Fincash » Mutual Funds India » Kill Bad Investment Habits This Dussehra

Table of Contents

- 15 Bad Investment Habits you Need to End this Dussehra

- 1. Taking Care of Overspending

- 2. Ignoring the Importance of Long-Term Financial Planning

- 3. Inadequate Tax Planning

- 4. Over Diversification is a Bad Thing

- 5. Combining Insurance and Investing

- 6. Keeping Money in a Bank Account that isn't Being Used

- 7. Impulse Purchasing

- 8. Investing without Proper Knowledge

- 9. Lack of Budgeting

- 10. Lack of Financial Planning

- 11. Not Putting Money into More Vital Things

- 12. Lack Of Examining Your Coverage

- 13. Investing in a Single Attractive Fund

- 14. Not Knowing where your Money is at all Times

- 15. Differentiating the Financial and Family Decisions

- Conclusion

Get Over Harmful Investment Traits This Dussehra 2025

financial planning is one of the few responsibilities that are frequently tossed around or ignored. While people are gradually learning to invest through time, there are a number of decisions that they make that are not the best. There are numerous unhealthy investment behaviours that everyone observed, whether it is overinvesting in one comfortable product or taking out loans to satisfy various desires. As people remember the victory of good over evil on Dussehra, it could be a good idea to break the negative investment habits everyone developed.

Dussehra commemorates Lord Rama's victory over Ravana in the north and Goddess Durga's victory over the buffalo demon Mahishasur in other locations (South India, Eastern States, etc.). This provides the ideal setting for you to break all of the bad financial habits that have harmed your investment account. If you're curious about the practices that could jeopardize your finances, keep reading.

15 Bad Investment Habits you Need to End this Dussehra

1. Taking Care of Overspending

The cardinal sin of Personal Finance is spending more than you make. This one bad behaviour will have a domino effect, generating major issues in every aspect of your personal finances. You have a choice to close the deficit, and for this, you can either limit your expenditure and budget more effectively or focus on earning more money.

