 30 Nov 24 ₹26,156 30 Nov 25 ₹29,290 Returns for ICICI Prudential Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month 0.9% 3 Month 2.9% 6 Month 4.5% 1 Year 9.3% 3 Year 18.7% 5 Year 22.2% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 17.2% 2023 28.2% 2022 11.7% 2021 41.7% 2020 9% 2019 9.3% 2018 -1.9% 2017 24.8% 2016 13.7% 2015 2.1% Fund Manager information for ICICI Prudential Equity and Debt Fund

Name Since Tenure Sankaran Naren 7 Dec 15 9.91 Yr. Manish Banthia 19 Sep 13 12.13 Yr. Mittul Kalawadia 29 Dec 20 4.84 Yr. Akhil Kakkar 22 Jan 24 1.78 Yr. Sri Sharma 30 Apr 21 4.51 Yr. Sharmila D’mello 31 Jul 22 3.26 Yr. Nitya Mishra 4 Nov 24 0.99 Yr. Data below for ICICI Prudential Equity and Debt Fund as on 31 Oct 25

Asset Allocation

Asset Class Value Cash 6.42% Equity 76.1% Debt 17.44% Equity Sector Allocation

Sector Value Financial Services 19.84% Consumer Cyclical 10.96% Energy 8.31% Health Care 7% Industrials 5.77% Utility 5.76% Technology 5.38% Consumer Defensive 4.91% Real Estate 2.84% Communication Services 2.58% Basic Materials 2.34% Debt Sector Allocation

Sector Value Government 11.29% Corporate 8.98% Cash Equivalent 3.62% Credit Quality

Rating Value A 1.75% AA 18.87% AAA 79.38% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 12 | ICICIBANK6% ₹3,089 Cr 22,962,853

↑ 4,652,988 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 22 | RELIANCE6% ₹2,756 Cr 18,543,909

↑ 2,845,823 NTPC Ltd (Utilities)

Equity, Since 28 Feb 17 | 5325555% ₹2,563 Cr 76,074,915 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 May 16 | SUNPHARMA5% ₹2,279 Cr 13,476,970

↑ 102,381 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | HDFCBANK4% ₹2,145 Cr 21,722,693

↑ 2,346,789 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 21 | 5322153% ₹1,413 Cr 11,459,322

↓ -3,324,953 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 28 Feb 18 | 5323433% ₹1,408 Cr 4,012,393 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 21 | MARUTI3% ₹1,363 Cr 842,167

↓ -60,600 Avenue Supermarts Ltd (Consumer Defensive)

Equity, Since 31 Jan 23 | 5403763% ₹1,231 Cr 2,962,780 Infosys Ltd (Technology)

Equity, Since 30 Jun 16 | INFY3% ₹1,206 Cr 8,138,013

↓ -1,600,000 4. JM Equity Hybrid Fund

JM Equity Hybrid Fund

Growth Launch Date 1 Apr 95 NAV (10 Dec 25) ₹118.129 ↓ -1.04 (-0.88 %) Net Assets (Cr) ₹816 on 31 Oct 25 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.3 Sharpe Ratio -0.53 Information Ratio 0.93 Alpha Ratio -7.75 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹12,690 30 Nov 22 ₹14,012 30 Nov 23 ₹17,706 30 Nov 24 ₹23,684 30 Nov 25 ₹23,285 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month -1.9% 3 Month -0.9% 6 Month -1.5% 1 Year -6.5% 3 Year 17.3% 5 Year 17.3% 10 Year 15 Year Since launch 12.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 27% 2023 33.8% 2022 8.1% 2021 22.9% 2020 30.5% 2019 -8.1% 2018 1.7% 2017 18.5% 2016 3% 2015 -0.2% Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.08 Yr. Asit Bhandarkar 31 Dec 21 3.84 Yr. Ruchi Fozdar 4 Oct 24 1.08 Yr. Deepak Gupta 11 Apr 25 0.56 Yr. Data below for JM Equity Hybrid Fund as on 31 Oct 25

Asset Allocation

Asset Class Value Cash 1.87% Equity 77.79% Debt 20.34% Equity Sector Allocation

Sector Value Financial Services 23.52% Technology 13.93% Industrials 12.68% Consumer Cyclical 11.76% Basic Materials 6.28% Communication Services 3.66% Health Care 3.62% Consumer Defensive 2.35% Debt Sector Allocation

