Table of Contents

- ICICI Direct 3-In1 Account

- Features of ICICI Demat Account

- ICICI 3-In-1 Account Charges

- ICICI Direct 3-in-1 Account Opening

- Documents Required

- Additional Points to Remember

- ICICI Demat Account Closure

- Why Choose ICICI Bank?

- ICICI Direct Trading Software and Platforms

- Conclusion

- Frequently Asked Questions (FAQs)

- 1. Is ICICI direct required to have a minimum balance?

- 2. What is ICICI Direct's AMC?

- 3. Is IPO available at ICICI Direct?

- 4. Are margin funds available from ICICI Direct?

- 5. What is the auto square-off timing for ICICI Direct intraday?

- 6. Are there any charges associated with ICICI Direct’s trading platforms?

- 7. What is the toll-free customer service number?

- 8. What is the ICICI Direct minimum brokerage amount?

- 9. Does ICICI Direct provide a brokerage calculator?

- 10. Is it possible to use ICICI Direct to place an After Market Order (AMO)?

Steps to Open ICICI Bank 3-in-1 Account

ICICI Direct is a prominent retail stock dealer in India. It is a full-service stockbroker with a Bank background that has been in business for over 20 years. The ICICI 3-in-1 account provides clients with a unique and smooth trading experience. ICICI Bank Ltd. serves both the Depository Participant (DP) and the banker for the Demat account.

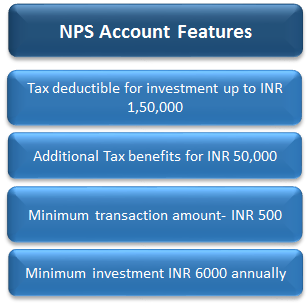

They can trade in stock, commodity and currency available in different exchanges like BSE, NSE, and MCX. Mutual Funds and Initial Public Offerings (IPO), fixed deposits, Bonds, Non-Convertible Debentures (NCDs), wealth products, home loans, and loans against securities are a few more of the services offered to customers.

The most popular Offering of ICICI direct is the 3-in-1 account. Here is the complete information of ICICI three in one account, along with opening process, charges and so on.

ICICI Direct 3-In1 Account

The ICICI Direct 3-in-1 account combines trading, Demat, and bank accounts into one convenient package. This account provides a smooth trading experience. The other name for it is ICICI Online Trading Account. By filing a single application form, all three accounts can be opened simultaneously. ICICI Demat account enables investors to purchase, sell, and trade a wide Range of products other than stocks and shares, all conveniently under one roof. You can also continue to earn 3.5% interest on the amount that has been set aside for trading but has not yet been used by you for trading.

Features of ICICI Demat Account

ICICI Trading Account is a popular trading account among investors and traders in India. This company offers many services and perks that make trading easier. Let's have a look at the features of this Demat Account:

- They offer a 3-in-1 trading account that allows you to manage your Demat, trading, and bank accounts all from one place.

- It facilitates accessibility and greater flexibility.

- It offers trading in both BSE and NSE.

- With ICICI Direct's "myGTC Orders," a share trader can select the date until which the order will be validated using this feature while making a buy/sell order.

- The ICICI I-Secure Plan, Prime Plan, Prepaid Brokerage Plan, and Neo Plan are all available through ICICI Direct.

Talk to our investment specialist

ICICI 3-In-1 Account Charges

A fee is charged, known as a brokerage, when a user buys or sells stocks via ICICI Direct. The following is a list of ICICI Direct's brokerage fees for equity, commodity, and currency derivative trading.

Equity

Here is the list of charges levied on equity trading which includes delivery, intraday, futures and options.

| Charges | Delivery | Intraday | Futures | Options |

|---|---|---|---|---|

| Transaction Charges | 0.00325% - NSE | 0.00325% - NSE | 0.0019% - NSE | 0.05% - NSE |

| Clearing Charges | - | - | 0.0002% - NSE | 0.005% - NSE |

| Demat Transaction Charges | Sell-side, ₹ 18.5 per scrip | - | - | - |

| SEBI Charges | ₹ 15 per crore | ₹ 15 per crore | ₹ 15 per crore | ₹ 15 per crore |

| STT | ₹ 100 per Lacs | Sell-side, ₹ 25 per Lacs | Sell-side, ₹ 10 per Lacs | Sell-side, ₹ 50 per Lacs |

| GST | 18% on Brokerage + Transaction + Demat Charges | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction + Clearing Charges | 18% on Brokerage + Transaction + Clearing Charges |

