Table of Contents

- Classification of ETFs

- What are Bond ETFs?

- Bharat Bond ETF: An Overview

- Benefits of The Bharat Bond ETF

- Limitations of The Bharat Bond ETF

- How does the Bharat Bond ETF work?

- Key Information

- Index Constituents

- Frequently Asked Questions

- 1. Where are the Funds invested?

- 2. What type of Bharat Bond ETFs are available now?

- 3. Is the return guaranteed?

- 4. Do we need a Demat account to invest in Bharat Bond ETF?

- 5. What are the different modes of payments for an ETF?

- 6. What are the minimum and maximum limits for investors?

- 7. Who can invest?

- 8. How can I withdraw my funds?

- 9. Is there any lock-in period?

- 10. Is it worth investing in Bharat Bond ETF?

- Conclusion

Bharat Bond ETF

India’s first big bond ETF, Bharat Bond ETF, was launched by the partnership of Edelweiss AMC and the Government of India. On December 4, 2019, the Cabinet Committee on Economic Affairs, chaired by Prime Minister Narendra Modi, approved the establishment of the Bharat Bond Exchange Traded Fund (ETF) with the aim of improving the corporate bond Market and lowering borrowing costs, which ultimately give a boost to debt availability of Public Sector Undertakings (PSUs).

The Bharat Bond ETF was introduced on December 12 by the government's Department of Investment and Public Asset Management (DIPAM). Thus, Bharat Bond ETF became India's first corporate bond to be traded on the stock market, sold by state-owned enterprises. It also provides investors with protection, liquidity (exchange trading), and predictable tax-efficient returns (target maturity structure). The scheme is managed by Mr Dhawal Dalal and co-managed by Mr Gautam Kaul.

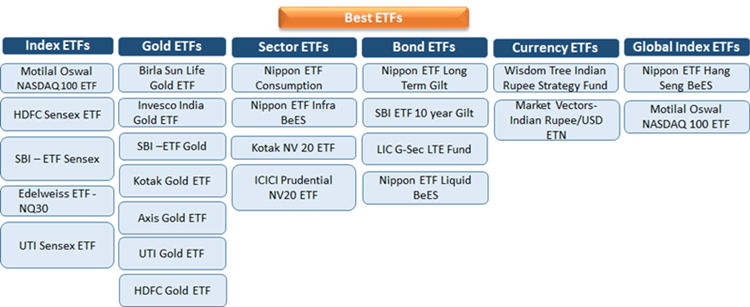

Classification of ETFs

To understand Bond ETFs, let’s just learn about the following terms first:

Exchange-traded

It is referred to something that is traded on an exchange, just like any stock. Because of this, anything that is traded gets linked to one of the indexes. Therefore, ETFs are also referred to as Index Funds but slightly in a different way because they are indexed for increasing their liquidity in the market.

Funds

People pool their money to form a fund that can offer an abundance of advantages, much like any other fund. This pool has a collection of securities.

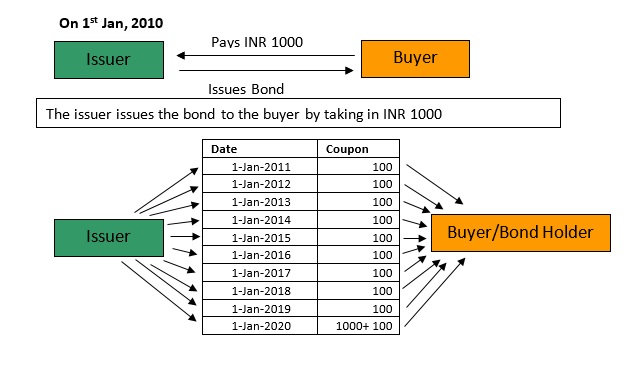

Bonds

What happens if you run out of money? Generally, you are left with two major options: either you can sell some of your possessions, or you can borrow money from someone. Just like that, when an organization runs out of money and wants funding to satisfy its demands, it has two choices: either borrow or sell its shares. However, selling a share means giving the profit of owners to someone else. Also, banks may not always give a favourable rate of interest. In this scenario, Bonds are brought into action. A company issues bonds to the general public, which helps in generating required funds. And in return, the company pays interest on the loaned money.

Talk to our investment specialist

What are Bond ETFs?

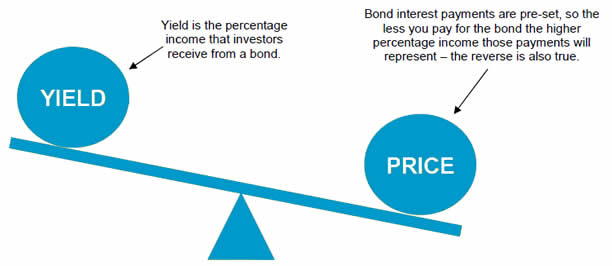

Bond Exchange-Traded Funds is a Portfolio of bonds in the Underlying index. It is a type of exchange-traded funds which exclusively invests in bonds and is tradable in the debt market.