Sector Value Corporate 11.9% Government 9.4% Cash Equivalent 0.91% Credit Quality

Rating Value AA 6.37% AAA 93.63% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK4% ₹35 Cr 350,000 Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Jan 25 | 5429044% ₹31 Cr 5,950,865 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIARTL4% ₹30 Cr 145,246

↓ -15,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5000344% ₹29 Cr 275,040 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹28 Cr 30,676 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 May 21 | LT3% ₹27 Cr 68,000 Waaree Energies Ltd (Technology)

Equity, Since 31 May 25 | 5442773% ₹26 Cr 77,000 One97 Communications Ltd (Technology)

Equity, Since 30 Jun 25 | 5433963% ₹22 Cr 170,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | ICICIBANK3% ₹21 Cr 155,114 6.48% Govt Stock 2035

Sovereign Bonds | -3% ₹21 Cr 2,075,000

↑ 2,075,000 5. SBI Multi Asset Allocation Fund

SBI Multi Asset Allocation Fund

Growth Launch Date 21 Dec 05 NAV (10 Dec 25) ₹64.2003 ↑ 0.14 (0.22 %) Net Assets (Cr) ₹11,306 on 31 Oct 25 Category Hybrid - Multi Asset AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.46 Sharpe Ratio 0.7 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹11,728 30 Nov 22 ₹12,581 30 Nov 23 ₹14,893 30 Nov 24 ₹17,583 30 Nov 25 ₹20,276 Returns for SBI Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month 1.8% 3 Month 6.8% 6 Month 8.5% 1 Year 13.9% 3 Year 17.2% 5 Year 14.6% 10 Year 15 Year Since launch 9.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 12.8% 2023 24.4% 2022 6% 2021 13% 2020 14.2% 2019 10.6% 2018 0.4% 2017 10.9% 2016 8.7% 2015 9.9% Fund Manager information for SBI Multi Asset Allocation Fund

Name Since Tenure Dinesh Balachandran 31 Oct 21 4.01 Yr. Mansi Sajeja 1 Dec 23 1.92 Yr. Vandna Soni 1 Jan 24 1.84 Yr. Data below for SBI Multi Asset Allocation Fund as on 31 Oct 25

Asset Allocation

Asset Class Value Cash 7.71% Equity 47.87% Debt 34.07% Other 10.34% Equity Sector Allocation

Sector Value Financial Services 15.4% Consumer Cyclical 6.24% Real Estate 4.75% Energy 4.23% Basic Materials 3.95% Technology 3.89% Consumer Defensive 3.62% Industrials 2.13% Utility 1.9% Health Care 0.9% Communication Services 0.36% Debt Sector Allocation

Sector Value Corporate 25.81% Government 9.11% Cash Equivalent 6.87% Credit Quality

Rating Value A 2.2% AA 50.67% AAA 47.13% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Silver ETF

- | -6% ₹758 Cr 48,296,178 SBI Gold ETF

- | -3% ₹398 Cr 37,241,000 6.33% Govt Stock 2035

Sovereign Bonds | -3% ₹370 Cr 37,500,000 6.68% Govt Stock 2040

Sovereign Bonds | -3% ₹343 Cr 35,000,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | HDFCBANK2% ₹263 Cr 2,662,000 Reliance Industries Ltd (Energy)

Equity, Since 15 Sep 24 | RELIANCE2% ₹261 Cr 1,720,000 Brookfield India Real Estate Trust (Real Estate)

-, Since 30 Apr 25 | 5432612% ₹259 Cr 7,664,234 PB Fintech Ltd (Financial Services)

Equity, Since 31 Jul 25 | 5433902% ₹213 Cr 1,222,500 Bharti Telecom Limited

Debentures | -2% ₹209 Cr 20,000 TATA Power Renewable Energy Limited

Debentures | -2% ₹205 Cr 20,000 6. BOI AXA Mid and Small Cap Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Growth Launch Date 20 Jul 16 NAV (10 Dec 25) ₹37.28 ↓ -0.19 (-0.51 %) Net Assets (Cr) ₹1,326 on 31 Oct 25 Category Hybrid - Hybrid Equity AMC BOI AXA Investment Mngrs Private Ltd Rating Risk Moderately High Expense Ratio 2.27 Sharpe Ratio -0.19 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹15,336 30 Nov 22 ₹15,389 30 Nov 23 ₹19,914 30 Nov 24 ₹25,601 30 Nov 25 ₹25,336 Returns for BOI AXA Mid and Small Cap Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month -2.3% 3 Month -1.8% 6 Month -4.4% 1 Year -7.2% 3 Year 16.6% 5 Year 19.7% 10 Year 15 Year Since launch 15% Historical performance (Yearly) on absolute basis