Commodity

Currently, there are roughly 50 main commodity markets across the world that enable investment trade in about 100 key commodities. Here is the list of charges levied on commodity trading:

| Charges | Futures | Options |

|---|---|---|

| Transaction Charges | 0.0026% Non-Agri | - |

| Clearing Charges | 0.00% | 0.00% |

| SEBI Charges | ₹ 15 per crore | ₹ 15 per crore |

| STT | Sell side, 0.01% - Non Agri | Sell side, 0.05% |

| GST | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction |

Currency

Banks, commercial enterprises, central banks, investment management firms, hedge fund, and retail forex brokers and investors all participate in the foreign exchange markets. The fees for currency trading are listed below.

| Charges | Futures | Options |

|---|---|---|

| Transaction Charges | 0.0009% - NSE / 0.00022% - BSE | 0.04% - NSE / 0.001% - BSE |

| Clearing Charges | 0.0004% - NSE / 0.0004% - BSE | 0.025% - NSE / 0.025% - BSE |

| SEBI Charges | ₹ 15 per crore | ₹ 15 per crore |

| STT | - | - |

| GST | 18% on Brokerage + Transaction | 18% on Brokerage + Transaction |

Note: 18% GST applicable on Plan Charges.

| Prepaid Plan (Lifetime) | Cash % | Margin / Futures % | Options (Per Lot) | Currency Futures & Options | Commodity Futures |

|---|---|---|---|---|---|

| ₹ 5000 | 0.25 | 0.025 | ₹ 35 | ₹ 20 per order | ₹ 20 per order |

| ₹ 12500 | 0.22 | 0.022 | ₹ 30 | ₹ 20 per order | ₹ 20 per order |

| ₹ 25000 | 0.18 | 0.018 | ₹ 25 | ₹ 20 per order | ₹ 20 per order |

| ₹ 50000 | 0.15 | 0.015 | ₹ 20 | ₹ 20 per order | ₹ 20 per order |

| ₹ 1,00,000 | 0.12 | 0.012 | ₹ 15 | ₹ 20 per order | ₹ 20 per order |

| ₹ 1,50,000 | 0.09 | 0.009 | ₹ 10 | ₹ 20 per order | ₹ 20 per order |

| Prime Plan (Yearly) | Cash % | Margin / Futures % | Options (Per Lot) | Currency Futures & Options | Commodity Futures | eATM Limit | Special MTF Interest rates/LPC (% per Day) |

|---|---|---|---|---|---|---|---|

| ₹ 299 | 0.27 | 0.027 | ₹ 40 | ₹ 20 per order | ₹ 20 per order | 2.5 lakhs | 0.04 |

| ₹ 999 | 0.22 | 0.022 | ₹ 35 | ₹ 20 per order | ₹ 20 per order | 10 lakhs | 0.0035 |

| ₹ 1999 | 0.18 | 0.018 | ₹ 25 | ₹ 20 per order | ₹ 20 per order | 25 lakhs | 0.031 |

| ₹ 2999 | 0.15 | 0.015 | ₹ 20 | ₹ 20 per order | ₹ 20 per order | 1 cr | 0.024 |