It is listed on the exchange for direct trading. Although Bond ETFs are different from both bonds and bond Mutual Funds, they combine the best of both. Ease of trading, diversification, higher liquidity and transparency in price are basic advantages of bond ETFs over traditional bond investments.

Bharat Bond ETF: An Overview

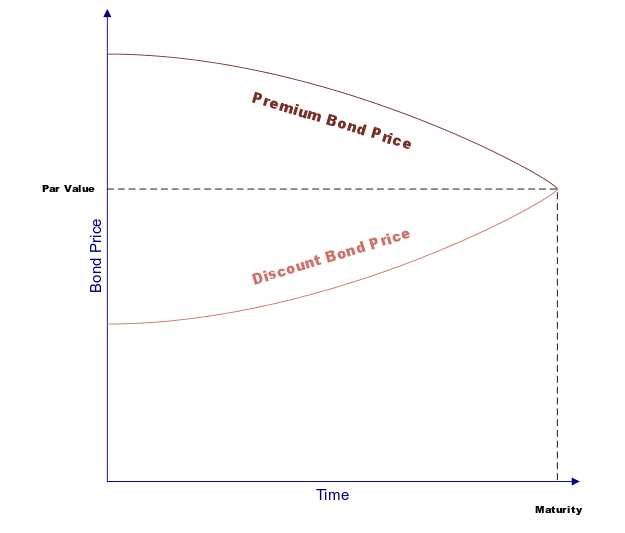

The Government of India introduced Bharat Bond ETF in order to help PSUs collect a debt. This investment is managed by Edelweiss Asset Management Fund. The Bharat Bond ETF is an open-ended Target Maturity Exchange Traded Bond Fund that aims to watch the Nifty BHARAT Bond Index's returns.

This one is a target maturity portfolio, just like a fixed maturity contract, and has a maturity date. The underlying securities in these ETFs are held before the scheme's maturity date. It provides a stable and predictable return at maturity.

The Bharat Bond ETF funds have a three-year (2023 Series) and a ten-year maturity term (2030 Series). The three-year yield is 6.7%, and the ten-year yield is 7.6%. It follows tax policy as that of debt mutual funds so that the yield post-tax would be 6% for the 2023 series and 7% for the 2030 series.

Benefits of The Bharat Bond ETF

Ease to Access

The Bharat Bond ETFs are easy to access. This buying and selling can be done in exchange as per the requirements during the trading hours.

High Liquidity

It offers higher liquidity because investors can buy and sell it on exchange whenever they want. Despite a lock-in period of 3 years or 5 years, buyers can still sell it on the exchange.

Safest Option

Bond ETFs are a much safer option than stocks because they lend money to businesses directly and receive a guaranteed rate of interest in return. They must be compensated first in the event of a company's liquidation. They are a suitable alternative to fixed deposits with marginally higher yields, but they do not deliver as decent returns as stocks.

Better Transparency

Portfolio constituents and live Net Asset Value (NAV) are disclosed on a regular Basis at various times during the day, which ensures better transparency for investors.

Taxation

Generally, Debt fund are taxed according to slab rates for 3 years. After that, 20% is charged. This means if you come under the 30% income tax slab and invest in bonds with a maturity date after 3 years, you can easily save 10% of Income earned from the bond.

Backed by the Government Body

The Bharat bond ETF remains the safest option than other investments as the Offering PSUs are backed by the government of India. Although beneficiary PSUs might be profitable, in any case of failure, the government will have to pay back money to investors.

Limitations of The Bharat Bond ETF

There is just one limitation, and that is for investors looking for big returns. Bonds do not have the same dividends as securities. Despite the fact that the returns are actually higher than fixed deposits, they do not compete with stocks.

How does the Bharat Bond ETF work?

To begin with, investors buy or sell units of Bharat Bond ETF, which is listed on the exchange. This ETF invests in bonds of public sector companies like:

- PFC

- REC

- Power Grid Corporation

- National Highways Authority of India

- Nuclear Power Corporation of India

- Indian Railway Finance Corporation of India

- Housing & Urban Development Corporation

- NHPC

The maturity period is pre-defined. On maturity of the fund, an investor gets back invested money along with returns, which are subjected to market conditions and the Indian Economy.

Key Information

Apart from the details mentioned above, here are a few things that you must know regarding Bharath bond ETF.

- The Bharat ETF bond has a set maturity date.

- It invests in high-quality public-sector bonds with a 'AAA' rating.

- It holds the bonds until they mature and reinvests the interest.