Year Returns 2024 25.8% 2023 33.7% 2022 -4.8% 2021 54.5% 2020 31.1% 2019 -4.7% 2018 -14.2% 2017 47.1% 2016 2015 Fund Manager information for BOI AXA Mid and Small Cap Equity and Debt Fund

Name Since Tenure Alok Singh 16 Feb 17 8.71 Yr. Data below for BOI AXA Mid and Small Cap Equity and Debt Fund as on 31 Oct 25

Asset Allocation

Asset Class Value Cash 9.83% Equity 75.73% Debt 14.44% Equity Sector Allocation

Sector Value Financial Services 17.09% Basic Materials 16.9% Industrials 14.66% Health Care 8.34% Consumer Cyclical 7.47% Technology 5.63% Consumer Defensive 4.07% Utility 0.89% Energy 0.68% Debt Sector Allocation

Sector Value Government 10.38% Corporate 8.09% Cash Equivalent 5.79% Credit Quality

Rating Value AA 1.4% AAA 98.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity Indian Bank (Financial Services)

Equity, Since 31 Aug 23 | 5328143% ₹43 Cr 505,000

↑ 86,000 Jindal Stainless Ltd (Basic Materials)

Equity, Since 30 Sep 21 | JSL3% ₹43 Cr 566,000 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Jul 19 | UNOMINDA3% ₹39 Cr 314,000

↑ 26,000 Housing & Urban Development Corp Ltd (Financial Services)

Equity, Since 31 May 24 | HUDCO3% ₹37 Cr 1,580,000 Hindustan Copper Ltd (Basic Materials)

Equity, Since 31 Oct 24 | 5135993% ₹36 Cr 1,050,000 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433902% ₹32 Cr 180,000 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS2% ₹31 Cr 195,000 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Jul 24 | 5411432% ₹30 Cr 196,000 TD Power Systems Ltd (Industrials)

Equity, Since 31 Jul 24 | TDPOWERSYS2% ₹29 Cr 380,000 Lloyds Metals & Energy Ltd (Basic Materials)

Equity, Since 28 Feb 25 | 5124552% ₹29 Cr 222,000 7. Sundaram Equity Hybrid Fund

Sundaram Equity Hybrid Fund

Growth Launch Date 23 Jun 00 NAV (31 Dec 21) ₹135.137 ↑ 0.78 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.64 Information Ratio -0.12 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹13,181 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Dec 25 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27.1% 3 Year 16% 5 Year 14.2% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

SIP Vs RD: Which is Better RD Or SIP?

Difference Between Recurring Deposit and SIP

The factors used here are the rate of return, liquidity, taxation, Volatility, risk factors, etc.

| Factors | Recurring Deposit (RD) | Systematic Investment Plan (SIP) |

|---|---|---|

| Rate of Return | The SIP returns are market-linked and may vary depending on the type of fund and the fund performance. However, the returns of a SIP are usually good when invested for a longer tenure. | The return rate of an RD is fixed due to its Fixed Interest Rate. So, there is no effect of market volatility on this investment. |

| Investment Scheme | In a RD scheme, you will have to invest in a deposit plan that will give you fixed rate of returns. You can also opt for flexible recurring deposit scheme if you are looking for more flexibility. | In a SIP for mutual funds, you can choose between debt or equity type of funds depending on your risk capability. |

| Investment Type | In a Recurring deposit scheme, the investor has to deposit a fixed amount every month. | Systematic Investment Plan is a way to put your money on mutual funds. Investment can be done on a periodic Basis - daily, weekly, monthly or quarterly. |

| Liquidity | To Cancel SIP, the investors can simply close their investment and withdraw their money without any penal charges. | In the case of an RD, the premature withdrawal or closure of the investment will cause penalty charges. |

| Taxation | Recurring Deposit amount or the interest earned on it are not exempted from tax. | SIP investments and returns are exempted from tax only when invested on Equity Linked Savings Scheme (ELSS) funds. |

| Volatility | Being market-linked, the SIP returns are volatile and may vary from fund to fund. | The RD returns are fixed and thus it is not a volatile investment. |

| Risk Factor | The risk factor is almost null in an RD investment as the returns are fixed. It is one of the safest investment. | The risk in SIP is higher than that in an RD, as SIP returns depend on stock market and Asset Allocation. |

| Investment Goal | Recurring Deposits usually serve short-term savings goal and do not help in long-term wealth growth. | SIPs can help in all kinds of investments goals, whether short- or long –term, depending on the frequency of investment, funds chosen and other factors. |

| Installment Frequency | Recurring Deposit usually come with monthly instalments | SIPs offer flexible instalment plans of daily, weekly, monthly, quarterly etc. |

