Fincash » Mutual Funds India » Tax Saving Investments for Senior Citizens

Table of Contents

- Top Tax-Saving Investment Choices for Retired Individuals

- 1. Equity Linked Savings Schemes (ELSS) Mutual Funds

- 2. Tax-Saving Fixed Deposits & Recurring Deposits

- 3. Tax-Free Bonds

- 4. Pradhan Mantri Vaya Vandana Yojana

- 5. National Pension System (NPS)

- 6. Insurance Premiums

- 7. Public Provident Fund (PPF)

- 8. Senior Citizen Savings Scheme (SCSS)

- 9. Post Office Monthly Income Scheme (POMIS)

- Conclusion

Tax Saving Investments for Senior Citizens 2025

retirement marks a significant milestone in life, regardless of whether you are self-employed or working for a company. Securing financial stability during retirement is a universal goal. Seniors should explore investment avenues Offering secure returns and tax benefits, recognising the importance of Tax Planning in wealth accumulation post-retirement. Initiating tax-saving measures at the beginning of each fiscal year is imperative for promptly realising financial objectives. Effective tax planning serves a dual purpose: aiding individuals in achieving financial objectives while minimising tax liabilities.

It involves leveraging deductions permitted by the income tax Act, encompassing various investments, savings, and expenses throughout the fiscal year. In this post, let's discover some of the best tax-saving investments for senior citizens and how beneficial they can be.

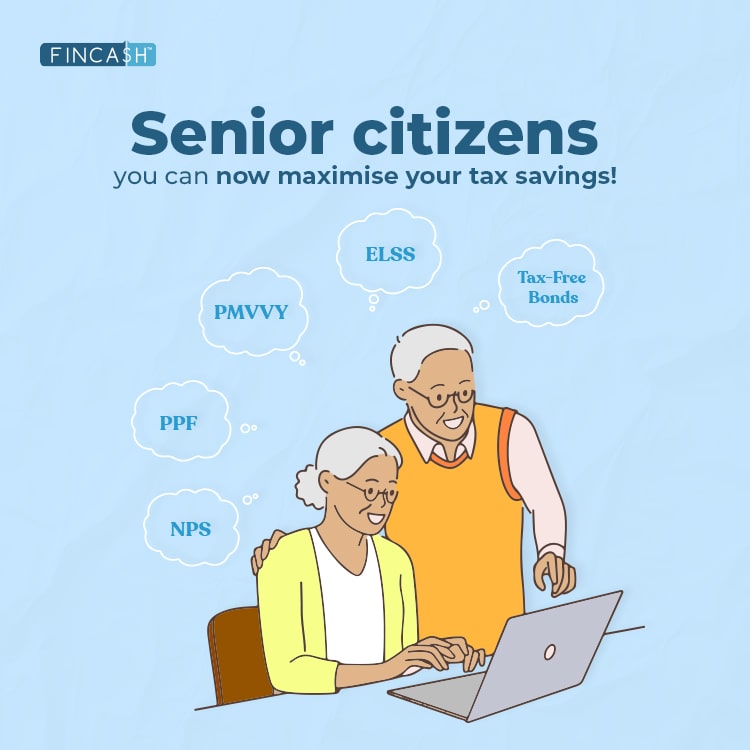

Top Tax-Saving Investment Choices for Retired Individuals

Here are some of the top tax-saving investment choices for retired individuals:

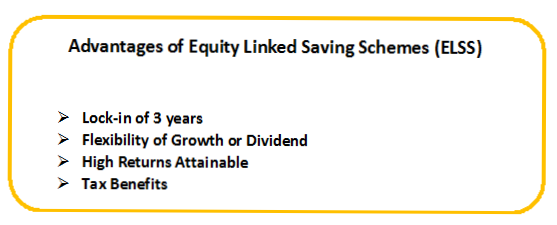

1. Equity Linked Savings Schemes (ELSS) Mutual Funds

Investing in ELSS is a premier choice for wealth accumulation over time. ELSS offers the dual benefits of returns that outpace Inflation and tax savings. Leveraging Section 80C of the Income Tax Act, ELSS allows you to defer Taxes up to Rs. 46,800. Furthermore, investments in ELSS funds qualify for deductions of up to Rs. 1.5 lakhs, whether made through a Systematic Investment plan (SIP) or lump sum.

2. Tax-Saving Fixed Deposits & Recurring Deposits

Fixed Deposits (FDs) and recurring deposits (RDs) present secure avenues for tax savings, making them highly recommended investment options for senior citizens. Banks often offer pensioners higher interest rates on FDs and RDs, mitigating risks associated with equity investments. Interest rates on these deposits are determined by banks and influenced by various factors. By investing in tax-saving FDs, you can deduct up to Rs. 1.5 lakhs from your income, with a mandatory 5-year lock-in period. While the interest received is taxable, typical interest rates range between 5.5% and 7.75%.