2. Ignoring the Importance of Long-Term Financial Planning

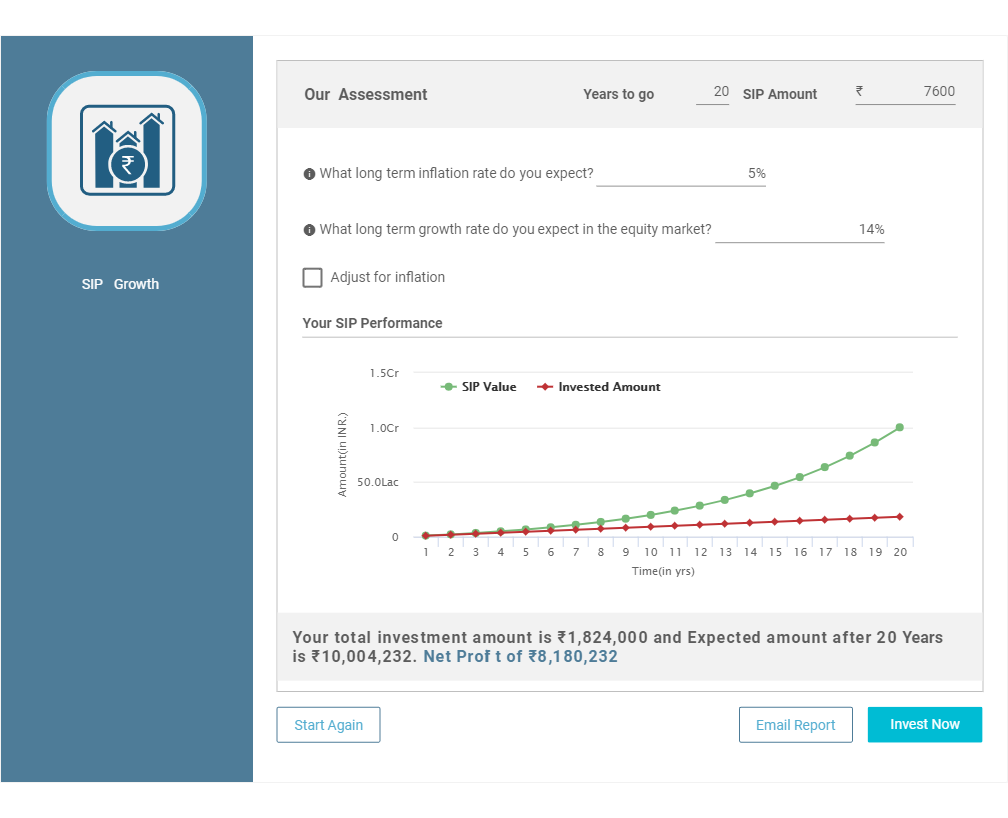

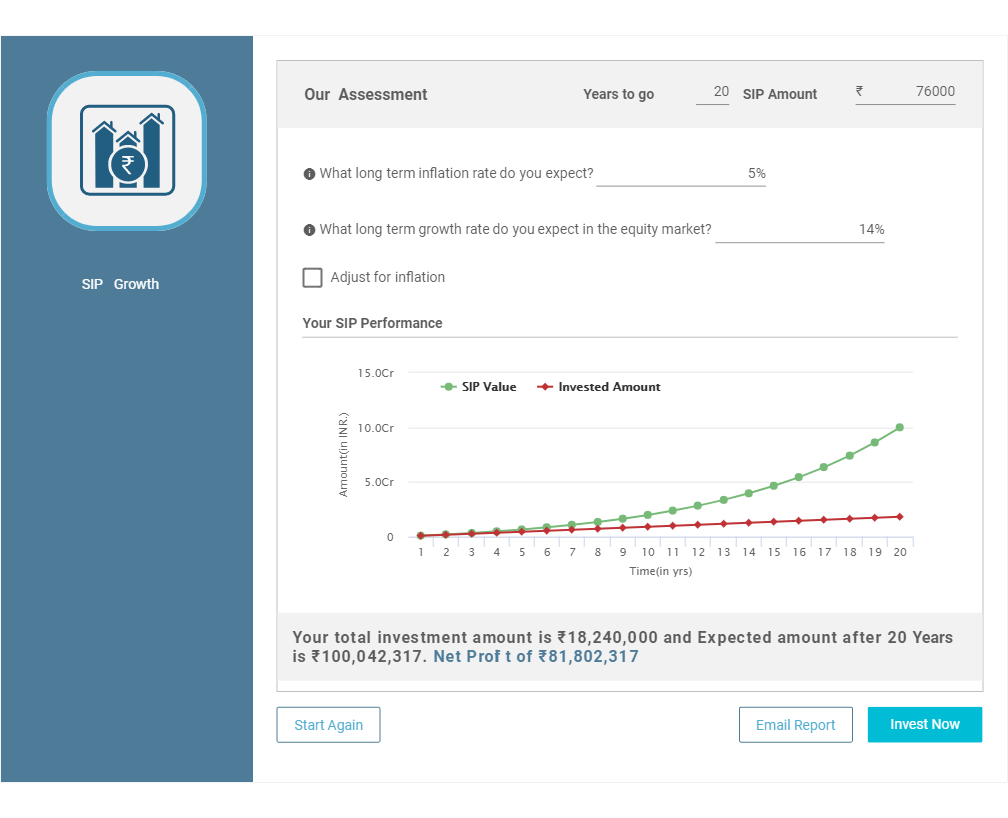

A majority of people start Investing because someone told them to. Investing for the sake of it will not get you anywhere. Investing for objectives is the one easy thing you must master. To have a sustainable Financial plan, you must understand that investments are the key to a sound and stable financial future, not a chance to make quick money. Set financial objectives and make sure your investments are guiding you in the proper direction.

Many investors focus on a stock or mutual fund's most recent performance rather than looking at its financial track record to see if it's a good investment option. Investing is a long game, and the most important trait for investors who want to develop money is patience. If you're investing for the long term, don't focus on short-term results; instead, consider the long-term cumulative returns.

3. Inadequate Tax Planning

When the accountants remind the employees to present investment proofs at the end of the Fiscal Year, most of the people begin investing in tax-saving programs. Invest in tax funds from the start to reap the full benefits of the fund as well as income tax advantages to avoid last-minute worry.

4. Over Diversification is a Bad Thing

Over-diversification is a major and widespread blunder that reduces investment returns in proportion to the benefits acquired. When the overall number of investments in any person’s Portfolio reaches the extent where marginal loss generated from the expected return is higher than the marginal benefit, this is known as over-diversification. The best way for the diversification of a portfolio is to buy a limited number of individual investments that are large enough to almost remove unsystematic risk but small enough to focus on the best chances.