- To control liquidity, it devotes 5% of its share to G-Sec and TREPS.

- For calculation, it follows the underlying index, which is the Nifty Bharat Bond ETF Index.

Index Constituents

NIFTY Bharat Bond Index - April 2023 constituents as of 5th Dec 2019-

| Issuer | Ratings | Capped Weights |

|---|---|---|

| REC Limited | AAA | 15.00% |

| National Bank For Agriculture & Rural Development | AAA | 15.00% |

| Power Finance Corp. Ltd. | AAA | 15.00% |

| Housing & Urban Development Corp. Ltd. | AAA | 11.84% |

| Export - Import Bank Of India | AAA | 8.00% |

| Power Grid Corp.Of India Ltd. | AAA | 7.24% |

| Small Industries Development Bank Of India | AAA | 7.00% |

| NTPC Ltd. | AAA | 6.67% |

| Hindustan Petroleum Corp. Ltd. | AAA | 4.87% |

| National Highways Authority Of India | AAA | 3.85% |

| Nuclear Power Corp.Of India Ltd. | AAA | 2.43% |

| Indian Railway Finance Corp. Ltd. | AAA | 1.88% |

| NHPC Ltd. | AAA | 1.21% |

| Grand Total | 100.00% |

NIFTY Bharat Bond Index - April 2030 constituents as of 5th Dec 2019-

| Issuer | Ratings | Capped Weights |

|---|---|---|

| National Highways Authority Of India | AAA | 15.00% |

| Indian Railway Finance Corp. Ltd. | AAA | 15.00% |

| Power Grid Corp. Of India Ltd. | AAA | 15.00% |

| REC Limited | AAA | 12.72% |

| NTPC Ltd. | AAA | 11.63% |

| Indian Oil Corp. Ltd. | AAA | 8.00% |

| Nuclear Power Corp. Of India Ltd. | AAA | 6.61% |

| Power Finance Corp. Ltd. | AAA | 6.51% |

| NLC India Ltd. | AAA | 3.93% |

| Export-Import Bank Of India | AAA | 2.84% |

| National Bank For Agriculture & Rural Development | AAA | 1.48% |

| NHPC Ltd. | AAA | 1.27% |

| Grand Total | 100.00% |

Frequently Asked Questions

1. Where are the Funds invested?

A. The funds will be invested in AAA-rated bonds issued by CPSEs, CPSUs, CPFIs, and other government agencies.

2. What type of Bharat Bond ETFs are available now?

A. Bharat Bond ETF - April 2023 (3 years) and Bharat Bond ETF - April 2030 (10 years) are existing ones that were launched in December 2019.

3. Is the return guaranteed?

A. No, there is no such assurance due to instability in market conditions and interest rates in the economy while the underlying risk associated with it is low.

4. Do we need a Demat account to invest in Bharat Bond ETF?

A. It is not necessary to have a Demat account to invest, but we suggest opening a Demat account to reap the huge benefits offered.

5. What are the different modes of payments for an ETF?

A. Net Banking and UPI are the two most common payment methods for online investments. If applying offline, please include a cheque with the application form. Bharat Bond ETF also offers an NEFT/RTGS alternative, for which the bank account information can be found on the application form. To stop the denial of your submission, you must use your own bank account.

6. What are the minimum and maximum limits for investors?

A. For individual retail investors, the minimum limit is Rs. 1000, and the maximum limit is Rs. 2,00,000, whereas, for non-individual investors (including corporate/partnership and non-retail individuals), the minimum limit is Rs.2,00,001. These apply during the NFO period.

7. Who can invest?

A. Any resident (including NRIs) individual and non-individual can invest in Bharat Bond exchange traded fund.

8. How can I withdraw my funds?

A. Exchange-traded funds (ETFs) are traded on exchanges, so it is easy for investors to buy and sell through trading accounts, just like any other traded securities.

9. Is there any lock-in period?

A. No, investors can buy or sell bond ETFs just like any other traded securities through trading or Demat accounts. However, in the case of Funds of Funds (FOF), there is an exit load of 0.10% charged if you withdraw before 30 days of investment. After 30 days, there is no exit load.

10. Is it worth investing in Bharat Bond ETF?

A. It totally depends on your investment strategy and outlook. However, the 3-year option is certainly better than 10 years one and can be considered for investment.

Conclusion

Since India's bond market is underdeveloped, organizations are expected to rely on banks for funding. Other consumers' interest rates will spike as a result of this. A well-developed bond market would assist businesses in turning to the public for funding, and banks will have more resources to sell lower-cost loans.

If you are looking out to diversify your portfolio with a good balance between debt and equity, it is definitely a good choice. Regardless of whether the Edelweiss Bharat Bond ETF succeeds, this move would be historic because it calls for the expansion of the bond Industry.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.