Table of Contents

How is your Credit Score Calculated?

A high Credit Score gives you access to the best credit cards in the Market. It also makes you eligible for lower interest rates.

In other words, you can apply for credits confidently. But, do you know where your score comes from? Let’s check how is your credit score calculated based on which you can even improve your it to the best.

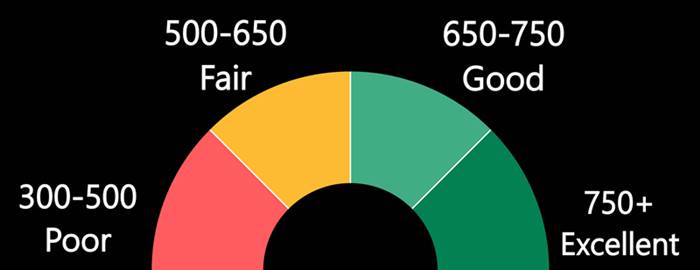

Range of Credit Scores

There are four RBI-registered Credit Bureaus in India- CIBIL Score, CRIF High Mark, Experian and Equifax, who provides you with your score. But, scores may vary as per the bureau. Typically, it ranges from 300 to 900. The closer your score to 900, the more credit benefits you have.

Here’s how the score ranges stand for-

| Poor | 300-500 |

|---|---|

| Fair | 500-650 |

| Good | 650-750 |

| Excellent | 750+ |

How is Credit Score Determined?

There are five major factors considered in determining the credit score. These are the common factors used by most bureaus to calculate credit scores.

| Category | % of your score |

|---|---|

| Payment history | 35% |

| Amounts owed | 30% |

| Length of credit history | 15% |

| New Credit | 10% |

| Credit Line | 10% |

Check credit score

Payment History

Your payment history is the largest category and the most significant component making up your score. It shows how responsible you are when it comes to paying loan EMIs and credit card dues on time. It also shows if you’ve missed any bills, and if you’re carrying any debt.

If you pay your obligations on time, then this category will boost your score. Conversely, if you have missed payments or have legal judgments or bankruptcies on your Credit Report, then your score will go down.

Amounts you Owe

How much you owe on credit cards & loans makes up 30% of your credit score. It also considers the types of accounts you have and the money you owe compared to how much credit is available. If your debt portion is high, then lenders will assume you are a risky borrower & may not lend you money. High debt also means a low score.

A good rule of thumb is to never miss your loan EMIs & keep your credit card balances as low as possible.

Length of Credit History

It overall includes the time length of all your accounts. Right from the oldest to the newest ones. Ideally, the longer your credit history of making timely payments, the higher will be the score.

This category holds 15% of your score, so ensure you make Good Credit history for your financial needs.

New Credit

This includes two things- how many new credit accounts you’ve opened and the number of credit inquiries you have made in the past 12 months. Multiple credit lines and too many inquiries can put your score down. This is also a big ‘No’ to the creditors. They imagine that you are ‘credit hungry’. So, avoid random inquiries and apply for credit only when you want it.

Credit Mix

A credit mix is the types of credit accounts you have. A good mix with the right credit discipline can boost your credit score. The reason for this category is that lenders want to know how responsible you’re in managing several types of credit lines. A mix of loans, credit cards with timely payments can be a good option for a healthy credit score.

Conclusion

Now when you know how is your credit score calculated, start improving it. Good credit history makes your financial life easier & smoother.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.