Fincash » Debt Funds » Building a Medical Emergency Fund Using Debt Mutual Funds

Table of Contents

- Why a Medical Emergency Fund is Essential?

- What Are Debt Mutual Funds?

- Why Use Debt Mutual Funds for a Medical Emergency Fund?

- How to Build a Medical Emergency Fund Using Debt Mutual Funds

- Practical Example: Building an Emergency Fund

- Key Considerations When Using Debt Funds

- Historical Perspective: Debt Funds in Uncertain Times

- Additional Tips for Managing Your Emergency Fund

- Best Debt Funds in India 2025

- Conclusion

Building a Medical Emergency Fund Using Debt Mutual Funds

Medical emergencies can be both emotionally and financially draining. The best way to safeguard yourself and your loved ones against unexpected medical expenses is by having a well-planned emergency fund.

While traditional savings accounts are commonly used for this purpose, they may not provide sufficient returns to beat Inflation. This is where debt Mutual Funds come into the picture. Debt funds offer a combination of stability and liquidity, making them an excellent option for building a medical emergency fund.

Why a Medical Emergency Fund is Essential?

A medical emergency can strike at any time and can lead to significant expenses. This could include hospital bills, surgery costs, or long-term treatments. Having an emergency fund ensures that you don't have to dip into your long-term investments or take on debt to cover these costs. According to financial experts, an emergency fund should ideally cover 6 to 12 months of your monthly expenses, including rent, groceries, utility bills, and especially unforeseen medical costs.

Talk to our investment specialist

What Are Debt Mutual Funds?

Debt mutual funds invest in fixed-Income securities like government Bonds, corporate bonds, treasury bills, and money market instruments. These funds are generally less risky than Equity Funds and offer a predictable return. They are well-suited for short to medium-term investment goals, such as creating an emergency fund.

Types of Debt Mutual Funds Suitable for an Emergency Fund:

- Liquid Funds: These invest in securities with a maturity of up to 91 days, making them highly liquid and relatively safe.

- Ultra-short-term funds: Ideal for holding funds for a few months to a year, these provide slightly higher returns compared to liquid funds.

- Short-Term Debt Funds: These invest in instruments with a maturity of 1 to 3 years and offer a balance between safety and returns.

Why Use Debt Mutual Funds for a Medical Emergency Fund?

Liquidity: The most critical aspect of an emergency fund is easy access to your money. Debt funds like liquid and ultra-short-term funds allow you to redeem your investments quickly, usually within one working day.

Better Returns than Savings Accounts: While a traditional Savings Account provides an annual interest rate of around 2.5% to 4%, debt funds can yield returns between 5% and 7%, helping you combat inflation.

Low Volatility: Debt funds are less volatile compared to equity funds, making them a safer option for emergency funds.

Tax Efficiency: If held for more than three years, debt mutual funds offer the advantage of indexation benefits, reducing the Tax Liability on your gains.

How to Build a Medical Emergency Fund Using Debt Mutual Funds

Step 1: Calculate Your Emergency Fund Needs

Start by estimating your medical emergency expenses. Consider costs like hospital stays, medication, and post-treatment care. If you think a medical emergency could cost ₹5 lakh, aim to accumulate at least this amount.

Step 2: Choose the Right Type of Debt Fund

- Liquid Funds for Immediate Access: If you want to access your funds immediately, liquid funds are the best option. They invest in short-term debt instruments and provide quick liquidity.

- Ultra-Short-Term Funds for Slightly Higher Returns: If you have a moderate risk appetite and are looking to park your funds for a slightly longer period, ultra-short-term funds may be suitable.

- Short-Term Debt Funds for Medium-Term Goals: If your medical emergency fund goal spans over a few years, short-term debt funds provide a good balance between risk and return.

Practical Example: Building an Emergency Fund

Let’s assume Rajesh wants to build a medical emergency fund of ₹5 lakh over the next three years. Here’s how he can do it:

Investment in Liquid Funds: Rajesh decides to invest a lumpsum of ₹4 lakh in a liquid fund yielding an Average Return of 5.5% per annum. At the end of three years, his investment will grow to approximately ₹4.67 lakh.

Monthly SIP in Ultra-Short-Term Funds: To reach his target of ₹5 lakh, Rajesh starts a SIP of ₹3,000 per month in an ultra-short-term Debt fund, with an average return of 6%. After three years, his SIP will accumulate to approximately ₹1.16 lakh.

