Table of Contents

SIP Vs FD

Which is a Better Investment Option?

Individuals are always in a catch 22 situation when it comes to choosing between FD and SIP for investment. SIP is a mode of investment in Mutual Funds through which individuals can deposit small amounts at regular intervals. FD, on the other hand, is an investment avenue where people deposit a certain amount for a fixed tenure and get back the amount with interest during maturity. So, let us understand which is better between FD and SIP, SIP return calculator, Top SIP to invest, and much more.

What is a Systematic Investment Plan or SIP?

Systematic Investment plan or SIP is an investment mode in Mutual Funds which allows people to deposit small amount at regular intervals. SIP can also be referred to as a goal-based investment. SIP is one of the beauties of Mutual Funds through which people can invest as per their convenience. Through SIP people can plan to achieve many objectives like purchasing a house, purchasing a vehicle, planning for higher education, and much more. Though SIP mode of investment is available in many schemes, however, it is generally referred in the context of Equity Funds.

People can start their SIP investment with the amount as low as INR 500.

What is a Fixed Deposit or FD?

Fixed Deposit of FD refers to an investment avenue which is generally offered by banks and Post Office. In case of FD, people need to deposit a considerable amount as a one-time payment for a fixed time frame. Here, people get back their investment amount at the end of the tenure. However, people cannot break the FD during the tenure and if they try to break they need to pay some charges to the Bank. The FD Income earns interest on the investment. This interest income earned is taxable in the hands of investors.

Which One to Choose?

Since SIP is an investment mode in Mutual Funds while FD is an investment avenue it itself; both of them show different characteristics. So, let us understand the differences between both of them.

Minimum Investment

The minimum investment in Mutual Funds through SIP mode of investment starts with INR 500. Therefore, it can be ensured that it does not pinch people’s pockets much. Moreover, the frequency of SIP can also be set as monthly or quarterly as per people’s convenience. On the other hand, in FD the minimum investment amount ranges between INR 1,000-10,0000. Since FD investment is through lump sum mode, therefore, people do not keep on Investing the amount.

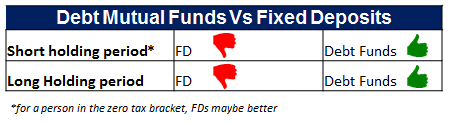

Tenure

FDs being a traditional investment avenue are considered for both short-term and long-term investment. The tenure of FD can be 6 months, 1 year and can go up to 5 years. On the contrary, SIP is generally chosen for long-term investment. Since SIP is generally referred in the context of equity funds, the long-term investment would help you to earn maximum revenues. In addition, people can enjoy maximum benefits if they are held longer.