ICICI Direct 3-in-1 Account Opening

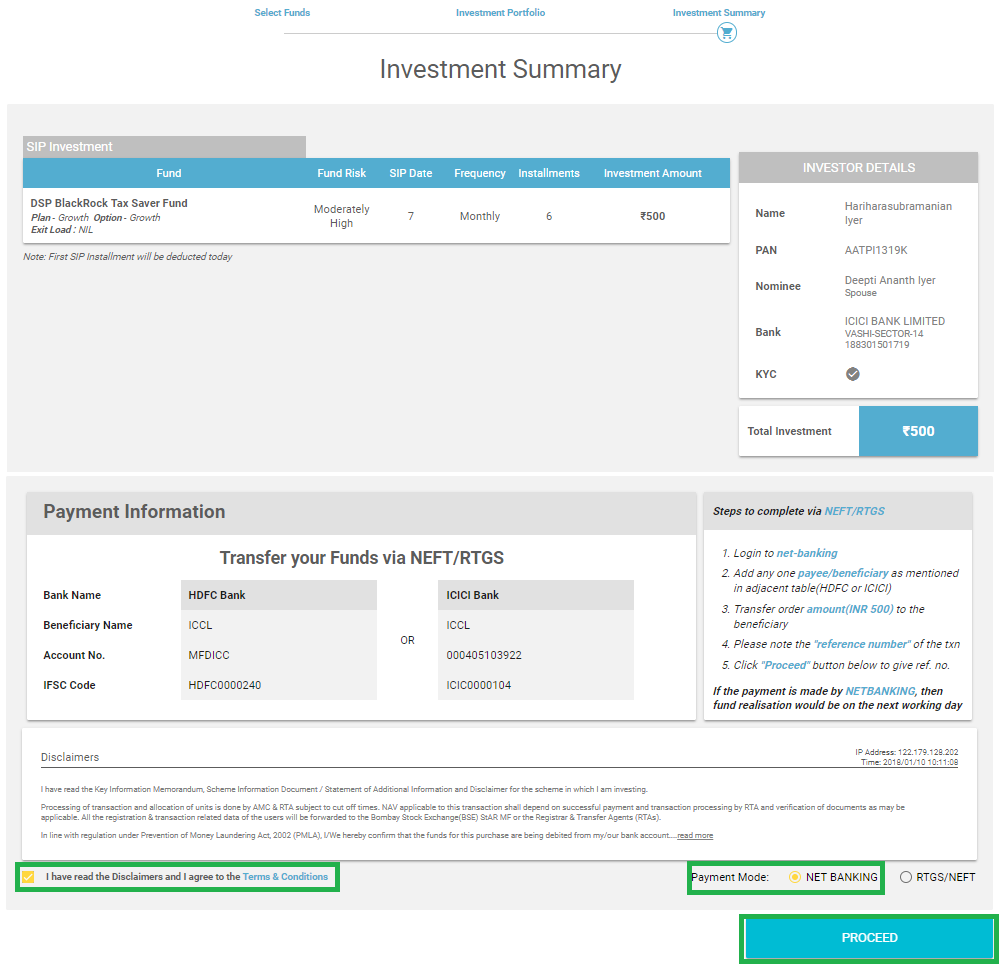

To create an ICICI Demat account, you can either visit the local ICICI branch or log into ICICI net banking and fill out the Demat request form, and submit it along with the required documents. Follow these steps to create a 3-in-1 account with ICICI bank online:

Step 1: Visit the official website and click on ‘Open Your Account.'

Step 2: To proceed, provide your mobile number. Verify it with the OTP received.

Step 3: Now, submit your PAN card details, phone number, email address, birth date, and Pin code. Press Enter to proceed.

Step 4: To continue logging in to Digilocker, input your Aadhaar number. To proceed, click Next. Now, enter the One-Time Password (OTP) that was sent to your registered phone number.

Step 5: Allow ICICI to access your digilocker account by clicking the allow button.

Step 6: Verify that the information you entered is correct. You may also update the details by clicking the "Details are wrong" button if they are wrong.

Step 7: Now enter your bank account details, then click Continue to proceed.

Step 8: Then upload documents, like ID proof and signature, by clicking the browse option. Then click continue.

Step 9: Now submit some personal and financial information and click continue. You'll next be prompted to upload a 3-second video of yourself.

Step 10: Your account set-up is completed and will be activated within the next 24 hours.

Documents Required

The following is a list of the documents required at the time of opening an ICICI three-in-one account. Before starting with the application process, it’s advisable to keep the soft copies in hand.

- Scanned copy of PAN card

- Photo or scanned copy of signatures

- Scanned copy of Aadhar card

- Bank account details

- Identification proof

- Cancelled cheque/ recent bank statement

- Income proof (Only required if wish to trade in futures and options)

- Residence proof

Here is the list of documents that can be used as proof for verification:

Residence proof documents: Ration cards, passports, voter’s ID, driver's license, bank passbook or statement, verified copies of electricity bills, and residential telephone bills.

Identification proof documents: voter's ID, passport, PAN card, a driver's licence, electricity bills, telephone bills, and ID cards with the applicant's photo issued by the central or state government.

Additional Points to Remember

To open a Demat account, you'll need a valid ID, proof of address, and your PAN card. You will mandatorily require two documents in addition to the minimum requirement of a PAN card. The important points to consider are listed below.

- Your aadhaar card should be linked to an active mobile phone number. This is required to finish the eSign-in process, which includes OTP verification.

- Your name must be clearly written on the cheque along with the IFSC code and bank account number.

- As proof of income, the listed documents can be used:

- Latest 6-months bank statement

- Net worth certificate from a CA

- Income Tax Return Acknowledgement

- Form-16

- Latest salary slip

- Signatures should be done with a pen on a blank piece of paper and should be legible. Your submission will be rejected if you use pencils, sketch pens, or markers.