Talk to our investment specialist

5. Combining Insurance and Investing

Many investors make the mistake of combining insurance and investment in their portfolios. They don't conceive Life Insurance Corporation of India (LIC) as an investment; they don't plan for wealth protection. Investors should have a term plan that is solely for their Life Insurance needs, as well as a separate Investment plan for wealth accumulation.

6. Keeping Money in a Bank Account that isn't Being Used

It's just as bad to let your money sit idle as it is to lose it. Invest in the correct instruments to make your money work for you rather than letting it sit idle. This is also beneficial to get the extra benefits out of all your Income saved till the time while ensuring that your money is at a safer place without any risks.

7. Impulse Purchasing

Impulsive purchases lead to overspending and, ultimately, wealth loss. Rather than hasty purchases, concentrate on putting your money to work. During this momentous occasion, begin your investment journey with tiny yet consistent investments. Over time, amass substantial wealth. Investing wisely is critical to accumulating long-term wealth. And thus, this must be kept in the place of impulsive purchasing based on various occasions or festivals.

8. Investing without Proper Knowledge

Plants and investments are highly alike. The more you care for them, the more they will grow, and the more they will return. It is also advised not to invest one's hard-earned money in investments that one does not understand. It's the equivalent of buying something you'll never use. If you understand Real Estate, go for it; nevertheless, if you lack negotiation skills, you will lose money. As a result, before making any investment, make sure you have a thorough understanding of the option and potential returns from the investment you're considering.

9. Lack of Budgeting

The person who invests wisely is not a savvy investor. In fact, the person who invests and spends wisely comes out on top. You should always keep track of your spending, no matter how modest or large they are. You should keep a monthly budget that breaks down your costs into categories. You may save a good amount if you have a well-planned budget. With the help of a spending calendar, you can determine if you are in surplus or deficit. There are numerous smartphone apps that aid in the creation of financial budgets.

10. Lack of Financial Planning

Financial planning entails much more than just saving money or cutting back on expenses. It's a good idea to have a strategy in place for future financial needs. It might be your child's marriage, parental medical coverage, further education, homeownership, or business ventures. Your tax structure, rental income, interest income, and other sources of revenue should all be known to you. Always have a financial strategy for the future-ready, which may be tweaked on an annual Basis.

11. Not Putting Money into More Vital Things

Having a financial portfolio that includes Mutual Funds, stocks, real estate, and other assets is fantastic. However, because everyone knows that life is full of hazards, it is always a good idea to invest in other crucial items like life insurance, health insurance, medical emergency reserves, and contingency funds. Consider what your stock would do if you were no longer alive. As a result, having health and life insurance is critical since it can safeguard your family in the event of a life-threatening emergency.

12. Lack Of Examining Your Coverage

Insurance is among the few items that most people regard as merely a safety net. A majority of people do not give much thought to the type of insurance or coverage they select. Reviewing your Insurance Coverage and reinvesting in newer, better possibilities is something you should do on a regular basis. Whether it's health insurance or life insurance, go over your policies again and compare them to the newer plans to see whether they still meet your needs.

13. Investing in a Single Attractive Fund

There's some great feeling of security that comes with familiar things that makes you want to cling to them. Unfortunately, this is not a good habit to have in your portfolio. Diversifying your portfolio and finding a solid balance of assets that arbitrage risk and returns to assure your financial security in the future.

14. Not Knowing where your Money is at all Times

Even if you enlist the assistance of your relationship managers and financial advisors, it is critical that you remain fully informed of the decision you are making. Knowing exactly what you are investing your money into, whether it is equities in your portfolio or the kind of funds that make up your mutual funds and ULIPs, is a practice that is highly helpful for anyone. Trust your financial advisors to make sound judgments, but double-check that you agree with them.

15. Differentiating the Financial and Family Decisions

Investing is a personal decision that you make. Most of the time, having financial discussions with your parents or partners is not something you look forward to. It is, however, usually easier for everyone if your financial plans are made public. Sharing information with your loved ones, whether it's about stocks and funds you've purchased or data about the health insurance plan you've chosen, makes life a lot easier. That way, even if a disaster strikes, your family will be aware of all the investments you've made for them.

Conclusion

These are only a few of the habits that have a direct impact on your assets. There are also additional unintended consequences of your terrible living choices that can be addressed this holiday season. It is simple to set aside one day to commemorate how evil has been defeated in the past; what is difficult but vital is to ensure that evil is held at bay in the future and that the good and right always triumph.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.