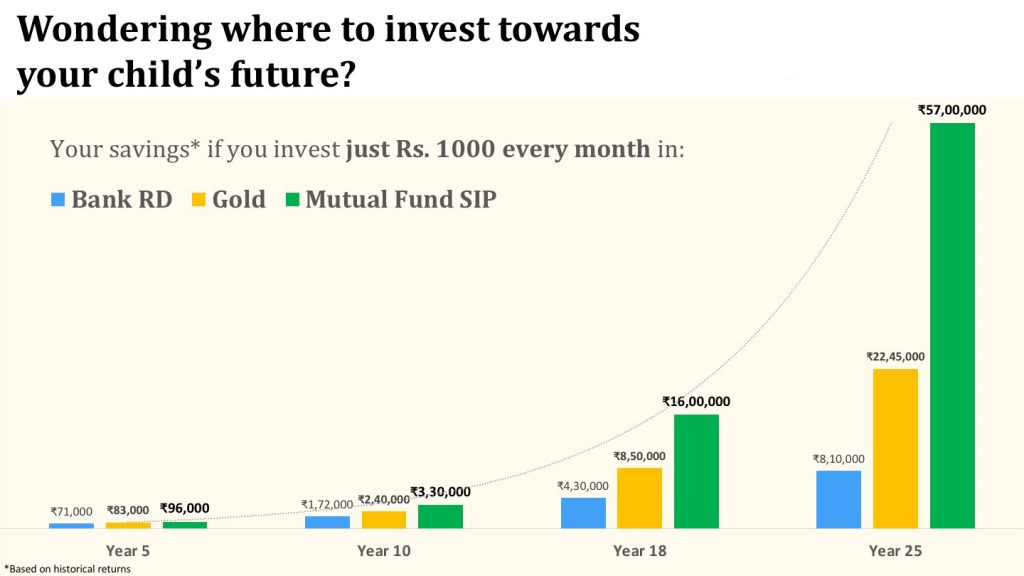

Returns

The returns on FD is fixed in the form of interest which does not change over a period of time. For the Financial Year 2017-18, the FD rates Range between 6%-7% approximately if the investment is kept for one year. On the contrary, in case of SIP, the returns are not fixed as the returns are dependent on the performance of the Underlying equity shares. However, if the Mutual Funds are held for a period of more than five years have given historical returns of more than 15%.

Talk to our investment specialist

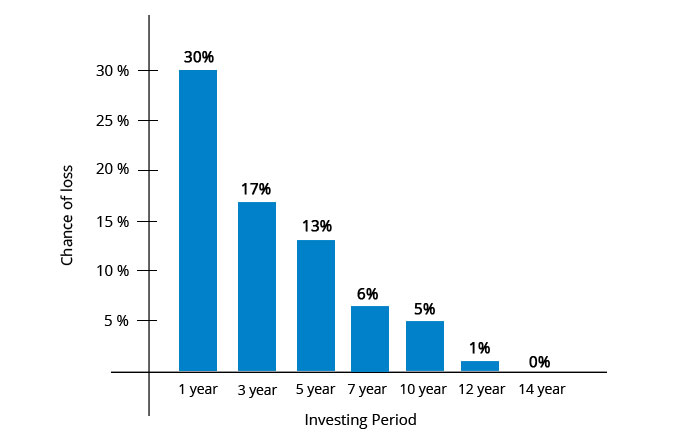

Risk Appetite

The risk-appetite of FD is considered to be less as compared to SIP. FDs are generally offered by banks. On the other hand, the risk appetite of SIP is more than the FD. However, if the SIP is held for a longer-tenure, the probabilities of loss reduces.

Liquidity

The liquidity in case of SIP is more as compared to FD. In case of SIP, if people redeem their investment they can get the money back in T+3 days for equity funds. However, in case of Debt fund, the settlement period is T+1 days. However, in case of fixed deposits, it is not easy to redeem it. Even if people try for premature withdrawals, they need to pay some charges to the bank.

Taxation

The taxation rules in case of Mutual Funds and FDs both are different. In case of FDs, for the Financial year 2017-18, the interest earned is charged as per the individual’s regular tax slabs. However, as SIP is generally with respect to equity funds, therefore the tax rules related to equity funds are explained as follows.

For the Financial Year 2017-18, if the equity funds are sold after one year from the date of purchase, they are applicable for long-term Capital gains which is not taxable. However, if these funds are sold before one year from the date of purchase then; it is subject to short-term Capital Gain which is charged at a Flat rate of 15% irrespective of the individual’s tax slab.

Characteristics

SIP has a lot of features such as rupee cost averaging, the Power of Compounding, and so on, which is not available in case of an FD. So, let us see what do these characteristics mean.

1. Rupee Cost Averaging

In case of SIP, people invest in Mutual Fund units at regular time periods when the markets are showing different price behaviour. Therefore, when the markets are showing a downtrend, people can purchase more units and vice versa. Therefore, the purchase price of units gets averaged out due to SIP. However, in case of FD, this feature is not available as the amount is deposited for only one time.

2. Power of Compounding

SIP is applicable to compounding. Compounding refers to the compound interest where the interest amount is calculated on the principal amount and already accumulated interest. In case of FD, the interest amount is also subject to compounding.

