Table of Contents

- Details about Form 26AS

- Importance of Form 26AS

- Where can you view Form 26AS?

- How to Download Form 26AS?

- FAQs

- 1. Does From 26AS contain details of high-value transactions?

- 2. Who files Form 26AS?

- 3. How can I access form 26AS?

- 4. What do I need to access Form 26AS?

- 5. What are the Income Tax details I have to fill in the form?

- 6. What are the TDS details I have fill in the form?

- 7. Can I file the form online?

- 8. Does form 26AS have anything to do with Form 15H or Form 15G?

- 9. Do I have to fill in Tax Collected at Source (TCS)?

- 10. What is the password for opening form 26AS?

What is Form 26AS?

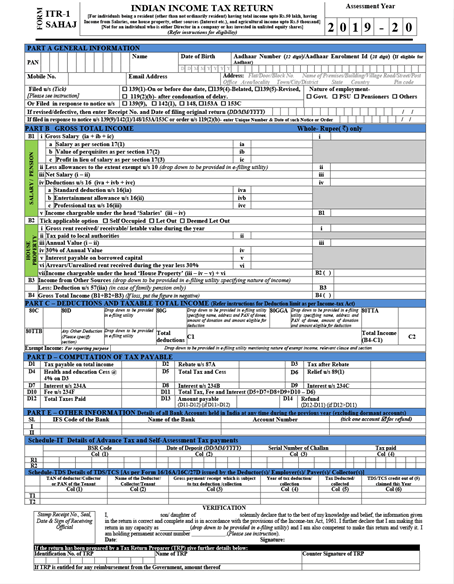

Form 26AS is one of the most important tax documents for a tax payer. People who file ITR must be familiar with the same. Generally, Form 26AS is the consolidated annual tax credit statement issued by the income tax Department. It holds information of tax deductions on your Income, by employers, banks, including self-assessment tax and Advance Tax paid during the year.

Details about Form 26AS

Form 26AS is a consolidated statement that keeps a record of all the tax-related information such as TCS, TDS, and refund, etc., based on PAN number for every financial year. It also contains details of any refunds received during the relevant FY.

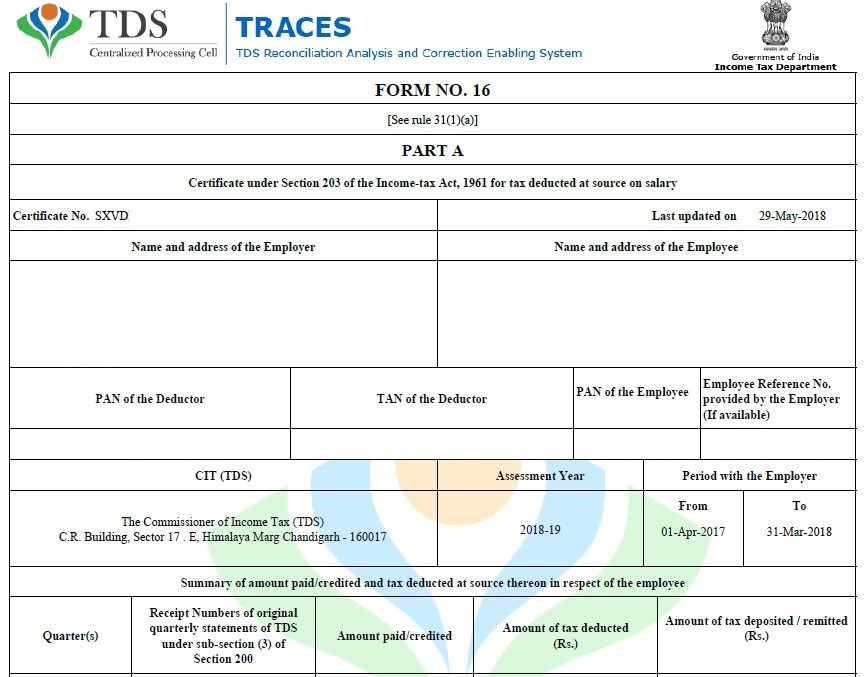

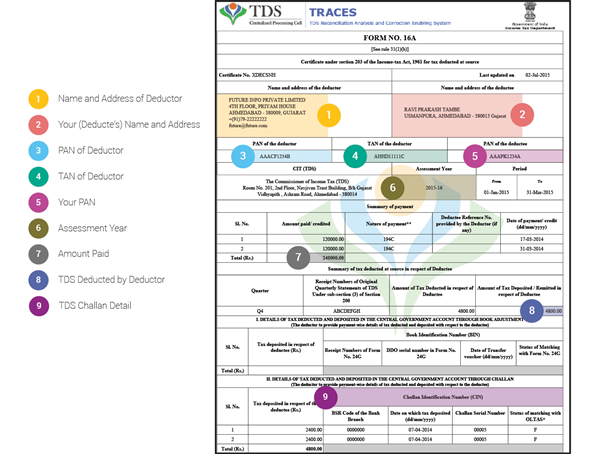

Form 26AS contains the annual tax statement under Section 203AA, Rule 31AB of the Income Tax Act, 1961. The statement reveals the tax amount that has been received by the government. It also contains information about an individual’s income sources that also includes monthly salary, income from investments, pension, income for professional services, etc. Also, tax deducted on your behalf by the employer, the Bank and other financial institution in which you have sale/purchase, an investment or rent of the immovable property.

While filling ITR it acts as a record about accurate Taxes that has been deducted on our behalf by different entities and also deposited into the account of the government.

Importance of Form 26AS

The major purposes that Form 26AS fulfils are:

The form helps to check if the collector has accurately filed the TCS or the deductor has accurately filed the TDS statement giving details of the tax collected or deducted on your behalf.

