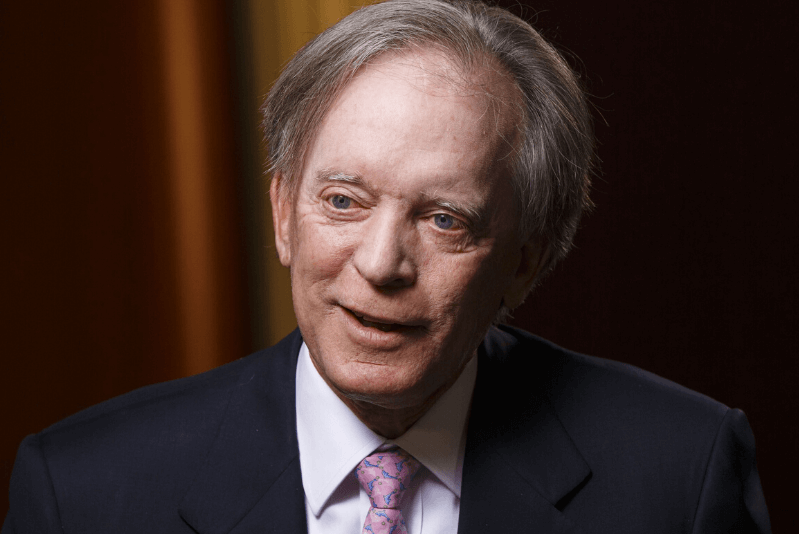

5 Golden Rules of Investing from William Gross

William Hunt Gross is a popular American investor, fund manager and a philanthropist. He was the co-founder of Pacific Investment Management Co (PIMCO) - the largest global fixed Income investment company. William Gross ran the $270 billion Total Return fund for the company before he joined the Janus Capital Group in September 2014. In 2019, he left Janus Capital Group to run his own charitable foundation.

He is famously known as the King of Bonds. In 1971, William Gross founded the PIMCO with two of his friends with $12 million of assets. By 2014, PIMCOs assets under management had grown to almost $2 trillion. This made it the largest active Fixed Income fund management firm in the world. William always credited his success to his sense with mathematics and instincts with blackjacks. In his early life, William would work at the blackjack tables where he counted cards for 16 hours a day. Months of his experience with this helped him learn a lesson that he applied to his investment decisions. The lesson he learnt was that taking too much leverage and holding too much debt can bring the house of cards to the ground. William started with the game with $200 in hand and when he left Vegas within 4 months, he had $10,000 in his pockets.

| Details | Description |

|---|---|

| Birthdate | April 13, 1944 |

| Age | 76 years |

| Birthplace | Middletown, Ohio, U.S. |

| Alma mater | Duke University (BA), University of California, Los Angeles (MBA)) |

| Occupation | Investor, fund manager, and philanthropist |

| Known for | Founding of PIMCO |

| Net worth | US$1.5 billion (October 2018) |

In 2014, when Mr Gross left PIMCO to join the Janus Group, the financial world was introduced to Janus like never before. On the day, Mr Gross joined and publicly announced his joining, Janus’ share price shoot up by 43%, which was a historical gain for the company that took place within a day. The funds that Mr Gross managed to grow to $80 million by the end of September 2014 from $13 million at the end of August 2014.

1. Finding the Best to Invest

One major tip from William Gross is to find the best person or the best organisation to invest your money. He encourages doing your best before you can invest. This would include research and understanding before making any investment. Get to know the company, its strengths, weaknesses and everything in between. Even if you are hiring someone to manage your Portfolio, make sure you know everything about the person and his work with portfolio management and investment.

2. Value Ideas

One of the many things William Gross believed is to never shun an idea away. He once said if you like a particular stock put 10% or so of your portfolio on it; make the ideas count. Good ideas should not be diversified away into meaningless oblivion. He encourages that if you truly believe that you like a particular stock, you should consider Investing in it before it feels unnecessary. However, this is subject to the knowledge you hold about the stock.

Talk to our investment specialist

3. Be Prepared for Losses

This is something investors Fail to understand. Everyone expects only good returns and abundant profit when it comes to investments. However, William Gross clearly says that the Market can move for irrational reasons and you have to be prepared for that. He is basically asking investors to be ready for anything that can come your way. Even when the irrational things happen in the market world, make sure you are prepared for it and stay away from panicking and making irrational choices.

4. Delivering Value

William Gross always believed in delivering value when it came managing funds. He once said that he is obsessed with delivering value to investors and winning the game from a personal standpoint. He made it clear that investments are all about gaining value and giving value. It is a personal way of investing and encouraging investments that ultimately is profitable for all.

5. Bond Investors

William Gross is rightly called the King of Bonds. He loved bond investing to the extent that he once said that bond investors are the vampires of the investment world. They love decay, Recession and anything that leads to low Inflation and the protection of the real value of their loans. He encourages investors to invest in bonds because it is how investors can diversify well.

Conclusion

Even after his retirement at the age of 74, William Gross’ works and investment ideas continue to inspire people. He encouraged safe and strategic investment and suggested to never put an idea aside. Bond investments were his favourite kind of investments and his message to the masses was always clear that value everything that you do and make the best use of everything. Never run away from a problem and never panic when the market seems like going through a curve.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.