3. Disciplined Savings Habit

SIP develops disciplined savings habit among individuals as people need to deposit money at regular intervals. On the contrary, in FD as people deposit the money only once, they may or may not develop a disciplined savings habit.

The table given below summarizes the differences between SIP and Fixed Deposits.

| Parameters | SIP | Fixed Deposits |

|---|---|---|

| Returns | Varies as per the Fund’s performance | Predetermined |

| Minimum Investment | Starts from INR 500 | Ranges between INR 1,000 – 10,000 |

| Tenure | Generally used for long-term | Both Short and Long-term tenure |

| Risk | High | Low |

| Liquidity | High | Low |

| Taxation | Short-term: Taxed at a Flat Rate of 15% Long-term: Not Taxed | Taxed as per individual’s slab rates |

| Features | Rupee Cost Averaging, Power of Compounding, & Disciplined Savings Habit | Power of Compounding |

Best SIP to Invest for FY 25 - 26

The primary objective of the Scheme is to achieve long-term capital appreciation by investing in equity & equity related instruments of mid cap & small cap companies. Principal Emerging Bluechip Fund is a Equity - Large & Mid Cap fund was launched on 12 Nov 08. It is a fund with Moderately High risk and has given a Below is the key information for Principal Emerging Bluechip Fund Returns up to 1 year are on ICICI Prudential Banking and Financial Services Fund is an Open-ended equity scheme that seeks to generate long-term capital appreciation to unitholders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. However, there can be no assurance that the investment objective of the Scheme will be realized. ICICI Prudential Banking and Financial Services Fund is a Equity - Sectoral fund was launched on 22 Aug 08. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Banking and Financial Services Fund Returns up to 1 year are on (Erstwhile Invesco India Growth Fund) The investment objective of the Scheme is to generate long-term capital growth from a diversified portfolio of predominantly equity and equity-related securities. However, there can be no assurance that the objectives of the scheme will be achieved. Invesco India Growth Opportunities Fund is a Equity - Large & Mid Cap fund was launched on 9 Aug 07. It is a fund with Moderately High risk and has given a Below is the key information for Invesco India Growth Opportunities Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Multicap 35 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by primarily investing in a maximum of 35 equity & equity related instruments across sectors and market-capitalization levels.However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Multicap 35 Fund is a Equity - Multi Cap fund was launched on 28 Apr 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Multicap 35 Fund Returns up to 1 year are on The primary investment objective of the Scheme is to generate long-term capital appreciation to unit holders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Aditya Birla Sun Life Banking And Financial Services Fund is a Equity - Sectoral fund was launched on 14 Dec 13. It is a fund with High risk and has given a Below is the key information for Aditya Birla Sun Life Banking And Financial Services Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Principal Emerging Bluechip Fund Growth ₹183.316

↑ 2.03 ₹3,124 100 2.9 13.6 38.9 21.9 19.2 ICICI Prudential Banking and Financial Services Fund Growth ₹128.07

↑ 2.49 ₹8,843 100 9.5 4.1 18.3 15 23.5 11.6 Invesco India Growth Opportunities Fund Growth ₹89.58

↑ 0.87 ₹5,930 100 -1.1 -6.7 17.5 20.3 25.3 37.5 Motilal Oswal Multicap 35 Fund Growth ₹56.3349

↑ 0.62 ₹11,172 500 -3.7 -9.9 15.6 19.6 21.8 45.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹58.51

↑ 1.20 ₹3,011 1,000 10.9 3.3 15 15.3 24 8.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21 1. Principal Emerging Bluechip Fund

CAGR/Annualized return of 24.8% since its launch. Ranked 1 in Large & Mid Cap category. . Principal Emerging Bluechip Fund

Growth Launch Date 12 Nov 08 NAV (31 Dec 21) ₹183.316 ↑ 2.03 (1.12 %) Net Assets (Cr) ₹3,124 on 30 Nov 21 Category Equity - Large & Mid Cap AMC Principal Pnb Asset Mgmt. Co. Priv. Ltd. Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 2.08 Sharpe Ratio 2.74 Information Ratio 0.22 Alpha Ratio 2.18 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,552 Returns for Principal Emerging Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 2.9% 3 Month 2.9% 6 Month 13.6% 1 Year 38.9% 3 Year 21.9% 5 Year 19.2% 10 Year 15 Year Since launch 24.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Principal Emerging Bluechip Fund