It supports one to check that the tax deducted or collected has been deposited to the account of the government on time.

It helps to verify the tax credits and computation of income before filing the Income Tax Return.

Moreover, the form 26AS also reflect details of AIR (Annual Information Return), which is filed by different entities based on what an individual has spent or invested on, mostly for high value transactions.

If the total amount deposited in a Savings Account exceeds INR 10 lakh, the bank will send an Annual Information Return. Also, if an amount more than INR 2 lakh is invested in a Mutual Fund or spent on a credit card, the same is been followed.

Talk to our investment specialist

Where can you view Form 26AS?

Form 26AS can be viewed through your net banking account or at TRACES- the TDS Reconciliation website or by logging into your e-return filing account on the tax department’s website.

How to Download Form 26AS?

Any tax payer can download the form 26AS with a valid PAN number. To do this you need to login on the Income Tax Department's website. Another easy way to download is by registering at the TRACES website of the IT Department.

You can also get this form 26AS through authorized banks using your net banking Facility. However, Tax Credit Statement (Form 26AS) is available only if the PAN details are mapped to the bank account that is going to be used to download the form. The facility is available for free. The list of authorized banks that provide the form are given below:

| Allahabad Bank | ICICI Bank | State Bank of Hyderabad |

|---|---|---|

| Andhra Bank | IDBI Bank | State Bank of India |

| Axis Bank | Indian Bank | State Bank of Mysore |

| Bank of Baroda | Indian Overseas Bank | State Bank of Patiala |

| Bank of India | IndusInd Bank | State Bank of Travancore |

| Bank of Maharashtra | Karnataka Bank | Syndicate Bank |

| Canara Bank | Kotak Mahindra Bank | Federal Bank |

| Central Bank of India | Oriental Bank of Commerce | Karur Vysya Bank |

| City Union Bank | Punjab National Bank | UCO Bank |

| Corporation Bank (Retail) | Punjab & Sind Bank | Union Bank of India |

| Corporation Bank (Corporate) | South Indian Bank | Vijaya Bank |

| Dena Bank | State Bank of Bikaner & Jaipur | Yes Bank |

| HDFC Bank | - | - |

FAQs

1. Does From 26AS contain details of high-value transactions?

A: Yes, it contains the details of high-value transactions. This has been recently introduced as a part of your IT Returns.

2. Who files Form 26AS?

A: Form 26AS is filed by individuals filing for ITR. In other words, it contains details of the tax that has been paid on your behalf by the deductor, as a result of income earned, interest income, rent earned from immovable property, or any other such means of earning income. If you have carried out any high-value transactions in the particular financial year, it will be displayed in the Form 26AS.

3. How can I access form 26AS?

A: The form can be easily accessed by visiting the website of the Income Tax Department of India. Otherwise, if your bank has a Net banking facility and you have provided your PAN to the bank, you can view the Form 26AS from your bank's website as well.

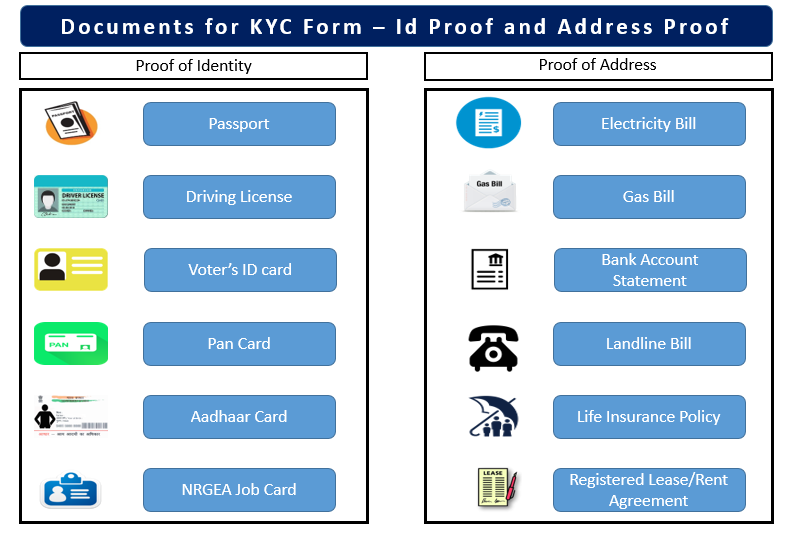

4. What do I need to access Form 26AS?

A: The primary requirement for viewing the form 26AS is your Permanent Account Number or your PAN.

5. What are the Income Tax details I have to fill in the form?

A: Part C of Form 26AS consists of the tax details. Here you can access any you have already deposited. You can fill in details of Tax Deducted at Source (TDS), advance tax, and do self-assessment of Tax directly from the form. These are the details regarding Income Tax that you can fill in form 26AS.

6. What are the TDS details I have fill in the form?

A: Goods sellers usually fill the TDS section of Form 26AS. If you are goods seller, you will have to make entries for the Transactions collected by you.

7. Can I file the form online?

A: You can view Form 26AS online on the website of the Income Tax department by logging into your profile. You can also fill the form directly from your profile.

8. Does form 26AS have anything to do with Form 15H or Form 15G?

A: Form 26AS has details for TDS, which is related to Form 15H and 15G. This will reflect on part A1 of the Form 26AS. If you have not submitted form 15H or 15G, this section will display 'No transactions at present.'

9. Do I have to fill in Tax Collected at Source (TCS)?

A: TCS is filled in by the seller. If you are a seller, you will have to fill in part B, or the entries will be made here if you are a seller.

10. What is the password for opening form 26AS?

A: The password for opening the form 26AS is your birthday filled in the DD/MM/YYYY format.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.