- Make sure the bank statement you're uploading has a legible account number, IFSC, and MICR code. Your application can be denied if these aren't legible.

ICICI Demat Account Closure

Due to regulatory restrictions, the account closure procedure is done manually/offline. It is necessary to file a request for account closure. The following are the procedures that must be followed in order to close the account:

- Visit the ICICI website, download the account closure form

- Print a copy of the form, fill it out and sign it

- Along with the form, attach unused Delivery Instruction Slip ( DIS)

- Submit the form at the branch office

- You’ll receive an account closure request number through SMS

- Within 2-3 days, you’ll get a confirmation SMS stating that your account is closed

Note: To avoid Annual Maintenance Charges (AMC) and account misuse, you are advised to close the account (If not using the same). Furthermore, each company has its own method for closing a Demat account. With ICICI, it takes anywhere between 7-10 business days.

Why Choose ICICI Bank?

There are plenty of options available in the Market from where you can open a Demat account, but why should you choose ICICI? Here is the list of benefits offered by ICICI to help you choose wisely.

- A bunch of investment options under a single account is available.

- Advisory and research services are provided free of charge.

- Provides an eATM service, which allows you to get funds from a sale in 30 minutes.

- At minimum cost, you can transfer securities 24X7 over the internet and Interactive Voice Response (IVR).

- You can receive your Demat Account Statement via email.

- It has a dedicated customer service staff to ensure a seamless experience.

- ICICI covers the depth of the market with more than 200 firms across different industries.

- Theft, forgery, loss, and destruction of physical certificates are all avoided with an ICICI Demat account.

- You can lock or freeze your accounts for a set length of time, and during this time, there will be no debits from your account.

ICICI Direct Trading Software and Platforms

A trading platform is computer software that allows investors and traders to place deals and track accounts through financial intermediaries. Customers of ICICI Direct have access to three different trading platforms:

Official Website: The ICICI Direct website is the most popular online Investing and trading platform. It provides online trading and Demat accounts, as well as IPOs, SIPs, mutual funds, insurance, and a variety of other services. Research and recommendations are also available on the website.

Trade Racer: ICICI trade racer is a desktop-based trading platform that can be installed as an executable file. It is simple to download and install on laptops or desktop computers. It is equipped with a slew of tools for high-volume, high-speed trading.

ICICI Direct Mobile App: It's the official mobile-based trading application for those who want to trade on the go. It provides real-time price alerts, research notifications, and personalised alerts on portfolio stocks, allowing users to trade from anywhere and at any time. The mobile application is downloadable for both Android and iOS users.

Conclusion

ICICI Direct comes with the best investment options in the market. It offers a trader-friendly package with a minimum brokerage which is reliable and user-friendly. They offer premium plans with various incentives, equity ATM Facility, Technical Analysis and charting tools to traders. For investors, ICICI Direct provides free access to premium online courses, magazines, and other publications, such as an e-magazine with market updates. You can assess the risk component of their portfolio and identify specific investment strategies by just logging in.

Frequently Asked Questions (FAQs)

1. Is ICICI direct required to have a minimum balance?

Yes, it is mandatory to keep a balance of Rs.20,000 in Demat or Trading account as minimum margin money.

2. What is ICICI Direct's AMC?

ICICI Direct charges a trading account AMC of Rs 0 (free) and a Demat account an AMC of Rs 300 (from the second year).

3. Is IPO available at ICICI Direct?

Yes, ICICI Direct offers IPO online.

4. Are margin funds available from ICICI Direct?

Yes, margin funding is offered by ICICI Direct.

5. What is the auto square-off timing for ICICI Direct intraday?

At 3:30 PM, all open intraday trades with ICICI Direct are automatically squared off.

6. Are there any charges associated with ICICI Direct’s trading platforms?

Yes, ICICI Securities does impose an additional fee for using their trading platforms.

7. What is the toll-free customer service number?

The toll-free customer service number of ICICI Direct is 1860 123 1122.

8. What is the ICICI Direct minimum brokerage amount?

The minimal brokerage at ICICI Direct is Rs 35 per trade.

9. Does ICICI Direct provide a brokerage calculator?

Yes, it provides a brokerage calculator.

10. Is it possible to use ICICI Direct to place an After Market Order (AMO)?

Yes, you can make AMO with ICICI Direct.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.