Evaluation: Returns of SIP Vs RD

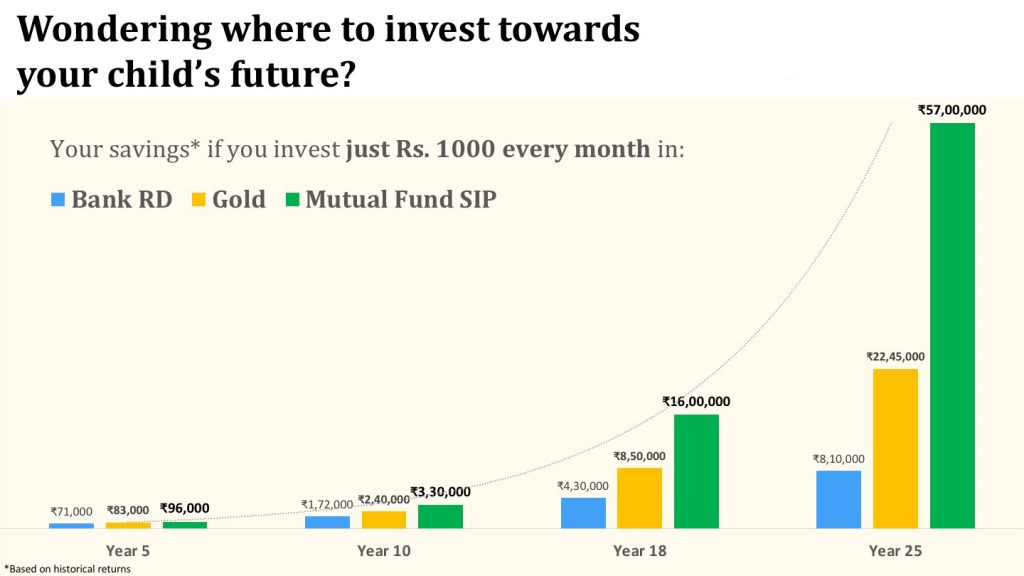

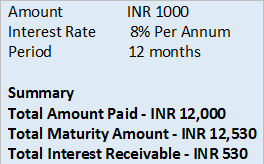

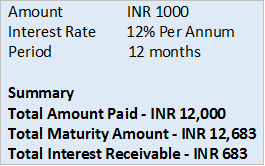

Which is a better investment option- SIP vs RD? The answer to this question may vary from person to person depending on their personal needs. As you know, the SIP returns are variable while the RD returns are fixed, let’s see how much the investment grows if one invests INR 1,000 in both an RD and a SIP for 1 year (12 months).

RD Return Calculator

The RD interest rate may vary at every Bank, but generally, the interest rate ranges from 7% to 9% p.a. Assuming the interest rate to be 8%, let’s analyse the growth in an RD investment of INR 1,000 monthly for 12 months.

SIP Return Calculator

Assuming the SIP interest rate to be 12%, let’s monitor how your SIP grows if you invest INR 1000 monthly for 1 year through the Power of Compounding.

In conclusion, here are some final tips for investors.

- If you are a risk-averse investor, RD or Recurring Deposit is a better option. The RD interest rate and returns are capped beforehand and are usually not very high, may vary from 7-9% p.a.

- If you wish to take a little risk, SIP is one of the best investment options for long-term investment. As per the analysis, SIPs offer good returns and the interest rates are usually higher, exceeding to 15% p.a. in some cases.

- When investing for 5 years, RD is a safer option for investors who are looking for fixed returns.

- However, when investing for a longer duration (more than 5 years) for a certain financial goal, SIP offers good returns and the money growth is much higher.

“Investing in equity via SIP is like planting a tree, one has to be patient to avail the fruits.”

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for UTI Multi Asset Fund