Name Since Tenure Data below for Principal Emerging Bluechip Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. ICICI Prudential Banking and Financial Services Fund

CAGR/Annualized return of 16.5% since its launch. Return for 2024 was 11.6% , 2023 was 17.9% and 2022 was 11.9% . ICICI Prudential Banking and Financial Services Fund

Growth Launch Date 22 Aug 08 NAV (17 Apr 25) ₹128.07 ↑ 2.49 (1.98 %) Net Assets (Cr) ₹8,843 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 1.98 Sharpe Ratio 0.27 Information Ratio 0.31 Alpha Ratio -4.12 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,701 31 Mar 22 ₹19,901 31 Mar 23 ₹21,205 31 Mar 24 ₹26,444 31 Mar 25 ₹30,205 Returns for ICICI Prudential Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 10.5% 3 Month 9.5% 6 Month 4.1% 1 Year 18.3% 3 Year 15% 5 Year 23.5% 10 Year 15 Year Since launch 16.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 11.6% 2022 17.9% 2021 11.9% 2020 23.5% 2019 -5.5% 2018 14.5% 2017 -0.4% 2016 45.1% 2015 21.1% 2014 -7.2% Fund Manager information for ICICI Prudential Banking and Financial Services Fund

Name Since Tenure Roshan Chutkey 29 Jan 18 7.09 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Banking and Financial Services Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 92.1% Industrials 0.18% Technology 0.07% Asset Allocation

Asset Class Value Cash 7.65% Equity 92.35% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK21% ₹1,887 Cr 10,891,127 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | ICICIBANK18% ₹1,619 Cr 13,445,003 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | 5322158% ₹730 Cr 7,188,596

↑ 173,125 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN6% ₹568 Cr 8,244,914

↑ 1,706,850 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 17 | SBILIFE5% ₹477 Cr 3,332,802

↑ 255,647 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Apr 24 | INDUSINDBK5% ₹433 Cr 4,371,007 HDFC Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 23 | HDFCLIFE4% ₹330 Cr 5,423,546

↑ 984,400 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 23 | KOTAKBANK3% ₹284 Cr 1,491,184

↓ -480,000 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIGI3% ₹236 Cr 1,396,761

↑ 311,863 Max Financial Services Ltd (Financial Services)

Equity, Since 31 Aug 19 | 5002712% ₹169 Cr 1,697,397

↑ 34,116 3. Invesco India Growth Opportunities Fund

CAGR/Annualized return of 13.2% since its launch. Ranked 6 in Large & Mid Cap category. Return for 2024 was 37.5% , 2023 was 31.6% and 2022 was -0.4% . Invesco India Growth Opportunities Fund

Growth Launch Date 9 Aug 07 NAV (17 Apr 25) ₹89.58 ↑ 0.87 (0.98 %) Net Assets (Cr) ₹5,930 on 28 Feb 25 Category Equity - Large & Mid Cap AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.88 Sharpe Ratio 0.15 Information Ratio 0.53 Alpha Ratio 8.42 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,107 31 Mar 22 ₹18,853 31 Mar 23 ₹18,682 31 Mar 24 ₹28,076 31 Mar 25 ₹32,206 Returns for Invesco India Growth Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 9.3% 3 Month -1.1% 6 Month -6.7% 1 Year 17.5% 3 Year 20.3% 5 Year 25.3% 10 Year 15 Year Since launch 13.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 37.5% 2022 31.6% 2021 -0.4% 2020 29.7% 2019 13.3% 2018 10.7% 2017 -0.2% 2016 39.6% 2015 3.3% 2014 3.8% Fund Manager information for Invesco India Growth Opportunities Fund