By combining both strategies, Rajesh would have an emergency fund totaling approximately ₹5.83 lakh, giving him a safety net well above his initial target.

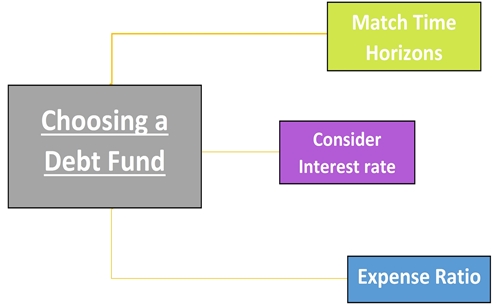

Key Considerations When Using Debt Funds

Exit Load and Redemption Time: While liquid funds generally don’t have an exit load, some ultra-short-term and short-term debt funds might. Check the fund’s terms before Investing.

Tax Implications: Gains from debt mutual funds are taxable. If sold within three years, they are taxed as short-term Capital gains, which are added to your income and taxed at your applicable slab rate. For investments held longer, gains are taxed at 20% with indexation benefits.

Risk Factors: Although debt funds are safer than equity funds, they are not entirely risk-free. Interest rate fluctuations and credit risks can impact returns.

Historical Perspective: Debt Funds in Uncertain Times

Debt mutual funds have proven to be reliable during financial uncertainties. For example, during Market downturns, investors who had parked their emergency funds in liquid or ultra-short-term debt funds were able to access their money without worrying about significant losses. This highlights the importance of having a stable and liquid investment option for emergencies.

Additional Tips for Managing Your Emergency Fund

- Regular Review: Periodically review your fund to ensure it meets your financial needs, especially if your lifestyle or medical costs change.

- Avoid Risky Investments: Your emergency fund should not be invested in high-risk assets like equity funds or stock markets, as the primary goal is to preserve capital.

- Automate Your Investments: Setting up an automated SIP can help you consistently build your emergency fund without the hassle of manual transfers.

Best Debt Funds in India 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity UTI Dynamic Bond Fund Growth ₹30.9395

↑ 0.01 ₹447 3.6 5.2 10.6 9.9 8.6 6.94% 5Y 5M 23D 8Y 14D ICICI Prudential Long Term Plan Growth ₹36.7861

↑ 0.01 ₹14,363 3.6 5.5 10.5 8.1 8.2 7.64% 4Y 11M 16D 10Y 2M 23D Aditya Birla Sun Life Corporate Bond Fund Growth ₹112.22

↑ 0.02 ₹24,570 3.4 5.1 10.2 7.7 8.5 7.31% 3Y 5M 16D 4Y 9M 14D HDFC Corporate Bond Fund Growth ₹32.3282

↓ 0.00 ₹32,527 3.3 5 9.9 7.5 8.6 7.31% 3Y 9M 5Y 10M 2D HDFC Banking and PSU Debt Fund Growth ₹22.8348

↓ 0.00 ₹5,996 3.3 4.9 9.4 7.1 7.9 7.25% 3Y 10M 10D 5Y 6M 4D Axis Credit Risk Fund Growth ₹21.1477

↑ 0.01 ₹360 2.9 4.6 9.1 7.1 8 8.41% 2Y 1M 28D 3Y 1M 2D UTI Banking & PSU Debt Fund Growth ₹21.6745

↓ 0.00 ₹785 2.9 4.5 8.8 9.2 7.6 7.14% 2Y 29D 2Y 4M 24D PGIM India Credit Risk Fund Growth ₹15.5876

↑ 0.00 ₹39 0.6 4.4 8.4 3 5.01% 6M 14D 7M 2D Aditya Birla Sun Life Money Manager Fund Growth ₹365.811

↑ 0.12 ₹25,581 2.4 4.1 8 7.2 7.8 7.35% 9M 9M 4D Aditya Birla Sun Life Savings Fund Growth ₹541.511

↑ 0.21 ₹13,294 2.3 4.1 8 7.1 7.9 7.75% 6M 25D 7M 28D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

Conclusion

Building a medical emergency fund using debt mutual funds is a wise strategy for financial security. The key lies in selecting the right type of debt fund based on your time horizon and liquidity needs. By investing in liquid or ultra-short-term funds, you can ensure that your money is easily accessible and growing at a rate that outpaces inflation. Start planning today and secure your future against unforeseen medical emergencies.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.