Talk to our investment specialist

3. Tax-Free Bonds

Tax-free Bonds emerge as an excellent option for seniors seeking returns that outpace inflation while ensuring a steady income. Issued by government-supported institutions, these bonds offer tax-free interest income, making them low-risk investments particularly beneficial for those in higher tax brackets. You can choose tax-free bonds with longer durations of 10 years or more, focusing on superior credit ratings, increased liquidity, and higher yield-to-maturity returns. It's essential to note that while the interest on tax-free bonds remains tax-exempt, selling them after a year subjects you to a long-term Capital gains tax of 10%, based on your income tax bracket.

4. Pradhan Mantri Vaya Vandana Yojana

Introduced in 2017, the Pradhan Mantri Vaya Vandana Yojana offers seniors a reliable source of income with a guaranteed monthly payout. Managed by Life Insurance Corporation (LIC), this ten-year program aims to provide retirees with a stable pension amid declining interest rates. Designed for those aged 60 and above, you can contribute a maximum of Rs. 15 lakhs under this scheme, with a lump sum Purchase Price required to enrol. While contributions to this scheme do not qualify for tax deductions under Section 80C, the PMVVY program is GST-exempt.

5. National Pension System (NPS)

Operated by the Pension Regulatory and Development Authority, the National Pension System (NPS) offers a range of pension funds and investment options as a government-backed voluntary retirement savings scheme. Open to individuals aged 18 to 70, contributors can get a tax benefit of up to Rs. 1.5 lakhs overall under Section 80 CCE and Section 80 CCD(1). Additionally, NPS subscribers are eligible for an extra Deduction under Section 80CCD (1B) for contributions up to Rs. 50,000 made to NPS (Tier I accounts). Furthermore, NPS provides tax exemption for annuity purchases post 60 or superannuation under section 80CCD (5).

6. Insurance Premiums

Given its multifaceted benefits, insurance remains a crucial component of investment strategies. health insurance, in particular, is vital in mitigating medical expenses during illness. Tax advantages on health insurance premiums under Section 80D make it a prudent investment choice. Senior citizens enjoy a higher deduction cap of up to Rs. 30,000, while non-retirees are eligible for a deduction of Rs. 20,000.

7. Public Provident Fund (PPF)

A part of long-term Post Office savings schemes, the Public Provident Fund (PPF) offers a secure avenue for recurring investments. With a maximum investment limit of Rs. 1.5 lakhs and a 15-year tenure, PPF allows withdrawals as per regulations starting from the sixth year. While it does not provide regular income, the maturity amount is entirely tax-free, making PPF a highly secure investment option.

8. Senior Citizen Savings Scheme (SCSS)

In India, retirees seek schemes offering high safety and regular income, favouring those backed by a sovereign guarantee, such as the Senior Citizen Savings Scheme (SCSS) introduced by the Government of India in August 2004. SCSS, a central government-supported savings scheme, provides full debt instrument security with zero risks, catering to individuals aged 60 and above, ensuring a guaranteed income throughout the investment tenure. Designed to ensure regular income post-retirement for at least five years, SCSS offers a medium-risk profile compared to low-risk options like PPF, remaining popular due to its income guarantee and capital protection.

9. Post Office Monthly Income Scheme (POMIS)

Administered by the Finance Ministry, the Post Office Monthly Income Scheme offers fixed monthly interest, providing significant capital protection ideal for Early retirement. Unlike other options, POMIS is not limited to senior citizens. Indian citizens aged ten years and above can invest in this scheme. Application is simple: visit your local post office, complete the necessary paperwork, and deposit funds via cash or cheque. Additionally, the account can be easily transferred to another city at no additional cost, appealing to potential investors anticipating relocation. With an interest rate of 7.4% p.a. as of June 2023, subject to quarterly changes, POMIS offers a competitive rate given today's economic climate. While not as high as other schemes, its steady income stream makes it attractive to Indian investors.

Conclusion

Reaching retirement age brings its own set of advantages and challenges. Crafting a forward-thinking retirement investment strategy is essential for ensuring a worry-free retirement. If you aim to create a strong retirement plan that provides assured investment returns and acts as a top-notch tax-saving investment avenue, it's wise to explore these options according to your requirements. The years of diligent work should pave the way for periods of relaxation and renewal. Investing in top-tier senior citizen schemes for retirement offers precisely that, with a bonus. It ensures a joyful transition from work life while embracing life to its fullest extent.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.