Name Since Tenure Aditya Khemani 9 Nov 23 1.31 Yr. Amit Ganatra 21 Jan 22 3.11 Yr. Data below for Invesco India Growth Opportunities Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 27.11% Consumer Cyclical 23.58% Health Care 14.39% Industrials 10.18% Technology 7.63% Real Estate 6.51% Basic Materials 4.56% Consumer Defensive 2.23% Communication Services 1.79% Asset Allocation

Asset Class Value Cash 2.01% Equity 97.99% Top Securities Holdings / Portfolio

Name Holding Value Quantity InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Mar 24 | INDIGO5% ₹274 Cr 612,171 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 28 Feb 23 | CHOLAFIN5% ₹269 Cr 1,921,954

↑ 84,346 Trent Ltd (Consumer Cyclical)

Equity, Since 28 Feb 22 | 5002514% ₹263 Cr 542,689

↑ 59,081 Swiggy Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | SWIGGY4% ₹223 Cr 6,673,912

↑ 1,381,517 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 15 | ICICIBANK4% ₹210 Cr 1,741,069

↓ -336,652 Zomato Ltd (Consumer Cyclical)

Equity, Since 30 Jun 23 | 5433203% ₹203 Cr 9,152,597 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 30 Nov 22 | MAXHEALTH3% ₹195 Cr 1,993,259 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Sep 22 | DIXON3% ₹182 Cr 130,340 L&T Finance Ltd (Financial Services)

Equity, Since 30 Apr 24 | LTF3% ₹181 Cr 13,404,597 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | FEDERALBNK3% ₹178 Cr 10,039,804 4. Motilal Oswal Multicap 35 Fund

CAGR/Annualized return of 17.1% since its launch. Ranked 5 in Multi Cap category. Return for 2024 was 45.7% , 2023 was 31% and 2022 was -3% . Motilal Oswal Multicap 35 Fund

Growth Launch Date 28 Apr 14 NAV (17 Apr 25) ₹56.3349 ↑ 0.62 (1.12 %) Net Assets (Cr) ₹11,172 on 28 Feb 25 Category Equity - Multi Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 0.94 Sharpe Ratio 0.34 Information Ratio 0.63 Alpha Ratio 14.54 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,169 31 Mar 22 ₹16,552 31 Mar 23 ₹16,009 31 Mar 24 ₹24,719 31 Mar 25 ₹29,279 Returns for Motilal Oswal Multicap 35 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.8% 3 Month -3.7% 6 Month -9.9% 1 Year 15.6% 3 Year 19.6% 5 Year 21.8% 10 Year 15 Year Since launch 17.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 45.7% 2022 31% 2021 -3% 2020 15.3% 2019 10.3% 2018 7.9% 2017 -7.8% 2016 43.1% 2015 8.5% 2014 14.6% Fund Manager information for Motilal Oswal Multicap 35 Fund

Name Since Tenure Ajay Khandelwal 1 Oct 24 0.41 Yr. Niket Shah 1 Jul 22 2.67 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Atul Mehra 1 Oct 24 0.41 Yr. Sunil Sawant 1 Jul 24 0.67 Yr. Data below for Motilal Oswal Multicap 35 Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Technology 20.44% Industrials 18.3% Consumer Cyclical 17.23% Financial Services 9.73% Communication Services 9.21% Health Care 1.75% Asset Allocation

Asset Class Value Cash 23.82% Equity 76.18% Top Securities Holdings / Portfolio

Name Holding Value Quantity Coforge Ltd (Technology)

Equity, Since 31 May 23 | COFORGE10% ₹1,104 Cr 1,500,000

↑ 137,475 Polycab India Ltd (Industrials)

Equity, Since 31 Jan 24 | POLYCAB8% ₹845 Cr 1,793,750

↑ 6,917 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | KALYANKJIL7% ₹809 Cr 17,500,000

↑ 250,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Mar 23 | PERSISTENT7% ₹782 Cr 1,475,000

↓ -321,350 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Jan 23 | 5002517% ₹728 Cr 1,500,000

↓ -335,546 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Mar 23 | CHOLAFIN6% ₹630 Cr 4,500,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Jan 25 | 5000935% ₹601 Cr 10,500,000

↑ 4,000,000 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 30 Apr 24 | 8901575% ₹558 Cr 5,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL4% ₹471 Cr 3,000,000 PG Electroplast Ltd (Technology)

Equity, Since 31 Dec 24 | PGEL4% ₹397 Cr 5,000,000 5. Aditya Birla Sun Life Banking And Financial Services Fund

CAGR/Annualized return of 16.9% since its launch. Ranked 3 in Sectoral category. Return for 2024 was 8.7% , 2023 was 21.7% and 2022 was 11.5% . Aditya Birla Sun Life Banking And Financial Services Fund

Growth Launch Date 14 Dec 13 NAV (17 Apr 25) ₹58.51 ↑ 1.20 (2.09 %) Net Assets (Cr) ₹3,011 on 28 Feb 25 Category Equity - Sectoral AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.99 Sharpe Ratio -0.16 Information Ratio 0.14 Alpha Ratio -10.69 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,760 31 Mar 22 ₹19,860 31 Mar 23 ₹20,711 31 Mar 24 ₹27,001 31 Mar 25 ₹30,038 Returns for Aditya Birla Sun Life Banking And Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 12% 3 Month 10.9% 6 Month 3.3% 1 Year 15% 3 Year 15.3% 5 Year 24% 10 Year 15 Year Since launch 16.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.7% 2022 21.7% 2021 11.5% 2020 16.8% 2019 1.1% 2018 14.9% 2017 -2.4% 2016 47.6% 2015 15.7% 2014 -0.5% Fund Manager information for Aditya Birla Sun Life Banking And Financial Services Fund

Name Since Tenure Dhaval Gala 26 Aug 15 9.52 Yr. Dhaval Joshi 21 Nov 22 2.28 Yr. Data below for Aditya Birla Sun Life Banking And Financial Services Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 97.02% Technology 1.09% Asset Allocation

Asset Class Value Cash 1.89% Equity 98.11% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | ICICIBANK20% ₹601 Cr 4,993,129 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | HDFCBANK19% ₹578 Cr 3,336,948 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Sep 16 | 5000347% ₹199 Cr 233,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | 5322157% ₹196 Cr 1,927,100 State Bank of India (Financial Services)

Equity, Since 31 Oct 17 | SBIN5% ₹162 Cr 2,351,492 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 31 Jan 20 | CHOLAHLDNG4% ₹110 Cr 667,972 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹97 Cr 1,577,700 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 19 | KOTAKBANK3% ₹89 Cr 469,972 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 23 | 5406112% ₹74 Cr 1,308,861 Repco Home Finance Ltd (Financial Services)

Equity, Since 31 Dec 13 | 5353222% ₹58 Cr 1,751,838

↓ -180,986

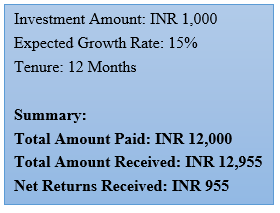

SIP Return Calculator

The returns of SIP keep on varying. However, assuming the historical rate of returns being 15%, let’s see how the SIP investment of INR 1,000 grows over a period of 12 months.

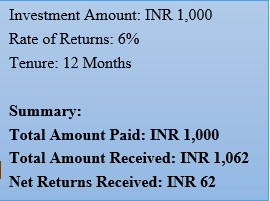

FD Calculator

The FD rates also keep on varying from bank to banks. However, assuming the interest rate to be 6%, let us see how the FD will perform over a period of 12 months if the investment amount is INR 1,000.

How to Invest in MF SIP Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion: SIP or FD

To conclude, it can be said that SIP has more advantages as compared to FD. However, it is always advised to people that they understand a scheme’s functioning completely before investing. In addition, they can even consult a personal financial advisor to ensure that their investment is safe and their objectives are met.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.